What is Credit Card Skimming?

Credit card skimming means illegal capture of card data, often at ATMs, gas stations, or point-of-sale terminals, without the victim’s knowledge, to clone the cards for unauthorised transactions.

In addition to unauthorized transactions, credit card skimming can lead to identity theft, and financial losses.

A fraudulent method of obtaining data from ATM, debit, or credit cards when they are actually being used at the place of sale such as merchant locations, ATMs, gas stations, etc. Credit card skimmers use unauthorized devices in the act of copying information from the magnetic strip of a credit or debit card.

Most fraudsters utilize a small, hidden gadget known as the skimmer to obtain this data every time you use your card to make a transaction.

What Can you Do to Protect Yourself from Card Skimming?

The following steps can be followed:

- Every person should examine card readers before inserting payment cards.

- Conduct an inspection of the machine to check for unusual accessories added to its framework.

- Chipped credit cards present a superior defense against skimmers since they provide harder targets than magnetic stripe cards.

- Check your account statements frequently to spot any doubtful transactions.

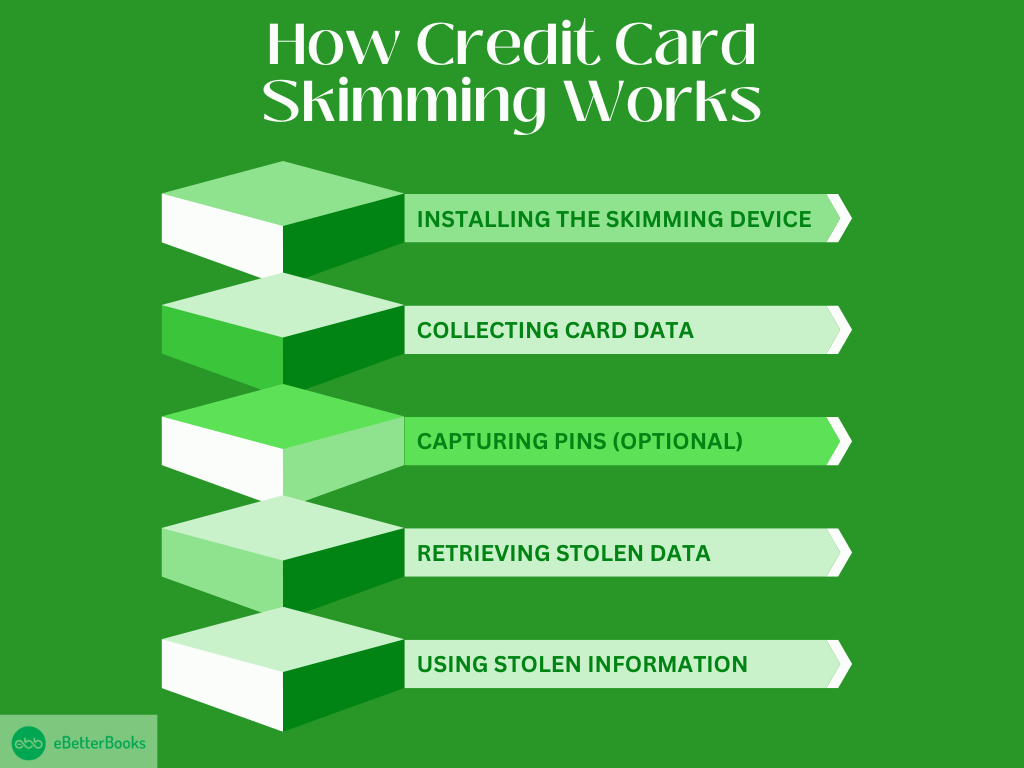

How Credit Card Skimming Works

Credit card fraud involves a fraudster obtaining your card details without your consent in what is known as card skimming.

This is commonly achieved by embedding hardware at the point of sale, such as card readers, to capture information from its magnetic strip and, at times, PIN.

Here’s a step-by-step breakdown of how it works:

1. Installing The Skimming Device

Fraudsters start the process by fixing a skimmer, a small and almost invisible device fixed over the original card reader.

These skimmers are usually manufactured to look like a natural part of the original machine, and users are often unable to note the change.

- ATMs: A skimmer is placed above the card slot, and a hold of a fake keypad or a concealed camera is used to capture your PIN.

- Gas Stations and Retail Stores: Skimmers are installed on fuel pump card readers or at the point of sale terminals.

2. Collecting Card Data

When you insert or swipe your card, the skimmer captures and copies the data that is encoded globally in magnetic stripes. This stripe contains essential details such as:

- Security code (in some cases)

- Cardholder’s name

- Card number

- Expiration date.

3. Capturing PINs (Optional)

If a PIN is required for the transaction, fraudsters may use one of these methods to steal it:

- Hidden Cameras: Miniature cameras are located in anticipation of capturing your hand as you type your PIN.

- Fake Keypads: A blank keypad overlaid on the actual one records the keys you press on the actual keypad.

4. Retrieving Stolen Data

After the skimmer has captured card details, the fraudsters recover the data.

This can be done in several ways:

- Manually: They physically withdraw the skimming device to get into the stored information.

- Wirelessly: Bluetooth-enhanced Skimmers, together with other Wireless technologies, enable criminals to download data from a distance.

5. Using Stolen Information

After obtaining your card data, fraudsters use it for unauthorized activities such as:

- Cloning Cards: Fraudulent credit cards are made for use in physical stores for purchases.

- Online Shopping: Involves making purchases that do not necessitate the physical use of the card by inputting the card details.

- Selling Data: The use of stolen information in the black market to sell to other criminals.

How to Spot a Credit Card Skimmer?

The Identification Technique for Credit Card Skimmers includes:

- Check card readers for any abnormal objects or altered segments.

- Watch for indications of tampering by checking machine parts that show looseness or misalignment.

- Examine extra devices in the payment slot to spot any unusual attachments which do not belong.

What Happens to your Card After it Has Been Skimmed?

Skimming victims must understand how criminals will use their stolen card information from this moment forward. An unauthorized person can conduct illegal transactions using your card information thus putting your money at risk. Your card falls victim to criminals who use cloning techniques to create copies of it for illegal buying activities. The first response when you notice skimming of your card should be an immediate call to your bank to freeze your account and report unreputable transactions.

How to Avoid Credit Card Skimming Fraud?

If you know how criminals operate and ensure that you maintain secure practices, then you definitely won’t have your card details stolen.

Follow these best practices to avoid credit card skimming:

1. Inspect Card Readers and ATMs

If you decide to use a card reader at an ATM, petrol station, or even in a shop, first look for signs of interference.

- Look for Loose or Bulging Components: A skimmer may make the card reader look loose or even abnormally thick.

- Inspect for Mismatched Colors: Compare the texture, color, or shape of the card slot and the neighborhood with those of the other slots or areas of the device.

- Check the Keypad: Make sure that it connects firmly and does not conceal any incorrect overlays, which will record your PIN.

2. Use EMV Chip Cards

EMV (Europay, MasterCard, and Visa) chip cards are much more secure than magnetic cards, making it very hard for fraudsters to swipe your data.

- Chip Cards: These cards come with Universal Integrated Circuit Cards that create a serial code for each transaction, which cannot be easily copied on the card or used to forge the data.

- Contactless Payments: Avoid using this card by swiping or inserting it, as it is likely to be skimmed. Instead, use the contactless option.

3. Cover the Keypad When Entering Your PIN

Skimmers use small cameras or fake keypads to capture your PIN as you key it in.

To protect yourself:

- Cover the Keypad: When entering a PIN at the ATM or during card transactions, keep your hand or fingers over the keypad to prevent cameras from capturing your PIN.

- Watch for Hidden Cameras: Search for any concealed cameras the size of a pinhole that is located close to the card reader or keypad.

4. Use Mobile Payment Methods

Services such as Apple Pay, Google Pay, or Samsung Pay for mobile payments are far safer than sliding your card through the terminal because your data is tokenized and encrypted.

- Contactless Payments: Pay cashless by employing a smartphone or a smartwatch instead of physically using a card or swiping.

- Tokenization: Mobile wallets use card data that is as sensitive as magnetic strips, but instead of using the actual data for identifiers, they use codes that could be more helpful to fraudsters.

5. Choose Your ATM and Payment Terminals Well

Some areas are more at risk of having counterfeits than others, and that is why the current findings suggest that some of the devices purchased in this field are most probably counterfeits.

Here’s how you can minimize risk:

- Use Bank-Owned ATMs: Customers should prefer ATMs located inside the banking premises, as most of them are monitored.

- Avoid Standalone Machines: Self-service banking terminals sited in dark or secluded places are most vulnerable to unlawful meddling.

- Look for Security Features: Choose UPTs equipped with security cameras and ATMs located in saturated, secured spaces.

6. Monitor Your Statements Often

Prevention is the best refrain, as they say, and the best way to prevent fraud is to detect it early.

- Monitor Transactions: Always remember to monitor your bank account and credit card statements to identify fraudulent transactions.

- Set Up Alerts: Most banking institutions send transaction alerts to users’ email or mobile devices. You need to sign up for alerts to be informed when your card is in use.

7. Install Anti-Malware Software

While skimming is often referred to as using physical devices, another aspect is online skimming, or “Magecart” attacks.

- Use Strong Security Software: It is highly recommended that you install effective, quality anti-virus and anti-malware software on your devices.

- Use Secure Websites: To protect yourself when ordering online, always check that your connection is encrypted (be sure https is included in the address, and there is a padlock sign).

8. Report Suspicious Activity Immediately

If you think your card data is compromised, do not waste time; mitigate the consequences.

- Notify Your Bank or Card Issuer: Specifically, users should report any suspicious transactions and demand that the bank issue them a new card with a different number.

- Freeze Your Account: Most banks have a feature that enables you to block your card and stop future transactions from being processed.

- File a Police Report: In case of high fraud amounts or if your identity was compromised, also notify the law enforcement agency.

9. Be Cautious with Public Wi-Fi

All Wi-Fi hotspots available to the public are usually unsecured, and hackers can easily compromise individuals’ credit card information.

- Avoid Online Transactions on Public Wi-Fi: When connected to public Wi-Fi, avoid browsing or typing information, especially passwords and accounts such as banking apps or shopping sites.

- Use a VPN: If you still must connect to a public Wi-Fi to process financial transactions, use a VPN connection.

10. Learn More About Skimming Techniques

Learn about today’s most common skimming strategies. Luckily, there is a way to differentiate a skimmer from a normal card reader by identifying what to look out for.

- Stay Updated: Daily monitor for new cases of skimming scams and the different ways in which fraud occurs.

- Learn from Others: You should also share tips with friends and family to ensure their safety.

When you find fraudulent activities on your credit card or account, it is important to take immediate action to reduce the losses.

Here’s a step-by-step guide on how to report unauthorized transactions:

- Go Directly to Your Bank or the Card Company Immediately: You can report fraud by calling the customer service number on the back of your credit card or through the bank’s website.

- Freeze or Block Your Card: Ask to suspend your account or block your card in order to stop preying on additional unauthorized transactions.

- Review Recent Transactions: Review the list of all the recent transactions. This will help you discover fraudulent charges.

- File a Fraud Claim: Report the fraudulent transaction to your bank and provide all the necessary information in a formal fraud claim.

- Request a New Card: Request for a new card with a new account number and security code instead.

- Notify the Authorities: For serious fraud, write a report to the police or any other law enforcement agency.

- Monitor Your Accounts: To deal with any continued fraud easily, check your account statements and set up fraud alerts.

Following is a table with links to the helpline websites of major banks and financial institutions for reporting unauthorized transactions:

| Bank/Card Issuer | Bank/Card Issuer | Website to Report Fraud |

|---|---|---|

| Bank of America | 1-800-421-2110 | Report Fraud on Bank of America Website |

| Chase | 1-800-955-9060 | Report Fraud on the Chase Website |

| CitiBank | 1-800-248-4226 | Report Fraud on Citibank Website |

| Wells Fargo | 1-800-869-3557 | Report Fraud on Wells Fargo Website |

| American Express | 1-800-528-4800 | Report Fraud on American Express Website |

| Discover | 1-866-240-7938 | Report Fraud on Discover Website |

| Capital One | 1-800-427-9428 | Report Fraud on Capital One Website |

| Mastercard | 1-800-627-8372 | Report Fraud on Mastercard Website |

| Visa | 1-303-967-1096 | Report Fraud on Visa Website |

| HSBC | 1-800-462-1874 | Report Fraud on HSBC Website |

The Bottom Line

Credit card skimming can occur in any environment that accepts credit card use; however, awareness and prevention milestones will lower this risk.

It may sound strange, but the best ways to guard against this emerging form of fraud are to check card readers, use safer forms of payment, and monitor your financial activity.

Always remember: if something does not seem quite right, whether visual or a gut feeling, do not go through with the transaction.

FAQs!

What is a credit card skim?

A credit card skim is the illegal process of capturing your card’s data using a small device, often attached to ATMs or card readers, without your knowledge.

How do you tell if your credit card has been skimmed?

Signs of card skimming include unexpected transactions on your account, unfamiliar charges, or a sudden decline when using your card.

How do I stop my credit card from being skimmed?

To prevent skimming, inspect card readers for tampering, use credit over debit, enable alerts, and cover your PIN while entering it.

What is the risk of card skimming?

The risk of card skimming includes unauthorized transactions, financial loss, and potential identity theft.