FIFO, an acronym for First In First Out, is one of the inventory handling methods applied in organizations to determine the cost of goods sold.

It presumes that a business disposes of its products, starting with the first that it produces.

FIFO is easy to understand and apply, which is why FIFO is widely used in accounting and attractive to investors and business owners who want to evaluate the profits of the company.

It is also a correct method of recording that the value of inventories is approximately equal to the market value of stocks.

What is FIFO?

FIFO stands for First-In, First-Out, where oldest inventory items are sold or used first, meaning that costs are assigned in the same order as those purchased or produced.

FIFO method helps companies to align inventory flow with cost flow, aiding in accurate accounting and strategic decision-making.

FIFO is an approach to cost flow assumptions that assume that the first-bought or first-produced products will be sold first.

FIFO operates under the presumption that the first products added to inventory are also the first ones sold and are frequently employed by firms that maintain a physical inventory of some type. Items depart inventories in the same order they entered under FIFO.

When businesses sell older inventory at current, inflated market pricing, they can lessen the impact of inflation and assist the company in selling inventory before it becomes obsolete. Moreover, businesses that use it can also opt for tax minimization strategies.

How the FIFO Method Works?

FIFO is short for First In, First Out, a method of inventory valuation. Under this method, every item of stock that was purchased first is sold or used first.

In other words, it first intakes the items into the inventor, and then the initial items that it takes in the inventory are the first to go out for sale.

COGS stands for the cost of goods sold, and under FIFO, this is the oldest inventory price because FIFO believes that the oldest item is sold first.

Example

For instance, we have a company that initially stocked 100 units of a particular product and then bought more units from the market at other different prices.

| Date | Units Purchased | Cost Per Unit | Total Cost | COGS | Ending Inventory |

| January 1 | 100 Units | $10 | $1,000 | 100 units @ $10 | 350 units @ $15 |

| March 1 | 200 Units | $12 | $2,400 | 200 units @ $12 | 150 units @ $15 |

| May 1 | 150 Units | $15 | $2,250 | 200 units @ $15 | 150 units @ $15 |

| Total COGS | – | – | $6,400 | – | – |

| Ending Inventory | – | – | – | – | $2,250 |

Inventory Details:

- January 1: 100 units at $10 each (Total cost $1000)

- March 1: 200 at $12 each or $2,400 in total cost

- May 1: 150 units @ 15$ each (Total cost = $2250$)

- Total Inventory: 450 units @ various costs.

Step 1: Selling Under FIFO

Assuming 500 units are sold in total:

- The first 100 units sold are from January 1 at $10 per unit.

- The next 200 units sold are from March 1 at $12 per unit are numbered 200-400.

- The other 200 units sold are those that were made from May 1 @ $15 each.

COGS Calculation:

- COGS = 100 units * $10 + 200 units * $ 12 + 200 units * $15

- COGS is $1000+ $2400+ $3000= $6400

Ending Inventory:

- 150 units are still available at $15 each.

- Cost of inventory = 150 units at $15/h = $2,250/100hrs.

What is the Purpose of the FIFO Equation?

The FIFO approach is based on the idea that to prevent obsolescence, a business should sell its oldest inventory products first and keep its newest ones on hand. An entity must be able to explain why it chose to adopt a specific inventory valuation technique, even though the actual method utilized does not have to correspond to the real flow of inventory through a corporation.

The primary purpose of the FIFO equation is as follows:

- Accurate Financial Reporting: It helps calculate the cost of goods sold and end inventory for financial statements, ensuring transparency and compliance with accounting standards.

- Profitability Analysis: By matching older costs with current revenues, FIFO helps businesses better understand their gross profit and margins, particularly when inventory costs are changing over time.

- Inventory Valuation: FIFO provides a clear method for valuing inventory, which is crucial for balance sheet accuracy and assessing the business’s overall financial health.

- Tax Implications: Since FIFO results in higher net income during inflationary periods (as older, cheaper inventory is used first), it affects the taxable income and, thus, the taxes a business may owe.

- Operational Efficiency: It supports effective inventory management by ensuring older stock is used or sold first, reducing the risk of obsolescence or spoilage.

What are the Pros and Cons of FIFO?

Pros of FIFO:

- Accurate Costing in Rising Price Environments: FIFO assigns the cost of the oldest, usually cheaper inventory to the cost of goods sold (COGS). This means that during periods of rising prices or inflation, the remaining inventory is valued at more recent (higher) prices, leading to higher asset values on the balance sheet.

- Simplicity and Logical Flow: FIFO is simple to understand and implement, aligning with natural business operations where the oldest items are typically sold or used first. This makes inventory tracking easier.

- Higher Net Income in Inflation: Since older, lower-cost inventory is sold first, the COGS is lower, resulting in a higher net income. This can be beneficial for businesses that want to showcase strong financial performance.

- Favorable for Financial Reporting: FIFO often provides a more accurate representation of current market conditions, as it ensures that the inventory on the balance sheet is valued closer to current prices, making financial reports more relevant and reflective of actual inventory costs.

- Improved Inventory Turnover: FIFO encourages the sale or usage of older inventory first, reducing the risk of inventory becoming obsolete, damaged, or perishable. It helps maintain fresher stock, which is especially important for industries like food and retail.

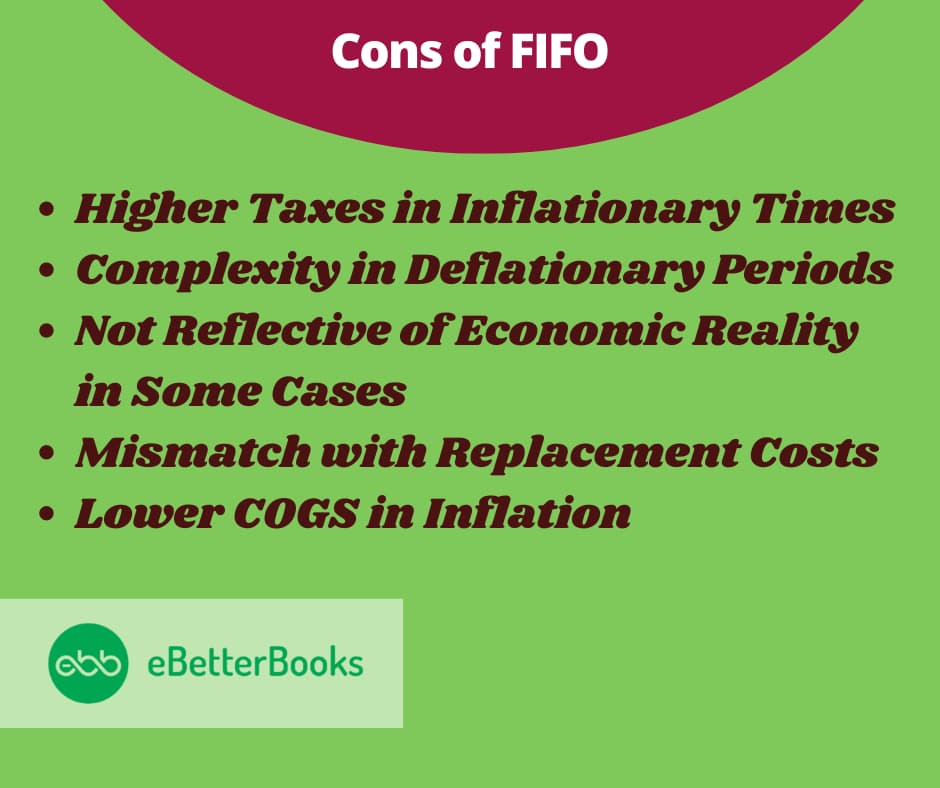

Cons of FIFO:

- Higher Taxes in Inflationary Times: With FIFO, when net income is higher due to lower COGS (since cheaper inventory is sold first), it results in a higher taxable income. This can increase the tax liability, which may not be favorable for businesses seeking to minimize taxes.

- Complexity in Deflationary Periods: During deflation, FIFO can lead to a lower valuation of ending inventory, as the newer, lower-cost inventory is left unsold, while older, higher-cost inventory is reflected in COGS. This can result in overstated expenses and lower net income.

- Not Reflective of Economic Reality in Some Cases: FIFO does not always reflect the current economic situation, particularly when there are significant fluctuations in inventory costs. It may not accurately show the real cost businesses incur in the short term, leading to financial discrepancies.

- Mismatch with Replacement Costs: FIFO might not reflect the actual cost of replacing inventory, especially in times of inflation. Since the older, cheaper goods are sold first, the inventory that remains may be priced much higher, which could distort profit margins and future inventory replacement strategies.

- Lower COGS in Inflation: While lower COGS boosts profits, it may not accurately reflect the current cost of inventory. In times of inflation, the cost of replacing sold goods may be significantly higher than the costs recorded, potentially leading to cash flow issues when restocking.

Requirements for FIFO to be Applicable

FIFO is a method commonly used by businesses, particularly in retail, food, and related industries, to manage inventory. FIFO approach ensures that the oldest stock in inventory is sold first.

Under GAAP, businesses can choose from three inventory valuation methods: FIFO, average cost, and LIFO. However, under IFRS, businesses can only use the FIFO method.

To implement the FIFO method effectively, several key requirements should be met:

1. Inventory Audits

Regular inventory audits are necessary to maintain FIFO accuracy. Audits help identify any discrepancies or issues with the method’s implementation and ensure that the oldest items are sold first, particularly during supply chain challenges.

2. Detailed Inventory Tracking

Accurate tracking of products as they enter and exit the inventory is essential for FIFO. Keeping precise records of inventory costs ensures that the first items brought into stock are the first to be sold.

3. Employee Training

Employees must understand the FIFO concept and its importance for maintaining a smooth flow of operations. Proper training ensures staff can accurately track inventory costs and appropriately label and organize products.

4. Proper Labeling and Inventory Management

Effective labeling and organization of inventory are critical for FIFO. Clear labeling helps identify the oldest items, ensuring they are sold first. Labels should include manufacturing or arrival dates, aiding in better inventory management.

Why is FIFO Crucial to Businesses?

FIFO is crucial to businesses for the following reasons:

- Accurate Cost Tracking: FIFO ensures that the cost of goods sold reflects the actual purchase price of older inventory, providing a more accurate picture of profit margins, especially during inflation or price fluctuations.

- Better Inventory Management: By moving older stock first, FIFO helps reduce the risk of stock obsolescence or spoilage, especially for perishable goods or products with expiration dates.

- Financial Reporting Compliance: FIFO often aligns with International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) and , improves the accuracy and transparency of financial statements.

- Tax Efficiency in Inflationary Times: In an inflationary environment, FIFO tends to report higher net income due to using older, cheaper inventory first, which can have tax implications.

- Simplified Accounting Process: FIFO provides a straightforward and logical method for tracking inventory and calculating costs, making it easier for businesses to maintain accurate records and perform audits.

- Improved Customer Satisfaction: FIFO can improve customer satisfaction by ensuring that products are fresher and less likely to be outdated, particularly in industries like food and pharmaceuticals.

FIFO vs. LIFO

The two most popular methods for determining the cost of products sold out and inventories are LIFO and FIFO. First in, first out is abbreviated as FIFO, which denotes that the first items entered into inventory are often the first items removed from inventory for sale.

The name “last in, first out,” or LIFO, stands for this concept: the items that were most recently added to inventory are thought to be the items that are first removed from inventory for sale.

Why Pick One Method Over Another?

The following are some factors to consider:

| FIFO | LIFO | |

| Abbreviation | It stands for first-in, first-out | It stands for last-in, first-out |

| Approach | The FIFO approach is the reverse since it utilizes lower cost figures when computing COGS and believes the oldest goods in your inventory will be sold first. | The LIFO approach is based on the belief that the newest items in your inventory will be consumed first. |

| Results | FIFO results in a larger closing inventory and lower COGS. | Most of the time, LIFO will cause a decrease in closing inventory and an increase in COGS. |

| Popularity among Industries | FIFO is more popular since it is a globally recognized accounting concept and because firms often seek to sell their oldest inventory before bringing in new stock. | Businesses with big inventories tend to choose LIFO because it allows them to benefit from larger cash flows and reduced taxes while prices rise. |

| Inflation | When expenses rise, the first products sold are the least costly; as a result, your cost of goods sold declines, you report higher profits, and you, therefore, pay more income taxes in the short run. | If expenses rise, the final products sold will be the costliest; as a result, the cost of goods sold will increase, you’ll report fewer profits, and you’ll pay less in income taxes in the short run. |

Conclusion

Any firm that wants to grow must have excellent bookkeeping practices. Accounting offers us a variety of approaches, but FIFO stands out for its ease of use and viability. Due to its effectiveness in boosting earnings, many companies worldwide use FIFO.

FAQs!

What are the five main reasons for using FIFO?

Five advantages of FIFO storage:

- Increased Warehouse Area.

- There is more efficiency in warehouse operations.

- Minimizes stock handling as much as possible.

- Improved Quality Assurance.

- Control over warranties.

Why should businesses adopt first in, first out (FIFO) principles?

Reducing the effect of inflation on your inventory expenses is one of the main benefits of employing the first in, first out approach. Inventory profit is maximized by selling older stock created when inflation and costs are lower.

How does FIFO impact ending inventory?

Due to the fact that the older things have been used up and the most recent purchases match current market pricing, FIFO can be a better estimate of the value for ending inventory.

Which technique of inventory valuation is the best?

Most organizations employ the FIFO technique in inventory accounting since it often provides the most accurate representation of costs and profitability.

Under which method of inventory cost flows is the cost flow assumed to be in the reverse order in which the expenditures were made?

The Last-In, First-Out (LIFO) method assumes that the cost flow of inventory is in the reverse order in which the expenditures were made. Under LIFO, the most recent items purchased or produced (the “last in”) are the first ones to be sold or used (the “first out”). This means that older inventory costs remain on the balance sheet.

Which technique of inventory is the best under inflation?

FIFO: FIFO can potentially increase the value of remaining inventory and result in higher net income during inflation.

What is the primary reason for the popularity of LIFO?

The Last-In, First-Out (LIFO) method is popular because it offers potential tax benefits. When prices are rising, LIFO allows businesses to match their most recent, higher-cost inventory against current revenues. This results in higher costs for goods sold (COGS), lower taxable income, and consequently, lower taxes.

Why do most businesses employ FIFO?

Since FIFO tracks inventory in line with the natural flow of inventory, older products will be sold first. By doing this, the possibility of having unsalable, out-of-date products on the books is eliminated.