Hi, I’m Larry McDonald“I recently shut down my business permanently after 8 years of operation and now I want to cancel my QuickBooks Desktop Premier 2024 subscription. I had been using it regularly for payroll, vendor payments, and monthly bank reconciliations. Now that my business is closed, I’ve already paid off all dues, filed final tax returns, and informed vendors and clients.

I still want to retain access to my financial records for legal and audit purposes, but I don’t want to keep paying for a license I no longer need. What’s the best way to properly cancel or deactivate my QuickBooks Desktop Premier 2024 license without losing access to my historical data? Do I need to take any extra steps if I used enhanced payroll services or had Intuit data backups enabled? Also, what precautions should I take before uninstalling or archiving anything, especially in case I need access 2–3 years down the line for tax reference or compliance?”

Yes, Larry McDonald you can cancel your QuickBooks Desktop Premier 2024 subscription if you’re shutting down your business permanently even after using it for 8 years. Just make sure everything related to your business is fully settled and closed out—this includes clearing all dues, finalizing vendor payments, filing your last tax returns, balancing monthly bank reconciliations, paying off loans or credits, issuing final employee forms (like W-2s or 1099s), closing out sales tax accounts, and notifying your accountant, vendors, and clients as needed.

QuickBooks Desktop Premier 2024 is sold only on a subscription basis. That means you don’t own it permanently—you must renew annually to keep using full features. The subscription includes ongoing access to the latest updates, critical security patches, and customer support. However, if you choose not to renew, access to essential features like creating invoices, running reports, or reconciling bank accounts will be limited or disabled entirely.

Things to Do Before Cancelling Your QB Desktop Premier Subscription

Before cancelling or letting your subscription expire, it’s important to:

- Save a local backup of your company file.

- Export important reports and financial data (like profit & loss statements, balance sheets, payroll summaries, 941/940 filings, bank reconciliations etc.)

- Make sure all payroll and tax filings are complete.

- Finish monthly reconciliations and vendor payments.

- Discontinue the payroll service separately in Intuit Account Manager (CAMPs) if you have Enhanced Payroll.

- Notify your accountant, if applicable, for a final review.

How to Cancel or Deactivate QB Desktop Premier 2024 Subscription?

Hey Larry, no worries—we’ve got you covered!

We know closing a business is a big step, and we’re here to make the cancellation process smooth and stress-free. Follow the step-by-step guide to help you cancel your QuickBooks Desktop Premier 2024 subscription safely—while making sure you keep full access to your financial records for any future tax, audit, or legal needs.

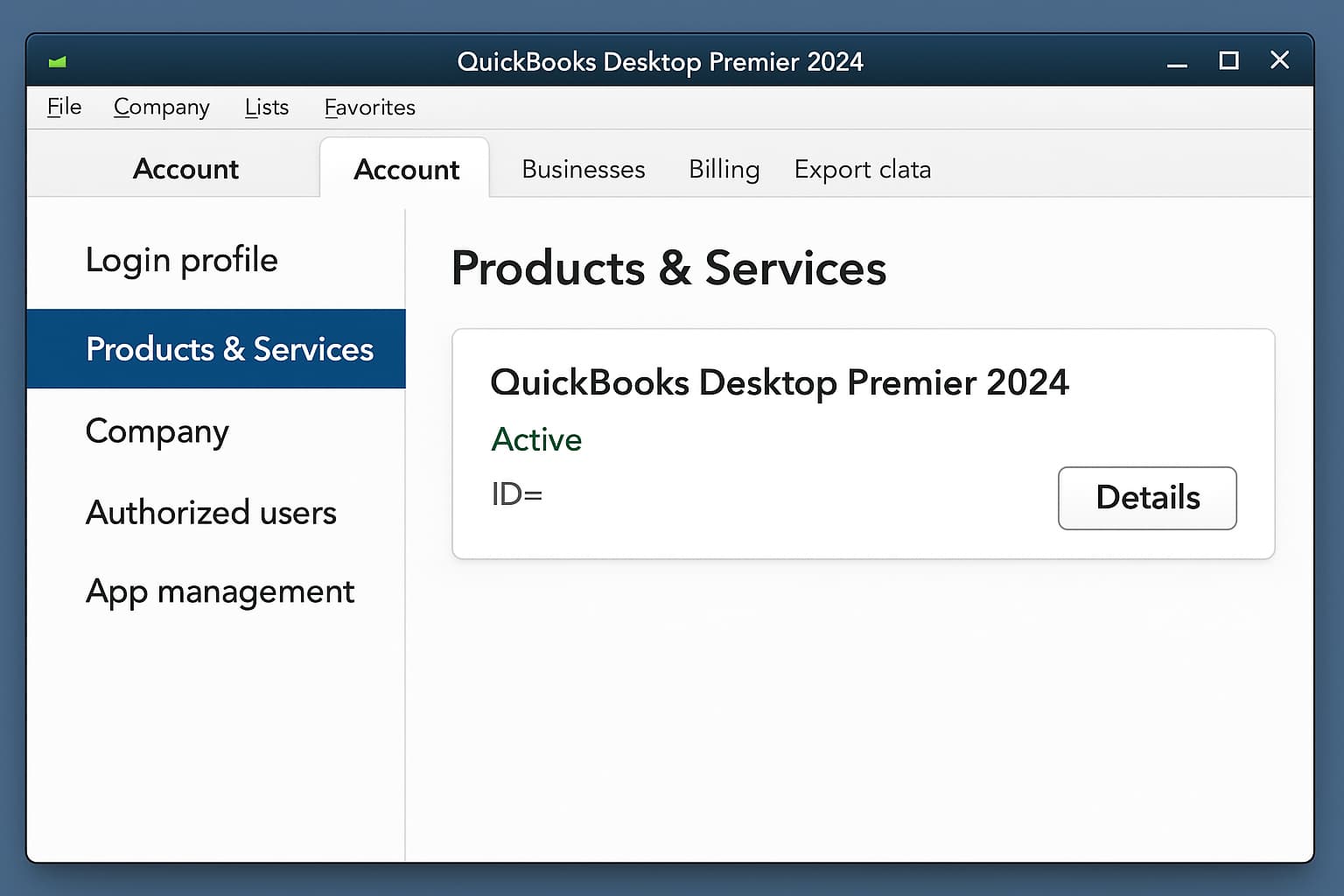

- Step: Log into your CAMPs account.

- Step: Select the QuickBooks Desktop Account you want to modify.

- Step: Your login profile will show you which one is currently selected in case you have multiple accounts.

- Step: Under the Products & Services area, locate your subscription or service and click Details.

- Step: Review this is the product or service you no longer need and choose Cancel Service under the active.

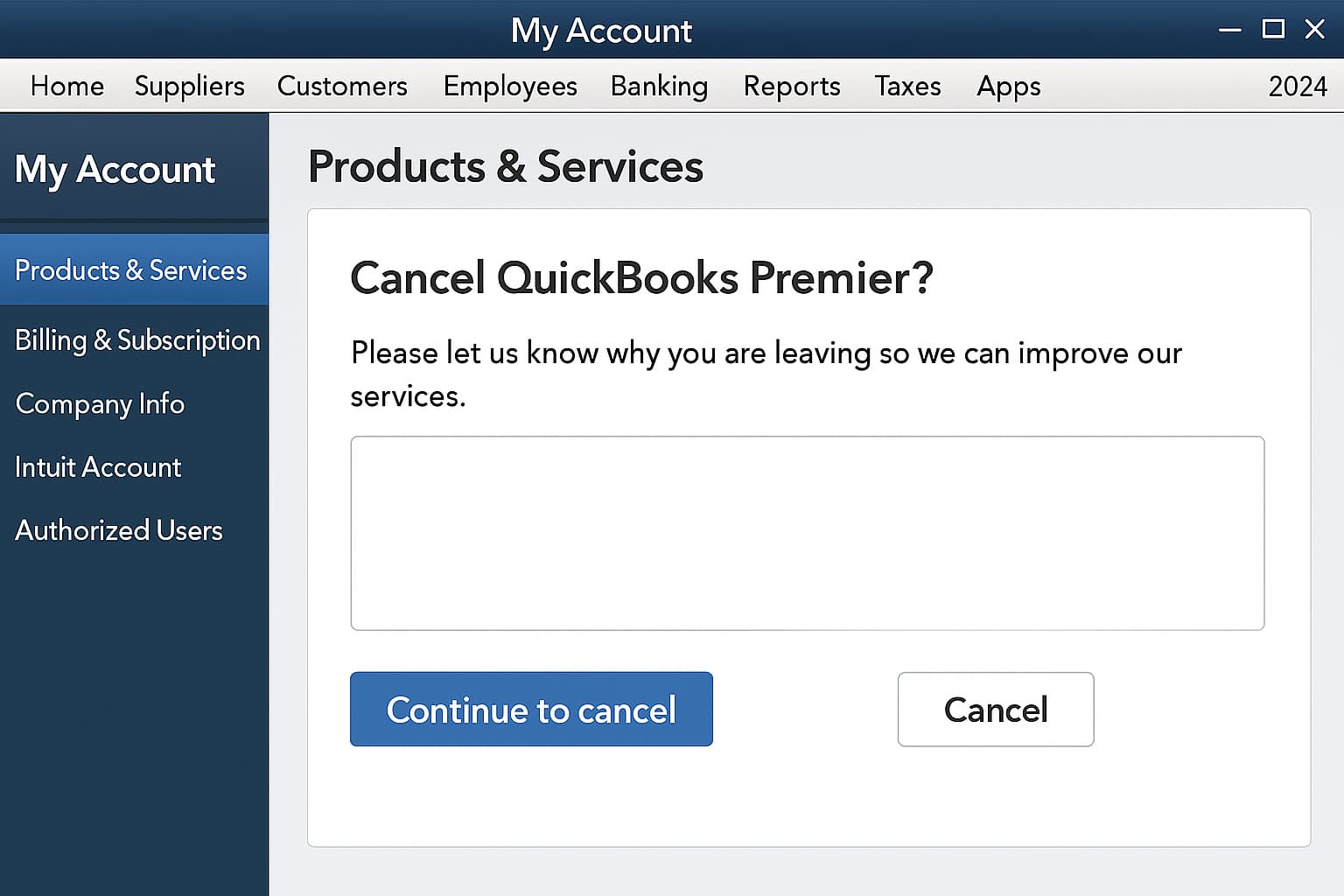

- Step: Please let us know why you are leaving so we can improve our services. After providing the details (optional), select Continue to cancel.

- Step: Click Cancel Now to confirm your cancellation.

- Step: You’ll get a confirmation message by email.

Note: You can use these same steps to cancel or deactivate your 2023 or 2025 QuickBooks Desktop Premier subscription.

What Happens After Cancelling QuickBooks Desktop Premier Subscription?

When you cancel your QuickBooks Desktop Premier 2024 subscription, the software does not stop functioning immediately—but your access and functionality will be significantly limited. QuickBooks may stop offering new desktop licenses after September 30, 2024. So if you cancel, re-subscribing later may not be an option for you. Here’s a breakdown of post-cancellation impacts:

Read-Only Access (Up to 12 Months):

After cancellation, you will retain read-only access to your company file for up to 12 months. This means you can still open the software and view your financial data, reports, transactions, and historical records. However, you cannot:

- Create new invoices or sales receipts

- Record expenses or bills

- Reconcile bank accounts

- Enter or adjust payroll

- Make changes to existing data

This limited access is designed to help you reference your data or export necessary reports for your accountant or tax purposes during the transition period.

Loss of Connected Services:

All subscription-based services will stop functioning once your plan expires, including:

- Payroll services (both assisted and enhanced)

- Online banking (bank feeds and reconciliation tools)

- Customer support access

- Software updates and security patches

- Automatic data backups via Intuit

- Multi-user access, if enabled on your subscription

These features are fully deactivated, and you won’t be able to perform any payroll-related tasks through the software unless you reactivate your subscription.

After 12 Months:

Once 12 months have passed without renewal, even read-only access may be revoked. You may be completely locked out of your company file, which can lead to complications if you need financial data for audits, tax filings, or compliance purposes. To avoid data loss:

- Export key reports (Profit & Loss, Balance Sheet, etc.) in PDF or Excel format.

- Create and store local backups of your company file (.QBW) and portable company file (.QBM).

- QuickBooks has announced it will stop selling new Desktop licenses after September 30, 2024, so reinstating access later may not be possible.

Quick Tips:

Larry if you’re planning to cancel your subscription because you’re shutting down your business, changing software, or budgeting, make sure your final month includes:

- Completing all payroll and tax activities

- Filing necessary reports

- Notifying your accountant

- Reviewing outstanding balances or vendor dues

- Downloading all required financial records

Being proactive will help you stay compliant and avoid disruptions when access is lost.

Monthly vs. Annual — QuickBooks Desktop Premier Subscription Cancellation Policy

QuickBooks Desktop Premier 2024 operates on an annual subscription model, which means access to its features is tied to active billing. If you choose to cancel your subscription before the renewal date, you’ll continue to have access to the full features until the end of your current billing cycle. However, once the subscription period ends, the software will switch to read-only mode for up to 12 months—allowing you to view your data but not create or edit transactions.

Note: You’re eligible for a prorated refund as soon as you upgrade your subscription. This means you may cancel your current subscription and get a prorated refund for the remaining months when you upgrade.

Monthly or Quarterly Plan: Cancellation Terms

The following conditions apply to monthly and quarterly plans:

Cancellation Rules

- You may cancel it for free.

- You’ll continue to have access to your service through the end of your current subscription period.

- Your service will end at the next auto-renewal date.

- You won’t get a refund if you cancel before the next auto-renewal date.

What Stops Working After Cancellation?

Once your plan ends, you’ll lose access to:

- Get assisted support for issues and questions not covered by the Intuit QuickBooks Desktop software support policies without additional fee/s.

- Get Data Recovery services without additional fee/s.

- Use other services included in your plan, such as Intuit Data Protect.

- Use the QuickBooks Desktop software. However, you’ll retain access to your company data file stored on your device.

Tip: You can convert your company file back into a readable QuickBooks Desktop format if you later choose to:

- Reactivate your subscription,

- Purchase a new license.

Annual Plan: Cancellation Terms

You may cancel your QuickBooks Desktop Premier Plus subscription with annual billing. However, it’s important to understand that the support plan has specific terms & conditions.

Within the 60-Day Money Back Guarantee period

This subscription has a 60-day money back guarantee. You’ll only receive a full refund for your subscription if you cancel within 60 days from sign-up. Your refund goes to the credit or debit card you used to purchase your subscription with.

After the 60-day Money Back Guarantee period

- You won’t get a prorated refund for the unused portion of your subscription.

- You’ll continue to have access to your service through the end of your current subscription period.

- Your service will end at the next auto-renewal date.

What Stops Working After Cancellation?

Same as monthly plans, once your subscription ends, you lose:

- Get assisted support for issues and questions not covered by the Intuit QuickBooks Desktop software support policies without additional fee/s.

- Get Data Recovery services without additional fee/s.

- Use other services included in your plan, such as Intuit Data Protect.

Final Note!

Whether you’re on a monthly or annual plan, knowing these details ensures a smooth exit strategy. Larry, since you’ve already made the thoughtful decision to close your business after 8 successful years, we’re here to support you in wrapping things up smoothly and confidently.

This guide will help you cancel your subscription confidently while keeping your important records secure. If you decide to resume accounting tasks or move to a new platform in the future, your backed-up data will remain valuable. Need help converting to QuickBooks Online or exporting your files? We’re here to assist you.

Disclaimer: The information outlined above for “Can I Cancel QuickBooks Desktop Premier 2024 Subscription After 8 Years of Operation?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.