Highlights (Key Facts & Solutions)

- Manual vs. Bank Feed: Manual entry is necessary for capturing pending charges that have not yet cleared the bank feed, ensuring real-time financial accuracy.

- Accounting Distinction: A credit card Charge must be recorded as an Expense (impacting Profit and Loss), while a credit card Payment must be recorded as a Transfer or “Pay down credit card” (impacting the Balance Sheet).

- Duplication Prevention: After manually entering a charge, always use the Match feature in the Banking center when the bank feed imports the transaction later, rather than the “Add” feature, to prevent duplicate entries.

- Employee Tracking: Use Credit Card Sub-Accounts under the main corporate card to efficiently track employee or departmental spending while simplifying the overall reconciliation process.

- Audit and Compliance: The Audit Log is essential for tracking all changes, including deletions or edits to credit card charges, providing accountability and supporting compliance requirements.

- Dispute Handling: Do not delete a disputed or fraudulent charge; instead, add a detailed memo to the transaction and record the recovery funds using a Deposit or Refund Receipt against the original expense account.

- Most Important Step: The monthly reconciliation of the credit card account against the official statement is the single most crucial action to ensure transaction accuracy, clear errors, and maintain audit readiness.

Overview

QuickBooks Online allows you to record credit card charges using both traditional and manual methods to stay updated with your expenses and maintain accurate financial reports. A credit card gives you the option to borrow funds for purchases or for paying bills. You can set up your credit card account to track the charges and payments you’ve made.

Managing credit card charges in QuickBooks Online helps you to ensure every transaction is accurately recorded and categorized. Whether you’re manually entering charges, uploading receipts, or using automated tools, QuickBooks provides different ways to keep your finances organized and up-to-date.

- Positive Balance: There are pending charges on your credit card.

- Negative Balance: The amount you paid is more than your balance due.

- Zero Balance: You didn’t make any charges or you’ve already paid your balance due.

- Credit Card Sub-Accounts: You can enter the charges and payments in the sub-account, and it will display on the account register. The total amount of these charges and payments should be equal to the total balance for the parent account. So, you only need to reconcile the parent account.

Things to Do Before Entering Credit Card Charges in QuickBooks Online

Before entering credit card charges in QuickBooks Online, you’re recommended to follow some steps to streamline your cash flow and keep track of the expenses you’ve made.

Here’s a checklist you need to follow:

- Ensure that all your credit card accounts are properly set up in QuickBooks Online.

- If you’ve connected your credit card account to QuickBooks Online via bank feeds, check for any imported transactions.

- Review and categorize imported charges before manually entering any transactions to avoid duplication.

- Check that the opening balance for your credit card account is accurate and maintain proper reconciliation between QuickBooks and your credit card statement.

- Keep all receipts or supporting documents handy for the credit card charges you’ll be entering.

- Make sure you know the exact transaction date and posting date before entering charges.

- When entering charges, select the appropriate expense categories (e.g., supplies, travel, advertising) to track expenses correctly for tax and reporting purposes.

- Make sure the credit card charges haven’t already been recorded (through bank feeds, manual entry, or another method). Duplicate charges can throw off your account reconciliation and financial reports.

- Stay updated with your credit card’s available balance and the credit limit to avoid missing due dates.

- Reconcile your credit card accounts on a regular basis to ensure that all credit card charges are accurately reflected in your QuickBooks Online account and there are no missing or duplicated transactions.

Steps to Enter Credit Card Charges in QuickBooks Online

Entering your credit card purchases into QuickBooks Online and then matching that transaction to the bank feed is the best method, at least from a bookkeeping standpoint. Bank feed allows your banking and credit card transactions to be reconciled and reported more accurately and efficiently.

The QuickBooks Online bank feed is a QuickBooks feature that connects your online business bank account securely to your accounting software. It syncs your banking transactions with your QuickBooks Online records, so you don’t have to input every check, charge, transfer, Expense, or deposit manually.

Traditionally, bookkeepers entered transactions into ledgers from source documents like receipts and then reconciled these ledgers to the bank or credit card statement every month. But now, using the bank feed feature, you can make all banking and merchant account transactions, whether you have cash deposits or withdrawals, online payments, credit or debit card charges, transfers, or loan payments.

When your bank data flows directly into your QuickBooks Online account, every transaction is instantly synced and sorted for you. As you add data and approve transactions, QuickBooks recommends categories for your expenses and gets smarter over time.

Record Credit Card Charges as an Expense

In QuickBooks Online, you can enter your credit card charges as Expenses. From there, you can choose a category to post the amount individually.

Let’s see how:

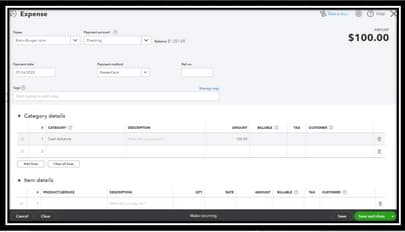

- Click on the + New icon and then select Expense.

- Navigate to the Payee field, and choose the vendor.

- From the Payment Account drop-down menu, choose the credit card account you used to pay for the Expense.

- Enter the date for the Expense under the Payment date section.

- From the Payment method drop-down list, select how you paid for the Expense.

- Type the advance amount.

- Fill out all the other necessary information.

- Once done, press Save and Close.

Enter Charges Directly into the Credit Card Register

- Hover over Accounting in the left side menu and then select Chart of Accounts.

- Find your credit card account and click View Register.

- Choose Add Expense (or similar, depending on your QuickBooks version).

- Type the Date, Vendor/Payee, Amount, and Category.

- Save the transaction to record it directly in the credit card register.

Connect your Credit Card for Bank Feeds

- Navigate to the Banking or Transactions tab on the left.

- Link your credit card account if not already connected. QuickBooks will download recent charges directly from the bank.

- Review each transaction under the For Review tab, categorize it, and choose Add to record it in QuickBooks.

- Set up bank rules for automatic categorization if there are recurring expenses.

Upload Receipts Using the QB Online Mobile App

- Open the QuickBooks Online mobile app.

- Head to Transactions, then click Receipt Snap.

- Select the Receipt camera and take a picture of your receipt for a credit card purchase.

- Click Use this photo and press Done.

- QuickBooks will create a draft transaction, which you can later review, categorize, and save.

Steps to Manually Enter Credit Card Charges in QuickBooks Online

QuickBooks Online offers the ability to manually enter transactions associated with a credit card. This will help you get the most accurate and up-to-the-minute financials. Bank feeds allow your credit cards to sync to QuickBooks Online, making transactions instantly viewable in the register. There’s a time lag between the actual credit card transaction and when the transaction shows as pending before it posts to your credit card statement.

If you need up-to-date financials due to end-of-period accounting reports, pending charges cannot be imported through QuickBooks Online bank feeds. Only an actual payment that has been processed via your credit card and appears on your statement will transfer to your bank feeds. To get the most accurate real-time view of your finances, you need to manually enter credit card charges in QuickBooks Online.

Here’s how:

- Hit the Plus icon.

- Now, choose Expense.

- Select the credit card account from the Bank/Credit account drop-down menu.

- Type the additional information about the transaction.

- Press Save at the end.

Advanced Credit Card Charge Management in QuickBooks Online

Efficient financial tracking goes beyond just entering expenses. To truly stay in control, you need to master every layer of credit card charge management in QuickBooks Online. From correcting mistakes to reconciling monthly statements, each task affects your books directly. In this section, we’ll cover five critical workflows—all designed to help you edit, monitor, reconcile, and safeguard your credit card records with precision. If you’re aiming for error-free accounting, smarter oversight, and full compliance, this is where you start.

How to Edit or Delete Credit Card Charges in QuickBooks Online

QuickBooks Online lets you edit or delete charges in just a few steps, giving you full control over your records. To edit a charge, go to the Expenses tab, locate the transaction using filters like vendor name, amount, or date, and click Edit. Make your changes and hit Save. To delete a charge, follow the same path but select More > Delete at the bottom. Always double-check the payment account, transaction date, and category before editing. Editing or deleting incorrect entries helps you avoid reporting errors, reconciliation issues, and financial mismatches.

Differences Between Credit Card Payments and Charges in QuickBooks

In QuickBooks Online, a credit card charge is money you’ve spent, while a payment is money you’ve used to pay the card. Charges are logged as expenses, vendor-specific, and affect your profit and loss. Payments, however, are recorded as transfers, impact cash flow, and reduce your card balance. Go to + New > Expense to enter a charge, and + New > Pay down credit card for payments. Mixing them up can lead to duplicate entries, reconciliation errors, and inaccurate financial reports. Always verify account type, amount, and transaction flow before recording either.

How to Reconcile Credit Card Accounts After Entering Charges

To reconcile your credit card account, go to Settings > Reconcile, choose the correct credit card account, and enter the statement ending date and balance. Match each charge with your statement using filters like amount, date, and vendor. Look for missing, duplicate, or unmatched transactions. If the difference is zero, click Finish now. Reconciliation ensures transaction accuracy, clears pending errors, and aligns your books. Always keep receipts, charge dates, and vendor names handy for fast matching. Doing this monthly helps avoid audit risks, tax issues, and end-of-year confusion.

How to Track Employee Credit Card Usage in QuickBooks Online

Start by giving each employee a credit card sub-account under your main credit card in the Chart of Accounts. Record each charge using + New > Expense, selecting the right employee account, date, and category. Use Classes or Tags to identify who made what purchase, where, and why. This helps monitor spending limits, policy violations, and tax-deductible expenses. Run custom Expense by Vendor or Class reports to review spending patterns. Tracking employee usage avoids misuse, overspending, and reconciliation delays, while ensuring full visibility across departments.

How to Handle Disputed or Fraudulent Charges in QuickBooks

First, identify the disputed charge by checking vendor name, transaction date, and amount in the Expense or Banking tab. Tag it clearly using a memo note, class, or flag, and do not match it with bank feeds until resolved. Report the issue to your card issuer immediately and request a temporary credit or investigation. In QuickBooks, either exclude the charge, mark it as unresolved, or create a reversal entry. Handling disputes properly prevents data misreporting, false expense totals, and reconciliation errors. Track resolution progress in your records to maintain transparency.

Strengthening Your Credit Card Workflow in QuickBooks Online

Once you’ve learned how to enter credit card charges, the next step is mastering how to manage them smarter. This section focuses on advanced yet essential practices—like preventing common mistakes, using audit tools, and maximizing your tax efficiency. By applying these five expert strategies, you’ll boost accuracy, compliance, and confidence in your financial tracking. Whether you’re preparing for taxes, audits, or just cleaner reports, these tips help make your QuickBooks credit card process stronger and more future-proof.

Importance of Categorizing Credit Card Expenses for Tax Deductions

Accurate categorization helps you claim tax deductions, avoid IRS red flags, and maintain clean records. In QuickBooks Online, each expense should be assigned a proper category like travel, meals, or advertising—not just for reports but for tax filing. Misclassified charges can lead to lost deductions, audit risks, and inaccurate profit analysis. Use the Chart of Accounts, bank rules, and tags to automate consistent categorization. This habit improves year-end reporting, speeds up filing, and increases deduction accuracy. Proper setup today saves time, money, and effort during tax season.

Common Mistakes to Avoid While Recording Credit Card Charges

Avoiding mistakes in QuickBooks starts with not duplicating entries, choosing the correct account, and entering exact dates. One common error is recording both a charge and a payment as expenses, which leads to inflated totals, reconciliation mismatches, and confusion in reports. Also, users often skip adding receipts, causing audit issues, missing context, and loss of proof. Using the wrong category can result in incorrect tax deductions, poor expense tracking, and flawed budgeting. Always double-check the amount, vendor, and payment method before saving any charge to keep your books reliable.

Using Audit Log to Track Credit Card Charge Changes

QuickBooks Online’s Audit Log gives you a clear trail of who changed what, when, and how—essential for monitoring edits, deletions, or backdated entries. Go to Settings > Audit Log, filter by user, date, or event type, and review changes related to credit card charges, categories, or amounts. This tool helps catch unauthorized edits, accidental updates, and missing transactions. It also supports internal controls, accountability, and audit readiness. For every charge entered, the audit log preserves its original state—keeping your financial history transparent and tamper-proof.

Best Practices for Monthly Credit Card Reconciliation

Monthly reconciliation ensures your records match your credit card statement—reducing errors, fraud risks, and reporting issues. Always start by collecting your latest statement, then in QuickBooks go to Settings > Reconcile, and select the correct credit card account, ending balance, and date. Match each transaction based on amount, vendor, and posting date. Flag or investigate any missing, duplicate, or mismatched entries immediately. Lock the period after reconciling to prevent changes. Following this routine boosts accuracy, financial control, and audit preparedness while keeping your books clean and dependable.

How to Generate Credit Card Expense Reports in QuickBooks Online

To view your credit card spending, go to Reports > Expenses by Vendor Summary or use Transaction Detail by Account for deeper insights. Filter by credit card account, date range, and category to isolate specific charges. You can also customize columns for vendor, memo, class, or payment status to get a clearer picture. Export reports in PDF or Excel for sharing or review. These reports help in budget planning, audit preparation, and tax filing by providing real-time, organized views of where your money went and why.

Bottom Line!

Entering credit card charges in QuickBooks Online is crucial for record keeping, which ensures accuracy and integrity in your bank transactions. It helps you to connect your bank or credit card accounts and keep track of your finances before printing financial statements at the end of the month, quarter, or year.

Businesses can either manually enter or automate the process by importing transactions, which increases efficiency and reduces the risk of errors. Regularly reviewing and entering these credit card charges ensures your books stay up-to-date and ready for financial decisions or audits.

Frequently Asked Questions

1. Why is manually entering a credit card charge sometimes better than waiting for the bank feed?

Manually entering a credit card charge ensures you have the most up-to-the-minute financials, which is critical for end-of-period reporting.

The key reasons to manually enter a transaction are:

- Pending Charges: Bank feeds only import transactions that have posted to the statement (cleared the bank). Pending charges, which affect your real-time available credit, cannot be imported until they officially clear the bank.

- Real-Time Accuracy: For critical cash flow analysis or reconciliation cutoffs (like month-end), manually recording a charge ensures the expense is captured on the correct date for tax and financial reports.

Once the bank feed imports the transaction, QuickBooks will automatically find the manual entry and prompt you to match the two transactions, preventing a duplicate.

2. What is the fundamental difference between recording a credit card charge and a credit card payment in QuickBooks Online?

Mixing these two actions is a common accounting error that leads to reconciliation failures and inaccurate reports.

- Credit Card Charge: This is recorded as an Expense (or Bill). It increases the Credit Card Liability account and increases an Expense account, impacting the Profit and Loss (P&L) statement.

- Credit Card Payment: This is recorded as a Transfer (or Pay down credit card feature). It decreases the Checking Account (Asset) and decreases the Credit Card Liability account. It impacts only the Balance Sheet and Cash Flow.

Recording a payment as an expense will falsely inflate your business expenses.

3. When should I set up a credit card as a sub-account instead of a standalone account?

Setting up credit cards as sub-accounts is a best practice for managing employee or department-specific cards under one main corporate card.

The benefits of using sub-accounts include:

- Simplified Reconciliation: You only need to reconcile the Parent Account against the primary, consolidated statement received from the credit card company.

- Detailed Tracking: You can easily run reports to monitor the spending limits and usage of each sub-account (employee or department) while keeping the total liability consolidated.

- Clearer Chart of Accounts: It keeps the Chart of Accounts clean by grouping related liability accounts.

4. How can I ensure a transaction from a bank feed doesn’t accidentally become a duplicate entry?

The risk of duplication is highest when you manually enter a transaction (to capture it immediately) and then also allow the bank feed to import the same charge later.

To prevent duplication:

- Prioritize Matching: Always check the For Review tab in the Banking center first. If the bank feed finds a manual entry with a matching amount, date, and payee, it will suggest a Match action instead of an Add action.

- Review Before Adding: Never click Add on a bank feed transaction without verifying it is not already in your register. If QuickBooks suggests a Match, confirm it to link the manual entry to the downloaded transaction.

If you mistakenly add a duplicate, use the Exclude feature in the Banking center to remove the unwanted bank feed entry, or Undo if already categorized.

5. Why is the Audit Log essential for managing credit card charges, and how do I use it?

The Audit Log is crucial for internal controls and compliance because it creates an uneditable record of all changes made to your financial data.

The Audit Log helps you:

- Track Deletions: Identify which user deleted a credit card charge, when the deletion occurred, and what the original amount was.

- Monitor Backdating: Review changes to the transaction date to spot potential backdated entries that could skew month-end reports.

- Ensure Accountability: Confirm who made any edits to the transaction’s amount, vendor, or category.

Access the log by going to Settings $\to$ Audit Log, then filter the events by specific users, dates, or events.

6. If I dispute a fraudulent charge, how should I record it in QuickBooks Online?

When you dispute a charge, you should not delete the original transaction because it is an accurate reflection of the initial bank activity.

Follow these steps for proper tracking:

- Identify and Memo: Add a detailed memo to the original expense entry (e.g., “Disputed: Reported to Visa on 12/01”).

- Do Not Match: Do not match or add the charge from the bank feed until the dispute is resolved. If already recorded, use a note or tag to track its status.

- Record Credit/Refund: When the card issuer issues a credit/refund for the fraudulent amount, record the incoming money using the Bank Deposit or Refund Receipt feature, posting the amount back against the Original Expense Account or a dedicated account for disputed funds.

This process ensures your books match the statement while tracking the recovery process.

7. What is the single most important action to take after entering all credit card charges for the month?

The single most important action is to reconcile the account monthly.

Reconciliation is mandatory because it provides the final verification that your books match the official statement from the credit card company.

Monthly reconciliation ensures:

- Transaction Accuracy: Confirms all charges are correctly posted and categorized, and no unauthorized or fraudulent transactions were missed.

- Cleared Errors: Clears all pending errors and reconciliation discrepancies, locking the period for financial integrity.

- Audit Readiness: Provides a locked, official record of the account balance on the statement date, which is essential for tax filings and audits.

After reconciliation, the difference must equal zero before you click Finish now.

Disclaimer: The information outlined above for “How to Enter Credit Card Charges in QuickBooks Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.