Using a credit card for all purchases can lead to debt and high fees if mismanaged. You can use credit cards for traveling, grocery, gas, clothing, and toiletries, etc.and avail offers, convenience and rewards.

Carrying a credit card balance can result in high interest rates and fees, so it is crucial to pay off your balance promptly.

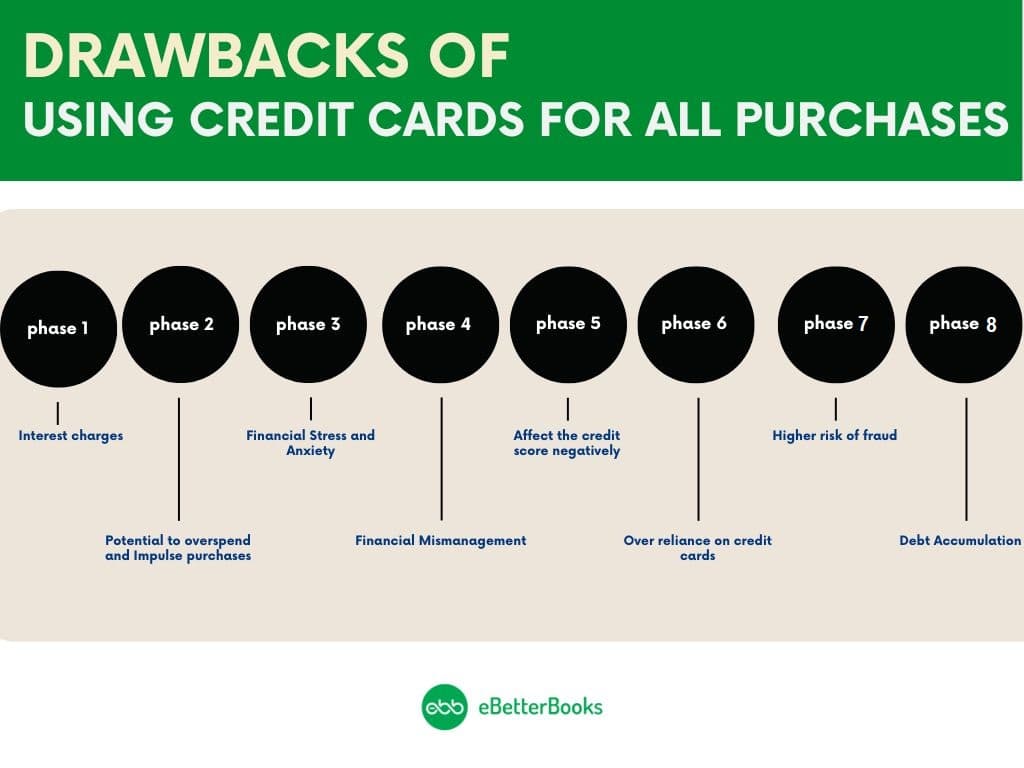

Drawbacks of using credit cards for all purchases

Relying solely on credit cards can lead to overspending, high-interest debt, financial mismanagement, and potential harm to your credit score.

1. Potential to overspend and Impulse purchases

Overspending on credit cards often leads to carrying a balance and accruing high interest charges. Beyond interest, issuers may charge fees for late payments, balance transfers, cash advances, and more, including annual fees.

Impulse purchases can make credit cards tempting, but failing to check your account regularly can lead to bills that are larger than you can manage, creating a dangerous cycle of debt.

2. Interest charges

Your credit card provider typically charges interest on your purchases if you don’t pay off your balance in full each month, these interest charges can accumulate quickly, leading to credit card debt. Additionally, there are other costs associated with credit cards that you should consider to determine whether a credit card is cost-effective for your everyday spending or not.

To avoid these costs, aim to pay off your balance in full by the due date. If that’s not possible, ensure you make the minimum payment on time to maintain good standing. Always review your credit card agreement for details about the interest rates and other fees your provider may impose. Using a credit card for everyday purchases can be beneficial if you can make the monthly payments and wish to build a credit history.

3. Financial Mismanagement

Using a credit card for all the purchases can result in financial mismanagement as there could be complete lack of accountability. The credit card statement comes at the end of the billing period while the cardholder may not be able to keep track of all the spending resulting in overspending, budget-overshooting, and exhausting finances. Financial mismanagement due to excessive credit card usage can impact personal life too.

4. Financial Stress and Anxiety

Using a credit card for every purchase can lead to debt accumulation and a situation where your credit taken is more than 30% of the total credit limit, harming your credit score and putting a stress on your payback capability.

5. Debt Accumulation

Some credit card companies allow you to exceed your credit limit and charge hefty fees for this convenience, adding to your credit card balance.

When you fail to make your credit card payments in full, it leads to accumulation of debt. To help prevent getting into debt, create a budget and review your spending.

6. It can affect the credit score negatively

If you are utilizing a large portion of your available credit, high credit utilization may appear on your credit report, which can lower your credit score. This decrease in your score might make it more challenging to borrow in the future. You can practice debt management if you are struggling to make timely credit card payments.

7. Higher risk of fraud

If your credit card number gets into the wrong hands, you may become a victim of fraud. Once criminals have your information, they can charge your account, open fraudulent accounts, clone your credit card, or even commit identity theft. To protect yourself, follow some of the best practices for prevention.

8. Over reliance on credit cards

If you are over-reliance on credit cards, then it may lead to serious financial issues like debt, high-interest payments, and a negative impact on your credit score. It’s essential to use credit responsibly by budgeting, limiting credit card use, and paying off balances in full whenever possible.

What credit card should you use?

Using a credit card for daily purchases can be convenient and rewarding when used responsibly. Different credit cards meet various needs based on your financial situation and credit history.

When deciding on a credit card, consider the following factors:

- Rewards and Benefits: Look for those cards that offer rewards such as cashback and travel points, that align with your spending habits.

- Interest Rate: Check the Annual Percentage Rate (APR) and consider how you plan to use your card. If you carry a balance, a lower interest rate is beneficial.

- Fees: Pay attention to annual fees, foreign transaction fees, and any other charges. Some cards have no annual fee, which is the most beneficial for students.

- Promotional Offers: Many cards come with introductory 0% APR or sign-up bonuses. These can be great incentives if they fit your plans.

Conclusion

Relying solely on credit cards can delay accurate spending tracking, as not all vendors accept them, and it may lead to overspending due to a false sense of financial security. This increases the risk of debt if payments are missed, resulting in interest charges and a lower credit score.

To avoid these issues, it’s best to balance credit card use with cash or debit transactions, helping you stay mindful of your spending and avoid debt.