Fraudulent charges on your credit card result in financial loss, affect your credit score and create problems when applying for loans.

For business owners, credit card fraud damages their revenue and reputation, leading them to raise interest rates and fees for consumers.

Though, many banks offer a zero-liability policy to their customers in order to protect them from being liable for fraudulent purchases, if they report the fraud within 60 days.

Credit card companies make use of credit card fraud-detection systems, encryption, fraud monitoring, multi-factor authentication, and adherence to industry standards such as PCI DSS, to protect customer data and transactions from frauds such as skimming, application fraud, phishing, lost credit cards, card takeovers, etc.

Additionally, credit card companies utilize EMV chip technology, which involves using encrypted microchips on cards to generate unique transaction codes. This makes it more difficult for criminals to steal or clone card information.

Credit Cards Online Fraud & Protection

Online credit card fraud is common due to advancements in technology and the shift towards contactless payments.

The most common online fraud cases happen:

Fraudsters frequently use fake emails and texts to manipulate you into disclosing your personal information, so stay vigilant and protect yourself from these scams.

Fraudsters can steal your card information by using devices attached to ATMs or point-of-sale (POS) terminals.

Fraudsters use stolen credit card numbers to make online purchases without needing the physical card.

Online fraud can occur if you install malicious software on your computer, risking your credit card data.

Hackers steal credit card information from businesses that do not store it securely.

How to Protect your Credit Card from Online Fraud?

Online shopping is convenient but comes with security risks. Protect yourself by using virtual cards, secure websites, strong passwords, and digital wallets. Stay alert for scams and monitor transactions regularly.

- Virtual Card: For online purchases, use virtual card numbers instead of your real card number to help protect your information.

- Shop on Secure Websites: Make sure that the website you are shopping on is secure by looking for “https” in the address bar and a padlock icon.

- Don’t Click on Suspicious Links: Avoid clicking on links in emails or messages from unknown or untrusted sources.

- Verify the Legitimacy of Requests: If you receive a request for personal information, confirm its legitimacy by contacting the company directly through their official website or phone number.

- Use a VPN: Always use a Virtual Private Network (VPN) because it encrypts your data and protects your online activity.

- Avoid Public Wi-Fi: Avoid online purchases or accessing sensitive information on public Wi-Fi, as it is often unsecured and vulnerable to hackers.

- Regularly Review Statements and Transaction History: Most credit card issuers will not hold you responsible for fraudulent charges. However, it’s important to monitor your spending history to identify any unauthorized charges quickly.

- Use Digital Wallets: Consider using digital wallets like Apple Pay or Google Pay for online purchases, which can help protect your credit card information.

- Strong Passwords: Use long, unique passwords for each online account and avoid easily guessable information like your name or birthdate. A password manager can help you create and store strong passwords securely.

- Be Cautious of Phishing Scams: Be careful of emails or messages that request your personal information, especially if they seem suspicious.

- Limit Risk with a Separate Account: Avoid using your primary credit card for all online purchases. Consider using a virtual card or a different credit card specifically for online transactions.

Enhancing Your Credit Card Security

In addition to the security features (such as EMV chip technology, CVC/CVV codes, signature verification,etc.) provided by the bank, customers should also activate additional features to enhance the security of their credit cards.

Here are some credit card security tips for 2025:

- Two-Factor Authentication (2FA): To enhance your credit card security, it is important to enable two-factor authentication (2FA) on your accounts. This feature adds an extra layer of protection by requiring a code sent to your phone or email, in addition to your password, when you log in.

- Set Up Fraud Alerts: Many banks and credit card companies provide fraud alert services. These alerts can inform you of any unusual or suspicious activity on your account, allowing you to respond quickly to potential threats.

- Account Freeze Option: Some cards allow users to freeze their accounts for added security when they suspect fraud or are traveling.

- Use Identity theft Protection Service: To protect your credit cards and personal information from identity theft, consider using a reliable identity theft protection service that provides features such as credit monitoring, fraud alerts, and possibly, identity theft insurance and resolution services.

- Report Suspicious Activities Immediately: If you observe any suspicious activity on your account, contact your bank or credit card company immediately. Taking prompt action can help prevent additional unauthorized transactions and reduce potential damage.

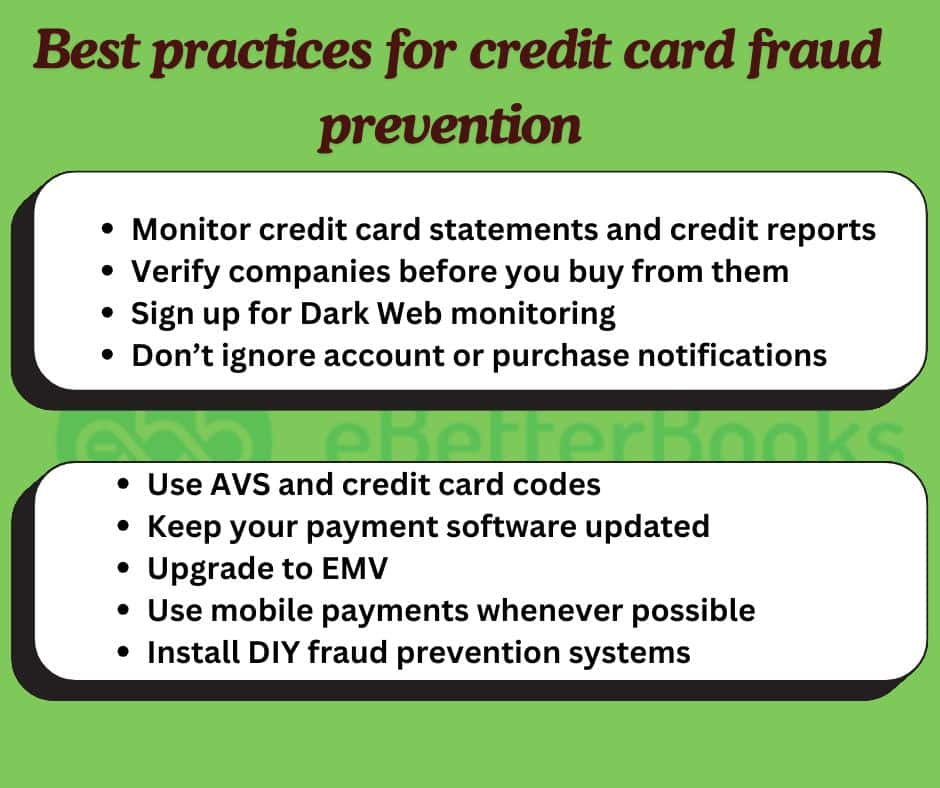

Best Practices for Credit Card Fraud Prevention

To protect yourself and your business from credit card fraud, it is important to follow best practices for prevention.

Tips to protect yourself from credit card fraud

Protecting your financial information is crucial in today’s digital world. Follow these key steps to monitor your credit, verify online purchases, and enhance security against fraud and cyber threats.

- Monitor Credit Card Statements and Credit Reports: Be sure to check for any unauthorized or suspicious charges, even minor ones, since fraudsters often begin with small transactions to test your credit card. Additionally, review your credit reports from all three major credit bureaus – Experian, Equifax, and TransUnion, at least once a year for any unusual activity, such as new accounts or inquiries that you did not authorize.

- Verify Companies Before you Buy from them: When shopping online, buy from reputable stores and known brands. For new or unknown brands, verify a working phone number, email, and physical address, and check company ratings for safety.

- Sign Up for Dark Web Monitoring: Dark Web monitoring involves using browsers like Tor to hide your IP address, making it an effective fraud detection method. By choosing specific information to monitor, a Dark Web service can scan forums and databases of stolen data to alert you to any breaches.

- Don’t Ignore Account or Purchase Notifications: Monitor email or password change requests on your online accounts, as it could be a warning sign of an account takeover. You can enable multi-factor authentication (MFA) for added security, as it requires more than just a username and password to access your accounts, making them less vulnerable to cyberattacks.

- Use Mobile Payments Whenever Possible: Wireless and mobile payments are safer than credit cards. Mobile payment apps create unique, one-time numbers for each transaction. This renders stolen information useless for future transactions and reduces the risk of credit card skimming.

Here are some steps you can take as a business owner to minimize your risk and potential losses:

Tips to protect your business from credit card fraud

Protect your business from payment fraud by implementing key security measures. Verify transactions with AVS and CVV, update payment software, upgrade to EMV, and use DIY fraud prevention strategies.

- Use AVS and Credit Card Codes: AVS, and CVV, are two important security measures that your online payment gateway should verify. AVS checks the house number and zip code against the records held by the issuing bank, while CVV ensures that the customer has the physical card in their possession.

- Keep your Payment Software Updated: Businesses should ensure that their payment app is updated to avoid any vulnerabilities and fraud.

- Upgrade to EMV: Upgrading to EMV technology is a smart choice as it helps prevent fraud and protects you in chargeback cases. While upgrades used to be difficult, there are now custom POS integrations that allow for smooth transitions without changing systems.

- Install DIY Fraud Prevention Systems: Instead of automatically declining transactions over a certain amount, redirect customers to a service page or temporarily decline them. Notify an employee via email to manually verify credentials before approval.

What to do if you are a victim of credit card fraud?

If you are a victim of credit card fraud or your identity has been compromised, follow the below mentioned steps to report a credit card fraud:

Step 1: Inform the Credit Card Company

If you suspect any credit card fraud, inform the credit card company about fraudulent activity and ask them to freeze your account as soon as possible. Submit a detailed letter along with a list of fraudulent transactions.

Step 2: File an FTC Report

Go to IdentityTheft.gov, as this website helps people report and recover from identity theft. Once you report the issue, submit a copy to your credit card company.

Step 3: Setup Credit Fraud Alert

To set a fraud alert, contact one of the major credit bureaus (Equifax, Experian, or TransUnion); they’ll share it with the others. For a credit freeze, you’ll need to make separate requests to each bureau.

Advanced Measures For Credit Card Fraud Detection

Companies are now using machine learning, predictive analytics, adaptive authentication, artificial intelligence and behavioral biometrics to identify unusual patterns and anticipate fraudulent activities.

Behavioral biometrics analyzes user behaviors, like mouse movements and keystroke dynamics, to detect anomalies linked to fraud.

Deep learning enhances the prediction and prevention of complex fraud schemes by recognizing patterns in large data sets.

Blockchain technology provides a secure digital ledger for transactions, ensuring transparency and making it difficult for fraudsters to alter data.

AI-powered chatbots and virtual assistants are also used for real-time detection of potential fraud. Together, these methods represent the future of effective fraud prevention.

Conclusion

To protect yourself from fraud, enable instant alerts from your financial institution and regularly check your transactions for suspicious activity. Choose a bank that provides strong fraud protection, including EMV chip technology and 24/7 monitoring.

FAQs!

What are the common types of credit card fraud?

The common types of credit card fraud include card-not-present (CNP) fraud, skimming, account takeover, and application fraud, etc.

What security features should I look for in a credit card?

The security features to look for in a credit card includes:

- Biometric authentication

- EMV chip technology

- OTP verification

- Real-time alerts

- AVS and CVV checks

- Account freeze option

- Virtual card number for online transactions

How do EMV chips and contactless payments improve security?

EMV chips and contactless payments improve security by using encryption, unique transaction codes, and making data replication difficult, which reduces fraud vulnerability.