Credit Bureaus

Credit bureaus or Credit Reporting Agencies, like Equifax, Experian or TransUnion gather individuals’ credit information to generate credit scores and are regulated under the federal Fair Credit Reporting Act (FCRA).

Credit bureaus collect financial information of individuals which is reported by various financial institutions like banks, fintech companies, BNPL apps, credit card companies, etc. regarding payments, defaults, amount due, loan amounts, etc.

The credit score defines the individual’s creditworthiness from “poor” to “excellent.” Credit scores are key indicators that determine your eligibility for credit and the terms you’ll receive.

In United States, there are three major credit bureaus:

- Equifax

- Experian

- TransUnion

FICO and VantageScore are two popular credit scoring models that assess an individual’s creditworthiness using data from credit bureaus.

FICO scores, developed by the Fair Isaac Corporation, serve as the industry standard and are calculated separately by each bureau.

VantageScore, created by the three major bureaus, is used to evaluate your creditworthiness.

Three Major Credit Bureaus in USA

| EQUIFAX | EXPERIAN | TRANSUNION |

|---|---|---|

| Equifax Inc. is an American multinational consumer credit reporting agency based in Atlanta, Georgia. Equifax collects data on over 800 million consumers and 88 million businesses globally, offering credit monitoring and fraud prevention services to consumers. | Experian is a multinational data broker and consumer credit reporting company based in Dublin, Ireland. It offers consumer services, including access to credit history and identity theft protection. Experian Boost is a feature that allows users to add positive payment history—such as utility, phone, rent, and streaming service payments—to their Experian credit report, potentially increasing their FICO score. | TransUnion is a credit reporting agency that gathers consumer credit information, such as payment history and credit utilization, to create credit reports and scores used by lenders to evaluate creditworthiness. In 2006, TransUnion, Experian, and Equifax created the VantageScore model to standardize credit scoring across all three major bureaus. |

How do Credit Bureaus work?

Each of the three credit bureaus uses its own algorithms to analyze your data and compile a credit score. However, they generally evaluate the same key factors to assess your creditworthiness.

| Personal Information | Account Behavior | Public Information |

|---|---|---|

| This section includes your legal name (or any previous names), current and past addresses, Social Security number, date of birth, and current employer. | Credit bureaus review your payment history, current outstanding balances on credit cards and loans, and whether those accounts are in good standing. They also consider your approved credit limits. | The bureaus take into account certain financial events that are publicly available, such as bankruptcies and liens. |

Which Information Is Not Included in Credit Report:

- Criminal records or your current income

- bank account balances,

- transactions,

- medical history

- educational background.

When you apply for credit, lenders may request your credit report from one or more of the credit bureaus. This request can come from credit card companies, utility providers, insurance agencies, or government bodies that assess candidates for financial assistance.

Credit Reports

A credit report is a detailed statement of information about your credit activity and current credit situation such as loan,mortgage and other bills.

The Consumer Financial Protection Bureau (CFPB) states that each credit bureau provides slightly different credit reports, typically organized into four or five sections.

The information included in this report are:

| Personal Information | Collection Items | Credit Accounts | Public Records | Inquiries |

|---|---|---|---|---|

| Legal Name (or any variations of your name that you use) | Loans sent to collections | Account Balance | Tax liens | All the organizations that have recently requested to view your credit report. |

| Address – Both Current and Former | Information about overdue child support provided by state or local child support agencies, or verified by any local, state, or federal government agency. | Name of the creditor | Legal Judgement and Civil suites | – |

| Date of Birth | Missed Payments | Account payment history | Bankruptcies | – |

| Phone numbers | – | The credit limit or amount | Foreclosures | – |

| Social Security Number (SSN) | – | Current or historical credit accounts | – | – |

| – | – | The date the account was opened and closed | – | – |

Why Is Your Credit Report Important?

A credit report is important because it tracks your credit history, allowing lenders and businesses to evaluate your creditworthiness when considering loans, credit cards, or rental applications.

Here are key points about its importance:

- Loan Approvals: A strong credit report and high credit score improve your chances of being approved for credit products.

- Building Credit History: Responsible credit management, such as timely payments, can enhance your credit history and score.

- Creditworthiness Assessment: Lenders use your report to assess your ability to repay debt, looking at your payment history, outstanding debts, and credit utilization.

- Monitoring Accuracy: Regularly reviewing your report helps identify errors or suspicious activity that could harm your credit score.

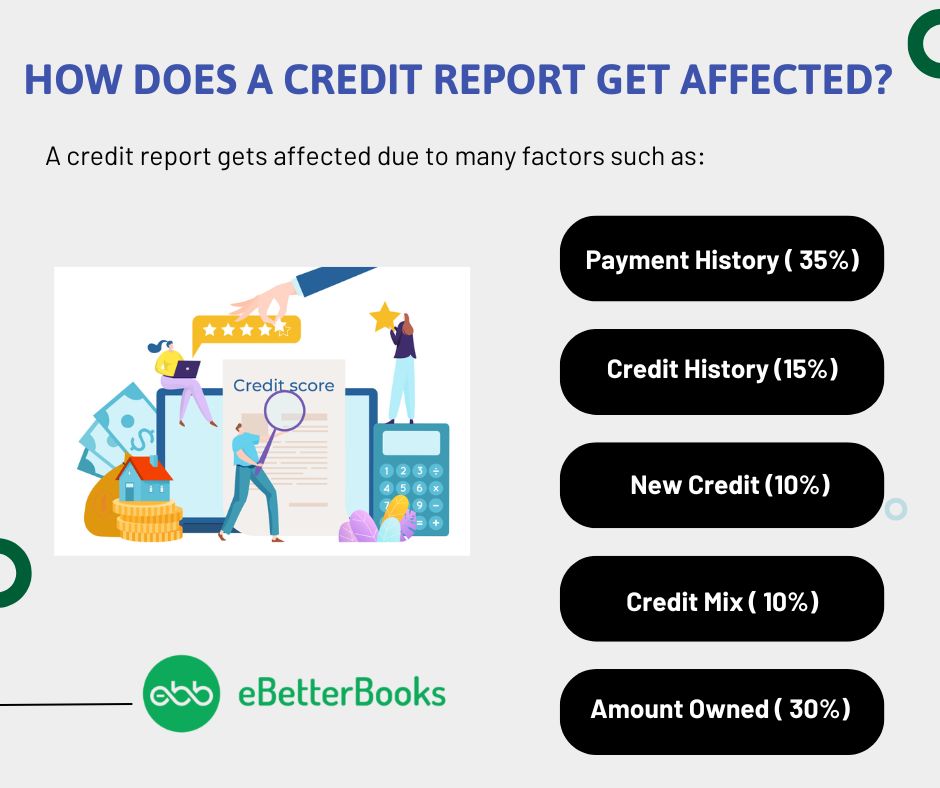

How does a Credit Report get affected?

A credit report gets affected due to many factors such as:

- Payment History ( 35%): This is the most important factor, reflecting how consistently you have paid your debts. Late or missed payments on credit cards, student loans, or utility bills can significantly harm your credit score.

- Credit History ( 15%): A positive credit history demonstrates responsible borrowing behavior and can enhance your credit score.

- New Credit ( 10%): Opening too many new accounts at the same time can hurt your credit score, as each application results in a “hard inquiry” on your credit report.

- Credit Mix ( 10%): Having a variety of credit types, such as credit cards, loans, and installment credit, can positively influence your credit score.

- Amount Owned ( 30%): This includes your credit utilization ratio, which indicates how much of your available credit you are using. High outstanding balances or nearing the maximum limit on your credit cards can negatively affect your score.

Who Uses Credit Reports?

There are various organizations that utilize credit reports to assess the financial risks associated with individuals.

These include:

- Landlords – Landlords may examine credit reports and scores when assessing rental applications. Individuals with poor credit histories might have difficulty qualifying for a rental or might be required to pay a higher security deposit.

- Employers – In some states, employers can conduct credit checks during the hiring or promotion process. This practice is common in the financial sector for financial management roles or positions requiring security clearance.Employers do not receive a credit score with the credit report, and the report provided to them differs from the one given to lenders

- Creditors – Creditors, such as lenders and credit card issuers, rely on credit reports and data from credit bureaus in several ways:

- Targeted Offers – Creditors can partner with credit bureaus to generate lists of consumers who meet specific criteria, allowing them to send preapproved credit offers, like the credit card ads you receive by mail.

- Customer Monitoring – Creditors regularly purchase credit reports and scores to oversee existing accounts. Based on changes in a customer’s credit report, they may choose to close an account, upgrade a card, or adjust the credit limit.

- Application Decisions – When an individual applies for credit, creditors typically consult the credit report and credit score to determine whether to approve the application and establish the terms of credit.

- Other Organizations – Many other entities use credit bureau data for identity verification purposes. This includes financial institutions, casinos, and online marketplaces. While they do not receive a full credit report, these companies can verify that the identifying information provided by a user matches data in the credit bureau’s records. If there’s a mismatch in the name, address or date of birth, that indicates potential identity fraud.

What are Credit Scores?

Credit Scores is the three-digit number, typically ranging from 300 to 850.

Your credit score is a numerical representation of your credit history, reflecting how well you have managed your past and present debts.

Credit scores are derived from information in your credit reports, which includes:

- Length of credit history

- Number of recent applications for new credit

- Amount of debt outstanding

- Payment history, including the number of late and on-time payments

- Credit mix, such as loans and credit cards

Lenders and creditors use the overall score and the details in the credit report to determine whether an individual qualifies for additional credit, the amount offered, and the interest rates for loans or credit cards.

How to Monitor your Credit Score?

Regularly Check Your Credit Reports

You can get free credit reports from AnnualCreditReport.com, which the government authorizes. You can also get the report for free from credit card issuers and banks. Make sure to review your report carefully for any errors or disputes. Disputing errors can significantly improve your score so don’t ignore mistakes!

Review Your Credit Card Statements

Make sure to review your credit card statements for unauthorized transactions or any unexpected changes that may impact your score.

Utilize Credit Monitoring Services

There are many free credit score tools available in the market, so you need to sign up for services such as Experian, Equifax, or TransUnion or use apps like Credit Karma and myFICO to keep track of changes in your credit score.

Set Up Alerts

You can activate notifications from your bank or credit monitoring service to receive updates on score changes, new accounts, or any suspicious activity.

How to Dispute Credit Report Errors?

To dispute an error on your credit report, it is essential to first review the reports from all three major credit bureaus: Equifax, Experian, and TransUnion.

Next, contact the bureau that has the incorrect information and provide detailed information about the error, along with any supporting documents. Be sure to follow the specific dispute process outlined by the bureau, whether it’s online, by phone, or by mail.

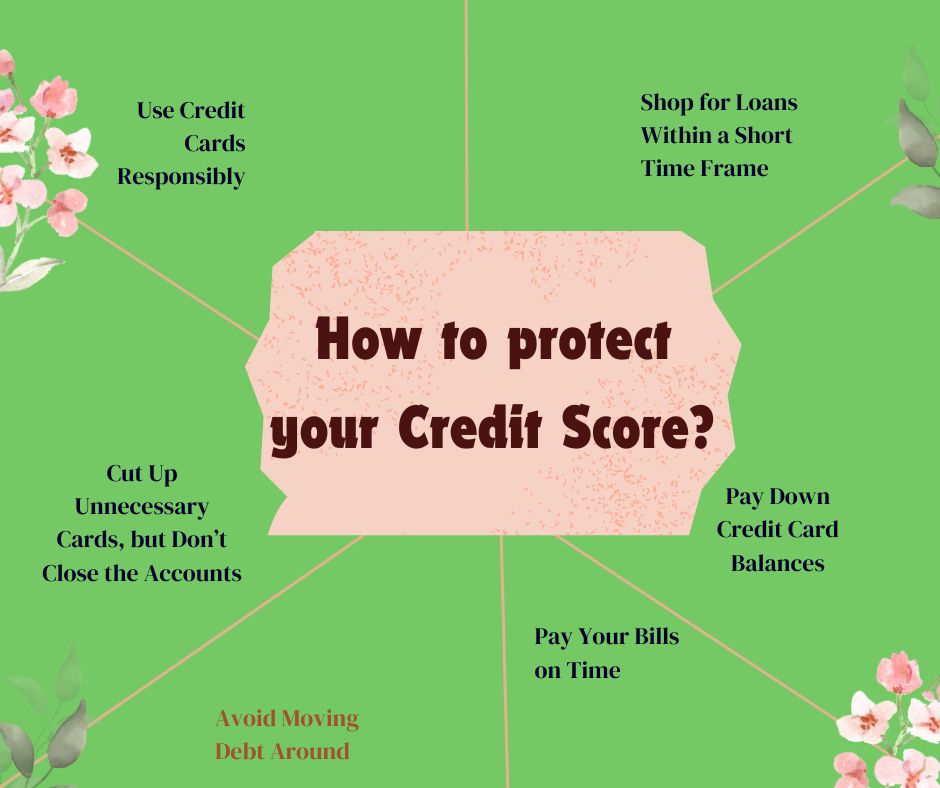

How To Protect Your Credit Score?

Maintaining a healthy credit score requires smart financial habits. From timely bill payments to responsible credit card use, these key strategies can help you build and sustain strong credit.

Pay Your Bills on Time

Set a system that ensures you pay your bills promptly. Consistently making on-time payments will positively impact your credit score.

Avoid Moving Debt Around

Focus on paying down your debt rather than shifting it from one account to another to avoid payments.

Pay Down Credit Card Balances

One should aim to reduce their credit card balances to below 35% of the available credit limit, with 10% being ideal. Keep your credit card balances low relative to your total available credit, as high balances can negatively affect your credit score.

Shop for Loans Within a Short Time Frame

When looking to obtain a loan, make sure to do your research within a short period. If you extend your search over a long time, lenders may assume you are applying for multiple credit lines instead of just one loan.

Use Credit Cards Responsibly

Lenders want to see a history that demonstrates your ability to manage debt wisely.

Cut Up Unnecessary Cards, But Don’t Close the Accounts

Since your credit utilization rate accounts for 30% of your FICO score, avoid reducing your available credit by closing old accounts. Instead, consider cutting up unnecessary cards or simply not carrying them.

Conclusion

Credit reports are vital for your financial well-being; errors or fraud can negatively impact your score. Major credit bureaus (Experian, Equifax, TransUnion) monitor your credit history. Keeping an eye on your credit helps identify fraud, enhance your score, and secure better financial options.

FAQs!

How Lenders Use Credit Reports?

When applying for a loan, line of credit, or credit card, lenders usually check your credit by obtaining a report from one or more of the three major credit bureaus. Most lenders rely on one report, but mortgage companies often review all three due to the larger amounts involved. Each inquiry is noted on your report and can temporarily lower your credit score, as it shows your intention to access more credit.

Why Do I Have Different Credit Scores for Each Bureau?

Your credit score can vary for a few key reasons:

- You’re comparing different types of credit scores.

- You’re comparing scores from different time periods.

- Your credit reports aren’t identical.

How is your credit report used?

Lenders review your credit reports to evaluate whether to extend credit and to determine the terms of that credit. Additionally, your credit report may be checked when you are securing insurance or applying for utilities and mobile phone contracts.

Do Credit Bureaus Score Your Credit?

Credit bureaus, such as Experian, Equifax, and TransUnion, collect and provide data, but they do not generate your actual credit score. Instead, scoring models like FICO and VantageScore utilize this data to calculate your score. Each bureau may have different information on file, which can lead to slight variations in your credit score.