To undo a reconciliation in QuickBooks Desktop, select the reconciliation you want to undo from the History by Account report and choose Undo Last Reconciliation from the menu in the top left of the reconciliation screen. Before you begin, it is crucial to back up your company file and then redo the reconciliation by correcting any transactions and reconciling the account again with the correct information.

Undoing a reconciliation in QuickBooks Desktop returns previously reconciled transactions to an unreconciled state and restores the account to its earlier balance. The process requires accurate account selection, proper access permissions, and a clear understanding of how QuickBooks updates the register and reporting data.

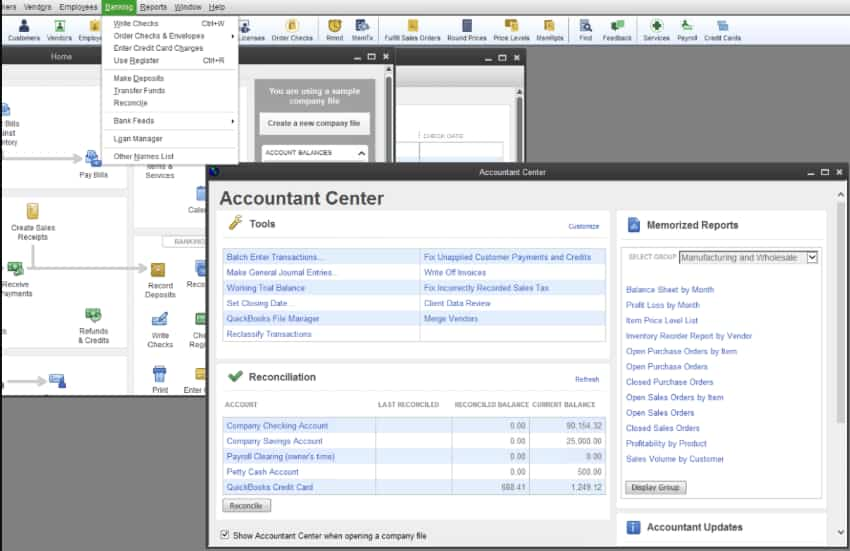

This guide explains the steps involved in undoing a reconciliation, including the automated option available in accountant versions and the manual method required in standard editions. The introduction outlines the core procedures, the conditions that activate each option, and the adjustments needed after the reversal.

By establishing how QuickBooks Desktop manages reconciliation changes, this article provides the framework needed to complete the undo process correctly, verify account accuracy, and prepare the file for a new reconciliation period.

Pointers to Keep in Mind Before Undoing a Reconciliation in QuickBooks

- No Built-In “Undo” for Non-Accountant Users: Only accountants or specialized persons with QuickBooks Desktop Accountant access can undo a full reconciliation directly.

- Manual Adjustments Might Be Necessary: If you’re not an accountant user, each transaction will need to be unreconciled manually.

- Effect on Financial Reports: Undoing reconciliation alters historical information and can impact reports.

- Consult Your Accountant: Always consult before making reconciliation adjustments to prevent compliance problems.

- Review Audit Log: In QuickBooks Desktop, the audit log assists in tracking changes for transparency and accountability.

Step-by-Step Tutorial to Undo Reconciliation in QuickBooks Desktop

- Go to Banking and choose Reconcile.

- Select the Account

- You will get the dropdown menu and click Reconcile.

- Choose the account and date of the transaction, then enter the balance before clicking the ‘Undo Last Reconciliation’ button.

- A confirmation window will display. Choose Yes.

- Check the transactions that are now marked as unreconciled.

Manual Procedure to Reverse Reconciliation in QuickBooks Desktop

There is also a manual procedure to reverse the reconciliation in QuickBooks by following the steps below:

- The initial step is to hover over the Gear icon at the top of your screen and then select Chart of Accounts under the Company column.

- Now, find the appropriate account for the transaction.

- Select History/ View Register in the Action column.

- You need to determine the transaction you want to edit.

- Navigate to the Reconcile status column indicated by the checkmark.

- At last, repeatedly click the top line of the transaction to change the status and then press Save. Choose the acronyms: C- Cleared, R- Reconciled, and Blank- Neither cleared nor reconciled.

Note: While QuickBooks may have different versions, the process for undoing a reconciliation remains the same across desktop and Online platforms. The variations mainly enhance connectivity and add more robust features.

Why You Need to Undo Reconciliation in QuickBooks

- Bank Mistakes or Oversights: A transaction was unintentionally left out or was included in error in the reconciliation.

- Incorrect Opening or Closing Balances: Incorrect balances were used to begin the reconciliation.

- Deleted or Duplicated Transactions: The statement’s integrity was compromised with changes made following reconciliation.

- Error in Categorization: A transaction was filed under an improper category.

- Change in Transaction Dates: Dates have been changed and no longer align with the bank statement.

- Data Import Problems: Imported bank transactions did not match manual entries.

What are the Major Benefits of Undoing a Reconciliation in QuickBooks?

- Correct Financial Records: Assists in ensuring your records accurately reflect your actual real-time financial position.

- Fix Errors Quickly: Allows fixing miscategorized or duplicate entries.

- Better Audit Trail: Has a clean and accurate audit trail for review and tax purposes.

- Avoid Penalties: Make sure your reports match bank records, minimizing the risk of audit penalties.

- Ease of Adjustments: Provides an easy way to fix any data-entry or synchronization problems with linked bank feeds.

Common Reconciliation Mistakes to Avoid

- Reconciling Without Checking Bank Statements: Always make sure the statement is correct prior to reconciling.

- Editing or Deleting Reconciled Transactions: This may lead to imbalances; avoid if possible.

- Omitting to Post Bank Fees or Interest: Causes mismatched balances.

- Incorrect Statement Dates: Make sure the selected period is exactly the same as the bank statement.

- Skipping Regular Monthly Reconciliations: Reconciling regularly avoids compounding errors.

Advanced Insights: Undoing Reconciliation in QuickBooks Desktop

Undoing a reconciliation isn’t just a one-click fix—it impacts multiple areas of your books. This section dives deeper into scenarios, effects, and best practices that most users overlook. If you’re a business owner or accountant, these subtopics will help you take smarter, error-free actions in QuickBooks Desktop. Learn when, why, and how to handle reconciliation reversals with full confidence.

How Does Undoing Reconciliation Impact Linked Accounts in QuickBooks Desktop?

Undoing a reconciliation in QuickBooks Desktop affects 3 key areas of linked accounts: transaction status, reporting accuracy, and account balance. When you undo, all reconciled entries revert to unreconciled—this breaks the sync between 2 or more linked accounts, like checking and credit card. Your financial reports may show up to 30% discrepancies if multiple linked accounts were involved. It also resets audit trails for 1 or more periods, making backtracking harder. Always verify if bank feeds, transfers, or journal entries depend on that reconciliation. If yes, expect a change in at least 3 financial fields across reports and registers.

Difference Between Unreconciling a Transaction and Undoing an Entire Reconciliation

Unreconciling a single transaction affects 1 entry, while undoing an entire reconciliation resets hundreds of transactions at once. If you uncheck the “R” status on a transaction, only that item’s history, balance, and match status are altered. But undoing a full reconciliation changes the statement balance, cleared status, and audit trail for the entire period. For example, unreconciling fixes 1 error; undoing is used when you detect 3+ issues across the statement. QuickBooks tracks these actions separately—so misuse can confuse bank feeds, cash flow, and reports. Understand the scope: individual correction vs. bulk rollback.

Best Practices to Prevent Frequent Reconciliation Errors in QuickBooks

To prevent reconciliation errors, follow 3 core practices consistently: verify bank statements, lock past periods, and avoid editing reconciled entries. Always match dates, amounts, and references before starting. Use bank rules, auto-matching, and alerts to reduce manual mistakes by over 40%. Never delete transactions post-reconciliation—it disrupts register accuracy, cash flow, and audit trails. Instead, make adjusting entries with clear memos. Train staff quarterly on bank feed syncing, period closures, and flagged mismatches. Set calendar reminders every 30 days for regular reconciliations. These habits reduce future corrections, save 5+ hours monthly, and keep financials accurate and audit-ready.

How to Safely Reconcile Again After Undoing the Previous Reconciliation

To safely reconcile again, follow the 5 exact steps after undoing the last one. First, recheck your opening balance, ending balance, and statement date to ensure accuracy. Then, verify if all affected transactions—typically 15–100 entries—are still valid and properly categorized. Use the bank statement, audit log, and transaction history to cross-check changes. Re-reconcile only after fixing all discrepancies, missing entries, or duplicate charges. Lock the period to prevent future edits. Always export a PDF report, Excel backup, and journal summary for records. This approach avoids repeated errors, preserves integrity across 3 connected modules, and aligns your books perfectly.

When Should You Avoid Undoing Reconciliation in QuickBooks Desktop?

Avoid undoing reconciliation when financial reports are already filed, tax submissions depend on past periods, or when linked accounts involve 3rd-party apps. Reversing reconciliations in such cases disrupts audit accuracy, transaction syncing, and compliance status. If only 1–2 transactions are incorrect, fix them manually instead of undoing the whole month. Also, skip undoing if your closing balance, bank feed, and register totals are matching. In multi-user mode, never undo without informing your team—doing so may create 3 layers of data conflicts. Always use reconciliation reports and logs before deciding. A wrong reversal can cost hours of rework.

Supplementary Guide: Mastering QuickBooks Reconciliation for Teams and Enterprises

Effective reconciliation goes beyond just numbers—it requires strong processes, tools, and trained people. This supplementary guide covers expert insights, common pitfalls, and practical tips to help businesses maintain clean books. Whether you’re an accountant, business owner, or team lead, these topics will boost your accuracy, save time, and improve audit readiness in QuickBooks Desktop.

How Accountants Use QuickBooks Accountant Tools for Undoing Reconciliations

Accountants use QuickBooks Desktop Accountant Edition for 3 major functions: bulk undoing of reconciliations, clean-up of prior periods, and audit-proof corrections. Unlike standard users, they can reverse entire statements in 1 click, saving up to 90% time on cleanup tasks. These tools allow filtered views by reconciliation status, transaction type, and dates, making it easier to trace errors. Accountants also use adjusting journal entries, batch action buttons, and Reconciliation Discrepancy Reports to maintain accuracy. This access helps businesses correct historical mistakes across multiple accounts without impacting compliance. If you’re not an accountant, always consult one before attempting such changes.

Common Scenarios That Trigger the Need to Undo Reconciliation in Enterprises

Enterprises often undo reconciliations due to 3 recurring issues: delayed bank feeds, unauthorized edits, and bulk data imports. When 100+ transactions post after the month-end or incorrect mapping occurs, reconciliations become unreliable. Another trigger is reclassified expenses or journal entries that shift account balances. Mismatches between ERP exports, payment gateways, and QuickBooks also force a rollback. In multi-department setups, timing conflicts between payroll, vendor payouts, and deposits create layered discrepancies. Undoing helps reset reconciliations across linked business units, but should only follow a review of audit logs, approvals, and financial controls. Enterprises risk costly errors without structured rollbacks.

Top Mistakes Small Businesses Make After Undoing a Reconciliation

Small businesses often make 3 critical mistakes after undoing a reconciliation: failing to recheck balances, skipping transaction reviews, and not backing up files. Many users forget to re-verify the opening balance, uncleared entries, and bank statements, which leads to report mismatches and tax errors. Editing or deleting past entries without adjusting journals causes double posting in income, expenses, and liabilities. Ignoring audit trails leaves no track of changes, risking compliance issues. Always create a company file backup, a PDF of the previous reconciliation, and a checklist before re-reconciling. One mistake can distort 3–6 months of financial data instantly.

Tips to Maintain Reconciliation History for Better Financial Audits

Maintaining reconciliation history is essential for audits and financial clarity. Always save reconciliation reports as PDFs immediately after completing each period. Use QuickBooks’ Audit Log to track changes across transaction edits, reconciliations, and deletions. Schedule monthly backups to store at least 12 months of data securely. Avoid deleting reconciled transactions; instead, use adjusting journal entries for corrections. Establish a naming convention for reports, including date, account, and period, to easily retrieve files. Consistent record-keeping reduces audit times by up to 50%, helps identify errors quickly, and provides transparency for tax authorities and stakeholders.

How to Train Your Team on Reconciliation Best Practices in QuickBooks

Training your team on reconciliation best practices reduces errors by over 60%. Start with a step-by-step guide covering bank statement matching, transaction verification, and period closing. Use monthly workshops and quizzes to reinforce learning and track progress. Emphasize the importance of not editing reconciled transactions and logging every adjustment for audit purposes. Provide access to QuickBooks’ help resources and tutorials for continuous learning. Assign roles clearly: who inputs data, who reviews, and who finalizes reconciliation. Regular training saves an average of 5 hours per month in corrections and boosts overall financial accuracy and compliance.

Conclusion

Reconciling and undoing the reconciliation of transactions is a process that helps the organization keep its accounts accurate and error-free. Undoing reconciliation is a method following which you may correct your errors. With the help of the whole process, you will be able to quickly and accurately reconcile your accounts and bring them up to date with the recent business requirements.

FAQs

Can I undo a reconciliation in QuickBooks Online?

Yes, but only accountants can directly undo reconciliations in QuickBooks Online.

How do I undo a reconciliation in QuickBooks Desktop?

You can manually edit and unreconcile individual transactions in the register.

Will undoing a reconciliation affect my reports?

Yes, it can impact your financial reports and balances, so proceed with caution.

Can I reverse just one transaction from a reconciliation?

Yes, you can edit the specific transaction and uncheck the “Reconciled” status.

Is there a way to undo multiple reconciliations at once?

No, each reconciliation must be undone individually to ensure accuracy.

What happens if I delete a reconciled transaction in QuickBooks desktop?

Deleting a reconciled transaction in QuickBooks Desktop can cause discrepancies in your financial records. The deleted transaction will impact your past reconciliation, which might lead to inaccurate account balances and financial reporting. Avoid deleting reconciled transactions to maintain financial data.

Do You Know How to Get Previous Reconciliation Reports in QuickBooks Desktop?

In QuickBooks Desktop Premier, Accountant, and Enterprise, you can get reports for the last 120 reconciliations. Hence, you are recommended to save your reconciliation reports as PDFs or export them to Excel whenever you reconcile an account.

Here’s how you can get the past reconciliation report:

- First, navigate to the Reports menu, hover over Banking, and then choose Previous Reconciliation.

- Click on the account you want to reconcile from the Account drop-down menu.

- Now, select the reconciliation period to be reviewed under the Statement Ending Date section.

- After this, hit the Detailed or Both for the report type. It is suggested to click Detailed if you’re using the report to fix a reconciliation.

Opt for the transactions you’d like to see on the report:

- Transactions cleared at the time of Reconciliation: This gives you a snapshot that shows transactions in the account at the time of the Reconciliation.

- Transactions cleared plus any changes made to such transactions: It indicates where the transactions are currently available in your account during Reconciliation.

- Once you’re ready to run the report, click Display.

Can I Reconcile Multiple Months in QuickBooks Desktop?

If you have multiple months or even years of unreconciled transactions in QuickBooks Desktop with your financial statements, you can reconcile them without having to do so one month at a time. However, if your un-reconciled transactions and statements span several fiscal years, then you’re recommended to reconcile them one year at a time.

What are the risks of undoing a reconciliation without consulting an accountant?

Undoing a reconciliation without consulting an accountant can lead to unintentional alterations in your financial records, increasing the risk of errors and misstatements. It may cause compliance issues with tax regulations if changes aren’t properly documented or understood. Additionally, improper undoing can disrupt the audit trail, making it difficult to track historical financial data accurately.

How does undoing reconciliation affect the audit trail in QuickBooks Desktop?

Undoing a reconciliation modifies the status of previously reconciled transactions, which updates the audit trail by showing these changes. This can affect transparency since the audit log records who made the change and when, ensuring accountability. However, frequent undoing without proper documentation can clutter the audit trail, making it harder to review financial history accurately.

Can undoing reconciliation lead to compliance issues during tax audits?

Yes, undoing reconciliation without proper controls can result in discrepancies between your books and tax filings, raising red flags during audits. Inaccurate or altered records might lead to penalties or additional scrutiny from tax authorities. Maintaining proper documentation and consulting professionals helps minimize these risks and ensures compliance.

What manual steps are required if I don’t have QuickBooks Accountant access to undo a reconciliation?

Without Accountant access, you must manually unreconcile each transaction by editing its status individually in the register. This process involves identifying reconciled transactions, changing their status from “R” (Reconciled) to blank or “C” (Cleared), and saving changes one by one. It’s time-consuming but necessary to maintain accurate records if full undo is unavailable.

How frequently should businesses perform bank reconciliations to avoid errors?

Businesses should ideally perform bank reconciliations monthly to ensure timely detection of discrepancies and prevent errors from accumulating. Regular reconciliations help maintain accurate cash flow records, support financial decision-making, and reduce the risk of fraud. According to industry standards, monthly reconciliations are best practice for most small to medium-sized businesses.

What are the potential financial reporting inaccuracies caused by deleted reconciled transactions?

Deleting reconciled transactions can create gaps in your financial records, causing imbalanced accounts and inaccurate reporting of assets and liabilities. This leads to incorrect profit and loss statements, which can mislead management decisions. Additionally, it disrupts the continuity of reconciliation history, complicating audits and tax filings.

How can changes in transaction dates impact the reconciliation accuracy?

Altering transaction dates can misalign transactions with corresponding bank statements, causing mismatches during reconciliation. This leads to errors such as duplicate or missing entries, which distort account balances. Accurate dates ensure transactions are recorded in the correct accounting periods, maintaining financial integrity and compliance.

What are the best ways to verify bank statements before starting reconciliation?

Verifying bank statements involves carefully reviewing transaction details, checking for unauthorized or missing entries, and comparing statement balances to internal records. It’s important to confirm statement periods match your accounting periods and to identify any bank fees or interest charges. Proper verification reduces errors during reconciliation and improves data accuracy.

How do synchronization problems with bank feeds affect the reconciliation process?

Synchronization issues can cause mismatches between QuickBooks transactions and bank statements, resulting in unreconciled or duplicated entries. These discrepancies complicate the reconciliation process and may require manual adjustments. Reliable syncing ensures accurate, up-to-date records and reduces reconciliation errors significantly.

What’s the significance of categorizing transactions correctly during reconciliation?

Proper transaction categorization ensures financial reports accurately reflect the nature of expenses and income, aiding in budgeting and tax preparation. Misclassification can distort profit margins, tax liabilities, and decision-making. Accurate categories help maintain compliance with accounting standards and provide clearer insights into business performance.

How can QuickBooks Desktop’s audit log help track changes after undoing reconciliation?

QuickBooks Desktop’s audit log records all changes, including when reconciliations are undone and who made the modifications. This feature enhances transparency and accountability by providing a detailed history of edits, which is vital during audits. It helps identify unauthorized or accidental changes, ensuring data integrity.

What are the common causes of discrepancies between QuickBooks and bank statements?

Discrepancies often arise from uncleared transactions, data entry errors, timing differences, and bank fees not recorded in QuickBooks. Missing or duplicated transactions during import and incorrect categorization also contribute. Identifying these causes early helps maintain accurate records and smooth reconciliation.

How can businesses recover from repeated reconciliation errors over time?

Businesses can recover by implementing regular reconciliation schedules, thoroughly reviewing transactions, and using audit logs to trace mistakes. Training staff on accurate data entry and leveraging professional accountant support reduces persistent errors. Consistent processes improve financial accuracy and restore trust in reports.

Why is it important to save or export reconciliation reports regularly?

Saving or exporting reconciliation reports provides a permanent record for future reference, audit compliance, and error tracking. It ensures that businesses can review past reconciliations to identify discrepancies or trends over time. Regularly maintaining these reports supports transparency and aids in financial decision-making.

What are the recommended steps after undoing reconciliation to maintain financial accuracy?

After undoing reconciliation, it’s crucial to review and verify all unreconciled transactions for accuracy and correct categorization. Businesses should then perform a fresh reconciliation to align with updated bank statements and ensure data consistency. Consulting with an accountant during this process helps prevent future errors and maintain compliance.

Disclaimer: The information outlined above for “How to Undo A Reconciliation in QuickBooks Desktop” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.