A credit card payment schedule is a well-set plan for handling and controlling credit card payments.

A Credit Card Payment Schedule is a planned agreement between a cardholder and a card issuer that specifies when payments are due, how often they occur, and the amounts to be paid.

A cardholder can manage their payment schedule by setting it in advance (AutoPay option). Making payments on a timely basis, helps a cardholder build or improve the credit history.

A credit card payment calendar shows your statement closing dates and payment due dates, typically within a 28 to 31-day cycle.

Why is the Credit Card Payment Schedule Important?

Credit Card Payment Schedule is important because:

- It helps the cardholder in protecting and building the credit score.

- It helps in reducing interest charges.

- It helps in maintaining a good relationship with the card issuer.

- Cardholders can avoid the late fees, usually costing around $40 – $70, depending on the type of credit card policies.

- It helps in building a positive payment history.

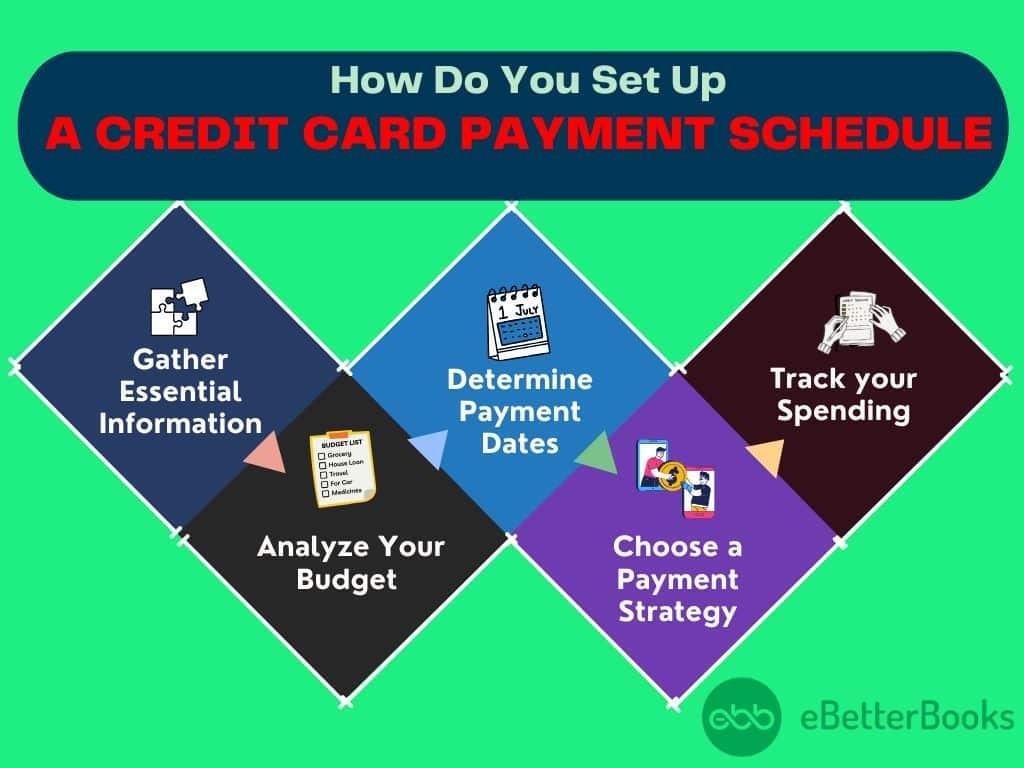

How Do you Create a Credit Card Payment Schedule?

Step 1: Gather Essential Information

Cardholders should begin by collecting all the necessary details about their credit cards, including:

- Credit limits.

- Billing cycle dates.

- Minimum payment amounts.

- Interest rates.

Step 2: Analyze Your Budget

Use the collected information to decide how much percentage of your income you can afford to pay off your credit card. Now, calculate your basic and net take-home pay for the given month.

Note: It is advisable to pay more than the minimum amount on your credit card to eliminate your debt quickly.

Step 3: Determine Payment Dates

Most credit cards have a fixed due date on which the cardholder is expected to have paid for the expense incurred. You can select the date on which you would like to make the payment – one may set reminders several days prior to the specific due date.

If you have more than one credit card, try to make payment dates similar to avoid creating confusion.

Step 4: Choose a Payment Strategy

Decide on a payment strategy based on your financial goals:

- Debt Avalanche: Minimum payments should be made on the other cards, then the focus should be on paying the card with the highest interest rate.

- Debt Snowball: Pay the amount and revive the principal to the smaller balances first for psychological motivation.

Step 5: Track your Spending

Track your spending to manage debt and prevent accumulation. Regularly review credit card statements for unauthorized charges or errors.

How Do You Set Up a Credit Card Payment Schedule?

Cardholders generally find it difficult how to schedule a credit card payment.

So here are the steps mentioned below:

Step 1: Decide the Payment Method

The easiest way to ensure on-time payments is to set up automatic payments by logging into your account online or through the app and connecting your bank account.

If you prefer to pay manually, use calendar reminders or a payment tracking app. Many credit card companies also offer email and SMS alerts for due dates to remind you to pay on time.

Step 2: Open your Account

You can either use a mobile app or online portal to open your account in order to set up the automatic payment option.

To avoid late payment cases, make direct payments through your bank or card issuer. You can automate the minimum payment or the desired amount of your choosing.

Step 3: Automate Payments

For automatic payments:

- Access your account’s payment settings.

- Link your bank account for payments.

- Set up automatic payments for the full balance or a minimum amount.

- Choose a payment date before your credit card due date.

- Confirm the payment details.

For manual payments:

If you choose manual payments, set reminders in your calendar or use a payment tracking service. Ensure your contact details are updated with your credit card issuer for payment reminders.

Step 4: Monitor and Adjust

Check payment settings for accuracy and confirm that automatic payments have been assigned to your account. Pay attention to the timing of your payment. Daily life and economic objectives may be dynamic, so adjust your schedules accordingly.

Benefits of Credit Card Payment Schedule

The schedule of paying the amounts due for a credit card is beneficial for the people and company concerned in a way that they can manage their finances more effectively.

Here are some key benefits:

- Improved Budgeting: A payment schedule helps people understand when and how much they should pay. This assists in managing expenses, and you avoid wasting or missing payment for a particular project.

- Avoid Late Fees: A fixed routine prevents forgetting certain payment dates and thus reduces the late fees or penalties that will be added to the amount.

- Better Credit Score Management: A consistent payment schedule improves credit scores because on-time payments are essential for credit scoring.

- Reduced Interest Payments: A regular payment schedule allows the balance to be paid down at a faster fee, thus charging less interest on the balance.

- Stress Reduction: People are not under pressure when payment is due or the amount that is expected to be paid, unlike when one has to budget for repayment without knowing the amount to be paid.

- Debt Reduction: It is much more effective to pre-arrange how you’ll pay off the amount you owe instead of adding it up repeatedly.

- Improved Financial Discipline: When credit card bills are paid on time, it is easier to know and regularly keep track of other expenses on an agreed-upon date.

- Increased Savings: If you bill thoroughly for payments and avoid extra interest, you will be in a better position to invest more money in savings or other areas.

How Can a Payment Schedule Damage Your Credit Score?

- Missed Payments

When you fail to make the agreed payment, the lender is going to report it to the credit bureaus ( Equifax, Experian,TransUnion). A payment that is more than thirty days overdue can negatively affect your credit score.

- Underpayment

Paying only the minimum on your bills can hurt your credit utilization ratio as lenders see high balances as risky. Even if you pay off your balance monthly, a consistently high balance can negatively impact your score if it’s overlooked.

- Failure to Account for Changes in Payment Terms

Your credit card issuer may change the Annual Percentage Yield (APY), payment due date, or minimum payment amount. If the payment schedule isn’t updated, you might underpay or miss a payment, resulting in fees, higher interest rates, and a negative impact on your credit rating.

- Paying Too Much, Too Quickly

It’s best to eliminate debt quickly, but large payments that you can’t afford can cause you to miss other payments and damage your credit score. This emphasizes the need to prioritize your payment obligations.

How a Payment Schedule Can Improve Your Credit Score?

On-Time Payments

Agreeing to a payment plan increases your chances of making on-time payments, which is crucial for your credit rating. Payment delays can remain on your credit report for up to seven years, negatively affecting your score. A payment schedule helps you avoid forgetting due dates.

Consistent Reductions in Debt

A credit score is influenced by factors such as credit usage and available credit. Make sure to keep your credit utilization below 30% and make regular payments, ideally exceeding the minimum due. This helps lower your balance and shows creditors that you manage credit responsibly, which can improve your credit score.

Assists With Credit Card Usage

A good payment plan allows you to pay down balances and maintain a healthy credit card utilization ratio. High utilization, especially with only minimum payments, can negatively impact your credit score. So, making timely payments by using the payment schedule helps in improving the credit score.

Difference Between Payment Schedule and Billing Cycle

| Aspect | Payment Schedule | Billing Cycle |

|---|---|---|

| Definition | A plan you create to manage when and how much to pay towards your credit card balance. | A fixed period (28–31 days) defined by your card issuer to track transactions, fees, and payments. |

| Timing | Flexible; you can set payment dates based on your financial situation (e.g., weekly, bi-weekly, monthly). | Fixed; set by your card issuer (e.g., 1st to 31st of each month). |

| Purpose | To ensure consistent, on-time payments and manage debt repayment. | To track all transactions, calculate balances, and generate a statement. |

| Impact on Credit | Directly impacts your credit score through timely payments and utilization. | Indirectly affects your credit score via credit utilization and reported balance. |

| Dates | Payment dates are based on your schedule (e.g., 10th of each month). | Start and end dates are fixed (e.g., 1st to 31st), with statements and due dates. |

| Flexibility | Highly flexible; you control how often and how much you pay. | Your credit card issuer sets fixed dates and cannot be adjusted. |

| Examples | Paying $100 on the 15th of each month to stay on top of your balance. | A billing cycle from March 1st to March 31st, with a statement issued on April 1st |

Apps to Assist With a Payment Schedule

A payment schedule ensures that you make a payment on time and stick to your financial plan. There are various apps to help you with tracking, budgeting, bill payment, and paying off debts.

- YNAB (You Need A Budget)

“You Need A Budget” is an online budgeting software allowing users to manage their unpredictable expenses, create emergency corpus and versatile budgeting strategies. Users can sync with their financial institution accounts in no time.

| Official Website Link: | YNAB.com |

|---|---|

| Pricing: | Annual Plan: $109 USDMonthly Plan: $14.99 USD/ month*prices may vary |

- Quicken Classic Bill Manager

Quicken Classic Bill Manager is a perfect tool for managing your bills and paying them on time. It enables you to manage electronic and check payments, View Bill PDFs, and track expenses, taxes, and budgets. The mobile companion app for iOS and Android is also available.

| Official Website Link: | Quicken.com |

|---|---|

| Pricing: | Quicken Simplifi : $2.99 /monthQuicken Business & Personal: $3.99/monthClassic : $5.99/ month*prices may vary |

- Debt Payoff Assistant

Debt Payoff Assistant is an app that follows your debt-paying process and encourages you throughout the process.It allows users to select a strategy that “Debt Payoff” uses to pay back balances based on the snowball approach or any other considered approach.

| Official Website Link: | DebtPayoffPlanner.com |

|---|---|

| Pricing: | Free to around $10-$20 ( for premium features)*prices may vary |

- AwardWallet

AwardWallet helps you track your credit card rewards and supports all the most popular programs, from Citi ThankYou to American Express Membership Rewards and Chase Ultimate Rewards. The app also notifies users when the rewards attached to their accounts are nearing expiration, ensuring that they keep them.

| Official Website Link: | AwardWallet.com |

|---|---|

| Pricing: | AwardWallet : FreeAwardWallet Plus: $49.99 USD per year**prices may vary |

- Sift

Sift assists you in monitoring credit card perks, including price assurance, warranty coverage, and travel insurance plans. It connects your email and scans digital receipts to let you know when benefits are available for those purchases. Retailers like Amazon, Target, and Macy’s allow price protection claims for items you purchased if their prices drop afterwards.

| Official Website Link: | Sift.com |

|---|---|

| Pricing: | Free to around $10 ( for premium features) *prices may vary |

Tips for Creating a Payment Schedule that Boosts Your Credit Score

To make sure your payment schedule works in your favor, here are some practical tips:

- Set Up Alerts: To prevent missing a payment on a specific date, consider using a reminder or setting up automatic debit. Most banks and credit card companies offer payment reminder options that notify you when a payment is due or when it has been successfully made.

- Pay More Than the Minimum: To manage your credit card balance effectively, try to pay more than the minimum each month. This will help you pay off the balance faster, lower your credit utilization, and improve your credit score.

- Review Your Statements Regularly: Verify your credit card statements to ensure you are paying the correct amount by the due dates. If any terms, such as payment terms, change, you must adjust your payment schedule accordingly.

- Monitor Your Credit Utilization: Credit utilization should be no more than 30% of your total limit. Those with multiple credit cards should ensure that no card exceeds this threshold.

- No Fixed Income/Expenditure: If your income or expenses change, adjust your payment plan accordingly to avoid difficulties in meeting payments or experiencing economic stress.

Conclusion

A payment schedule is a helpful tool for managing credit card payments and maintaining a good credit score. By making timely payments, paying more than the minimum, and monitoring your credit utilization, you can enhance your credit. However, failing to follow or adjust your payment plan as needed can lead to missed payments and damage your credit status.