Converting credit card purchases to EMIs can lead to reduced interest rates and easier repayment, but look out for processing costs, limited credit limits, and potential impact on your credit score.

What is a Credit Card Loan EMI?

A credit card loan’s Equated Monthly Installments (EMI) allows users to break down large purchases into manageable monthly installments. This option is particularly handy for expensive goods like electronics, appliances, and furniture.

Credit card issuers often charge interest and processing fees, which vary by issuer. However, some issuers provide a no-cost EMI, which removes any further interest or fees, making it an enticing option for cardholders.

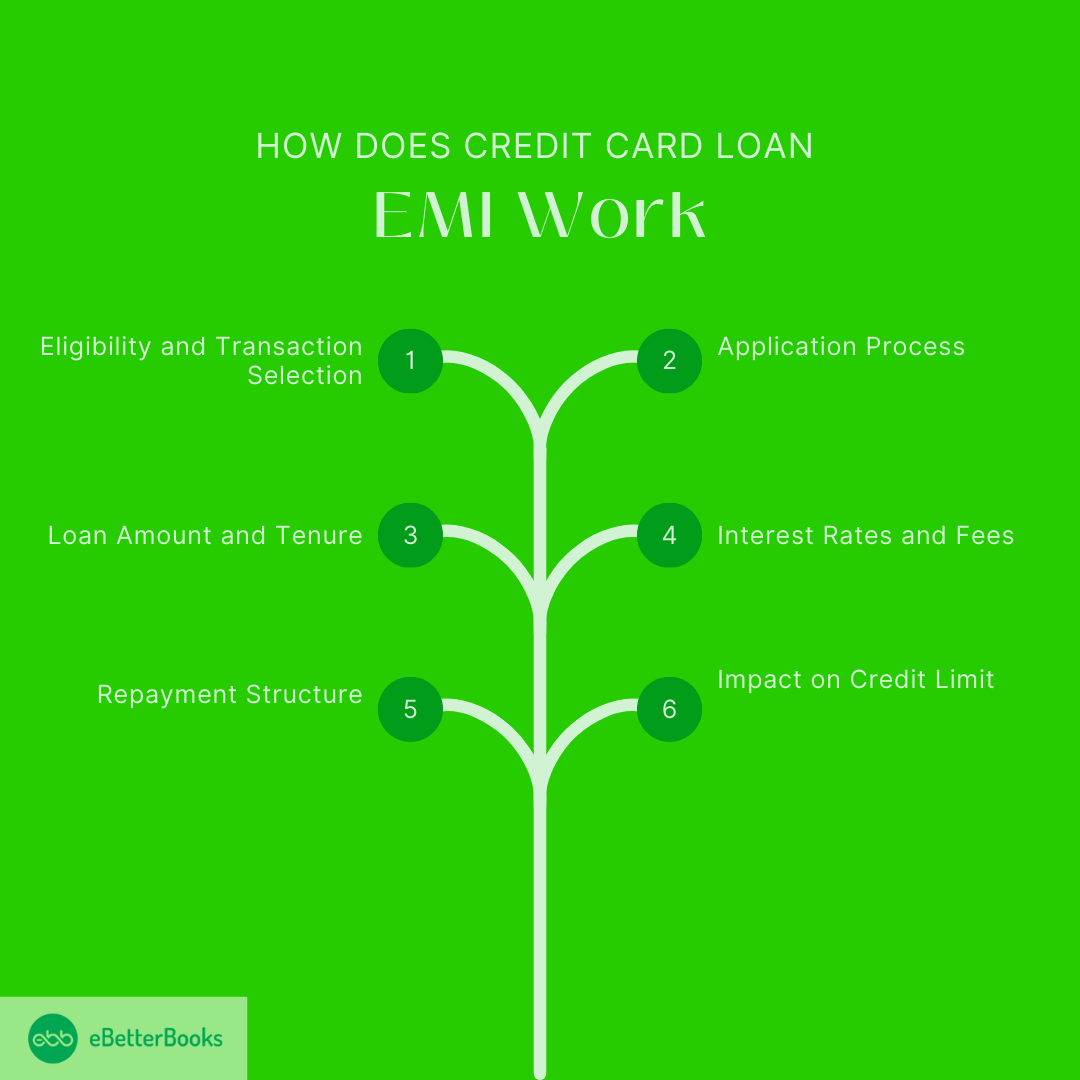

How does Credit Card Loan EMI work?

Credit Card Loan EMIs, sometimes known as credit card installment plans, enable cardholders to divide qualified purchases into fixed monthly payments over a predetermined period. This method makes controlling spending easier, particularly for large purchases.

Here’s how these payment plans work:

1. Eligibility and Transaction Selection

Eligible Transactions: Not every purchase qualifies for installment conversion. Typically, transactions surpassing a certain amount (for example, $100) are eligible. However, thresholds vary per issuer.

Time Frame: Cardholders often have a limited time after purchase to enroll in an installment plan, frequently within one or two billing cycles.

2. Application Process

Initiation: You can request installment conversions from your credit card issuer’s website, mobile app, or customer service. Some issuers provide this choice at the moment of sale.

Approval: Before granting the request, the issuer may consider your creditworthiness and account position.

3. Loan Amount and Tenure

Principal Amount: The purchase amount you select to convert forms the basis for your payment plan.

Payback Period: You choose a payback period, which normally ranges from 3 to 24 months, depending on the issuer’s options.

4. Interest Rates and Fees

Interest Charges: Installment plans may contain interest charges or set fees, which are often lower than regular credit card interest rates. Some issuers provide no-interest or low-interest programs, usually for select merchants or promotional periods.

Processing Fees: A one-time processing charge may apply, which varies according to the issuer and plan details.

5. Repayment Structure

Monthly Installments: Each installment includes both the principal and any relevant interest or fees, ensuring that the purchase is fully paid at the end of the term.

Automatic Deductions: Installments are added to your monthly credit card account and must be paid on time to avoid penalties.

6. Impact on Credit Limit

Credit Utilization: The converted purchase amount may lower your available credit limit until it is repaid. As you make payments, your available credit progressively recovers.

Real-World Examples of Credit Card Loan EMI

Emily and Chase used flexible payment plans for their purchases. Here’s how AMEX “FlexPay” and Chase “PayOverTime” work, including costs and repayment details.

- Emily’s AMEX “FlexPay” Plan

Scenario: Emily spent $2,000 on a premium smartwatch using her American Express card. She chose the “FlexPay” plan with a 12-month repayment schedule. Emily pays $175 every month, including a $20 set monthly charge. Over a year, Emily will spend $2,240 on the smartwatch.

- Purchase Price: $2,000 (e.g., premium smartwatch)

- EMI Plan: 12 months.

- Monthly Payment: $175.

- Interest/Fees: Fixed monthly cost of $20 (depending on the purchase amount and tenure).

- Total Cost: $2,000 plus $240 (monthly fees) = $2,240.

- Chase “PayOverTime” Option

Scenario: You paid $2,500 for a home entertainment system using your Chase card and selected the “PayOverTime” option. With an APR of 14% for 18 months, your monthly payment will be about $159.16. The system would cost $2,786.88 in total over time, including interest.

- Purchase Price: $2,500 (e.g., home theater system)

- EMI Plan: 18 months.

- Interest Rate: 14% APR.

- Monthly Payment: about $159.16.

- Total Cost: $2,500 plus $286.88 (interest over 18 months) = $2,786.88.

How Do You Convert your Credit Card Loan into Easy Monthly Payments?

Distributing payments over time and converting a credit card purchase into an installment plan may assist in managing significant costs.

This is a step-by-step guide:

Step 1: Examine your Credit Card’s Options for Payments

Issuer Programs: For qualified purchases, several credit card issuers provide installment plans. For instance, cardholders can divide purchases into equal monthly payments with a set cost by using American Express’s “Plan It” service.

Eligibility: Conversion is usually available for purchases over a specific threshold, such as $100.

Step 2: Choose the Conversion Purchase

Transactions Eligible: Decide on the transaction you want to convert. Frequently, you may accomplish this using your mobile app or online banking interface.

Time Frame: After making a purchase, some issuers ask you to choose an installment plan within a certain amount of time.

Step 3: Select the Installment Plan Terms

Tenure Options: Choose a payback duration, which typically ranges from 3 to 24 months. Longer durations may result in greater costs.

Fees and Interest: Are there any set fees or interest rates linked with the plan? For example, U.S. Bank’s ExtendPay lets you divide purchases into equal monthly payments with no interest and simply a fixed monthly charge.

Step 4: Confirm and Activate the Payment Plan

Review the Terms: Carefully read the terms and conditions, including any impact on your credit limit and any late fees.

Authorization: Confirm the setup via your issuer’s platform. Once activated, installment payments will appear on your monthly bill.

Step 5: Monitor and Manage Payments

Monthly Statements: Keep track of your statements to guarantee on-time payments and prevent late penalties.

Early Repayment: Some issuers may allow you to pay off your installment plan early without incurring penalties; check this option if you want to settle the debt sooner.

Best EMI Plans for Credit Card Loans

| Bank | American Express (Amex) | Citi | Chase |

|---|---|---|---|

| Plan Name | Plan It | Flex Pay | Pay Over Time |

| Eligibility | Available on eligible American Express personal charge and credit cards. | Available on eligible Citi credit cards. | Available on most consumer Chase credit cards. |

| Qualifying Purchase | Purchases of $100 or more. | Purchases of $75 or more; for Amazon.com purchases, $50 or more. | Purchases of $100 or more made within the last 90 days. |

| Repayment Terms | Choose from 3 to 24 months, depending on the purchase amount. | The terms are up to 60 months, based on loan amount and creditworthiness. | Choose from 3 to 18 months based on the purchase amount and plan selected. |

| Cost | Fixed monthly fee instead of interest; determined by purchase amount and chosen period. | Fixed interest rate determined by loan amount and creditworthiness. No origination fee. | Fixed monthly fee instead of interest; determined by purchase amount and chosen period. |

Equated Monthly Installment (EMI) plans, which frequently have set interest rates or occasionally even provide free choices, enable credit cardholders to break down their purchases into manageable monthly payments over a certain period. Interest rates, tenure flexibility, processing costs, and other incentives like reward accumulation all affect how appealing these programs are.

Some noteworthy EMI options from different credit card providers are listed below:

Plan It by American Express

| Eligibility | Qualifying Purchase Amount | Repayment Terms | Cost | Benefits | Considerations |

|---|---|---|---|---|---|

| Credit and personal charge cards that qualify are available on American Express. | Purchases totaling $100 or more qualify as qualifying purchases. | Depending on the purchase price, you can choose between three and twenty-four months. | Depending on the purchase price and selected payback time, a set monthly cost is assessed in lieu of interest. | No credit check or application is necessary. | You may pay off plans early, but once they are set up, they cannot be canceled. The American Express |

| – | – | – | – | You may pay off the plan early without incurring any additional expenses; there are no early payback penalties. | The kind of card and account status determine eligibility. |

| – | – | – | – | Ongoing reward accrual from purchases. | – |

Flex Pay from Citi

| Eligibility | Purchases | Repayment Terms | Benefits | Considerations |

|---|---|---|---|---|

| Available on Citi credit cards that qualify. | $75 or more, or $50 or more for purchases made on Amazon.com, qualify as qualifying purchases. | Depending on the plan chosen and the purchase price, options range from three to forty-eight months. | No application or credit check is necessary. | Plans cannot be amended or canceled after enrollment. |

| – | – | – | There are no early payback penalties; you may pay off your plan early without incurring additional expenses. | Eligibility and conditions vary depending on account status and card type. |

| – | – | – | Continued earning of incentives for purchases. | – |

My Chase Plan

| Eligibility | Qualifying Purchase Amount | Repayment Terms | Cost | Benefits | Considerations |

|---|---|---|---|---|---|

| Available on various Chase consumer credit cards. | $100 or more spent within the last 90 days. | Range from three to eighteen months, depending on the purchase amount and plan selected. | Instead of interest, a fixed monthly fee is charged, depending on the purchase amount and chosen repayment period. | No application or credit check is necessary. | Plans cannot be amended or canceled after enrollment. |

| – | – | – | – | There are no early payback penalties; you may pay off your plan early without incurring additional expenses. | Eligibility and conditions vary depending on account status and card type. |

| – | – | – | – | Continued earning of incentives for purchases. | – |

Benefits of Converting Your Credit Card Loan to EMI

Converting your credit card debt to Equated Monthly Installments (EMIs) can bring numerous major benefits, including better debt management and repayment.

The following are the key benefits:

| Step-by-Step | Key Benefit | Impact | Example |

|---|---|---|---|

| 1. Easier Repayment Structure | EMIs divide a lump sum loan into smaller, set monthly payments. | This alleviates the immediate financial pressure, making it simpler to manage your payments over time. | If you owe $2,000, you can repay it in equal monthly payments, such as $167 over 12 months, rather than paying the total amount all at once. |

| 2. Lower Interest Rates | Credit card EMIs often have lower interest rates than ordinary credit card charges. | Over time, you pay less interest, making debt management more reasonable. | Instead of paying 20% APR on your amount, you might choose for an EMI with an APR of 14%, lowering your overall interest load. |

| 3. Flexible Tenure Options | You may customize your EMI plan from 3 to 24 months. | Flexibility allows you to customize the payback time to fit your budget and financial circumstances. | Choosing a shorter duration will enable you to pay off the debt more quickly, but a longer tenure with lower payments can be preferable if you need to relax your monthly budget. |

| 4. Better Budgeting | Improved cash flow management and planning are made possible by fixed EMI payments. | With a clear understanding of your payback amount, you may manage your monthly spending with confidence. | You may plan for this in your monthly budget and prevent unforeseen financial pressure if you have a $200 monthly fixed EMI. |

| 5. Possible Advantages for Credit Scores | Making your EMI payments on time might raise your credit score. | Making your payments on time shows that you are a responsible person, which, over time, might improve your creditworthiness. | You may demonstrate to lenders that you can handle debt responsibly by regularly making your EMI payments on time. This could raise your credit score and make it easier for you to get future loans. |

| 6. No Financial Stress Right Away | The immediate financial effect of a one-time payment is lessened when significant purchases are converted into EMIs. | This allows you some breathing room, particularly if you need to handle high-interest credit card debt or have made large expenditures. | You may ease your cash flow and preserve other financial objectives by converting a $3,000 purchase into 12 months of $250 payments. |

Things to Consider Before Choosing EMI Conversion

Converting your credit card balance to EMIs might be a handy way to manage debt, but you must examine many things before making the decision.

Here’s a summary of everything to keep in mind:

1. The Total Cost of Loan Repayment

What to Know: EMIs minimize the immediate financial stress, but they may result in higher payments over time, owing to increased interest.

Why This Matters: A longer term entails higher interest rates, which raises the total amount you’ll owe.

Action Tip: Before you commit, always consider the overall payback cost. Consider if repaying the loan in full now will save you money in the long term.

2. The Impact On your Credit Limit

What You Should Know: Once you convert your amount to EMIs, that portion of your credit is frozen until it is completely paid off.

Why It Matters: Your available credit limit may be lowered, which may limit your ability to make more purchases with the card.

Action Tip: Make sure the blocked credit does not interfere with any other planned bills or purchases you may need to make.

3. Comparison of Personal Loans

What You Should Know: Personal loans can occasionally provide better interest rates than credit card EMI choices, particularly if you have a good credit history.

Why it Matters: A personal loan may provide better conditions, such as cheaper rates, larger loan amounts, or more flexible payback periods.

Action Tip: Before making a decision, compare credit card EMIs to personal loan offers from different lenders since a personal loan may be less expensive in some situations.

4. Prepayment Penalties

What You Should Know: Some issuers impose a fee if you want to pay off your EMI early.

Why It Matters: Early repayment costs offset the benefits of paying off your debt sooner, making it less enticing if you’re thinking about paying off your loan ahead of schedule.

Action Tip: Inquire about prepayment fees and compare them against the benefits of paying off your loan early.

The Bottom Line

Converting your credit card loan into EMIs can be a wise financial decision if you require additional time to pay off your debt without incurring high interest rates. It provides flexible repayment options, eases financial strain, and helps manage cash flow; however, before making a decision, always check the interest rates, processing fees, and impact on your credit limit. If you’re having trouble repaying your credit card loan, EMI conversion is a workable way to make repayment easier.