The decision to sell stocks to pay off a high credit card balance can be a difficult one. Credit card debt rapidly increases and can cause remarkable financial stress, and generally leads individuals to sell their investments, including stocks, in order to settle these debts.

Stocks are capital investments that an individual hopes of growing wealth over time. Credit cards, somewhere often come with high interest rates, and carrying a balance can feel like an unending cycle of debt.

In general, it may seem like the best option to trade off your stocks and settle off your credit card balance, but there are numerous variables involved. The choice ultimately rests on the individual’s financial standing, the interest rates on your credit card, the performance of your stocks, and your overall long-term financial objectives.

The Nature of Credit Card Debt

Before addressing the advantages and disadvantages of paying off credit card debt with your stock investments, let’s look at what makes credit card debt such a bad idea.

The Effect of High-Interest Rates

Credit cards also have a reputation for high interest rates, which may be anything from 15% to 25% a year or even more, based on the card and your credit rating. That is to say that even when you only have a tiny balance, you may be paying plenty in interest charges over the years.

For instance, if you have a $5,000 balance on a credit card with a 20% interest rate, you will pay an extra $1,000 in interest if you don’t settle off the balance in a year. The interest compounds and it becomes more difficult to settle off the principal balance.

The Minimum Payment Trap

Another factor contributing to credit card debt is the minimum payment requirement. The minimum payment on most credit cards is usually a small percentage of the total balance, often around 2% to 3%. While this sounds manageable, making only minimum payments means you’re paying mostly interest, and it can take years to settle off the balance.

The Power of Compound Growth

Among the major advantages of investing in the stock market is the possibility of compound growth. Stocks tend to have a long-term rate of return greater than traditional savings accounts or other conservative investments. Historically, the stock market has averaged between 7-10% per year over the long term, although rates of return can vary widely over the short term.

The Emotional Toll

Excessive credit card debt can also have an emotional cost. The stress of paying off a large amount, contending with interest, and juggling several bills makes it more difficult to make financial choices. Being prepared with a plan for paying off your credit cards is the first step in taking control back.

Risks of Stocks

However, there are risks involved in investing in stocks. Stock prices rise, but they also fall. Your stock portfolio value may be impacted by market conditions, the performance of the companies, economic trends, and other factors. If you sell stocks when the market is in a downturn, you may end up with a loss, and the long-term advantages of keeping stocks may be lost.

Understanding Stocks and Investments

Now, consider your stock, which is a type of investment. When an individual buys stocks, then he/she buying ownership of a company. The value of the stock is expected to go up over time so that it can sell it for more money.

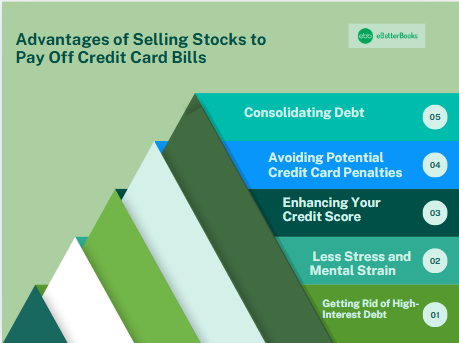

Advantages of Selling Stocks to Settle Off Credit Card Bills

Having discussed in detail credit card debt and stocks, let’s now explore the possible advantages of selling your investments in stock to settle an exorbitant credit card balance.

1. Getting Rid of High-Interest Debt

One of the most direct advantages of paying off credit card debt is cutting off the exorbitant interest payments that go with it. When you settle off your credit card, you liberate your finances from the heavy interest weight that can ensnare you in debt for decades. By selling stocks, you’re actually halting the cycle of accumulating interest.

2. Less Stress and Mental Strain

Debt on credit cards can lead to heavy emotional and mental pressure. The anxiety of how you are going to clear the balance, dealing with the minimum payment, and fear of penalty can affect your well-being negatively. Clearing this debt by selling stocks can be a relieving experience, providing you with better peace of mind.

3. Enhancing Your Credit Score

Credit utilization the ratio of how much credit you’re using compared to your total available credit is a significant factor in your credit score. If your credit utilization is high because of a large credit card balance, it may be negatively affecting your credit score. Paying off your balance could improve your credit utilization ratio, potentially boosting your score.

4. Avoiding Potential Credit Card Penalties

If you are late on payments or make partial payments on your credit cards, you may be charged late fees, suffer higher interest, and even hurt your credit rating. Selling stocks to settle your credit card will save you from these possible charges and fees.

5. Consolidating Debt

Selling stocks can enable you to settle several credit cards or loans. This helps to streamline debt into a single, manageable figure that is less complicated to handle when dealing with multiple creditors.

Disadvantages of Selling Stocks to Settle Credit Card Debt

Although cashing in stocks may present a simple solution to clearing credit card debt, there are quite a number of disadvantages to take into consideration.

1. Risk of Losses on Investments

The biggest disadvantage of cashing in shares is that you can sell your investments for a loss. If the stock market is falling or if your shares have lost value, selling them might freeze a loss. This might be giving up potential future gains that might have surpassed the interest on your credit card debt.

2. Missing Long-Term Growth Opportunities

One of the main reasons individuals invest in the share market is for long-term growth. In the long run, the value of your share portfolio could grow significantly faster than you’re paying in interest on your credit card, representing a lost opportunity to build wealth. By selling shares capital to cover credit card debt, you may be sacrificing the long-term advantages of retaining those investments.

3. Tax Implications

If your stocks have increased in value, cashing them in may result in capital gains taxes. Depending on how long you’ve owned the stocks, these taxes may decrease the funds available to you to use to eliminate your credit card debt. Short-term capital gains are taxed more than long-term capital gains, which may influence your decision even further.

4. Not Tackling the Underlying Issue

Cashing out investments to settle off credit card balances is not the real solution, since it does nothing to help you avoid running into debt in the future. As long as you continue your existing spending patterns, you’ll only end up accumulating more credit card debt later.

5. Reduced Financial Flexibility

As soon as you sell stocks, money is no longer earned for you in the marketplace. You’ll miss out on potential future growth, and according to your investing plan, you might discover you have less economic flexibility in the future if you need to save or invest for retirement.

Other Options to Opt for Before Selling Stocks

Before selling your stocks, use these options to manage credit card debt:

1. Debt Consolidation Loans

A debt consolidation loan is getting a personal loan with a lower interest rate to use to settle off your high-interest credit card balances. This can make it easier to make your payments and save you money on interest.

2. Balance Transfer Credit Cards

Others offer 0% introductory APR on balance transfers for a few months. If you are approved, moving your high-interest credit card balance to one of these cards can help you repay your debt without piling up interest for a designated time.

3. Debt Settlement or Negotiation

If you’re having trouble paying, you could try negotiating directly with your credit card company to settle the debt for less than you owe. This can be bad for your credit score, but it will lower your overall debt.

4. Credit Counseling Services

A credit counseling service can assist you in making a payment plan for your debt, negotiating with creditors, and possibly lowering your interest rates. This is a viable option if you prefer not to sell investments.

Conclusion

Selling stocks to cover a hefty credit card bill can be a tempting fix for getting out from under debt right away, but it’s not always the best idea. Paying off the credit card might ease your financial burden and stave off continuing interest charges, but selling stock may involve skipping out on future growth potential, losses, and tax liabilities.

Prior to making the decision, alternatives such as credit counseling services, balance transfers, or debt consolidation should be explored and your financial goals as a whole should be assessed. Cash-in stocks either way are essentially based on what you can endure in your case, which incorporates risk tolerance, investment perspective, and future capabilities of managing the debt.

FAQs

- Is it a good idea to sell stocks to pay off credit card debt?

Selling stocks to pay off credit card debt can be a good idea if the credit card interest is higher than potential stock returns. - Is it better to pay off credit card debt or invest in stocks?

It’s typically better to pay off high-interest credit card debt before investing in stocks. - Should you pay off 100% of your credit card?

Yes, paying off 100% of your credit card debt is a smart move for financial health. - Is it bad to pay off large credit card debt?

Paying off large credit card debt is not bad it improves your credit score and financial stability.