My name is Sylvia, and I’m running payroll in QuickBooks Desktop Premier Plus, and I just realized something’s off taxes aren’t being withheld when I process employee paychecks. I’ve been using the same setup for months with no issues, so this caught me off guard. I noticed it while reviewing the pay stubs before finalizing there were no deductions showing up for federal or state taxes, and the net pay looked unusually high.”

“I double-checked my payroll item list and employee profiles to see if anything had changed like exemptions being marked by mistake but everything looks normal from my end. I even updated the payroll tax table thinking it might be outdated, but that didn’t resolve the issue either. It’s concerning because I’m afraid I might be submitting incorrect payroll data and underpaying taxes, which could lead to compliance problems down the road.”

“At this point, I really need help figuring out why the system is skipping withholding and what I can do to make sure employee taxes are calculated correctly before the next pay cycle. This is time-sensitive I can’t afford to run inaccurate payroll again.

Hi Sylvia,

Thanks for reaching out to us. I can completely understand how stressful it must be to suddenly see taxes not being withheld while processing employee paychecks even though everything has been running smoothly until now. You’re doing all the right things by catching the issue early and reviewing the setup before finalizing your paychecks.

Based on what you’ve described, it seems like QuickBooks Desktop Premier Plus has stopped calculating federal and state tax withholding for your employees. You’ve already taken some powerful troubleshooting steps from checking employee profiles for exemptions to reviewing the payroll item list, and updating the payroll tax table. Since the issue is still unresolved, it’s likely that something deeper in the configuration is interfering with tax calculations.

No worries, we’ll get this sorted out. I’m here to help you resolve the issue before your next payroll cycle. Below, I’ll walk you through the most common causes for missing tax withholdings in QuickBooks Desktop, along with step-by-step solutions to restore accurate payroll calculations, stay compliant, and ensure your employee taxes are being calculated correctly.

Common Reasons Why Payroll Taxes Are Missing in QuickBooks Desktop Premier Plus!

QuickBooks Desktop Premier Plus often fails to withhold federal or state taxes from employee paychecks due to misconfigured employee profiles, inactive payroll items, or incorrect tax setup. Even a small change in filing status, exemptions, or tax tables can disrupt calculations.

- The employee is marked as exempt from federal or state withholding.

- “Do not withhold” is selected in the employee’s tax setup.

- Required payroll tax items are missing or inactive.

- The employee’s filing status or number of allowances is incorrect.

- The payroll tax table is outdated or not fully installed.

- The total annual salary of the employee exceeds the salary limit.

- The employee’s gross wages are below the minimum taxable threshold.

- Manual edits or overrides were made to the paycheck.

- The employee is flagged as inactive but still included in payroll processing.

- The company’s federal or state tax setup is missing or incorrectly configured.

How to Fix Missing Payroll Tax Withholdings in QuickBooks Desktop Premier Plus?

Sylvia, if payroll taxes aren’t being withheld as expected, it’s important to review both employee and company payroll setups in QuickBooks Desktop Premier Plus. The steps below will help you to identify configuration issues, reactivate missing tax items, and ensure that tax calculations apply correctly during payroll processing.

Solution 1: Check Your Employee Payroll Set up

QuickBooks Desktop calculates payroll taxes based on the employee details and payroll items you’ve entered. Make sure that both your employee profiles and payroll item setup are properly configured to ensure accurate tax withholdings.

- Navigate to Employees, and select the Employee Center.

- Double-check the employee’s name to open their profile.

- Select Payroll Info and check the Pay Frequency dropdown menu.

- Click the Taxes button.

- Under the Federal and State tabs:

- Make sure “Do not withhold” is not selected.

- Ensure correct Filing Status and Allowances are entered.

- Confirm the employee is not marked as exempt unless intended.

- Edit them if needed.

- Choose OK when you’re done.

Solution 2: Revert your Employees Paychecks

If you updated tax information or installed a payroll update after creating paychecks, the changes won’t apply retroactively. To ensure accurate tax calculations, revert any affected paychecks. This action removes previously saved data and allows QuickBooks to recalculate taxes using the latest payroll setup.

- Navigate to Employees, and select Pay Employees

- Choose Scheduled Payroll or Unscheduled Payroll.

- Select Resume Scheduled Payroll. Employees with recent updates will be highlighted in yellow.

- Right-click on any highlighted employee’s name to proceed.

- Click Revert Paychecks.

Solution 3: Configure State and Local Tax Settings

Ensure your employee’s state and local tax details are set up correctly. This includes selecting the correct state for withholding, assigning applicable local taxes, and completing any pending tax setup to calculate payroll taxes accurately.

Step 1: Set Up State and Local Withholding

- Navigate to Employees, and select the Employee Center.

- Click New Employee if you’re adding a new employee. If an existing employee moved to a new state, double-click your employee from the list.

- Select the Payroll Info tab, and click Taxes.

- Choose the State tab.

- From the State Worked drop-down menu, select the state where you’re required to pay State Unemployment Insurance. If your employee works remotely, the “State Worked” may differ from their physical work location.

- Choose the state you’re required to collect and pay State Income (or Withholding) tax for your employee from the State Subject to Withholding. If you need to handle State Withholding tax in multiple states, consider using QuickBooks Online Payroll for better multi-state support.

- You’ll get a prompt to set up the new taxes. Follow the instructions below in Set up your new state taxes.

- You might also be prompted to confirm whether your employee is subject to additional taxes.

- If your employee is subject to one or more taxes, click Yes. These will appear under the Other tab. To remove any that don’t apply, select the item and choose Delete.

- If your employee isn’t subject to any of the taxes, click No.

If your employee is subject to local taxes, set them up to ensure accurate calculations. You’ll have to pay and file your local taxes manually.

- Click anywhere inside the blank area below the Item Name box in the Other tab.

- Select the dropdown menu, and choose Add New.

- Follow the on-screen instructions to select the type of local tax, enter your account number, and rates.

Step 2: Complete State Tax Setup and Enable E-File/E-Pay

When adding or editing your employee’s State Subject to Withholding and State Worked fields on the Taxes tab, you may see many prompts to set up new state taxes.

- Choose Setup on the state tax prompt.

- Leave the state tax name as is. Click Next.

- Type the name of the state agency and your account number if you use QuickBooks Desktop Payroll Assisted, or you e-file/e-pay.

- Select the dropdown if you want to use a different liability or expense account than the one(s) shown.

- Choose the account you created and click Add New to set up a new one.

- Enter your SUI tax rate for each quarter if you’re setting up State Unemployment.

- Once done, click Next, and Finish.

If your employee is subject to local taxes, set up the local tax items.

- From the Other tab, click anywhere inside the blank area in the Item Name box.

- Choose the dropdown, and click Add New.

- Follow the on-screen instructions to select the type of local tax, enter your account number, and rates.

Note: You’ll need to pay your local taxes and file local tax forms manually. Or, consider switching to QuickBooks Online Payroll Premium or Elite for automated local tax handling.

For QuickBooks Desktop Payroll Enhanced with e-file and e-pay

You may also need to set up e-file and e-pay for your new state.

- Go to Employees, and select Payroll Taxes and Liabilities > Edit Payment Due Dates.

- Choose Schedule payments.

- Select your new state tax, and click Edit.

- From the Payment (deposit) method, choose E-pay.

- Select your Payment (deposit) frequency and click Finish.

- Click Continue.

- Choose the bank account you want to use for tracking your e-payments in QuickBooks. This should match the bank account you submitted when enrolled with your state tax agency. Then, click Edit.

- Enter your bank routing and account numbers and choose Finish.

- Select Continue, and click Finish Later.

Important: If you use QuickBooks Desktop Payroll Assisted, you’ll receive an email with state authorization forms. Follow the instructions to sign and return them. These are necessary for QuickBooks to file and pay your state taxes on your behalf. If you’re using Basic, Standard, or Enhanced versions, no authorization forms are required.

Solution 5: Use Verify & Rebuild Data Tool

The Verify & Rebuild Data tool can help identify and fix common problems. Running this tool ensures your file is error-free, helping payroll calculations and settings work as expected. It’s a quick way to resolve hidden data inconsistencies before contacting support.

Verify your company data

- Navigate to Windows > click Close All.

- Open the File menu > select Utilities.

- Choose Verify Data when you see:

- QuickBooks detected no problems with your data—your data is clean, and there’s nothing else to do with it.

- An error message—look for it on the QuickBooks Desktop support site for how to fix it.

- Your data has lost integrity—Data damage was found in the file. Rebuild your data to fix it.

Note: Contact the QuickBooks Support Team before you rebuild your data in case you use Assisted Payroll.

Rebuild your company file data

- Navigate to File > Utilities > select Rebuild Data.

- QuickBooks will ask to create a backup before it rebuilds your company file. Click OK. A backup is required before you rebuild.

- Choose where to save your backup and click OK. Don’t replace another backup file. Enter a new name in the File name and click Save.

- Click the OK tab when the message Rebuild has completed appears.

- Move to File > select Utilities > choose Verify Data again to check for additional damage.

- When the verify tool finds more damage, fix it manually. Look for the error(s) in the qbwin.log on the QuickBooks Desktop support site for how to fix them.

- When your error can’t be found, restore a recent backup. Go to File, then choose Open or Restore Company.

Note: Avoid replacing your existing company file and re-entering the info into your company file after the backup was created.

Solution 6: Update Payroll Tax Table

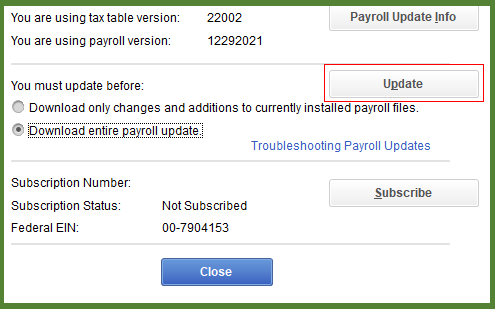

QuickBooks Desktop Payroll provides payroll updates to QuickBooks Desktop Payroll subscribers. These updates include the most current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file and pay options.

Note: The latest payroll update number is 22513 released on July 3, 2025.

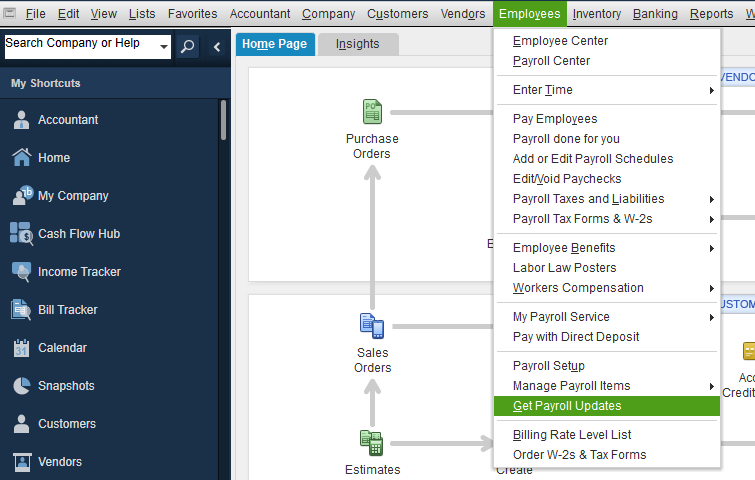

- Navigate to the Employees menu.

- Choose Get Payroll Updates.

- Select the Download entire payroll update radio-button.

- Click Update.

- Wait until the update is complete.

Solution 7: Run the Payroll Setup Interview

The Payroll Setup Interview is a step-by-step wizard in QuickBooks Desktop that helps ensure your payroll system is fully and correctly configured. This tool is especially helpful if you’re setting up payroll for the first time or need to make major corrections to an existing setup. Before you begin, ensure your QuickBooks Desktop Payroll service is activated.

- Open QuickBooks Desktop.

- Select Employees, and click Payroll Setup.

- Follow the screens to add your employees, and set up your company payroll items or taxes.

Note: Make sure to include all employees you’ve paid during the current calendar year, even if they’re no longer employed. You’ll also need to enter their year-to-date payroll info as well.

Preventive Measures to Avoid Missing Payroll Tax Withholdings in QuickBooks Desktop Premier Plus!

To avoid payroll tax withholding issues in QuickBooks Desktop Premier Plus, it’s important to follow correct setup procedures, keep your payroll data up-to-date, and review employee and tax settings regularly. These preventative steps will help you to ensure accurate tax calculations, timely filings, and overall payroll compliance.

- Always update QuickBooks Desktop and payroll tax tables at regular intervals.

- Verify employee tax setup during onboarding and after any status change.

- Ensure all applicable state and local tax items are added correctly.

- Double-check liability and expense account mappings for payroll items.

- Use the Payroll Setup Interview tool for complete and accurate configuration.

- Run payroll reports frequently to catch missing or incorrect withholdings.

- Use the Verify and Rebuild Data tool to identify and fix data issues.

- Revert paychecks if payroll data was saved before tax setup changes.

- Confirm e-file and e-pay settings are enabled for supported tax agencies.

- Review scheduled payroll settings to confirm employee changes are applied.

Final Verdict!

Sylvia, I know how overwhelming it can feel when payroll tax withholdings don’t show up the way they should even when you’re doing your best to stay compliant and keep everything running smoothly.

You’ve already completed the most critical steps to address the issue: reviewing your payroll setup, updating employee tax information, running the Payroll Setup Interview, and using the Verify & Rebuild Data tool. Each of these actions reflects your focus, precision, and dedication to making sure your payroll stays accurate and compliant.

To maintain accurate payroll operations, regularly check employee tax settings, keep QuickBooks Desktop or payroll tax tables updated, and back up your company file. These small but important steps can help you avoid future payroll disruptions and maintain accurate tax withholdings.

And if things still feel off like federal or state taxes missing from paychecks, employees not being marked correctly as tax-subject, or outdated tax setup, we’re here to assist you anytime.

Disclaimer: The information outlined above for “Why Are Payroll Taxes Not Withholding in QuickBooks Desktop Premier Plus?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.