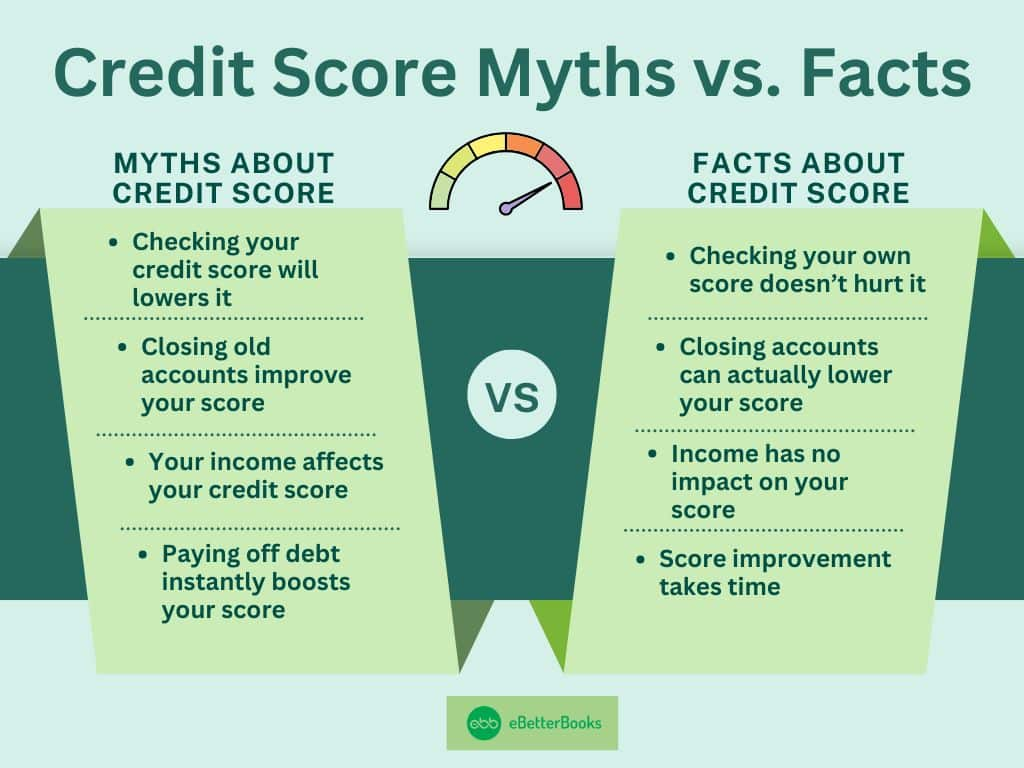

Credit score myths may guarantee you quick improvements, yet they often cause more harm than good. A credit score is important for your financial well-being, but numerous misconceptions can create poor credit handling, debt accumulation, high interest charges, etc.

Myths like carrying a credit card balance or closing old credit accounts harm you the most and may also reduce your credit score. Learning the truth behind these myths helps you maintain a healthy credit record.

Common Credit Score Myths

Some common myths related to credit scores are:

| Serial Number | Credit Score Myths |

|---|---|

| 1. | Checking your credit score will lower it |

| 2. | There is only one credit score |

| 3. | Closing old credit accounts will improve your credit score |

| 4. | Having a high credit limit will hurt your credit score |

| 5. | Carrying a balance on my credit card boosts my credit score |

| 6. | Your salary has an impact on your credit score |

| 7. | Bad credit will last forever |

| 8. | Having multiple credit cards improves your credit score |

| 9. | Paying off debt immediately improves your credit score |

| 10. | Using a debit card enhances your credit score. |

Myth 1: Does checking my credit score lower it?

No, checking your credit score does not lower it. When you check your credit report, it’s considered a “soft inquiry,” which does not affect your credit score. Hard inquiries, including when lenders pull your credit for credit cards or loans, can temporarily lower your score.

Checking your credit score from time to time is a good financial practice. It allows you to:

| Monitor Changes | Identify Errors | Act on Them Timely |

|---|

Checking your score does not reflect borrowing habits, so it does not affect your creditworthiness. However, several hard inquiries in a short time can indicate financial hardship to lenders, which may influence your score.

Most financial apps and credit bureaus provide free credit score checks without a negative impact on your score. These instruments can keep you in the loop and make good use of your credit.

Myth 2: Do I have only one credit score/ Is there only one credit score?

No, you really do have several credit scores. The three credit bureaus (Experian, Equifax, and TransUnion) calculate distinct scores based on your credit behavior. Scoring systems like FICO and VantageScore employ different weightage to factors, so your score will be different based on which one is applied.

In reality, the lenders can use various scores depending on their needs. A mortgage application might have FICO from a bank, while an automobile lender might be using a unique version of VantageScore. Your credit score may be different from a lender’s point of view.

Every scoring model places different weights on influencing factors, such as:

| Payment History | Credit Utilization | Length of Credit | Credit Mix | New Credit, etc. |

|---|

To keep your credit profile healthy, you need to understand the different influencing factors and look at overall credit health instead of one score.

To understand more about how various factors impact the credit score, read our in-depth guide: [Credit Score Breakdown: How Each Factor Impacts Your Score]

You are entitled to one free report from each bureau per year from AnnualCreditReport.com. Checking all three reports will help you catch discrepancies and have errors corrected.

Myth 3: Does closing old credit accounts improve my credit score?

No, closing old credit accounts can hurt your score. Your credit history length is an important credit scoring factor, and closing an older account lowers your overall credit age. It can also raise your credit utilization ratio, which hurts your score.

Leaving an old account open (particularly those with no yearly fees) serves to keep a long credit history. Long-standing accounts are considered favorable by creditors because they reflect good credit behavior over time. If you have to close an account, think about how it will affect your overall available credit. A sharp reduction in available credit can raise your utilization rate, which can decrease your score.

A mindful solution is, rather than closing unused accounts, to utilize them for making small recurring payments and clearing the balance every month. This keeps them active and prevents you from losing your credit score.

Myth 4: Does having a high credit limit hurt my credit score?

No, a high credit limit does not hurt your credit score but rather helps maintain it.

Having a high credit limit can be a great advantage for cardholders, as it opens up better financial opportunities, enhances credit utilization, and helps manage balances. These factors can positively influence your credit score.

In reality, the debt-to-credit ratio plays a big part in your credit score. This ratio represents how much of your total available credit you are using. If you have a higher credit limit but a lower debt or you keep your credit utilization low, then it will improve your credit score.

If you overspend, then it does not matter whether you have a high or low credit limit; your credit score will be impacted negatively.

For instance,

- If you have a $5,000 credit limit and a balance of $2,500, your utilization rate is 50%, which is considered high and can negatively impact your credit score.

- But if your credit limit goes up to $10,000 and you still owe $2,500, your usage drops to 25%. This shows that you’re a responsible borrower.

| Tip: It is recommended to keep your credit utilization below 30% to maintain a strong credit score. However, those with excellent credit often keep it below 10%. |

Many credit cards with higher limits come with several rewards, such as cashback, travel benefits, premium customer service, and better loan offers.

If you maintain a strong credit profile with a high limit, then you may qualify for:

- Lower interest rates on future loans.

- Higher borrowing power for mortgages or car loans.

- Exclusive credit card rewards programs with better incentives.

Myth 5: Do I need to carry a balance on my credit card to improve my score?

No, it’s not necessary to carry a balance. Also, it can end up costing you money in the form of interest. Paying your balance in full every month is the best means of establishing credit without taking on more debt.

In reality, credit score is determined by payment history and usage of credit, not whether or not you carry a balance. Constant use of your credit card and regular payment shows good financial management.

Most credit card companies report your payment history to credit bureaus even when you pay off your balance in full. Having a high balance can raise your credit utilization ratio, and that can hurt your score. Your utilization should be no more than 30% of your limit for good credit.

Myth 6: Does your salary have an impact on your credit score?

No, your income is not part of your credit score. Your payment history, credit utilization, credit history length, new credit, and credit mix determine your credit scores. Your salary is not listed among these.

Lenders consider your income separately when evaluating your ability to repay a loan. While a high income can improve your chances of loan approval, it does not directly boost your credit score.

Even with a high salary, poor financial habits like late payments or maxing out credit cards can damage your credit score. Responsible credit management matters more than your earnings.

Try these credit management practices:

| Monitor your Spending | Avoid Skipping Payments | Pay more than the Minimum Payment | Build a Budget |

|---|

Having a higher income can help indirectly in the sense that it enables you to settle your debts quicker and secure lower-interest loans. Still, it doesn’t impact the underlying credit scoring mechanism.

Myth 7: If I have bad credit, will it last forever?

No, bad credit is not forever. Credit scores fluctuate over time due to your past financial actions. Negative information like late payments and collections will fade away from your credit report in time, permitting you to create good credit.

Most of the bad items, such as late payments and defaults, stick to your credit report for roughly seven years, with bankruptcies sticking to seven to ten years.

Still, as you show good credit behaviour, your score will improve over time, such as:

| On-Time Bill Payments | Debt Reduction | Low Credit Utilization Ratio | Avoid Acquiring Multiple Loans |

|---|

Consistency is the rule for long-term betterment. Most lenders are concerned with recent credit behaviour and not with past errors. If you are good with money, you will qualify for loans and credit cards even before negative old marks vanish entirely.

Myth 8: Does having multiple credit cards improve my credit score?

No, having too many credit cards does not improve your credit score; rather, it creates a Debt Snowball that harms your credit score. It can lead to overspending and missed payments and ultimately lower your credit score.

Many people believe that owning multiple credit cards is advantageous, but it’s the other way around.

If you have multiple credit cards, then several ways may affect your credit score:

- Difficulty in managing more than one due date.

- Having access to more credit.

- Decreases average required length of credit history.

- High credit utilization due to increased daily spending.

- Increases the number of credit inquiries.

Rather than signing up for lots of credit cards, it’s better to focus on one or two that you can manage well, especially if they have a high credit limit. This approach helps you to build a strong credit profile while minimizing risks associated with excessive credit card ownership.

Myth 9: Will paying off debt immediately improve my credit score?

No, while reducing debt is beneficial, your credit score considers multiple factors like credit history length and credit utilization. Your score may not increase immediately after paying off debt, as credit reports take time to update.

In the real world, your credit score is built on steady, long-term financial habits. Although you may pay off a credit card or loan, your credit mix and account age still play a role in your overall score. Closing a paid-off account can even decrease your score from time to time due to a shorter credit history.

However, paying on time and keeping a low credit utilization ratio (less than 30%) will enhance your credit score over time. Ongoing good credit behavior is more important than making a single payment.

Some creditors report monthly, so it can take a billing cycle or two for changes to be reflected in scores. Patience and ongoing credit management are the keys to having a healthy credit profile.

Myth 10: Will using a debit card enhance my credit Score?

No, your credit score is not affected by debit card transactions. As debit cards draw on your own money instead of borrowed money, they do not build your credit history or influence your credit score.

Credit scores are based on considerations such as credit utilization, payment history, and credit mix—none of which debit card use has any impact upon. Only credit products, like credit cards, personal loans, or mortgages, help build your credit record.

If you wish to construct or enhance your credit rating, try these:

| Opt for a Secured Credit Card | Apply for a Small Loan | Become an Authorized User on Another Person’s Account |

|---|

These practices build a good credit history. Although debit cards do not affect credit reports, they assist with budgeting and debt aversion. Others provide credit-builder programs tied to debit cards but involve independent registration and are different from standard credit products.

Conclusion

Credit scores are commonly misconceived, and myths surrounding them can do more harm than good to financial choices. The belief that looking at your score decreases it, closing old accounts increases it, or income has an impact on your credit score can lead to costly errors.

In fact, good credit management, like paying bills on time, keeping credit utilization low, and having a long credit history, can actually help.

By debunking these myths, you can gain control of your financial accountability and make sound decisions. Paying debt, managing credit responsibly, and knowing how various financial activities affect your score will enable you to establish and maintain good credit.

Keep in mind that credit scores change over time, and with good financial practices, you can enhance yours. Educate yourself, steer clear of myths, and take proactive measures towards financial security.