Bank of America® Premium Rewards® Elite Credit Card for high-net-worth card platform offers premium benefits made precisely for users who seek absolute excellence.

The invite-only, metal-body, luxury credit card offers exceptional services and rewards that ensure higher financial freedom for its owners.

The Bank of America® Premium Rewards® Elite Credit Card exists as a financial indicator of accomplishment while maintaining anti-public admission and rigorous membership screening procedures. This card is an exclusive credit card for the elite.

Several upscale features surpass regular credit cards thus making this credit card an authentic asset to those who require deluxe experiences throughout their financial journey.

Individuals who have a high net worth and a significant amount of portfolio may use The Bank of America® Premium Rewards® Elite Credit Card.

The cardholders generally belong to the following groups:

- Top Executives Category of Businessman: High-level executives, CEOs, and successful businesspeople are among the cardholders who use the premium rewards for both personal and professional purposes.

- Artists and other Celebrities: Artists, sportspeople, and media personalities tend to use this card to avail themselves of special access to events and luxury benefits.

- Frequent Travelers: Business travelers and holidaymakers who fly a lot appreciate the travel benefits of this card most, with airport lounge privileges, travel insurance, and rewards for travel-related spending.

- Affluent Individuals: Individuals with high income, assets, or investments tend to carry this card to make their lifestyle and finances easier to manage, leveraging the card’s broad range of rewards and benefits.

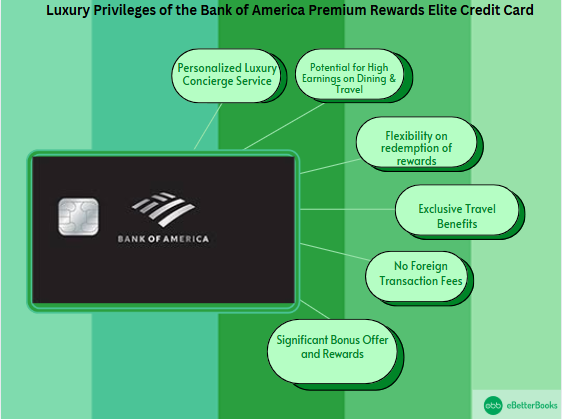

The Bank of America Premium Rewards Elite Credit Card provides premium luxury advantages and rich reward benefits that exceed typical credit cards. The Premium Rewards Elite Credit Card delivers multiple key benefits to its users comprising travel enhancements together with dining services and concierge access and other benefits. The card benefits aim to create convenience and luxurious experiences for customers as well as deliver enhanced rewards.

Personalized Luxury Concierge Service

The Premium Rewards Elite Credit Card provides subscribers with 24/7 access to a personalized concierge service.

The concierge service available to Premium Rewards Elite card members provides members access to luxurious support which includes:

- Through the private jet and yacht charter services Card members secure flights aboard private jets and luxury yacht charters for both business and personal purposes.

- The concierge service provides exclusive invitations to top-level international high-society events which include fashion shows alongside movie premieres together with concerts and sporting tournaments.

- Through the concierge service premium rewards card members obtain hotel stays at the top luxury establishments as well as villa bookings and resort access that exceeds regular consumer access.

- Eligible customers who own these cards can arrange personalized shopping sessions at brands like Chanel along with Louis Vuitton and Rolex for premium shopping access.

Potential for High Earnings on Dining & Travel

The Bank of America® Premium Rewards® Elite Credit Card offers its rewarding benefits program as its main attractive benefit to credit card holders.

The card provides:

- Hunters of travel adventures and dining merriment can build up their reward points at a 3-point rate for every dollar they allocate to dining expenses and travel costs.

- All cardholders earn two points for each dollar spent on any purchase made through any source.

Flexibility on Redemption of Rewards

When receiving premium rewards through the Premium Rewards Elite Credit Card members can choose either travel experience statement credits or gift cards to redeem their points. Frequent diners who watch entertainment regularly should choose this card because it offers high travel along with dining purchase rewards.

Exclusive Travel Benefits

The Bank of America Premium Rewards Elite Credit Card focuses on serving travelers who want exclusive travel advantages including:

- Priority Pass Airport Lounges are accessible to members who hold the card because they can visit more than 1,000 airport locations worldwide for relaxed and comfortable travel.

- All upgrades are free through this card’s program because it automatically provides better hotels and flights (when available) for its members.

- The card supplies a total travel insurance package including protection for trip cancellations and coverage against lost items and emergency medical needs that create reassurance during foreign travel.

- Travel protection services from the premium rewards credit card ensure safe purchase and warranty coverage for customers who use this card.

No Foreign Transaction Fees

International travelers benefit from the Bank of America Premium Rewards Elite Credit Card which provides no foreign transaction fees on their purchases abroad. The card removes the usual 3% fee that credit cards typically add to purchases made abroad. Cardholders can purchase anywhere abroad without facing additional costs while using this credit card for their transactions in Paris, Tokyo, and Dubai.

Significant Bonus Offer and Rewards

The Bank of America Premium Rewards Elite Credit Card features an excellent welcome bonus opportunity for new members. The Premium Rewards Elite Credit Card provides new members with 50,000 bonus points through their first three months of spending $3,000. Credit card members can immediately start their reward accumulation through up to $500 worth of redeemable points at the time of account activation. The Bank of America Premium Rewards Elite Credit Card maintains an ultra-exclusive status that keeps many individuals from obtaining it.

- Issuer – Bank of America

- Payment Gateway – Visa

- Credit Score – Excellent

- Standard APR – 20.24% – 28.24% variable

- Intro APR – NA

- Sign-Up Bonus – 75,000 online bonus points (a $750 value) after spending $5,000 in the first 90 days

- Annual Fee – $550

- Best For – Frequent travelers, high spenders

- Reward Rate – 2 points per $1 spent on travel and dining; 1.5 points per $1 on all other purchases

- Balance Transfer Fees – 4% on each transaction

| Additional Benefits | Other Information |

|---|---|

| $300 annual statement credit for airline incidental fees | Up to $100 annual statement credit for travel incidentals |

| Up to $100 for TSA PreCheck/Global Entry | Access to exclusive events and experiences |

| $150 for qualifying rideshare, food delivery, streaming, and fitness services | – |

| No foreign transaction fees | – |

| Luxury travel perks (e.g., concierge services) | – |

Pros & Cons:

Pros

- High rewards for travel and dining

- Valuable sign-up bonus

- Luxury travel perks.

Cons

- Requires excellent credit

- No introductory APR offers.

Exclusivity: Why Everybody Can’t Have It?

The Bank of America Premium Rewards Elite Credit Card stands among the elite credit cards that only offer limited approval opportunities. Unlike most premium credit cards which award membership to individuals with satisfactory credit scores and substantial income the Premium Rewards®️ Elite Credit Card only serves Bank of America customers who already maintain a strong financial bond with the institution.

In order to qualify for this card, prospective cardholders should have some qualifications that meet the following:

| Existing Bank of America Client | Financial Stability and Creditworthiness | Invitation-Only Access |

|---|---|---|

| The applicants are required to already have an account with Bank of America. Clients are usually asked to have a substantial balance in their accounts or investments to qualify for the card. | Bank of America will evaluate the creditworthiness, income, and assets of an applicant. Individuals with a good financial history and high assets are likely to be approved. | The Bank of America® Premium Rewards® Elite Credit Card can be accessed only by invitation. Potential card members need to get an invitation from Bank of America to apply for the card, which makes it even more special. |

The Bank of America® Premium Rewards® Elite Credit Card is available only to those who meet specific eligibility criteria, ensuring it remains an exclusive offering for affluent individuals.

Here are the key requirements:

| Current Bank of America Customer | Applicants should be existing Bank of America customers with a good relationship with the bank. |

| Financial Stability and Creditworthiness | Bank of America considers credit scores, income, and assets when considering applicants. |

| Invitation-Only Access | The card is only accessible by invitation. Even if you qualify financially, you need to be invited by Bank of America to apply. |

| Feature | Premium Rewards® Credit Card | Premium Rewards® Elite Credit Card |

|---|---|---|

| Bonus Points | 60,000 points after $4,000 in purchases | 75,000 points after $5,000 in purchases |

| Annual Fee | $95 | $550 |

| Foreign Transaction Fees | None | None |

| Travel & Lifestyle Benefits | Various travel rewards and perks | Enhanced travel rewards, lifestyle benefits, and perks |

| Rewards Rate | 2 points per $1 on travel and dining | Up to 2 points per $1 on eligible purchases |

| Redemption Options | Travel, cashback, gift cards, and more | Travel, cashback, gift cards, and more |

| Travel Credits | Up to $100 in airline incidental statement credits | Up to $300 in airline incidental statement credits |

| Airport Lounge Access | No | Yes (Priority Pass™ Select membership) |

| Purchase Protection | Included | Enhanced coverage |

The Bank of America® Premium Rewards® Credit Card is not a metal credit card. While it offers excellent rewards and travel benefits, such as 60,000 bonus points after meeting the minimum spending requirement and a $95 annual fee, it does not feature the premium metal construction typically associated with high-end credit cards. Instead, this card provides great value in terms of rewards, travel credits, and customer service without the added prestige of a metal design.

Conclusion

Bank of America Premium Rewards Elite Credit Card exists exclusively for wealthy individuals who want both exceptional rewards and personalized travel benefits along with premium concierge access. By applying exclusivity rules through invite-only access and stringent qualification criteria Bank of America ensures that their highest financial elite members become the exclusive beneficiaries of its benefits. Those fortunate enough to hold the Premium Rewards Elite Credit Card experience an item beyond traditional credit but instead reveal their top-tier financial standing and exceptional luxury.

FAQs!

The Bank of America Premium Rewards card is worth it for frequent travelers who value rewards and perks, with a $95 annual fee.

Credit limits typically range from $5,000 to $25,000, depending on creditworthiness.

Yes, it offers access to over 1,000 airport lounges through the Visa Luxury Hotel Collection.

The Premium Rewards card offers higher rewards on travel and dining, while the Travel Rewards card earns flat-rate rewards on all purchases.