What is Credit Card Churning?

Credit card churning is an act of deliberately opening the same or multiple cards in order to maximize rewards, like earning generous welcome bonuses and then closing the card before the next annual fee is charged.

Credit card churning is not illegal or unethical, but it does impact your credit score negatively.

While credit card churning is profitable for the user as they get hefty sign-up bonuses and other offers, it is burdensome for the card issuer because it increases the customer acquisition cost of the credit card issuers.

Credit card issuers monitor frequent account openings and closures, which may raise red flags and affect your chances of getting approved for future cards.

Real-World Example of Credit Card Churning

Julie, a graduate student, used credit card churning as a tactic to finance her travel goals without breaking the bank. She managed to meet minimum spending criteria and accrue significant rewards while having a mere stipend, which allowed for affordable local and foreign travel. In order to prevent debt, her strategy necessitated careful planning and rigorous adherence to spending limits.

Execution and Strategy

- Card Selection: Julie chose credit cards with high sign-up bonuses, such as those that give 50,000 points or more when a certain amount of spending is met within a predetermined period.

- Reaching the Minimum Spend: Julie carefully scheduled her applications to align with her anticipated expenses in order to meet the spending criteria, which frequently ranged from $3,000 to $5,000 within three months. To reach these goals without going over budget, she also used strategies like buying gift cards for later use.

- Reward Redemption: Julie paid for several of her travels by accruing points and miles. She used 60,000 points, for example, to pay for a round-trip overseas travel, which would have cost $1,200.

- Financial Management: Julie avoided interest costs by paying off her accounts in full each month, demonstrating her financial discipline. In order to guarantee prompt payments and account management, she also used spreadsheets to monitor her expenditures and card information carefully.

Insights

- Financial Discipline: Julie’s story highlights the need for careful money management, which includes making on-time payments and spending wisely in order to optimize gains without taking on debt.

- Credit Score Management: If accounts are handled carefully, responsible churning—like Julie’s—can coexist with preserving or even raising one’s credit score.

- Organizational Skills: To effectively manage several credit cards accounts, one has to be well-organized in order to keep track of expenses, deadlines for payments, and expiration dates of rewards.

- Risk Awareness: Possible risks include debt accumulation, potential harm to credit ratings if improperly handled, and the possibility that banks would tighten their approval standards for alleged churners.

Julie’s strategy demonstrates how people may use credit card churning techniques to obtain significant benefits without jeopardizing their financial stability if they plan and practice disciplined money management.

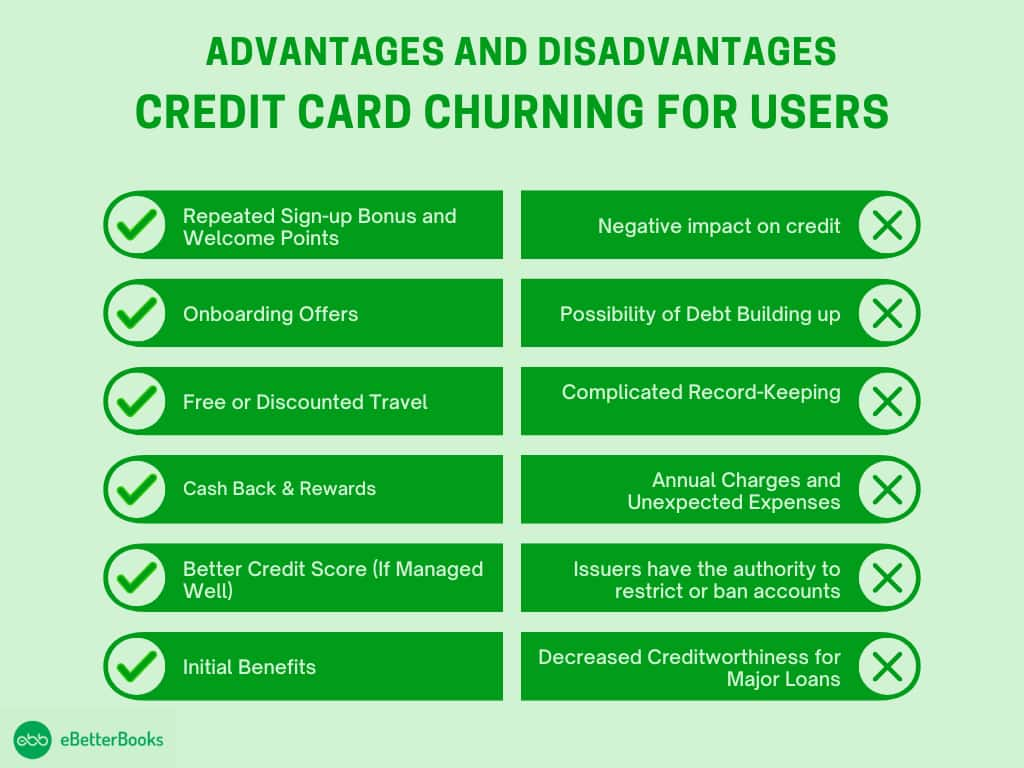

Advantages of Credit Card Churning for the Users

- Repeated Sign-up Bonus and Welcome Points: By repeatedly using their credit cards, users may accrue huge sign-up bonuses and welcome points, which are often worth $500 to $1,000 for each card. They can rapidly accrue points, miles, or cash back for free travel, items, or statement credits by timing applications and fulfilling spending terms.

- Onboarding Offers: Many credit cards have onboarding perks, which include travel, shopping, eating, or entertainment coupons. These can help you save money on flights, hotels, and other purchases, in addition to sign-up rewards.

- Free or Discounted Travel: Travelers may reserve flights and accommodations at a steep discount or even for free by using their accrued miles and points.

- Cash Back & Rewards: A lot of credit cards give cash back on purchases, which enables churners to receive rewards equal to a portion of their expenses.

- Better Credit Score (If Managed Well): Some consumers may eventually notice an improvement in their credit score if they maintain a low credit utilization rate and make on-time payments.

- Initial Benefits: Credit Card Churners receive benefits like statement credits, trip insurance, airport lounge access, and 0% APR periods.

Disadvantages of Credit Card Churning for the Users

- Negative Impact On Credit: Frequent credit card applications automatically decline your credit score, as each inquiry regarding the credit card drops the score. Also, even when the customer closes a credit card, the credit utilization ratio can decrease.

- Possibility of Debt Building Up: Users who fail to pay off their amounts in full risk paying exorbitant interest fees, which would offset the benefits of their incentives.

- Complicated Record-Keeping: In order to avoid penalties, managing several cards necessitates keeping track of spending requirements, payment deadlines, and yearly fees.

- Annual Charges and Unexpected Expenses: If the benefits don’t outweigh the cost, some premium cards have hefty annual fees.

- Issuers Have the Authority to Restrict or Ban Accounts: Frequent churners may find their options limited by bank restrictions such as Chase’s 5/24 rule, which prohibits applicants from obtaining five or more new cards in 24 months.

- Decreased Creditworthiness for Major Loans: Applying for too many credit cards quickly might cause lenders to become suspicious, which may have an impact on mortgage or auto loan approvals.

How Does Credit Card Churning Work?

Credit card churning is the act of opening multiple credit cards in order to get welcome offers or other rewards and closing them before the annual fee is charged.

Here’s how the procedure works:

| 1 | Choosing a Credit Card with a Lucrative Sign-up Bonus | The first step is choosing a credit card that offers a generous sign-up bonus like points, miles, or cashback. Cards with high rewards and minimal minimum spending criteria are perfect for churning. It’s crucial to review the issuer’s regulations regarding repeat bonus eligibility. |

| 2 | Meeting the Eligibility Minimum Spending Requirements | Most credit cards require you to spend a certain amount within the first few months (e.g., $3,000 in the first 90 days) in order to be eligible for the sign-up bonus. Churners carefully arrange their purchases to satisfy this criterion without going over budget or leaving a balance that is subject to interest. |

| 3 | Receiving and Redeeming the Rewards | The bonus is usually credited to the account within a billing cycle when the spending criterion is met. Depending on the rewards of the card, churners exchange these points for gift cards, cash back, travel, or statement credits. |

| 4 | Closing the Card Before the Next Annual Fee | Many churners downgrade or close the card before the renewal date in order to avoid paying a second-year annual fee. Future approvals may be impacted by restrictions that some issuers have that prohibit repeated cancellations. |

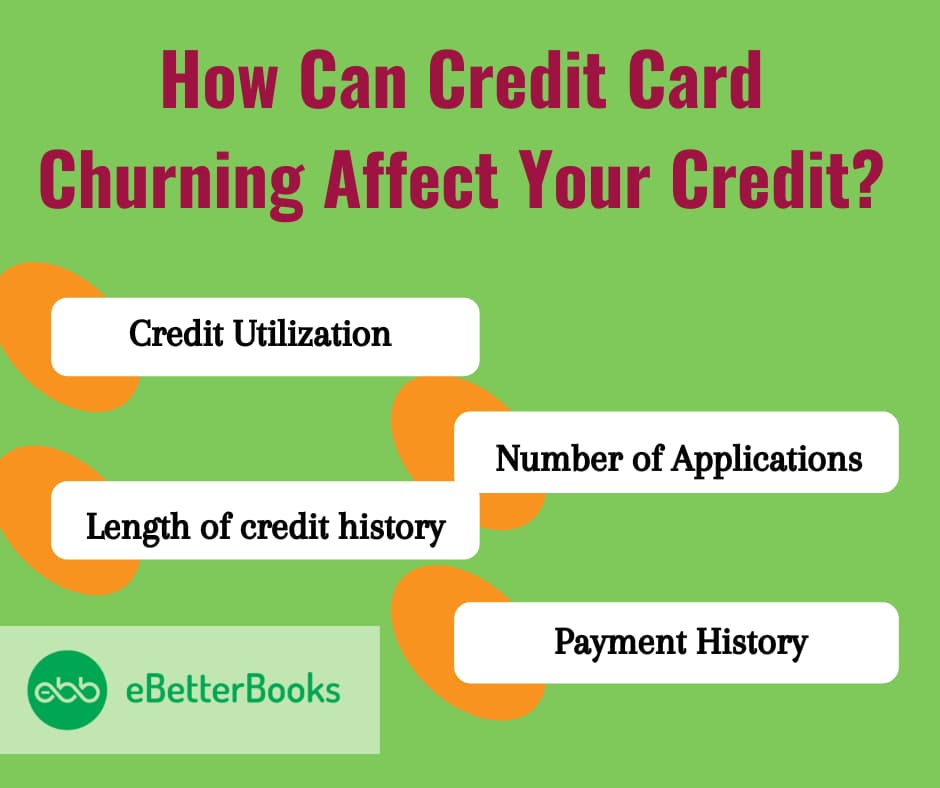

How Can Credit Card Churning Affect Your Credit?

Credit Utilization

Credit utilization makes up 30% of your credit score, so you should keep this number under 30% to maintain a good credit score.

Applying for multiple credit cards within a short period in order to get the incentives that the new card offers beyond paying the annual fee and then promptly canceling the card is actually damaging to your credit ratio.

If you have multiple credit cards and make sure to pay your bills in full each month, then your number is likely low. But, if you’re racking up large amounts of debt across credit cards to get sign-up bonuses, this number could be higher, and your credit health could be at stake.

Number of Applications

The minute you apply for a new credit card, a hard inquiry is generated. A hard inquiry is when a lender requests your credit reports before approving your application. It can appear on your credit report for up to two years and cause your credit rating to drop briefly by five to ten points.

Hard inquiries generally only hurt your credit scores a little, but multiple applications can increase the damage. Also, when you apply for these credit cards, it gets to the attention of the issuers that you are getting credit-hungry. You may be refused credit in the future.

Length of Credit History

If you are someone who opens many credit cards to get the sign-up bonus, then closing the cards will hurt your credit score.

The average length of credit history decreases, which makes up 15% of your credit score if you have many recent accounts.

It is easier to maintain an account and use it for that rather than to close old cards completely; you could switch your credit card to a no-fee card but still retain the same card number and, therefore, credit line and credit history.

Payment History

Payment history constitutes 35% of your FICO Score and 41% of your VantageScore. Though your credit score is part of your financial profile, it is crucial to maintain it.

If you miss the notices and fall 30 days behind, the card issuer may report the late payment to the credit bureaus, which could significantly hurt your credit scores. Delays in payments result in fees and penalties, but always call the card issuer and ask to have these charges removed if it is just an error.

While credit card churning may not heavily affect your score, it can significantly impact how credit card issuers view you as a customer in the future.

Bank Rules to Prevent Churning

Issuers often keep a limit on earning signup bonuses in order to prevent credit card churning. Though credit card companies like to attract new cardholders, they would prefer to establish a long-term banking relationship with credit card users rather than have temporary users. Banks get benefits when customers receive their cards but don’t utilize their offers and pay interest and fees.

There are different rules by different issuers, which make it difficult for cardholders to churn. Along with that, for customers who keep attempting to cancel credit card accounts too early, card issuers take back bonus points earned and deny further accounts.

Some of these restrictions include:

| Bank Name | Rule Name | Explanations |

|---|---|---|

| Chase | 5/24 Rule | Chase limits approvals if you’ve opened 5 or more personal credit cards (from any issuer) in the past 24 months. You are also ineligible for a sign-up bonus if you have received one for the same card during the previous 24 months. |

| Wells Fargo | 6-Month Rule | While there are no severe sign-up bonus limits, you may be disqualified for a new credit card if you have opened another Wells Fargo card within the last six months. |

| Bank of America | 24-Month Rule | There are no limitations on sign-up incentives, but you may be rejected for a new card if you’ve had the same one in the previous 24 months. |

| Capital One | 48-Month Rule | Welcome bonuses are only offered to new customers who have not received a bonus on the same card in the previous 48 months. |

| American Express | Once-Per-Lifetime Rule | Amex only permits one welcome bonus per card for a lifetime. Thus, you cannot obtain another bonus for the same card. |

| Citi | 48-Month Rule | Sign-up rewards are only eligible if you have not earned a bonus for the same card in the previous 48 months. |

The Bottom Line

Opening new credit cards strategically can help you earn points and miles, but it’s vital to choose cards that fit your lifestyle for long-term benefits. The opportunity to gather points, miles, and other bonuses is interesting. It may be easier to churn and obtain free rewards, but the consequences are dangerous to your credit standing and financial future. This lowers one’s credit score and, if not controlled properly, leads to needless overspending and debt accumulation.

FAQs!

Does churning credit cards hurt your credit score?

Yes, churning credit cards hurts your credit scores because each new account lowers the average age of your credit accounts.

What happens if I use 100% of my credit card?

A maxed-out credit card can lead to declined purchases, impact credit scores, and increase monthly credit card payments.

What is the golden rule of credit card use?

A golden rule of credit cards is never to charge more than you can pay off in full each month. This keeps your balance at $0 and helps you avoid paying interest.

Is credit card churning profitable?

No, credit card churning is not profitable for most people because to redeem most of the benefits, you need to reach a specific spending threshold.