What are Neobanks?

Neobanks, also known as “challenger banks,” is a digital-only fintech company that operates without any traditional physical location and relies on technology to streamline the banking process and offer a customer-centric experience.

Neobanks offers banking services like checking accounts and debit cards through apps and online platforms.

Neobanks are widely popular due to its intuitive, user-friendly digital interfaces, affordability and flexibility.

Neobanks usually targets tech-savvy customers, underserved groups, freelancers or eco-conscious people who want digital financial services.

Neobanks uses various technologies such as artificial intelligence, machine learning, low-code development, cloud computing, DeFi, BaaS and more to provide smooth user experience with high security.

Neobank’s services are available to users at a very low fee and more competitive rates than traditional banks and are accessible from anywhere with the help of an internet connection.

Examples of NeoBanks

- Current

- Revolut

- Varo

- Chime

How Do NeoBanks Work?

Neobanks are operated through a digital interface, usually through web-based platforms or mobile apps that provide money management and financial services to users.

Many neobanks develop their platforms, allowing users to easily sign up and access services through mobile apps, web browsers, and sometimes desktop applications. These platforms enable customers to manage their accounts, access support, and utilize the services offered.

Most neobanks partner with established traditional banks or financial institutions to leverage existing financial infrastructure and ensure regulatory compliance. Some neobanks can operate independently under their relevant license according to their service type.

Neobanks use decentralized finance (DeFi) to eliminate intermediaries, lowering costs and speeding up transactions.

Neobanks rely on cloud computing, which allows for rapid scaling and ensures data security while providing uninterrupted service to customers worldwide.

Different neo-banks offer a variety of financial services, including:

- Checking accounts

- Free peer-to-peer money transfers

- High-yield savings accounts

- Alternative ways to build credit

- Early access to paychecks

- Overdraft protection

- Financial education tools

Neobanks generate revenue through transaction fees, subscription charges, interest on loans, and by reinvesting deposits in the inter-bank lending market.

Basic Features of NeoBanks

Neobanks offer several features that are made to provide efficiency, convenience, and a user-friendly banking experience.

| Financial Tools | Security Measures | Customer Support |

|---|---|---|

| Neobanks uses data analytics to give personalized financial advice and product recommendations. They also provide budgeting tools and goal-setting features to help customers manage their finances effectively. | Neobanks implement advanced security technologies, including encryption, secure application programming interfaces (APIs), and two-factor authentication. Some may also use biometric verifications, such as fingerprint or facial recognition, for added security. | Support is available through digital channels such as in-app messaging and email and sometimes via phone. AI-powered chatbots are often utilized to address common queries. |

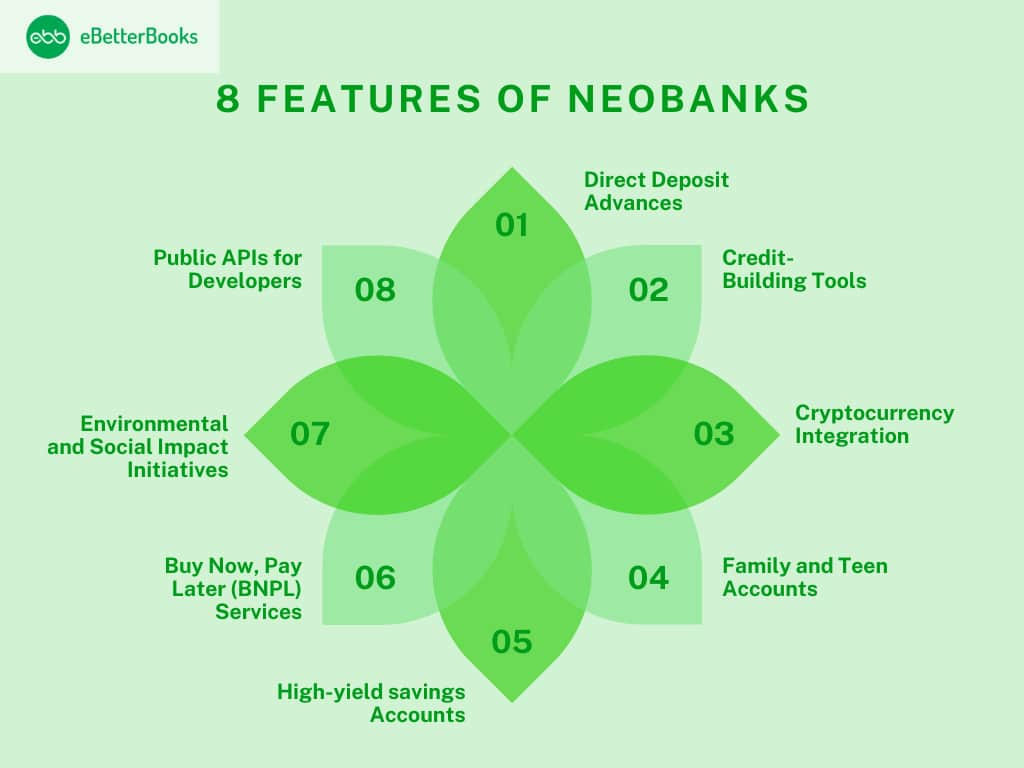

Features include:

- Direct Deposit Advances: Customers of neobanks like Chime and Varo may access their payroll deposits up to two days early, which improves cash flow flexibility and isn’t often offered by digital banks.

- Credit-Building Tools: Neobanks like Chime offer secured credit cards and credit-builder loans so users can build their credit by responsibly using their cards and making timely payments.

- Cryptocurrency Integration: Platforms like Revolut allow customers to purchase, trade, and manage cryptocurrencies straight from their banking app, combining traditional banking with digital asset management.

- Environmental and Social Impact Initiatives: Some neobanks use a portion of their profits in environmental and social impact causes and let their users choose which cause to vote for, thereby integrating banking services with the customer values.

- High-yield savings Accounts: Neobanks like Varo provide significantly higher savings interest rates than traditional banks. For example, Varo provides up to 5.00% APY on accounts up to $5,000, compared to the national average of 0.43%, which allows users to build their savings quickly.

- Buy Now, Pay Later (BNPL) Services: Neobanks like Monzo have a plan called “Monzo Flex”, which offers BNPL options enabling users to use their banking app to make purchases and defer payment over time.

- Family and Teen Accounts: Neobanks like Greenlight, which is specially made for couples and teenagers, provide educational tools and parental controls.

- Public APIs for Developers: Organizations like Bunq make public APIs available, which permits developers to create unique integrations and apps that promote creativity and individualized banking experiences.

Who Uses NeoBanks?

Neobanks are widely used by:

- Freelancers and self -employed

- Price -sensitive customers

- Underbanked populations

- Millennials and Gen Z

- Urban dwellers

- Tech early adopters

- Cross-border workers and immigrants.

Neobank vs Traditional Bank

Neobanks are digital-only banks with no physical branches and typically offer lower fees for their services. In contrast, traditional banks are physical financial institutions that charge a variety of fees such as annual fees, transaction fee, foreign transaction fees, balance transfer fees, etc from their customers.

Neobank vs Digital Bank

Neobanks are fintech companies that operate without physical locations and often partner with established banks, while digital banks represent the digitization of all traditional banking products, processes, and activities.

Neobank vs Online Bank

Neobanks are fintech companies that operate exclusively online, offering innovative banking services through technology, while online banks are traditional financial institutions that have transitioned to digital platforms while retaining some traditional features.

How to Choose Which NeoBank is Best for Business or Freelancers?

Businesses or Freelancers considering a neobank should look for various factors such as:

Look for those neobanks who are transparent with their pricing policies and avoid any hidden fees.

Look for those neobanks that are FDIC-insured or partner with an FDIC-insured bank.

Look for those neobanks that provide tools for expense tracking, simplified tax process, and managing cash flow.

If you’re looking for the best neobanks for your business, check out our article: Best Neobanks for Businesses & Freelancers.

How are Neobanks Linked with FDIC-Insured Institutions?

Neobanks collaborate with FDIC-insured institutions to offer FDIC insurance to the customers. The eligibility of funds in a neobank account for FDIC insurance depends on how the accounts are opened and where the funds are stored.

Neobanks with FDIC insurance can lend money, safeguard deposits, and provide the same financial services as traditional banks. To know about the difference between traditional banks and neobank, you can check out our article: Neobanks vs Traditional Banks: Which One Should You Choose?

Pros and Cons of Neobanks

Neobanks gives a modern approach to banking that fits the digital age, offering both benefits and challenges.

Pros of Neobanks

Lower Fees

Neobanks do not have physical locations, allowing them to pass on savings by reducing or eliminating common fees. They usually charge no monthly fees, lower foreign transaction fees, and no ATM withdrawal fees within certain networks.

User-Friendly Interfaces

Neobanks provides a user-friendly interface and prioritizes user experience, making banking simple and accessible.

Early Access to Direct Deposits

Neobanks provides early access to direct deposits of up to two days earlier, including payroll deposits, government benefits, tax refunds, and pensions.

Fast Account Setup

Opening a new bank account is quick and can be done with minimal documentation, making it faster than traditional banks.

Cons of Neobanks

Limited Customer Service

Unlike traditional banks that have physical branches where they can assist their user and offer in-person support, Neobanks has no physical branches and in-person customer support available for their customers.

Limited Product Range

Neobanks offer basic banking services but usually lack direct financial products like mortgages, loans, and insurance, often relying on third-party providers. As a result, if you need a mortgage or an investment account, you will likely have to visit a traditional bank.

Lack of Personal Interaction

Customers who prefer face-to-face interactions for managing complex banking needs may find neobanks inadequate.

Market Stability and Trust

As newer entrants in banking, some neobanks may lack the brand recognition and trust that traditional banks have built over the years, which can affect customer confidence during financial uncertainty.

No Guarantee of FDIC Protection

Neobanks aren’t chartered, so funds aren’t FDIC-insured unless they partner with a traditional bank.

Neobanks and Regulatory Considerations

Neobanks operate in a highly regulated financial environment, requiring compliance with various banking laws.

The key regulatory considerations for neobanks include anti-money laundering (AML), know-your-customer (KYC), data protection, and consumer protection laws.

Neobanks must also adhere to financial reporting standards and operational risk management guidelines from bodies such as the Financial Conduct Authority (FCA) in the UK and the Office of the Comptroller of the Currency (OCC) in the U.S.

Neobank vs Digital Bank: What’s the Difference & Which One Is Right for You?

Neobanks are non-physical and fully digital, while digital banks are traditional banks using technology to provide banking services.

Digital banks are the technological front for traditional banks; thus, they can have physical branches, too. Neo Banks exists in the virtual domain; thus, they do not have any physical branches.

A neobank may or may not collaborate with traditional banks, but this impacts the kind of banking services it can provide. Only regulated banks can take savings and issue plastic cards (debit cards and credit cards). A neo bank, in collaboration with traditional banks, can extend such services to its customers.

Choosing a neobank over a digital bank depends on the specialised financial service which the user wants. A neobank is not a replacement for a conventional bank, but a technological solution for some of the services for which the user may be needing customized solutions and prompt support.

NeoBanks vs Digital Banks:

| Category | NeoBank | Digital Bank |

|---|---|---|

| Establishment | Digital-only, has no physical branches. Functions fully online. | Collaborates with traditional banks. It may have its physical branch. |

| Bank or Fintech | Neobanks is not a bank, but a fintech company offering banking services, | It is a bank with a technological front. |

| Banking License | Partners with traditional banks to operate under their license. | It holds its banking license and is fully regulated. |

| Services Offered | Services like checking, saving accounts, transfers, plus fintech banking tools like budgeting, investing, etc. | It offers a wide range of banking services, such as checking, savings, loans, credit cards, and investments. |

| Customer Support | Digital support is available via chatbot, email, or in-app assistance only. | Digital banks provide both online and in-person support. |

| Regulatory Compliance | Operates under partner banks’ regulations and may have very few direct obligations. | Fully regulated by the country’s financial authorities to ensure compliance with banking requirements. |

| Users | Tech-savvy individuals, millennials and gen-z, small businesses. | Appeals to a wider range of customers, private citizens, and business customers who value the combination of online and offline banking services. |

Conclusion

Neobanks are transforming the financial landscape by offering a digital-first approach to banking that eliminates the need for traditional physical branches. As digital banking expands, neobanks are set to significantly influence the future of finance. Despite challenges like regulatory compliance and trust, their rapid growth indicates a move toward a more accessible and efficient finance handling.

Frequently Asked Questions

Why aren’t more neobanks FDIC-insured?

Getting a banking charter can take years, so most neobanks partner with traditional banks. The traditional bank handles insurance and regulations, while the neobank provides customer service and online access.

How is a neobank different from a traditional bank?

Neobanks are digital-only banks offering financial services via mobile apps and websites, while traditional banks have physical branches and a broader range of services.

Are neobanks safe?

Neobanks can be safe, especially if they partner with FDIC-insured institutions, ensuring your deposits are protected up to the federal limit. However, it’s crucial to verify if your neobank offers FDIC insurance or has a partnership with a bank that does.

How is a neobank different from a digital bank?

Neobanks are digital-only financial technology companies that don’t have branches. In order to provide simplified, digital-first banking experiences, they collaborate with traditional banks to offer services under their licenses.

However, digital banks can be either new companies that only operate online or old banks that have moved to online services. They could be licensed as banks and provide a wider variety of services, such as credit or loans.

Do digital banks have physical branches?

Digital banks have no physical branches and do all of their business online. From creating an account to transferring funds, all transactions are carried out via mobile applications or websites. They may provide services using this approach without having to pay for the expenses of operating physical sites.

Which is better, neobanks or digital banks?

Your unique banking requirements and preferences will determine whether you choose a digital bank or a neobank.

Take into account the following elements:

- Service Range: A digital bank can be more appropriate if you need a full range of banking services, such as credit facilities and loans.

- User Experience: For a simplified, digital-only experience with cutting-edge features, a neobank could be better.

- Regulatory Assurance: A certain amount of regulatory supervision is provided by the banking licenses that digital banks frequently possess. Neobanks usually function under partner banks’ licenses, which may limit the services they are able to provide lawfully.

Neobank Failures: What Happens When a Digital Bank Shuts Down?

Neobank failures can disrupt consumer access to funds, damage trust in digital banking, and lead to economic consequences. Challenges like regulatory issues, cybersecurity risks, and…

Best Neobanks for Businesses & Freelancers: Features, Fees & Benefits Compared

Neo-banks are becoming increasingly popular among businesses and freelancers, they rely on advanced technology to offer a smooth, convenient, and inexpensive banking experience. In contrast…

Neobanks & Credit: Do Digital Banks Offer Loans & Credit Cards?

Neobanks are digital-only fintechs with no physical branches, offering credit products like microloans, credit cards, bank overdrafts, etc. Neobanks are challenger banks that help underserved…

Neobank Regulations: How Digital Banks Stay Compliant in Different Countries

Neobanks are regulated via Anti-Money Laundering (AML), Know Your Customer (KYC), and indirect regulations to which traditional banks are subjected. Neobanks operate in a highly…