Businesses control their taxable income through multiple deductions allowed in the U.S. tax code. Under IRC Section 162, businesses can claim deductions for necessary and ordinary trade or business expenses.

Tax deductions authorized under IRC Section 162 reduce taxable income, leading to a diminished tax obligation that allows companies to reinvest their capital in their operations. The IRS carefully monitors deduction claims because understanding ordinary and necessary expenses is a crucial element of compliance.

Entrepreneurs’ improper allocation of personal expenditures combined with capital expenses frequently leads to Internal Revenue Service examinations and significant financial penalties. The tax compliance process requires all taxpayers to identify business expenses properly.

Understanding IRC Section 162

IRC Section 162 is a rule in the Internal Revenue Code (IRC) that determines whether business expenses qualify for deduction. Under this section, businesses are authorized to deduct every ordinary and necessary expense they incur or pay during the taxable year for trade or business operations.

The key points of IRC Section 162 include:

- For expense deductions to be allowed, businesses must prove clear business relevance.

- For tax purposes, the expense needs to be ordinary and necessary according to IRS rules.

- The deduction benefit exists for commercial businesses rather than personal use.

How Does Section 162 Help Businesses?

This provision is critical because it allows businesses to:

- Real business expenses qualify for tax deductions from taxable income amounts.

- The deduction of operational costs should be available to businesses when they invest in their operations.

- Financial clarity becomes possible when the business clearly identifies expenses between the business realm and personal needs.

Section 162 enables businesses to deduct expenses up to $100,000, divided between employee wages, rent, and office supplies. The business can use this deduction to reduce its taxable revenue, which will reduce its tax liability.

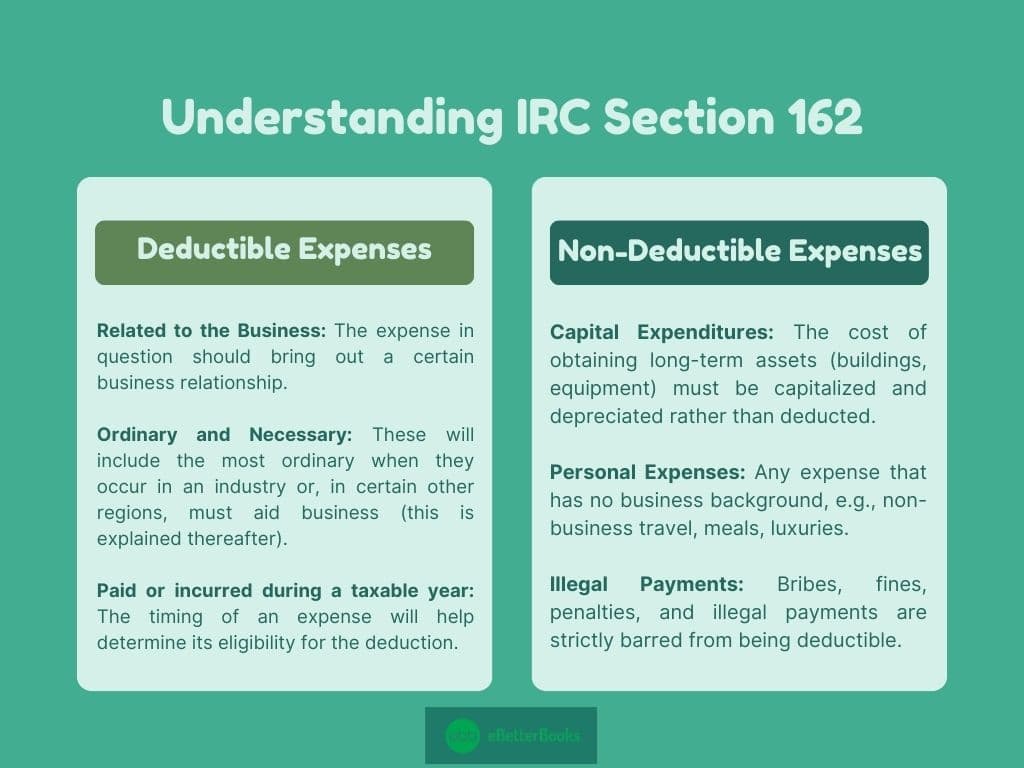

Deductible Expenses

Below are the deductible expenses in the IRC Section 162:

- Related to the Business: The expense in question should bring out a certain business relationship.

- Ordinary and Necessary: These will include the most ordinary when they occur in an industry or, in certain other regions, must aid business (this is explained thereafter).

- Paid or Incurred During a Taxable Year: The timing of an expense will help determine its eligibility for the deduction.

Most companies attempt to write down personal expenses as business-oriented ones, which can lead to audits and penalties from the IRS. Proper expense recording and classification can avoid this.

Non-Deductible Expenses

While Section 162 is a very encompassing chapter governing expenses, some are non-deductible.

They shall include:

- Capital Expenditures: The cost of obtaining long-term assets (buildings, equipment) must be capitalized and depreciated rather than deducted.

- Personal Expenses: Any expense that has no business background, e.g., non-business travel, meals, luxuries.

- Illegal Payments: Bribes, fines, penalties, and illegal payments are strictly barred from being deductible.

The failure to separate legitimate business costs from improper expenses results in audit investigations from the IRS that can lead to fines and applicable taxation penalties. Business operations demand tracking every financial transaction alongside expert tax advice and evidence to show proof of regulatory compliance.

The Cohan Rule: When the Records are Missing

Some expenses will be deemed absent in a business environment. There is the Cohan Rule of Cohan v. Commissioner of 1930 that applies here, which allows for a business to deduct items without full documentation as long as reasonable estimates cannot suffice.

How does the Cohan Rule work?

If the IRS or courts can reasonably estimate the amount, then in such instances where the business incurred the expense but no receipts are available, the cost may be deducted when:

- The expense was incurred in the course of business.

- The taxpayer can supply reasonable proof (through testimony and bank statements).

- The IRS or courts can estimate the amount.

Other Expenses The Cohan Rule Does Not Cover

- Such as travel and entertainment, which would be subject to strict documentation under IRS rules.

- The IRS is left to exercise discretion regarding whether to accept or reject estimated deductions based on the evidence produced.

A practical example of the Cohan Rule:

A self-employed consultant forgets to keep receipts for client meetings in restaurants.

If you were to be audited, you can still get a deduction by:

- Provide credit card statements with charges for the places you’ve met clients.

- Presenting emails or calendar records of the meetings.

- Sworn testimonies attesting to such business purposes.

Fundamentally, while the Cohan Rule is of assistance to businesses, the best way to prevent being caught in an argument with the IRS is by keeping proper records.

The Laugh Test: Ensuring Reasonable Expenses

The “Laugh Test” is an informal IRS analytical guideline for determining whether a certain business expense is reasonable. If the expense seems extravagant, ridiculous, or outrageous, it may not pass the test, and the IRS will likely disallow the deduction.

How the Laugh Test Works

The IRS considers the following:

- Is the expense justifiable for business purposes?

- Would the expense be considered both excessive or personal by a reasonable person’s standard?

- Does the expense meet industry standards?

Examples of Expenses That Don’t Pass the Laugh Test:

- A small business writes off a business jet purchase as a deduction.

- A freelancer includes the entirety of the home in the claim as a home office.

- A consultant deducting a luxury vacation simply as client entertainment.

How to Avoid Failing the Laugh Test

- Keep documentation explaining why an expense is business-related.

- Ensure expenses align with industry standards to avoid suspicion.

- Consult a tax professional if an expense seems questionable.

To be deductible according to the IRC Section 162, any expenditure must be normal and appropriate for a business. The normal and necessary expenses are those cognizant of IRS regulations so that your taxable income is kept to a minimum.

What are Ordinary and Necessary Expenses?

To qualify for deductions under IRC Section 162, an expense must meet two criteria:

Ordinary Expenses

Regular business expenses exist when industry stakeholders and participants consider them common business costs. For businesses functioning within particular industries, such industries must deem the expenses as typical operational costs.

Examples of Ordinary Expenses:

- A law firm purchasing legal research materials.

- A retail store has inventory and packaging expenses as it deals with consumer goods.

- A restaurant purchasing food items together with culinary kitchen supplies.

- A marketing firm uses digital advertising tools for its operations.

Necessary Expenses

Any business expense counts as necessary when it benefits operations and matches the business’s requirements. Even when not required, this expense delivers positive operational value to the business.

Examples of Necessary Expenses:

- Employee salaries are a part of almost every company’s maintenance operations.

- Office rent is essential for businesses operating from physical locations.

- Advertising and marketing expenses to capture client interest and product income.

- Business insurance protects against financial losses.

How Does O & NE Work?

Businesses must understand ordinary and necessary expense deductions to ease their tax burden. They perform intense calculations to ensure they make all deductions allowed by the IRS. In this section, we will outline how to calculate these deductions and provide some examples of how businesses determine an expense to be deducted.

The first thing a business must do when claiming some expense as Section 162 expenses is prove that the expense is both:

- Common within the business.

- A cost that is deemed ordinarily and directly appropriate and helpful to the business.

The IRS examines every particular expense for deductibility based on the nature of the business, common practice within the industry, and its business purpose.

Here are the steps to follow:

- Expense Type: Place it under the business expense-common cost category (rent, salaries, utilities, etc.).

- Check Industry Standards: Determine if similar businesses use the same costs for their business expenses.

- The Expense Purpose: Determine the expenses that are conducive to business operations.

- Documents: Ensure that receipts, invoices, and documentation are kept to justify the expenses for IRS audit purposes.

Businesses must categorize these expenses into non-deductible categories, such as capital expenditures, personal expenses, and fines.

Classification of Ordinary and Necessary Expenses

The following are part of the process of figuring out what business expenses are deductible:

A. Differentiating Expenses

Businesses must classify expenses to take proper deductions.

Common classifications may include:

- Fixed Expenses: Regularly occurring expenses that remain constant (such as rent and insurance).

- Variable Expenses: Expenses that cycle with improvements in business (like raw materials and advertising).

- Mixed Expenses: Expenses that have both business and personal elements (say, a home office and car expenses).

B. Determining the Amount to Deduct

If incurred entirely for business, 100 percent of the expense is deductible. If incurred partly for business, the business portion only is deductible.

The below examples can help us understand this:

Example 1: 100 percent Deductible Expenses: A law firm pays $3,000 monthly for office space rent. Since this is 100 percent business-related, the $3,000 is deductible.

Example 2: Partially Deductible Expenses (Home Office): A freelancer operates from home and uses 30 percent of the house directly for business purposes. The monthly rent for the premises totals $1,500.

Computation:

Business portion = 30 percent x $1500 = $450 deductible.

Example 3: Car Expenses (Mixed Use): A businessman drives 10,000 miles in a year. Out of that, 6,000 are business, and 4,000 are personal drives. Annual car expenses amount to $8,000 (fuel, repairs, insurance).

Business portion = (6,000/10,000) x $8,000 = $4,800 deductible.

Or, using the IRS standard mileage for example purposes (in 2023: $0.655/mile)

Deduction=6,000 miles * $0.655= $3,930

The car owner can choose to deduct the larger of the two amounts ($4,800 or $3,930).

C. Making Sure of IRS Guidelines

So, to avoid IRS problems, businesses ought to:

- Keep Accurate Records: These include receipts, invoices, mileage logs, and business expense reports.

- Separate the Business and Personal into Different Establishments: Use a business bank account for only business purposes.

- Take The Laugh Test: Check whether the expense is reasonable and could be justified.

- Exercise the Cohan Rule with Caution: Estimate in only those instances where documentation is otherwise missing.

By following these rules, businesses can safely and assuredly claim and book ordinary and necessary expenses while consistently complying with IRS Section 162.

Conclusion

IRC Section 162 is about assuring perfect records, adhering to IRS principles, depriving the IRS of the chance to nip deductions on acceptable expenses, and thus rescuing one from possible penalties and audits. Under such circumstances, reaching for professional assistance is sometimes the only means to access the more complicated deductions of IRC Section 162.