In financial emergencies, credit cards offer two options for getting immediate cash: cash advances and credit card loans.

Even though both promise instant access to credit, the two options widely vary in prices, repayment arrangements, and the appropriateness of the means.

Knowing what they are is important in guiding you towards getting the most convenient option for your financial situation.

Below are the key differences between both the options:

Key Differences Overview

| Feature | Credit Card Cash Advance | Credit Card Loan |

|---|---|---|

| Purpose | Quick cash withdrawal. | Lump sum loan for specific needs. |

| Interest Rate | High (25%-30%) | Lower than cash advance (12%-20%) |

| Processing Fees | 3%-5% of the withdrawal amount | 1%-3% of the loan amount |

| Repayment | Added to next billing cycle | EMI-based repayment |

| Approval Process | Instant at ATM or online | Requires application approval |

| Impact on Credit Limit | Reduces available credit limit. | It doesn’t affect available credit for purchases. |

What is a Credit Card Cash Advance?

A credit card cash advance is a feature that allows cardholders to withdraw cash from an ATM or bank with their credit card. In contrast to normal purchases, cash advances charge higher interest rates and extra fees.

Key Features

- Instant Access to Cash: Withdraw cash from a bank or ATM without further authorization.

- High Interest Rate: Interest is charged from the date of the transaction, typically between 25%-30%.

- Cash Advance Charges: A charge of 3%-5% of the withdrawal value.

Use Cases

Below are the common use cases for cash advances from a credit card:

- Emergency Medical Bills: Immediate access to cash for unforeseen hospital charges.

- Last-Minute Travel Expenses: Instant money for ticket booking or lodging.

- Utility Bills: When a bill is due and there are no other funds.

What is a Credit Card Loan?

A credit card loan is a pre-approved, credit-limit-based loan provided by banks to credit card users. In contrast to a cash advance, it is paid back in fixed EMIs over a fixed tenure.

Key Features

- Fixed Loan Amount: Take a lump sum amount as per eligibility.

- Lower Interest Rate: Generally between 12%-20%, lower than cash advances.

- Structured Repayment: Repaid through EMIs over a fixed tenure.

- Quick Processing: Usually disbursed within a few hours or days.

Use Cases

Below are the common use cases for credit card loans:

- Large Planned Expenses: Funding weddings, vacations, or home renovations.

- Balance Transfer: Consolidating high-interest credit card debt.

- Debt Consolidation: Managing multiple debts under one structured repayment plan.

Key Differences Between Cash Advances and Credit Card Loans

While both options offer financial assistance, they differ in several key aspects:

A credit card cash advance has much higher interest rates (25%-30%), which accrue from the withdrawal date. A credit card loan, however, has a lower interest rate (12%-20%) and a repayment schedule, so it is a cheaper borrowing option.

Cash advance carries a fee of 3%-5% of the amount withdrawn, which adds to the cost of borrowing. Credit card loans have lower processing charges, ranging between 1%-3% of the amount sanctioned.

A cash advance is to be repaid in the following billing cycle, which may result in a financial strain. A credit card loan is to be repaid in equal EMIs, thus providing more comfort in financial planning and management of cash flows.

A cash advance is available immediately through ATMs or online banking. Credit card loans involve an application and approval, which takes from a few hours to a few days.

Cash advances decrease the available credit limit, constraining subsequent transactions. Credit card loans don’t affect available credit for purchases, allowing for financial freedom.

Pros & Cons of Each Option

Both credit card loans and credit card cash advances have pros and cons:

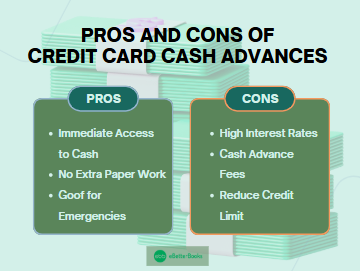

Pros & Cons Credit Card Cash Advances

| Pros | Cons |

|---|---|

| Immediate Access to Cash: Cash advances enable you to access money instantly from a bank or ATM without the need to wait for approval. | High Interest Rates: The interest is charged immediately, usually between 25%-30% per year, making it a costly borrowing facility. |

| No Extra Paperwork: Unlike loans, cash advances do not involve additional paperwork, thus making it a quick and easy process. | Cash Advance Fees: The bank charges 3%-5% of the amount withdrawn, increasing the expense. |

| Good for Emergencies: Perfect for emergency cash requirements like medical bills, traveling, or unexpected bills. | Reduces Credit Limit: The withdrawn amount is subtracted from your credit limit, reducing future purchases. |

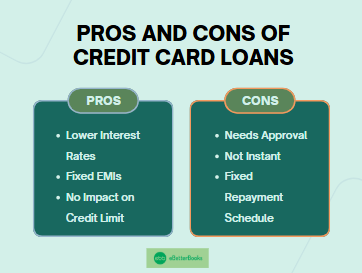

Pros & Cons Credit Card Loan

| Pros | Cons |

|---|---|

| Lower Interest Rates: Generally between 12%-20%, which is lower than a cash advance. | Needs Approval: In contrast to cash advances, credit card loans need an application and approval process. |

| Fixed EMIs: Facilitates systematic repayment, simplifying budgeting. | Not Instant: Although processing is fast, money is not given immediately like a cash advance. |

| Doesn’t Impact Credit Limit for Purchases: The loan amount does not count against your available spending limit on your credit card. | Fixed Repayment Schedule: There is a monthly EMI, which might be stressful to pay if not planned well. |

When to Choose a Cash Advance vs. a Credit Card Loan?

Cash Advance (Ideal for Emergency Needs)

- Medical Emergencies: When you must receive urgent money for medical expenses.

- Unexpected Travel: When you need cash for unforeseen travel.

- Time-Critical Utility Bills: Paying late may cause the disconnection of vital services.

Credit Card Loan (Ideal for Planned Needs)

- Debt Consolidation: When you have several high-interest debts, a credit card loan can provide orderly repayment.

- Large Purchases: If you’re planning home renovations, a wedding, or vacation, a credit card loan is better.

- Business Investment: If your business requires short-term expansion capital.

Alternatives to Consider

If a credit card loan or credit card cash advance does not suit your requirements, you may want to explore the following alternatives:

Online lenders and banks provide personal loans at lower interest rates and guaranteed EMIs, an expensive and predictable form of borrowing.

A revolving credit facility provides a line of credit against which you can borrow as and when needed, pay interest only on the balance used, and enjoy flexibility for unforeseen expenses.

Drawing on your emergency fund is the ideal means of paying for unexpected expenses without paying interest or fees, keeping you out of debt.

Certain credit cards have promotional 0% APR offers, providing interest-free payments for a limited period, making them a good option for short-term borrowing.

Certain employers offer salary advances with low fees, providing a cheap means of meeting short-term financial requirements.

Final Verdict & Recommendations

Both credit card cash advances and credit card loans have different functions. If you urgently need money for emergencies, a cash advance is fast but costly.

If you need a formal repayment plan for a known expenditure, a credit card loan is the most suitable option. Consider your current situation, costs compared, and available alternative borrowings before making a choice.

FAQs!

Is it better to get a cash advance or a loan?

It depends on your needs. A cash advance is ideal for urgent, short-term needs but comes with high fees and interest. A credit card loan is better for planned expenses, offering lower interest rates and structured repayment.

Is it good to take a cash advance from a credit card?

A cash advance is usually not the best option except in extreme necessity. The exorbitant fees and interest rates make it very costly compared to other forms of borrowing.

What is the penalty for a cash advance on a credit card?

Penalties are high-interest charges (from the date of the transaction) and cash advance charges (3%-5% of the withdrawn amount). Some banks may charge additional penalties if the amount is not repaid in time.

How does a credit card loan work?

A credit card loan enables you to take a fixed loan from your credit limit, to be repaid in EMIs over a specific time. The interest rates are lower than in cash advances, and the loan does not impact your available purchase credit limit.