QuickBooks Error PS033 is a payroll update error that occurs when QuickBooks Desktop cannot validate the payroll setup files stored in the CPS (Critical Payroll Setup) folder. The error interrupts payroll updates, tax table installation, and company file operations as QuickBooks relies on version-specific payroll configuration files to authenticate payroll data. Corruption in the CPS folder, outdated payroll components, invalid service key credentials, damaged company file entries, or incorrect billing information prevent QuickBooks from completing this validation process and trigger QB Error PS033.

The article identifies the primary technical causes of the error, which include corrupted CPS data, mismatched payroll version files, invalid tax table records, incorrect EIN or service key entries, and incomplete subscription authentication. It provides the essential procedures to resolve the error by updating payroll components, regenerating the CPS directory, rebuilding company file data, and adjusting system settings that affect payroll verification.

What is QuickBooks Payroll Update Error PS033?

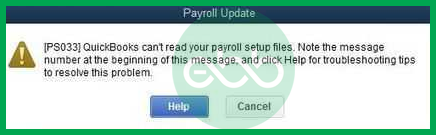

QuickBooks Payroll Update Error PS033 is a validation error that appears when the payroll update process detects irregularities in the payroll setup data used by QuickBooks Desktop. The error appears when the CPS data is corrupted, when payroll version files do not match the active QuickBooks release, or when the software cannot authenticate payroll information through the company file. When this verification fails, QuickBooks displays the message:

QuickBooks can’t read your payroll setup files. [Error PS033]

This error prevents the system from completing payroll-related tasks, and it temporarily stops access to features that depend on accurate payroll configuration data.

Why Does QuickBooks Payroll Update Error PS033 Occur?

Some of the common reasons behind QuickBooks Payroll Error PS033:

QuickBooks Payroll update error code PS033 happens when the users face problems while downloading or updating the Payroll. This error invalidates QuickBooks’ ability to confirm or open the company file because of several issues. Below are some common reasons behind this error:

- Corrupt CPS Folder or Files: The CPS folder, a subfolder of the Payroll Services folder, or any files in the CPS folder are corrupted, a condition that slows down the rate of performing payroll updates.

- User Account Control (UAC) Settings: UAC settings are still enabled, which should disable the payroll update.

- Outdated QuickBooks Desktop Version: Running an older version of QuickBooks can be dangerous because it may create compatibility problems with payroll updates.

- Damaged Company File: When a company file or its entries are corrupt, QuickBooks cannot process payroll updates, regardless of the software’s version and patches.

- Background Program Interference: This may cause bottlenecks, such as other programs running at the same time and intercontinental, causing a delay in the payroll update process.

- Damaged or Invalid Tax Tables: The payroll tax tables are filled with corrupted or invalid data that make updating them challenging.

- Incomplete or Incorrect Billing Information: If some billing detail is incorrect, it may contribute to discrepancies in the payroll update.

- Invalid Service Key, EIN, or PSID: Sometimes, the employer makes a mistake when supplying identification or service keys, causing payroll to not run correctly.

- Payment or Subscription Issues:Payroll subscriptions might be suspended, or there may be some pending payment problems with QuickBooks.

Core Methods to Fix QuickBooks Error Code PS033

The following solutions correct the payroll setup issues that trigger QuickBooks Error PS033 by restoring essential payroll files, updating required payroll components, and ensuring the system processes responsible for payroll validation function properly.

To resolve QuickBooks Payroll Update Error PS033, follow these solutions:

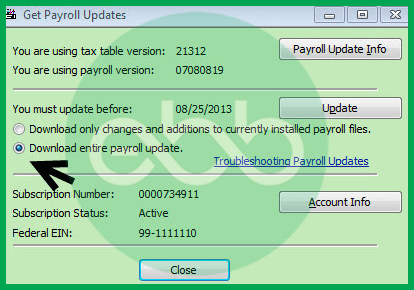

Solution 1: Updating to the Latest Payroll Tax Table

- Open QuickBooks Desktop and navigate to Employees > Get Payroll Updates.

- Select the option to Download the entire payroll update.

- Click Update.

Check if the error persists after the update.

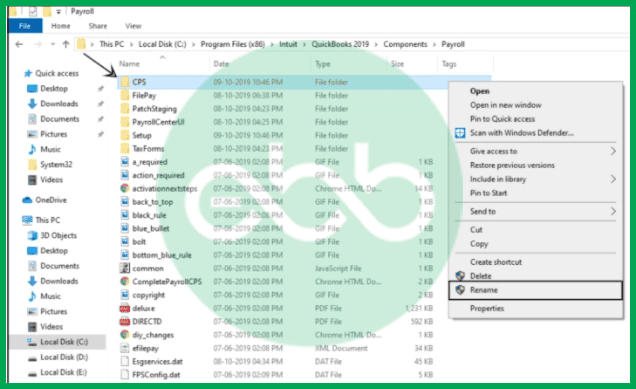

Solution 2: Rename the CPS Folder

- Navigate to the CPS folder using this path:

C:\Program Files\Intuit\QuickBooks 20pp\Components\Payroll\CPS

(Replace “20pp” with your QuickBooks version, e.g., 2018, 2020). - Rename the CPS folder to CPSOLD.

- Reopen QuickBooks and attempt to update the payroll tax table again.

Lastly, check if QuickBooks Payroll Error PS033 is resolved or not. Finally, update the payroll tax table.

Solution 3: If your computer is infected with the virus, turn off the User Account Control (UAC).

The UAC stands for User Account Control. Whenever a user performs unauthorized changes in the OS, it restricts the activity. Hence, it can also impact the activities of QuickBooks.

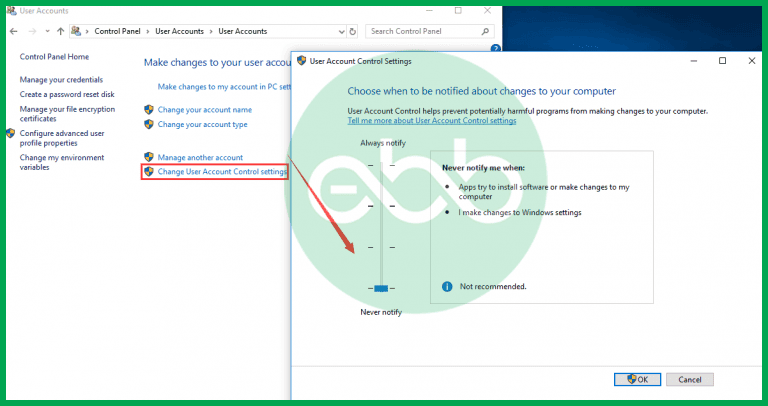

- Go to Start > Control Panel > User Accounts.

- Select Change User Account Control Settings.

- Drag the slider Never to Notify and click OK.

- Restart your system and try updating payroll again.

At last, restart the system and redownload the updates. Note that UAC is important for the system’s security. Hence, once the installation completes, switch the UAC back to the Always Notify option.

Solution 4: Troubleshoot in Safe Mode

- Open QuickBooks and go to File > Utilities > Rebuild Data. Follow the prompts to verify and rebuild the company file.

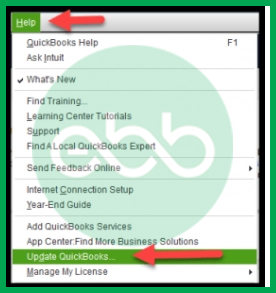

- Update QuickBooks Desktop to the latest version.

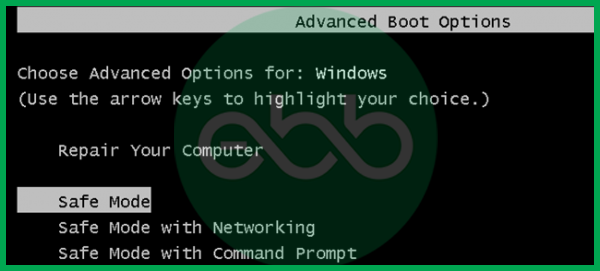

- Restart your computer in Safe Mode:

- Press and hold the Shift key while restarting your system.

- Select Safe Mode from the options.

- Update the QuickBooks payroll tax table.

- Restart the system in normal mode and verify if the error is resolved.

- Once again, enter normal mode by restarting the system and checking whether the problem is fixed or not.

Best Practices to Prevent QuickBooks Error PS033

Accurate payroll setup data and proper system configuration reduce the occurrence of QuickBooks Error PS033. The following best practices help maintain stable payroll records and ensure reliable payroll validation.

- Keep QuickBooks Desktop Updated: Install the latest QuickBooks Desktop releases to ensure alignment between program files, payroll components, and tax table updates.

- Regularly Update Payroll Tax Tables: Download the newest payroll tax table to maintain accurate payroll calculations and prevent validation conflicts during payroll updates.

- Ensure CPS Folder Integrity: Avoid modifying or moving files within the CPS folder. Create periodic backups to prevent data loss in the event of file corruption.

- Verify Company File Data: Use the Verify and Rebuild tools to detect and repair inconsistencies within the company file that may interfere with payroll validation.

- Check Service Key and Subscription Details: Confirm that the payroll service key, EIN, and billing information are correct and active to maintain uninterrupted payroll authentication.

- Use a Stable Windows Environment: Keep system settings updated and ensure that security software does not block QuickBooks processes related to payroll file validation.

- Perform Regular System Maintenance: Clear temporary files, update Windows components, and maintain consistent system performance to avoid disruptions during payroll updates.

- Maintain Correct User Permissions: Ensure that QuickBooks runs with appropriate administrative privileges so payroll setup files can be accessed and validated without restrictions.

Conclusion!

QuickBooks Error PS033 occurs when the software cannot validate the payroll setup data required for accurate payroll processing. The solutions outlined in the article repair the payroll configuration files, update payroll components, and correct system settings that interfere with payroll validation. These procedures support a stable payroll update process and minimize the chances of encountering error during future updates.

With this blog, we tried to list down all effective methods to solve QuickBooks Error PS033. Our support team keeps updating blogs for all other QuickBooks Errors. The solutions mentioned above will help you solve the issue. In case you cannot fix this error or are unable to understand the issue, reach out to us on our Error Support contact number +1-802-778-9005 for immediate support.

FAQs (Frequently Asked Questions)

Why is the Employer Identification Number (EIN) or Service Key critical, and how can I verify their accuracy in QuickBooks?

Errors like PS033 can be triggered by validation failures, which often point back to your core payroll credentials.

The Service Key links your QuickBooks Desktop software to your paid Intuit payroll subscription, enabling you to download tax tables and process payroll. The EIN (Employer Identification Number) is required to correctly identify your business for tax filings. If either is incorrect or mismatched with the Intuit servers, the payroll service will fail its validation check.

Verification Steps: You should check your service status directly in the software:

➜Close all company files and restart your computer.

➜Open QuickBooks Desktop.

➜Go to the Employees menu ➜ My Payroll Service➜ Manage Service Key.

➜Verify that your Service Name and Status show as Active.

➜You can select Edit to verify the service key number against your official Intuit records.

How do I verify if my QuickBooks Payroll subscription is still active and valid?

Since Error PS033 is often a validation issue, confirming your subscription is crucial. In QuickBooks Desktop, go to the Employees menu, hover over My Payroll Service, and select Account/Billing Information (or Manage Service Key). You will need to sign in to your Intuit account online to check the status and billing details of your payroll subscription. The status should display as Active or Current. An expired subscription will prevent any updates.

How do I check whether my QuickBooks Desktop version is still supported for payroll updates?

You can confirm your version’s support status in:

Help ➜ QuickBooks Desktop Updates ➜ Update Now or on Intuit’s “Supported Versions” product lifecycle page.

Unsupported versions frequently lead to payroll update restrictions that users encounter around PS-series errors.

How often should I run the Verify and Rebuild Data utilities to prevent payroll errors?

While there is no official schedule, it’s considered a best practice to run the Verify Data utility monthly (or quarterly) to preemptively detect any minor data inconsistencies. You should immediately run the Rebuild Data utility anytime the Verify Data tool reports that issues were found. Maintaining data integrity helps prevent file corruption from escalating to errors like PS033, which rely on a stable company file.

I keep getting a PS033 error. Should I always use the QuickBooks Tool Hub first?

Yes. Intuit recommends using the QuickBooks Tool Hub as the primary diagnostic starting point for most technical errors, including those in the PSXX series. The Tool Hub’s Quick Fix My Program feature automatically runs various program component repairs and system diagnostics that can resolve common causes of update and validation issues before you manually attempt steps like renaming the CPS folder.

How does the CPS folder relate to QuickBooks Error PS033?

The CPS folder contains payroll setup files required for payroll verification. Any corruption or version mismatch in this folder prevents QuickBooks from completing payroll validation and triggers Error PS033.

Can outdated tax tables lead to QuickBooks Error PS033?

Yes, outdated or invalid tax table files interrupt payroll verification because QuickBooks cannot authenticate payroll calculations using outdated data.

Does QuickBooks Error PS033 affect access to the company file?

Yes, when QuickBooks cannot validate payroll setup files, it may temporarily restrict payroll-related company file operations until the error is resolved.

How does updating QuickBooks Desktop help fix Error PS033?

Updating QuickBooks Desktop replaces outdated program files and aligns payroll components with the latest release, preventing validation conflicts that cause Error PS033.

Is renaming the CPS folder an effective solution for Error PS033?

Yes, renaming the CPS folder allows QuickBooks to create a new, error-free folder during the next update attempt, which resolves file corruption issues.

Can incorrect service key or EIN information trigger Error PS033?

Yes, incorrect payroll service key entries, EIN values, or subscription credentials disrupt payroll authentication and contribute to Error PS033.

Disclaimer: The information outlined above for “How to Fix QuickBooks Error PS033 – QB Can’t Read Payroll Setup Files?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.