Overhead costs are easily distinguishable from capital expenditures (CapEx), and their classification plays a significant role in operational effectiveness and compliance. Overhead costs are common ongoing expenses inherent in carrying out business activities in a day, compared to capital expenditures, which are costs incurred in procuring assets with a useful life beyond the current year.

This is not merely an academic differentiation. It has real economic consequences for revenues, statements, and spreadsheets. For instance, the incorrect categorization of an expense means that the firm is compliant, resource allocation is improper, or financial fraud is occurring. When these two categories are defined more clearly, the companies’ financials will be clearer, thus enabling managerial support for strategic goals.

What are Overhead Costs?

Overhead costs are costs that a business organization needs to maintain at a given time to keep its operation running. Still, these costs cannot be easily associated with the production of goods or provision of services. Fixed expenses, variable expenses, and semi-variable expenses are dependent on the nature of the business that is carried out.

Example

- Fixed Costs: Hire for accommodation either for an office or factory.

- Variable Costs: Services such as electricity and water.

- Semi-Variable Costs: The wages paid to administrative workers likely fluctuate with the number of extra hours worked but are quite stable otherwise.

- Some examples are premiums for insurance, stationery, and costs for maintaining apparatus.

Key Characteristics

- Proper Functioning: Ongoing and Recurring overhead costs are frequently necessary for the proper functioning of operations.

- Reported as Operating Expenses: Overhead costs are placed under the expenses of the operating section of the profit and loss statement.

What are Capital Expenditures (CapEx)?

Capital expenditures are expenses incurred by a business to acquire, improve, or maintain physical infrastructure, including land, buildings, or other accessories. They are meant to achieve other gains and improve a company’s future size or productivity.

Examples

- Purchasing capital to be used for manufacturing.

- Purchasing land or buildings.

- Making large investments in technology resources.

- Expansion of the existing facilities such as renovation.

Key Characteristics

- Non-Recurring and Large Investments: CapEx is usually characterized by lavish, non-recurring expenses compared to OpEx outlays.

- Depreciation and Amortization: These expenditures are capitalized in the sense that they are recorded in the balance sheet as an asset and then charged against that sum over the useful life of the asset in question.

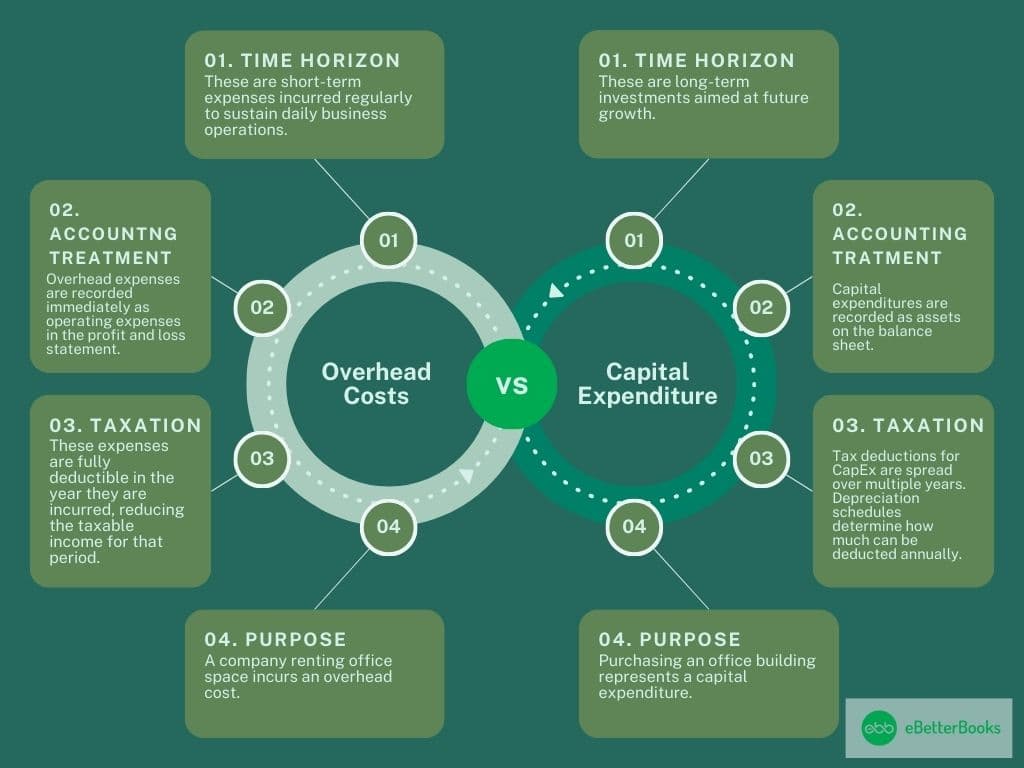

Key Differences Between Overhead Costs and CapEx

Below are the key differences between overhead costs and capital expenditure in a table form:

| Basis | Overhead Costs | Capital Expenditure |

| Time Horizon | These are short-term expenses incurred regularly to sustain daily business operations. For example, paying monthly electricity bills ensures that the lights and equipment remain operational. | These are long-term investments aimed at future growth. For instance, buying new manufacturing equipment may increase production capacity for years. |

| Accounting Treatment | Overhead expenses are recorded immediately as operating expenses in the profit and loss statement. They impact the current year’s financial results. | Capital expenditures are recorded as assets on the balance sheet. Their costs are distributed over several years through depreciation or amortization. |

| Impact on Taxation | These expenses are fully deductible in the year they are incurred, reducing the taxable income for that period. | Tax deductions for CapEx are spread over multiple years. Depreciation schedules determine how much can be deducted annually. |

| Purpose | These expenses support the ongoing operations of a business, such as maintaining a comfortable work environment for employees. | These investments aim to improve efficiency, expand capacity, or support long-term strategic goals. |

| Example | A company renting office space incurs an overhead cost. | Purchasing an office building represents a capital expenditure. |

Why the Distinction Matters?

The distinction between overhead costs and capital expenditure is critical for several reasons:

- Budget and Financial Planning: They assist in identifying the kind of expenses that really aid in running an organization with the aim of getting the best out of resources, more so money. For example, when operating expenses are excluded from capital expenditures, it is easier for companies to work out achievable budgets.

- Accurate Financial Reporting: Proper classification is in accordance with accounting rules, policies, standards, and guidelines and gives creditors, investors, and other users a clear insight into the company’s financial well-being. Misclassification might result in discretizations of overestimated profits or losses.

- Clarity for Investors and Stakeholders: Everyone wants the full and accurate picture, the truth about the state of the particular business at a given period before investing. It helps to recognize between overhead and CapEx and offers clear information, which serves as the way toward trust.

- Tax Compliance: Tax authorities rely on financial documents to enforce compliance. Failure to classify expenses correctly can cost one penalty or lead to legal proceedings being instituted against him.

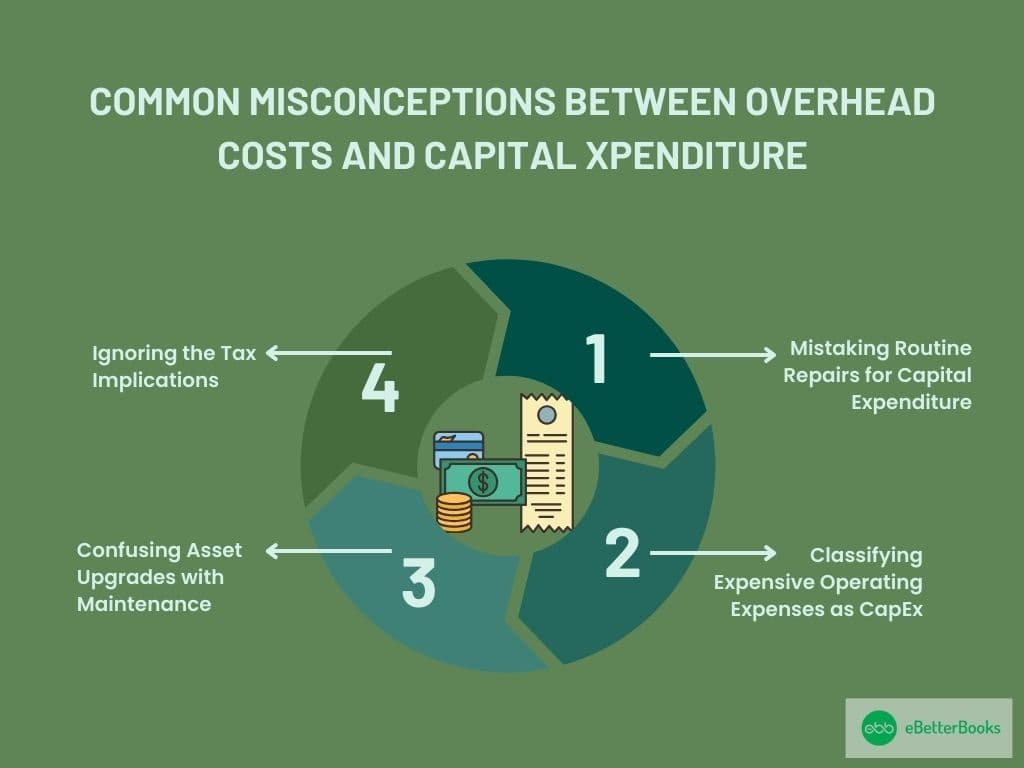

Common Misconceptions

It is sometimes cumbersome to distinguish between the overhead costs and the capital expenditures. The most common misclassifications resulted in financial reporting and compliance problems.

Below are four common misconceptions:

- Mistaking Routine Repairs for Capital Expenditures: Some companies wrongly attribute general maintenance, including wall repainting and completing small cracks, as part of CapEx. In reality, these are overhead costs because they do not add value or volumetric characteristics to the asset.

- Classifying Expensive Operating Expenses as CapEx: This is especially true when software is provided via cloud subscription or paid for as a short-term license. If the software is not expected to provide such benefits in the long term, then they should be recognized as operational costs.

- Confusing Asset Upgrades with Maintenance: Proactive measures, such as replacing worn-out spare parts in a machine or piece of equipment that is not necessary but is maintained to avoid frequent breakdowns, are classified under overhead costs. Combining these classifications may result in distorted accounts.

- Ignoring the Tax Implications: Several organizations do not realize that overhead costs are 100% deductible right from the start of the cycle, whereas Capex is capitalized and subsequently depreciated. Failure to categorize them correctly means that some expenses will go unpaid, and, in return, some taxes will be overpaid.

Tips for Managing Overhead Costs and Capital Expenditures

Reaching a good level in overhead costs and capital expenditures needs to be controlled and managed in advance and operate efficiently.

Here are four tips for each category:

Managing Overhead Costs

- Conduct Regular Expense Audits: To reduce overhead costs, periodic evaluations that determine the extra costs incurred may be useful. For example, adopting energy-efficient systems or changing the terms of service with vendors directly leads to amazing cuts in total costs.

- Leverage Technology: Subdue various cost types tracking through specific programs and tools to keep track of the company’s operation costs and avoid any category being over the assigned limit.

- Outsource Non-Core Functions: To reduce overhead expenses, activities such as payroll processing or managing the IT function may be effectively outsourced, but the impact may not be felt.

- Implement a Cost-Control Culture: Motivate the employees to save costs on unnecessary expenditures within the firm by reducing issues like the usage of paper or energy.

Managing Capital Expenditure

- Perform ROI Analysis: Authors recommend using ROI to appraise potential investments. For instance, buying an automatic machine may lead to high productivity and low future employee costs.

- Plan Budgets Strategically: The distribution of the CapEx budgets should reflect the organization’s growth strategies. For example, spending on the development of more facilities in some strategic areas will increase income.

- Prioritize Projects: Divide CapEx projects into high- and low-priority categories based on the extent of the benefits that are likely to be derived and the benefits that are most likely to be derived faster.

- Monitor Depreciation Schedules: Depreciation and amortization records, especially schedules, should be tracked to get the best of the tax system and record good financial books.

Real-World Case Studies

To clarify the concept, it is crucial to explain the practice of using overhead costs and capital expenditures (CapEx).

Below are case studies for each category:

Case Study 1: General Electric (GE) and Cost Optimization

A global tycoon of products, namely General Electric Co., encountered some performance issues related to the problem of overhead costs during a slump in the energy market. As part of its continuous improvement program, GE at least had to conduct a company-wide audit that pointed out many of the overhead costs it was incurring that may not be necessary. Organizational bureaucracy was cut down, employee headcount was slashed, and administrative staff saw their salaries cut down as overlapping positions were merged. Back-office operations were partially or fully digitized. GE also changed suppliers’ contracts to reduce utility and maintenance expenditures.

Result: The integration of activities mitigated overhead cost effects and enhanced profit during unfavorable market conditions.

Case Study 2: Amazon’s Investment Towards Fulfillment Centres

E-retailer giant Amazon continues to expand its inventory space, given its relentless dedication to a speedy delivery strategy. The company invested billions in CapEx to build modern complex warehouses with robotics and automation systems installed. These centers were positioned to help minimize delivery time and convey operational efficiencies.

Result: Through such capital expenditures, Amazon has increased its consolidated order fulfillment capacity, improving customer satisfaction and competitiveness.

Case Study 3: Starbucks and Energy Conservation

Recently, high energy bills were seen as a major overhead cost in Starbucks, a leading coffeehouse chain. To tackle this, the company created awareness about energy efficiency, for example, by installing efficient lighting, heating, ventilation, and air conditioning systems in all its outlets. Subordinates were encouraged to change their behaviors in the use of energy through knowledge and, for instance, by conserving electricity by switching off apparatuses where not required.

Result: Starbucks reduced its annual energy usage by 25 % and saved millions of dollars, strengthening its mission and helping enhance corporate responsibility for sustainability.

Case Study 4: Tesla’s Gigafactories

The application is best captured by Tesla’s Gigafactories exemplification of strategic CapEx planning. The company spent a lot of money constructing these colossal structures purposely to manufacture electric vehicle batteries and powertrains. Thus, by economizing battery in-house to integrate battery production vertically, Tesla was able to cut through certain percentages of its costs in the long run.

Result: By introducing the idea of Gigafactories, they have strategically placed Tesla directly in the middle of EV production, cutting production costs by half and upping output to record levels.

These cases depict how proper overhead cost and CapEx management improve operating efficiency and firm growth. In this way, one can abstract best practices that guide the formulation of suitable strategies for performance improvement for businesses.

Conclusion

It is important to differentiate overhead costs from capital expenditures. Incorrect classifications distort reporting, but tax problems occur when the government receives or pays the wrong amount. In fact, business leaders can dismantle the myths and realize how certain principles can really help improve overall business processes.

Business owners and managers need to consider certain tips, as these will pave the way for making certain changes in business to increase efficiency and improve prospects. Understanding that all expense categories possess peculiarities allows firms to arrive at the right decisions, all of which contribute to achieving sustainable business successes within emerging competitive environments.