Hi, I’m Ann, and I’m currently handling payroll in QuickBooks Desktop for our small business. When I logged in today to finalize this week’s payroll, I noticed that a chunk of payroll data specifically for the last pay period is just missing. The employee hours, paycheck history, everything we entered last week seems to have vanished.

I didn’t run any updates or make major changes recently, so I’m honestly not sure what caused this. I’ve checked the payroll center, tried switching between date ranges, and even looked into recent backups, but nothing seems to bring the data back. It’s frustrating because our team relies on timely and accurate payments and now I’m worried about re-entering data manually and possibly duplicating entries.

I need to get this resolved quickly to avoid delays in processing. If something got corrupted or went missing due to a sync error or file issue, I need help recovering that data fast. Right now, I’m stuck and can’t move forward with payroll until this is sorted out.

Hey Ann,

Thank you for reaching out. I can imagine how worrying this must be for you. You opened QuickBooks Desktop to finish payroll, and suddenly the last pay period’s data, employee hours, paycheck history, everything is just gone. You’ve already done the right things by checking the Payroll Center, adjusting date ranges, and reviewing backups, but nothing has worked so far.

Payroll accuracy is essential, not just for keeping records in order, but to ensure your team gets paid on time. When that data suddenly goes missing, it can be stressful, especially since re-entering it manually can cause duplicate entries or other issues. And when payroll is delayed, employees are left waiting for their paychecks and business operations are disrupted.

The good news is, issues like this can often be fixed without starting from scratch. It may be due to file corruption, sync errors, or data damage, all of which have proven recovery steps. You’ve already done the first and most important thing, noticing the problem right away and avoiding making changes that could overwrite or complicate recovery.

From verifying and rebuilding your company file to restoring from a verified backup, we’ll go step-by-step so you can recover the missing information quickly, minimize downtime, and get payroll processing back on track smoothly.

Possible Reasons for Missing Payroll Data in QuickBooks Desktop

Missing payroll data in QuickBooks Desktop can be alarming, but it usually happens due to a few common and fixable causes. In many cases, it’s linked to company file corruption, incomplete or failed data syncs, or accidental changes in payroll settings. Sometimes, outdated software versions or interrupted updates can cause recent payroll information to not display correctly.

- Company file corruption or damage.

- Failed or incomplete payroll data sync.

- Incorrect payroll settings, filters, or date ranges.

- Outdated QuickBooks Desktop or payroll tax table version.

- Interrupted or failed QuickBooks update or installation.

- Restoring from an outdated or incorrect backup file.

- Damaged or missing payroll-related components in QuickBooks.

- Data not sent to Intuit Payroll due to network connectivity issues.

- User access restrictions or permission changes.

- Payroll service subscription expired or inactive.

How to Restore Lost Payroll Data in QuickBooks Desktop?

When payroll data is missing in QuickBooks Desktop, you can restore it by checking direct deposit status, updating QuickBooks and tax tables, verifying and rebuilding your company file, and reviewing payroll transactions. You may also need to fix damaged components or resolve sync issues.These steps help recover your data and keep your payroll accurate and on schedule.

Solution 1: Check the Status of Employee Direct Deposits

To ensure your employees’ payments are processed correctly, regularly check the status of their direct deposits. This step helps you quickly identify if any paychecks are delayed, pending, or failed, so you can address issues before they impact your team’s timely payments.

- Navigate to the Employees menu and choose View Payroll Run Status.

- Select a payroll in the Recent Payrolls section.

- Choose the View Payroll Run Status drop-down arrow and click Selected payroll.

- You’ll see the paycheck status on the Payroll status window.

Solution 2: Restore Missing or Voided Paychecks

If a paycheck is missing or has been voided, restoring it promptly is essential to keep your payroll accurate and avoid payment delays. This process helps ensure your employees are paid correctly without causing duplicate payments or accounting discrepancies.

Note: Try sending a zero payroll to restore the paycheck if you use Assisted Payroll and you’re missing a paycheck.

Step 1: Create a direct deposit offset payroll item

The offset item is needed when you recreate missing or voided direct deposit paychecks that are sent to employees’ accounts. It is to zero out the net pay amount so that your employee doesn’t get paid again.

- Navigate to Lists, and click Payroll Item List.

- Choose the Payroll Item in the lower-left corner and click New.

- Select Custom Setup and click Next.

- Click Deduction and select Next.

- Enter the payroll item name, for example, “Direct Deposit Offset” and click Next.

- Leave the top two fields blank for Agency for employee-paid liabilities.

- From the Liability Account field, select Direct Deposit Liabilities, and click Next.

- Set the Tax tracking type to None and click Next.

- Ensure there are no taxes selected and choose Next.

- Set Calculate based on quantity to Neither and select Next.

- Set Gross vs. Net to net pay and click Next.

- Remain the Default Rate and Limit fields blank and click Finish.

Step 2: Recreate the missing or voided direct deposit paycheck

Missing direct deposit paychecks need to be recreated with zero net pay because the total amount should reflect in the direct deposit liability check. It’ll help balance your check register, and make sure your employees aren’t paid twice.

- Move to Employees, and choose Pay Employees.

- Select Unscheduled Payroll.

- Enter the check date and pay period to match the voided paycheck.

- Tickmark next to the affected employee(s) and select Open Paycheck Detail.

- Under the Preview Paycheck window, clear the Use Direct Deposit checkbox.

- Type the payroll item, rate, and hours as it was before.

- Enter the DD Offset payroll item in the Other Payroll Items section.

- Input a negative amount for the DD Offset item equal to the net amount of the paycheck.

- Click Tab on your keyboard to change the net pay to 0.

- Select Save & Close then Continue.

- Choose Create Paychecks.

Step 3: Correct the payroll liability balances

The direct deposit offset is a deduction item and will display in QuickBooks Desktop as a liability to be paid. You need to make a company adjustment to remove the deduction item amount from your liability balances.

- Navigate to Employees menu, and choose Payroll Taxes and Liabilities

- Select Adjust Payroll Liabilities.

- The Date and Effective Date should match the check date of the paycheck you just created.

- Choose Company Adjustment.

- Under the Item Name column, select the direct deposit offset item.

- Enter a negative amount equal to the DD Offset amount on the paycheck in the Amount column.

- Choose Accounts Affected.

- Select Do Not Affect Accounts.

- Click OK twice.

Step 4: Send payroll data to Intuit

You’ll send your payroll data to Intuit to sync.

- Head to Employees, and choose Send Payroll Data.

- Under the Items to Send section, make sure the direct deposit amount is zero.

- Select Send.

- Enter your direct deposit PIN.

- Wait for the message that your payroll session was successful.

- A confirmation report appears in the Items Received section of the Send Payroll Data window.

Solution 3: Customize the Payroll Detail Report

Customizing the Payroll Detail Report allows you to closely review employee payroll transactions and identify any missing or incorrect data. This helps you spot discrepancies early and ensures your payroll records are complete and accurate.

- Navigate to Reports and select Employees and Payroll.

- Choose Payroll Details.

Note: Customize the report as needed to review employee payroll transactions and identify any missing data or discrepancies.

Solution 4: Review & Verify Payroll Transactions

Reviewing and verifying payroll transactions at regular intervals helps determine errors or omissions before they impact your employees’ pay. This step ensures that all hours, wages, and deductions are correctly recorded and processed.

- Navigate to Reports > Accountant & Taxes > Transaction List by Date.

- Click the Display tab and select the columns you want to show (such as name, date, pay period begin and end dates, transaction number, and amount).

- Under the Filters tab, set:

- Account to All Accounts

- Date to your desired range (this month, week, day, etc.)

- Detail Level to Summary Only

- Transaction Type to Paycheck

- Change the Report Title to Paychecks for All Employees in the Header/Footer tab.

Solution 5: Add Your Employee’s Prior Paychecks

Adding your employees’ prior paychecks info ensures your payroll records are complete and up-to-date, especially if any data was missing or lost. This helps maintain accurate year-to-date information and avoids payment discrepancies.

- Choose Payroll History under the Payroll setup screen.

- Select the Yes, have paid employees in 2026 radio button, and click Continue.

- Click Yes or No on Consolidate paychecks for the previous quarters, and click Continue.

- Pick the employee you want to enter paycheck details for and select Edit payroll history.

- Enter the paycheck amounts either as a total for each previous quarter or by individual paycheck, based on your selection in step 3. Make sure to input amounts by paycheck date within the current quarter.

- When you’ve added all the paychecks for that employee, click Done.

- Repeat the same steps for every employee paid during the current year, including former employees.

Solution 6: Verify & Rebuild Company File

Verifying and rebuilding your company file helps identify and fix data corruption errors that could cause missing payroll information. Running these tools regularly keeps your QuickBooks file healthy and ensures accurate payroll processing.

Verify your company data

- Navigate to Windows > click Close All.

- Open the File menu > select Utilities.

- Choose Verify Data when you see:

- QuickBooks detected no problems with your data—your data is clean, and there’s nothing else to do with it.

- An error message—look for it on the QuickBooks Desktop support site for how to fix it.

- Your data has lost integrity—Data damage was found in the file. Rebuild your data to fix it.

Note: Contact the QuickBooks Support Team before you rebuild your data in case you use Assisted Payroll.

Rebuild your company file data

- Navigate to File > Utilities > select Rebuild Data.

- QuickBooks will ask to create a backup before it rebuilds your company file. Click OK. A backup is required before you rebuild.

- Choose where to save your backup and click OK. Don’t replace another backup file. Enter a new name in the File name and click Save.

- Click the OK tab when the message Rebuild has completed appears.

- Move to File > select Utilities > choose Verify Data again to check for additional damage.

- When the verify tool finds more damage, fix it manually. Look for the error(s) in the qbwin.log on the QuickBooks Desktop support site for how to fix them.

- When your error can’t be found, restore a recent backup. Go to File, then choose Open or Restore Company.

Note: Avoid replacing your existing company file and re-entering the info into your company file after the backup was created.

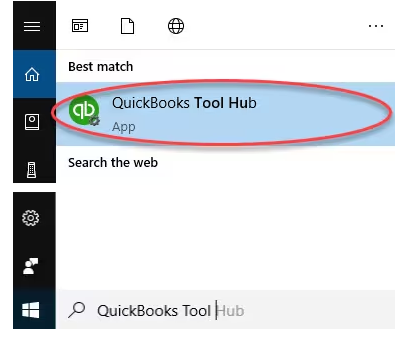

Solution 7: Download & Install the QuickBooks Tool Hub

The QuickBooks Tool Hub helps to fix common errors. You’ll need to close QuickBooks to use the tool hub. For the best experience, we recommend you use Tool Hub on Windows 10, 64-bit.

- Close QuickBooks.

- Download and install the most recent version (1.6. 0.8) of QuickBooks Tool Hub.

- Save the file somewhere you can easily find it such as your Downloads folder or your Windows desktop.

Note: To find out which tool hub version you have, select the Home tab and the version will be on the bottom.

- Open the downloaded file QuickBooksToolHub.exe to start the installation.

- Follow the on-screen steps to install and agree to the terms and conditions.

- When the installation finishes, click twice on your Windows desktop icon to open the tool hub.

Note: If you are unable to find the icon, do a search in Windows for QuickBooks Tool Hub and select the program.

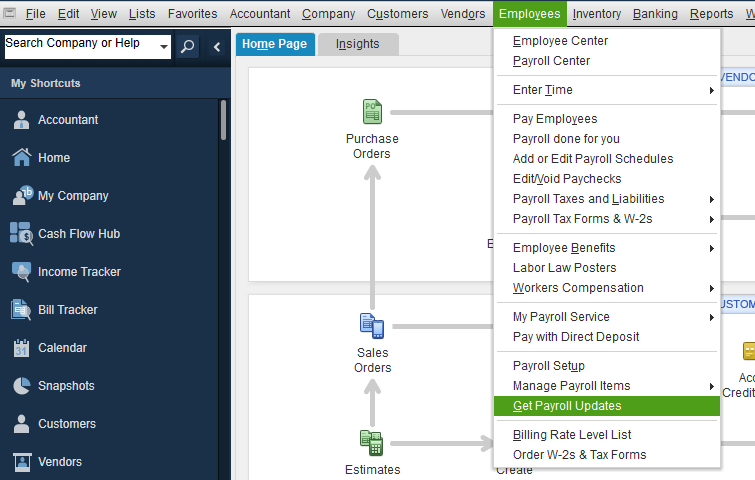

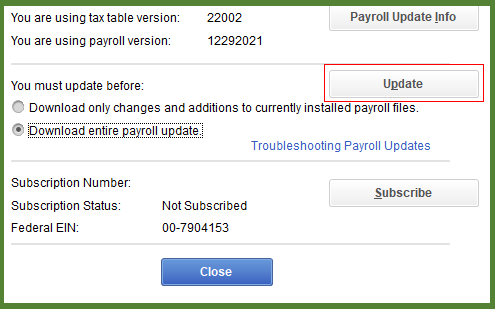

Solution 8: Update QuickBooks Desktop & Payroll Tax Table

Keeping QuickBooks Desktop and your payroll tax table up to date ensures you have the latest tax rates and software improvements. Regular updates help prevent errors, improve system stability, and keep your payroll calculations accurate.

Update QuickBooks Desktop to the latest version

An outdated QuickBooks version doesn’t allow you to download the QuickBooks Payroll Updates. Here’s how you can update your software.

- Open QuickBooks Desktop and navigate to the Help menu.

- Choose Update QuickBooks Desktop.

- Hit the Update Now tab. Tip: Tickmark the Reset Update checkbox to clear all previous update downloads.

- Select Get Updates to start the download.

- Once done, close and reopen QuickBooks to install the update again.

Get the Payroll Tax Table Updates

QuickBooks Desktop Payroll provides payroll updates to QuickBooks Desktop Payroll subscribers. These updates include the most current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file and pay options.

Note: The latest payroll update number is 22513 released on July 3, 2025.

- Navigate to the Employees menu.

- Choose Get Payroll Updates.

- Select the Download entire payroll update radio-button.

- Click Update.

- Wait until the update is complete.

Future Tips to Prevent Payroll Data Loss in QuickBooks Desktop

To avoid missing payroll data problems in QuickBooks Desktop, keep your software and payroll updates current, review payroll reports after each run and follow these best practices to maintain accurate and secure payroll processing.

- Back up your QuickBooks company file at regular intervals.

- Keep QuickBooks Desktop and payroll tax tables updated.

- Verify payroll data and direct deposit statuses after each payroll run.

- Limit user permissions to reduce accidental data changes.

- Review payroll reports frequently to spot discrepancies early.

- Maintain a stable internet connection during payroll processing.

- Document clear payroll records for easy reference and audit readiness.

Final Note!

Ann, I understand how frustrating it can be to face missing payroll data, especially when accurate payroll is so crucial for your team and business. You’ve already done a great job identifying the problem and taking careful steps to avoid making things more complicated. That thoughtful approach will really help as you work through restoring your data.

To stay ahead of payroll problems, make it a priority to regularly back up your company file and keep both QuickBooks and payroll updated. After each payroll run, take a moment to verify the details, limit who can access payroll data, and frequently review payroll reports to catch any discrepancies early. Ignoring these steps can lead to errors like missing paychecks, incorrect tax filings, or delayed employee payments, which can disrupt your business operations and timely payroll processing.

If you experience issues like missing paycheck history, incorrect payroll tax calculations, or problems with direct deposit status, don’t worry. We’re here to help you recover your data and keep your payroll running smoothly.

FAQs:

How long does QuickBooks keep my historical payroll data and paychecks on their servers, even if I cancel my subscription?

QuickBooks typically retains your historical payroll data (including paychecks and tax filings) on its servers for a period of time, even after you cancel your QuickBooks Desktop payroll subscription. This is done for tax compliance and audit purposes. However, the exact retention period varies by service type and is subject to change. It is always recommended that the user print all year-end tax forms and save local backups of the company file, as the primary responsibility for record-keeping lies with the business owner.

I use a third-party application to track employee hours. Why is it important to ensure its connection with QuickBooks is always stable?

Many QuickBooks payroll issues, including missing data, stem from incomplete or failed data transfers from third-party time-tracking or scheduling apps. If the connection fails mid-sync, the payroll data can be partially recorded, leading to missing hours or incomplete paychecks for a period. It is critical to verify the payroll summary report immediately after syncing third-party data and before processing payroll to catch these discrepancies.

How can I verify whether my payroll items, tax tables, or employee setups are still intact even if the last pay period’s data is missing?

You can review payroll configurations using Lists → Payroll Item List and Employees → Employee Center → Payroll Info.

QuickBooks recommends confirming that payroll items, pay schedules, tax tables, and employee defaults are still correctly assigned to employees, as these master records remain independent from individual paycheck data.

Can QuickBooks Desktop generate payroll summary or tax reports if certain pay periods are missing?

Yes. QuickBooks Desktop will still generate reports such as Payroll Summary, Payroll Item Detail, and Payroll Tax Liability. However, Intuit notes that reports may appear incomplete if a specific pay period’s data is missing, since reports pull only from existing paycheck records.

Can limiting user permissions prevent payroll data from accidentally being voided or deleted?

Yes, limiting user permissions is a key security measure. QuickBooks Desktop allows the administrator to restrict access to sensitive areas like payroll. By going to Company ➜ Set Up Users and Passwords ➜ Set Up Users, you can specifically prevent certain users from having the ability to create, modify, or delete paychecks and payroll items (including the ability to void a check). This prevents accidental data loss caused by non-payroll staff.

Disclaimer: The information outlined above for “Why Is My Payroll Data Missing for the Last Pay Period in QuickBooks Desktop? Causes & Solutions” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.