A good travel credit card offers travel benefits like miles points, lounge access, ticket discounts, co–branded airline offers, cashback on holiday packages etc. But other than the rewards, consider the value that may be obtained such as travel insurance, special deals and unique travel experience. Remember, that the best card for you is one which fits your financial situation and travel habits so that all spending is as rewarding as possible.

Travel Credit Cards

| Travel Credit Cards: Factors to Consider While Choosing One | |||

| Factors | Description | Example | Card Offering |

| Miles Points & Conversion | The card will allow you to earn rewards and it can be redeemed for flights, hotel stays, and other rewards. | Capital One Venture Rewards Credit Card | This card offers a one time bonus of 75,000 miles once $4000 is spent on purchases within 3 months. |

| Lounge Access | Card offering free lounge access at airports. | The Platinum Card® from American Express | This card includes access to airport lounges worldwide, which includes The Centurion Lounge, Delta Lounge. |

| Co-Branded | The card offers special benefits and rewards for purchases made with a specific brand. | Prime Visa | This card comes with an Amazon gift card of $150 upon approval. |

| Insurance | Card offers a variety of insurance benefits like rental car insurance. | Bank of America® Premium Rewards® credit card | This card offers trip delay reimbursement of up to $500 per ticket. |

| International Acceptance | Card can be used in a country other than the one it was issued | Chase Sapphire Preferred® Card | This card offers international travel benefits. |

| Foreign Exchange Fee | Foreign transaction fee is a charge on a credit card bill for purchases made in a foreign currency. | Capital One Savor Cash Rewards Credit Card | There are no foreign transaction fees on purchases made outside of the United States |

| Membership Elite Rewards | The card offers privileges like priority boarding or an upgrade to a room. | Chase Sapphire Reserve | This card offers benefits at a curated collection of hotels and resorts when you book through The Edit by Chase Travel. |

| Transferable Points | Card allow you to transfer the points to partner loyalty programs in order to increase your benefits. | Chase Ultimate Rewards | The points earned with Chase cards can be transferred to 11 airline frequent flyer programs and three hotel loyalty programs. |

| APR and Interest Rates | There are some cards that offer 0% APR for months. | Citi Double Cash Card | This card offers 0% Intro APR for 18 months on balance transfers. |

| Credit Score | Credit scores help you get a credit card with better terms. | Capital One Venture X Rewards Credit Card | This card offers 10,000 bonus miles every year. |

| Welcome Bonus | Some cards offer a great welcome bonus to their cardholders. | American Express Gold Card | This card offers a 60,000 welcome bonus to their cardholders. |

| Credit Limit | Credit limit is the maximum amount of money a person can charge to a credit card | Citi Strata Premier℠ Card | The average credit limit the Citi Strata Premier℠ Card offers is $14,175. |

What is a Travel Credit Card?

A travel credit card refers to a credit card that offers travel related benefits like cashback on ticket purchases, multiple points on hotel booking, points conversion to miles and ticket purchases, lounge access benefits, concierge services, etc.

Generally, a travel rewards credit card will rebate extra in its money when you use it to purchase travel yet rates differ. One card may give you 2 points or miles per $1 spent on airline purchases, the other can give you 3 points or miles per $1 spent on such purchases.

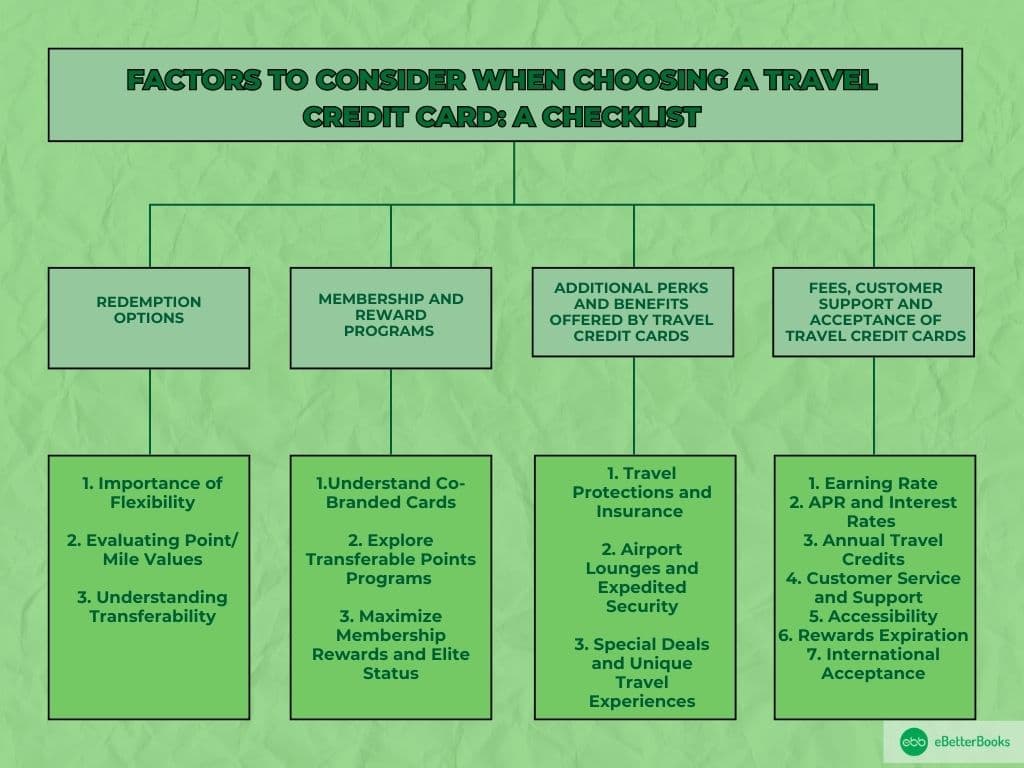

Factors to Consider When Choosing a Travel Credit Card: A Checklist

1. Redemption Options

Redemption options play an important role when determining which rewards travel credit card works well in meeting the user’s needs.

Mentioned below are the reasons why they matter:

- Importance of Flexibility: This depends on how fluid the value of the card is. By the same token, is it possible to transfer the accumulated points between airlines between different chains? Some of the cards allow you to choose between several airlines, also different hotels, or even get your cash back. For instance, you may be restricted to flying with a certain carrier, from Card A while Card B offers you a number of flight options and accommodation options.

- Evaluating Point/Mile Values: This means that not all points or miles created are similar. Determine the real value of these incentives. It is not only how many points are accumulated but also what these points can buy. This way you can properly compare value across different redemption choice so that you get the most out of it.

- Understanding Transferability: Some of the cards allow you permission to transfer the points to partner loyalty programs in order to increase your benefits. Find out if your card has this provision, if yes, how the transfer rates will be. For instance, with Card A you are able to transfer points at a 1:1 Card A may have a rate to Specific Airline, meaning that Card A gives better bargains as compared to Card B.

In other words, you should make sure that you are not just getting the best rewards for getting points for traveling, but you should also have other valuable options you can have for using those points.

2. Membership and Reward Programs

Specialty reward programs are the few most unique benefits of travel credit cards. Mentioned below are some tips for evaluating a card’s membership programs:

- Understand Co-Branded Cards

Co-branded credit cards involve a collaboration between a card issuer and a specific brand, generally an airline or hotel chain. For instance, a card might affiliate with American Airlines or the Marriott hotel chain. The main advantages of these cards is that they provide specific rewards and perks with the partnered brand, such as free night stays or bonus miles. In this way, brand loyalty is established, so for the holder which uses this card, they often opt for that airline or hotel brand.

- Explore Transferable Points Programs

Some of the cards that allow such a possibility include American Express Membership Rewards, or Chase Ultimate Rewards, where you may freely transfer points to different airline/hotel partners. These cards give more flexibility when it comes to the exercising of the right to redeem the rewards offered. However, you should know that the partnerships may change. It also ensures that you do redeem your points in the best manner next time by staying updated.

- Maximize Membership Rewards and Elite Status

Some are exclusive cards which make the cardholder unlock other tiers of rewards or gain the elite status with spending. It means all these cards may entitle travelers to such privileges as priority boarding or an upgrade to a room. Determine if these added value benefits correspond with your budgets and if they enhance your travel indeed.

Knowledge of how rewards programs operate will assist you in evaluating the practical benefits a card has and thus assist in optimizing the Usage of the card for its benefits.

3. Additional Perks and Benefits Offered by Travel Credit Cards

In addition to using points and travelling related to your credit card, most of the travel credit cards offer additional benefits which really boost your journey.

Mentioned below is the breakdown of some of these benefits:

- Travel Protections and Insurance

A lot of cards have travel protections and insurance. For instance, the Chase Sapphire Preferred Card provides card members with features such as trip cancellation and interruption insurance that can be rather helpful if your plans change. Cards offer rental car insurance so that you don’t have to buy additional coverage when you are renting a car or even a discount on renting a car. Others may also give purchase protection. Finding such features is useful when comparing credit cards.

- Airport Lounges and Expedited Security

Earning points and receiving perks is one of the travel rewards which includes access to airport lounges. These exclusive areas help to escape from packed terminals with various necessary facilities which include free internet, meals, and soft chairs. Further, there are few conveniences that come in the form of cards like TSAPreCheck or even Global Entry credits that enable cardholders to pass security checks quickly.

- Special Deals and Unique Travel Experiences

Some of the cards give you ways of experiencing travel like no other. Credit cards may provide rewards including early access to much anticipated performances or privileged tours. All these benefits are about money and making specific privileges to achieve what would otherwise be impossible.

4. Fees, Customer Support and Acceptance of Travel Credit Cards

Choosing the best travel credit card is not as easy as simply selecting the rewards. Mentioned below are some of the important factors to keep in mind:

- Earning Rate

A card’s earn rate determines how many points/miles you will earn for every dollar of spending. For instance, Card A may pay 2 points on each dollar used for travel and dining, and 1 point on all other expenses, while Card B may offer 1.5 points for every dollar spent.

- APR and Interest Rates

A simple comparison between the cards can be made using the card’s APR (annual percentage rate). A good travel credit card can be expensive depending on the amount of interest that is charged annually.

- Annual Travel Credits

Some cards offer money back for certain travels incurred expenses up to a yearly limit. For instance, Card A may offer $200 a year of travel credit while Card B does not offer any travel credit.

- Customer Service and Support

Customer support should also be customer friendly especially when the customer is in trouble while in a different country.

- Accessibility

Accessibility refers to the facility with which one is able to conduct transactions on the account, either through the online or a mobile application.

- Rewards Expiration

Ensure that the points that you earn are not easily expirable or the miles that you would have earned are not expirable within a short time. Again, there are cards that you can use throughout your lifetime, and there are those that come with a limited time for use.

- International Acceptance

This is one of the important factors. When you choose a travel rewards credit card, ensure that the card is widely accepted as not all cards provide this advantage.

What Types of Travel Credit Cards are Available?

Some common types of travel points credit cards are mentioned below:

1. Airline Credit Cards: Airline credit cards give points in the loyalty of a particular airline which can be used to travel or avail upgrade services.

2. Hotel Credit Cards: Hotel branded credit cards are associated with a particular hotel chain’s rewards program, and you will earn more points when spending on company-affiliated hotel chains. You also have the choice to redeem points and get a complimentary stay at a hotel or get an upgrade on your room of choice.

3. General Travel Credit Cards: Some of the general travel credit cards offer more flexibility in how you redeem your points and you are likely to earn more points than on specific airline or hotel travel credit cards. In these, you accumulate points based on your spending, and bonus points based on the kind of spending, for example meals, travel or grocery budgets.

4. Premium Travel Cards: There are a number of travel cards that offer some pretty impressive features. They are, however, meant for the replenishing of the enhanced needs of the more active traveler. These cards often have higher annual fees, but all the perks provided are useful, and those cards can have a higher rewards rate.

5. Flat-Rate Credit Cards: They are relatively basic and straightforward with the concept of travelling credit cards. With this card, you’ll earn a fixed number of points or miles on every purchase and there are no categories to remember and it’s not confusing.

Some Reminders Before Selecting the Best Travel Credit Card

To choose the right travel credit card, consider what you expect from your travel, analyse your current credit score, and your spending habits. Mentioned below are some helpful steps that you can consider before choosing the right travel credit card.

1. Define Your Travel Goals

Selecting the best travel credit card begins with defining your travel goals. Consider the following mentioned below:

- Your Choice of Travel: Are you the high end traveler, the backpacker or somewhere in the middle of the ranging scales? There are cards designated to each of them. Your best rewards card for travel might be loaded with lots of luxurious incentives for the elite while others offer you points for budget-friendly choices.

- Your Destination Preferences: You should be conscious whether your travels are mostly to different regions in your country or if you frequently travel to other countries. Therefore, while some of the credit cards are designed for domestic travels, others are the best credit cards for international travel, for foreign travels.

Understanding travel habits and goals in a destination will considerably reduce the number of options and assist in choosing the best card.

2. Know Your Credit Score

There are lots of factors which influence the credit cards you can get and the rewards associated with them. Credit card companies rely on credit score as a parameter for defining their risk when extending a credit.If your credit score is high, you will probably get better cards in terms of reward and benefits. On the other hand, a lower score really narrows down your choices or leads to higher interest rates on your loan.

Usually, the travel credit cards which are armed with the best rewards and rich privileges are offered to the customers with good or perfect credit histories. This ranking often incorporates scores in the range of 700 and beyond. Holders of these platinum cards such as Chase Sapphire Reserve or The Platinum Card from American express may be required to have high scores.

People with bad or no credit can get a travel credit card as much as it might seem difficult. There are cards out there targeted at such consumers but maybe the rewards are a bit low. For example, such types of credit cards as secured ones, which are issued only if the client proves his solvency with a deposit, are good enough for the beginning. The positive use can at some point increase the credit score and hence there’s always a better place to travel cards.

3. Consider Your Spending Habits

Examining your spending habits will help you find out your best travel credit card. Basically, maximizing rewards often depends on aligning card advantages with where your money goes.

- Examine Your Spending Patterns: Check out your previous bank and credit card statement and start recognizing categories where your spending is highest.

- Credit Cards That Match Your Habits: There are different cards available that offer varied reward rates that depend on the spending category.

- Don’t Overlook General Spending Cards: Although specialized rewards are great, consider cards that provide a flat rate on all purchases.

In Conclusion

There is no one single best travel credit card that you can use. It is about targeting your search to a card which fits the kind of spending you are likely to make. In essence it is advisable to stick with cards that match your habits as this helps you gain reward much faster and are likely to be rewarded in a way that you would prefer to be rewarded.

-

25 Best Credit Card for Travel Rewards in 2025

A credit card for travel rewards helps you earn points or miles on your purchases, which can be redeemed for flights, hotels, and more. These…

-

Chase Sapphire Reserve®: Luxury Travel Credit Card in USA in 2025

The Chase Sapphire Reserve® Credit Card is an excellent option for frequent travelers as it offers a generous sign-up bonus, high rewards on travel and…