QuickBooks Banking Error 102 occurs when the accounting software fails to establish a secure connection with a financial institution’s server. This disruption typically results from server maintenance, authentication conflicts, or unstable network communication between QuickBooks and the bank’s online platform. The error directly affects real-time transaction updates and synchronization accuracy, which are critical for financial data integrity.

This article provides a complete technical overview of QuickBooks Banking Error 102. It explains the underlying causes, outlines verified troubleshooting procedures, and describes preventive measures to ensure consistent connectivity. The solutions presented here are designed to help users diagnose connection failures, verify authentication details, and restore seamless integration between QuickBooks Online and their financial accounts.

Why does QuickBooks Error Code 102 Appear?

QuickBooks Error 102 commonly occurs in QuickBooks Online and QuickBooks Self-Employed when the software cannot connect to the bank’s website. The issue often arises due to server downtime, website maintenance, or interruptions during data transfer between QuickBooks and the bank’s server. The error can also result from incorrect bank login credentials, unstable network connections, newly added bank accounts, or temporary technical problems on the bank’s end, like website maintenance or downtime.

- Adding a new bank account or credit card that has not yet been fully activated for online banking integration.

- Temporary issues from the bank’s end, such as server downtime, website maintenance, or system updates.

- Entering incorrect or outdated login credentials while connecting QuickBooks to the bank account.

- Unstable or interrupted internet connectivity that prevents secure communication between QuickBooks and the bank’s server.

- Delayed synchronization due to security or verification settings on the financial institution’s website.

Effective Solutions to Fix QuickBooks Error Code 102

After identifying the causes of QuickBooks Error Code 102, apply the following solutions to restore proper connection and continue using QuickBooks Online without interruption. The steps below outline effective methods to resolve the banking error.

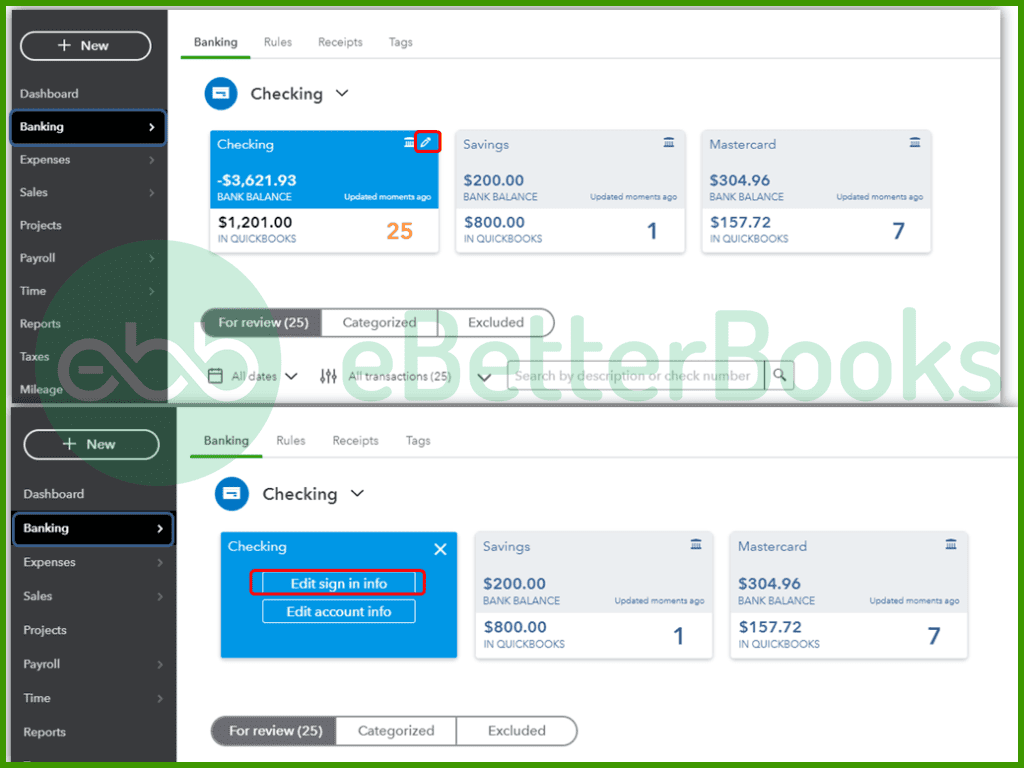

Solution 1: Ensure that the Account Details are Correct

You need to log in to the bank account using the URL given by your bank with online banking. If you are unable to connect the account to the bank, try connecting it by following the steps written below.

Step 1: Firstly, choose the menu and then click on Banking.

Step 2: In case of linking to the bank for the first time, click Search and look for the bank name.

Step 3: After that, choose the Add Account option and find the name of your bank.

Step 4: Once you are selected your bank, enter the credentials to log in to it.

Step 5: Next, tap on Continue and then choose Connect securely.

Step 6: For connecting your bank, click on the bank symbol from the drop-down menu.

Step 7: Now, you need to select the bank type or credit card account. If you don’t have an account, click on the Add + New option.

Step 8: Next, the online transactions will automatically get downloaded by QuickBooks for the last 90 days.

Step 9: Again, choose Connect.

Step 10: Once you are done with the process, go back to the banking page.

Step 11: Finally, choose the Review tab and accept the QuickBooks transactions.

Solution 2: Perform Manual Updates to QuickBooks Online

To manually update QuickBooks Online, click Menu > Banking, clear unwanted accounts, select Update Now, enter Multi-Factor Authentication (MFA), and click Continue to save changes.

Step 1: First of all, click Menu and then choose the Banking option.

Step 2: And then, choose the clear unwanted accounts to update the accounts.

Step 3: Next, click Update Now.

Step 4: You need to give the MFA (Multi-factor Authentication).

Step 5: Finally, click Continue to save the changes.

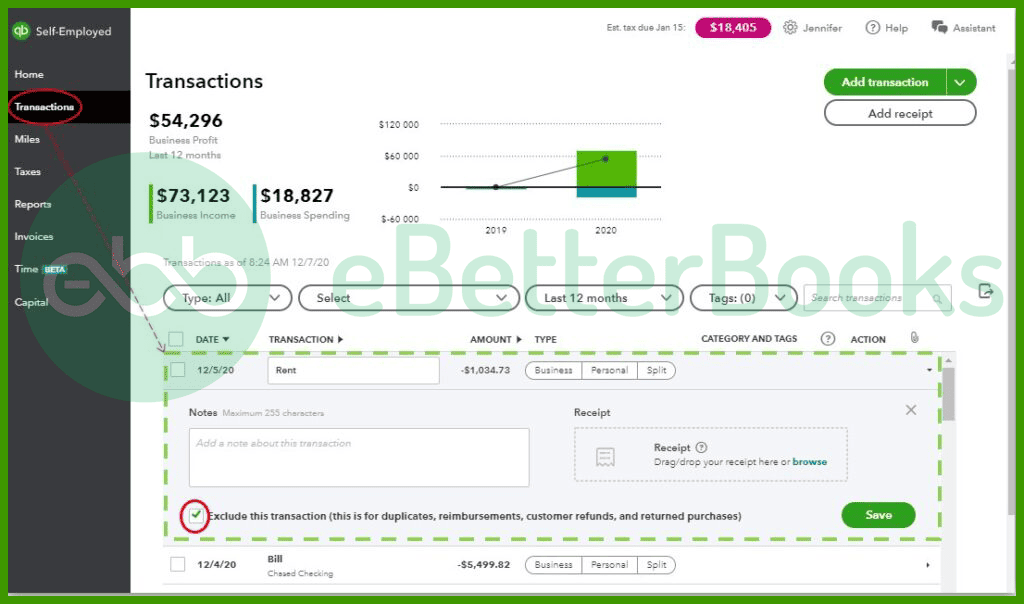

Solution 3: Update Bank Connections in QuickBooks Self-Employed

To fix QuickBooks Error 102, log in to QuickBooks Self-Employed, select the profile icon under Bank Accounts, and click Refresh All to update the bank connections.

Step 1: The initial step is to log in to the QuickBooks Self-Employed.

Step 2: Now, choose the profile icon from the Bank accounts.

Step 3: Finally, click on Refresh all and check whether QuickBooks online error 102 has been fixed or not.

Solution 4: Verify Whether the Account Is New to the Bank

You could also experience the same issue while opening a new bank account or credit card. You should keep in mind that a few new accounts do not support online banking. If you are stuck in the same situation, it is recommended to get connected with the bank/credit card provider to fix it.

Solution 5: Set QuickBooks to Update Automatically

If QuickBooks fails to update from a bank account, it will attempt the same update five additional times over the next five hours.

You can monitor the updates by following these steps:

Step 1: Access the Banking section from the left sidebar.

Step 2: Look for the “Update” option in the upper right corner.

Step 3: You will see the date and time of the last update.

Step 4: Perform a manual update.

Step 5: Go back to the Banking section.

Step 6: If you want to update only specific accounts, select “Clear Unwanted Accounts.”

Step 7: Choose the “Now Available Update” option.

Step 8: Enter your MFA (Multi-Factor Authentication) information and click on the “Continue” tab to proceed with the software upgrade.

For the next 90 days, you can expect your updates to be complete and reliable.

Solution 6: Wait Until the Bank Takes Action

In the end, if none of the above solutions worked in your case, then we suggest you wait for the bank’s response. Sometimes, the bank may take a long time to take action on such issues. They might be working on your server to fix the QuickBooks banking error 102. You must wait for 24 hours for the bank’s action.

Best Practices to Prevent QuickBooks Error Code 102 from Happening Again

To prevent QuickBooks Error Code 102, keep your bank credentials accurate, maintain a stable internet connection, update QuickBooks regularly, and monitor your bank’s server status.

- Verify Bank Credentials Regularly: Always ensure QuickBooks login details match your bank’s credentials and update them after any authentication changes.

- Monitor Bank Server Status: Before initiating synchronization, check the bank’s website for scheduled maintenance or temporary downtime notifications to avoid connection interruptions.

- Use a Stable Internet Connection: Use a secure and reliable internet connection to ensure uninterrupted data transfer between QuickBooks and your bank’s server.

- Keep QuickBooks Updated: Keep your QuickBooks Online or Self-Employed version updated to the latest release to ensure compatibility with your bank’s online system.

- Refresh Bank Feeds Periodically: Manually refresh bank feeds at regular intervals to detect any synchronization issues early and prevent data transfer delays.

- Avoid Adding Inactive Accounts: Confirm that new or recently opened accounts are fully activated for online banking before linking them with QuickBooks.

- Use Multi-Factor Authentication (MFA): Enable MFA for added security and to ensure successful verification during data synchronization with your financial institution.

Conclusion!

QuickBooks Banking Error 102 is primarily caused by connection failures between QuickBooks and a financial institution’s server, often due to server downtime, incorrect login credentials, or unstable internet connectivity. By verifying bank account details, updating the connection manually, and monitoring the bank’s server status, users can effectively restore synchronization. In some cases, waiting for the bank to complete maintenance or resolve server issues can also resolve the error automatically.

Accurate credentials, a stable internet connection, and regular updates in QuickBooks Online or Self-Employed help prevent this issue in the future. Consistent monitoring of your bank feeds and timely updates will ensure uninterrupted data exchange and accurate financial reporting within QuickBooks.

FAQs!

Can incorrect login credentials cause Error 102?

Yes, ensure that your bank login credentials used in QuickBooks match those used on the bank’s website. Reset your credentials if needed.

Can QuickBooks File Repair Tools help resolve Error 102?

Error 102 is typically a connectivity issue, tools like the QuickBooks Tool Hub can assist in diagnosing and resolving other related errors if any corruption is found in QuickBooks data files.

What are the initial steps to resolve Banking Error 102?

- Wait a few hours and try again if the issue is caused by bank server maintenance.

- Ensure your internet connection is stable.

- Manually update your QuickBooks banking connection by navigating to Banking > Update.

What causes QuickBooks Error Code 102?

QuickBooks Error Code 102 occurs when the software cannot connect to a bank’s server. This can result from server maintenance, incorrect login credentials, new or inactive bank accounts, or unstable internet connectivity during synchronization.

Does QuickBooks Error 102 affect my financial data?

No, error 102 does not impact your existing financial data in QuickBooks. It only prevents new transactions from downloading until the connection between QuickBooks and your bank is restored. After the resolution, all pending transactions will synchronize automatically.