Business people with a low credit rating between 300 and 669 can borrow business loans at a standard percentage ranging between 10% and 99%. Nevertheless, traditional loans are out of reach for many businesses, especially those with low FICO scores, and many traditional creditors demand security.

Companies such as OnDeck, BlueVine, and Fundbox offer business loans to owners with poor credit. The interest rates attached to these lenders are relatively high, and repayments are even shorter and usually made within a few months to a few years.

What is a business loan with bad credit?

A bad credit business loan is a contract offered to business owners with low credit scores, that is, below 669 on the FICO rating scale. Such loans serve businesses that are candidates for credit or with better credit.

Since lenders consider lending money to people with bad credit risky, these loans are characterized by high interest rates, small loan sizes, and short repayment periods. Although credit conditions under these types of credit are less beneficial than those under conventional credit, these loans offer important capital for financing organizations’ bills, continued operations, or opportunities for expansion.

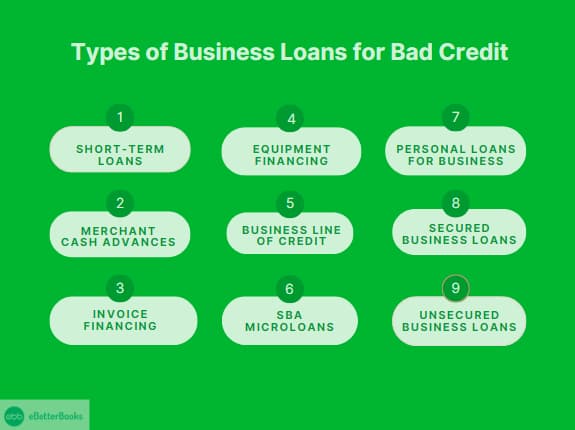

Types of Business Loans for Bad Credit

Business loans for bad credit can be of many forms and provide different propositions in terms of conditions, prerequisites, and types of loans.

Here are some of the most frequently taken, together with their definitions, average specifics, and some examples:

1. Short-Term Loans

Short-term loan funding is immediate, with the repayment period ranging from 3 to 18 months at the shortest. Such loans are perfect for companies seeking urgent funds but with low credit ratings.

Example: An on-balance sheet line from OnDeck by extending a $50,000 loan that has an interest rate of 35% that will be repaid over 12 months.

- Loan Amounts: $5,000 to $250,000

- Interest Rates: 10% to 99%

- Repayment Terms: 3 to 18 months

2. Merchant Cash Advances (MCA)

An MCA is based on a lump-sum cash payment given to a lender in which a percentage of daily credit card or debit card sales pays off the advance. This type of financing does not allow relying on credit scores, which is good news for businesses with bad credit.

Example: A $20,000 advance from Fundbox at a factor rate of 1.3 is equivalent to 30% interest on an 8-month repayment period.

- Loan Amounts: $2,500 to $500,000

- Interest Rates: 20% to 50% (via factor rates)

- Repayment Terms: Percentage of repeat orders as a percentage of daily turnover

3. Invoice Financing

It is a kind of funding where an entrepreneurial company monetizes its accounts receivables. They offer funds for a percentage of the value of an invoice that is paid back as soon as the customer pays the invoice. Compared to the first method, this method is not constrained by credit scores, and it actually looks at the quality of the invoices.

Example: BlueVine offers one-invoice financing, where the borrower can finance up to 85% of a $10,000 invoice for an interest rate of 15% over three months.

- Loan Amounts: $5,000 to $5 million

- Interest Rates: 10% to 60%

- Repayment Terms: Depending on invoice terms, it usually takes about 30 to 90 days

4. Equipment Financing

This loan is specifically for the purchase of fixed-asset equipment. Businesses with low credit scores may also find it easier to qualify because the equipment being purchased actually acts as security.

Example: Equipment loan of $ 30,000 from Crest Capital, 12 % interest rate with a repayment period of 4 years.

- Loan Amounts: $5,000 to $500,000

- Interest Rates: 8% to 30%

- Repayment Terms: 1 to 5 years

5. Business Line of Credit

A line of credit provides credit where the business can access it up to a certain credit limit and is only charged a certain interest. It offers this type of financing convenience and can be given to companies with poor credit, but it comes at higher interest rates.

Example: Kabbage a $50,000 line of credit at a 30% interest rate, advance $10,000, and pay it back within one year.

- Loan Amounts: $2,000 to $250,000

- Interest Rates: 10% to 60%

- Repayment Terms: Revolving (this has daily or weekly payments or is repayable in installments).

6. SBA Microloans

The SBA guarantees SBA Microloans, and can be obtained by business people with low credit scores. These types of loans are normally low-amount and intended for entrepreneurial startups and other firms requiring moderate funds.

Example: A $20000 SBA Microloan with interest charges of 8% and a SNAP term of 5 years.

- Loan Amounts: Up to $50,000

- Interest Rates: 6% to 9%

- Repayment Terms: Up to 6 years

7. Personal Loans for Business

Business-purpose loans can be taken when business loans are not available due to bad credit in the credit profile. They are personalized based on the person’s credit and used to finance the business.

Example: A $7,500 auto loan from Lending Club for 3 years at an interest-bearing rate of 25%.

- Loan Amounts: $1,000 to $40,000

- Interest Rates: 6% to 36%

- Repayment Terms: 1 to 5 years

8. Secured Business Loans

Secured business loans involve putting down real estate, inventory, or equipment to ensure the business gets the loan. Because collateral decreases the lender’s risk, these kinds of loans may be easier to secure for businesses with bad credit scores.

Example: $100,000 secured by $150,000 collateral, 12% interest rate for 5 years.

- Loan Amounts: $10,000 to $1 million

- Interest Rates: 6% to 30%

- Repayment Terms: 1 to 10 years

9. Unsecured Business Loans

Compared to secured business loans, unsecured business loans are granted without the demand for collateral, which makes them more risky to providers. This means that they include a higher rate of interest and more conditions for borrowers. Such loans are taken based on the creditworthiness of the borrower and the performance of the business.

Example: An unsecured loan for a sum of $ 25,000 with an interest rate of 18% for 3 years.

- Loan Amounts: $5,000 to $500,000

- Interest Rates: 10% to 40%

- Repayment Terms: 1 to 5 years

How to Get a Business Loan with Bad Credit

Finding a good provider for a business loan with bad credit may be a bit difficult, but it is not a far-fetched feat. If you go through the correct procedure and select the most appropriate path to choose the correct selections, your probability of obtaining endorsement may be enhanced.

Here’s a step-by-step guide:

1. Update Your Business Plan

Having a well-spent, updated business plan is essential when appearing before a bank for a loan with a bad record. Some of the lenders you will approach, especially the conventional financial institutions, will ask for a business plan since they want to know your prospects as a business entity.

Key areas to update include:

- Executive Summary: Emphasize your business model and product, their importance, and the expected revenues.

- Market Research: Make sure you show that the data is up-to-date for your target market and customers’ characteristics.

- Budget and Revenue Projections: Always revise the sources of income in relation to the company’s operations.

- Key Objectives: That’s why your business must focus on its primary objectives and the indicators you are tracking to meet them.

2. Choose the Right Type of Loan

Not all business loans are of the same kind. You should select the type that best suits your needs and your pocket.

Consider the following factors:

- Loan Purpose: Decide why you require the loan and how you want to utilize the money (this might be for equipment purchase or operating cash).

- Interest Rates: Interest rates should be compared to determine who offers the lowest interest rates.

- Collateral: Determine how valuable some of the assets can be pledged when obtaining a secured loan and whether doing so will help you get better interest rates.

- Repayment Terms: Select the loan length that is in concordance with your business’s cash flow cycle.

3. Select the Right Lender

Not all lenders have the same criteria and the same terms of lending.

Here’s how to choose the best one for your situation:

- Compare Lenders: Interest rates, fees, and loan terms differ between lenders. Consider online lending, traditional brick-and-mortar banking, and community-based finance institutions—CDFIs and MDIs.

- Check Eligibility Criteria: Minimum credit scores, minimum annual revenue, and the time that a particular business venture has existed, among other requirements, are always required.

- Prequalify with Multiple Lenders: Prequalification is a popular service that shows proposed terms for setting up a loan without any impact on the credit score.

- Evaluate Customer Service: When choosing a convenient lending option, look at the lender and how they treat customers.

4. Demonstrate Strong Financials

Despite this, the lenders will look at your business credit records as well as your business’s financial history.

Here are key factors they’ll consider:

- Annual Revenue: Most lenders insist that the business should have a minimum annual revenue of about $100,500 -$250,000, as amplified earlier.

- Time in Business: Ideally, a business will reach solid ground in six months to two years.

- Cash Flow: Profit is important; however, a positive cash flow is essential, and the lenders will analyze the bank statements for the last three months.

- Debt-to-Income Ratio: Creditors will consider your existing load status and the amount of profit you make when deciding on your business.

5. Find a Co-Signer

If your credit rating is below the minimum acceptable level that most lenders use, you can invite a co-signer to help guarantee the loan.

A co-signer can be anyone with a better credit score than you who is ready to pay the loan if you fail to do so. You will be able to achieve this goal, and this will help you to be attractive to lenders. And in some cases, you will get a low interest rate on your loan.

How Do Business Loans for Bad Credit Differ from Traditional Loans?

Bad credit business loans are specially offered for entrepreneurs with bad credit scores from 300 to 669. The loans on these platforms are marked differently than usual business loans in that they may not be eligible under the same criteria; they have different interest rates, different loan terms, and different collateral requirements.

Below are the key differences:

1. Eligibility Criteria

Bad Credit Loans: When it comes to business loans for bad credit, lenders place less emphasis on credit scores and look for things like business performance, cash flow, and revenue. Because they’re available to businesses with poor personal or business credit histories, these make them accessible.

- Credit Score Range: 300 to 669 (FICO)

- Alternative Factors: Sales, other financial metrics such as business cash flow, and overall financial health.

Traditional Loans: Traditional business loans from a bank or a credit union have stiffer eligibility requirements, including a higher credit score and a proven credit history.

- Credit Score Range: Typically 670 and above

- Strict Credit-Based Assessment: Traditional lenders too heavily weigh the credit score and may reject an application on a low score alone.

2. Interest Rates

Bad Credit Loans: Interest rates on business loans aimed at borrowers with bad credit are much higher because lenders perceive them as having a higher risk. The loan type and the lender can range rates from 10 percent up to 99 percent.

- Interest Rate Range: 10% to 99%

- Alternative Factors: A poor credit history causes risk perception to increase.

Traditional Loans: Traditional loans, which are usually offered to borrowers with good credit scores, usually have low interest rates of 4% to 25%.

- Interest Rate Range: 4% to 25%

- Lower Risk, Lower Rates: Lower risk means the most favorable rates go to borrowers with strong credit.

3. Loan Amounts

Bad Credit Loans: The higher default risk means that lenders who lend out on bad credit loans will give you a smaller amount of money because it is considered to be more risky. As a rule, maximum loan amounts usually are approx—$ 2,000 to $500,000.

- Loan Amounts: $2,000 to $500,000

Traditional Loans: Most traditional loans have larger loan amounts, ranging between $10,000 and even millions of dollars, based on the borrower’s creditworthiness.

- Loan Amounts: $10,000 to $5 million+

4. Repayment Terms

Bad Credit Loans: Repayment terms for bad credit business loans tend to be shorter, usually between 3 months and 5 years. The goal is to minimize the lender’s exposure to long-term risk.

- Repayment Terms: 3 months to 5 years

Traditional Loans: Traditional business loans usually have repayment terms between 1 and 25 years, and loan types and sizes all matter.

- Repayment Terms: 1 to 25 years

5. Collateral Requirements

Bad Credit Loans: Many of these bad credit business loans are unsecured; they don’t require collateral. However, some lenders may require personal guarantees or a business asset to reduce risks.

- Collateral: Unsecured or may need personal guarantee

Traditional Loans: In general, traditional lenders require collateral, such as business assets, real estate, or equipment, and typically, they will evaluate loan applications only in the context of large loan amounts.

- Collateral: (e.g., Property, inventory, equipment) are required (e.g., property, inventory, equipment).

6. Funding Time and Approval Process

Bad Credit Loans: Since bad credit business lenders generally have streamlined application processes for bad credit loans for small businesses and can approve and disburse funds quickly, they are perfect for businesses that have sudden capital needs.

- Approval Time: Range of 24 to 72 hours

- Funding Time: 2 to 7 business days

Traditional Loans: With traditional loans, approving someone takes longer as the check is rigorous. It can take several weeks to a few months.

- Approval Time: Weeks to months

- Funding Time: 1 to 3 months

Top 10 Bad Credit Business Loan Providers

When traditional loans are not available because of poor credit, several business loan lenders deal with companies that have poor credit scores.

Below is a list of the top 10 bad credit business loan providers, including their key offerings, terms, and eligibility criteria:

1. OnDeck

- Main Offering: Short-Term Business Loans and Lines of Credit

- Interest Rates: Loans come with an annual percentage rate (APR) starting from 29.9%.

- Conditions: Instead, it places greater emphasis on business cash flow rather than a credit score.

- Minimum Credit Score: 600+

- Repayment Terms: 3 to 24 months

- Program: OnDeck Short-Term Loan

- Additional Info: Quick approval process (and funding disbursement in as little as 24 hours) for eligible businesses that get up to $250,000 in funding.

2. BlueVine

- Main Offering: Business Line of Credit

- Interest Rates: 6 month draws start at 4.8%

- Conditions: It’s less dependent on credit scores and focuses on business performance.

- Minimum Credit Score: 600+

- Repayment Terms: revolving credit line, 6 or 12 months

- Program: BlueVine Line of Credit

- Additional Info: Flexible credit, up to $250,000, very suitable for the management of working capital.

3. Fundbox

- Main Offering: Fundbox Credit Line

- Interest Rates: For 12 weeks, draws starting at 4.66% per week

- Conditions: It is open to businesses with low credit scores

- Minimum Credit Score: 600+

- Repayment Terms: 12 or 24 weeks

- Program: Fundbox Credit Line

- Additional Info: Within minutes, approval decisions are made, and funds are available within 24 hours.

4. Kabbage (American Express)

- Main Offering: Kabbage Small Business Loans

- Interest Rates: Fees range from 1.5% to up to 10%.

- Conditions: Little flexibility in terms; mainly focused on the business performance and revenue.

- Minimum Credit Score: 640+

- Repayment Terms: 6, 12, or 18 months

- Program: Kabbage Business Loans

- Additional Info: Up to $250,000 with no origination fees is ideal for businesses that need quick capital in a flexible format.

5. Credibly

- Main Offering: Working Capital Loan

- Interest Rates: Starting at 9.99%

- Conditions: For businesses with bad credit, based on revenue.

- Minimum Credit Score: 500+

- Repayment Terms: 6 to 18 months

- Program: Credibly Working Capital Loan

- Additional Info: Offers loans up to $400,000 provided in as little as 24 hours.

6. National Funding

- Main Offering: Small Business Bad Credit Loans

- Interest Rates: Starts at 15%

- Conditions: Bad credit financing for businesses is its specialty.

- Minimum Credit Score: 500+

- Repayment Terms: 3 months to 2 years

- Program: Bad Credit Loans National Funding

- Additional Info: From offers up to $500,000, the repayment is structured in daily or weekly instalments.

7. Lendio

- Main Offering: Bob Dylan Lendio Business Loan Marketplace

- Interest Rates: Pay a lender-based rate (ranging from 8% to 36%)

- Conditions: Businesses with bad credit can get their best aggregate offers from multiple lenders

- Minimum Credit Score: 550+

- Repayment Terms: Varies by lender

- Program: Lendio Loan Marketplace

- Additional Info: It connects businesses with over 75 lenders, bringing access to all sorts of loan options.

8. Rapid Finance

- Main Offering: Merchant Cash Advances and Small Business Loans

- Interest Rates: Starting factor rates of 1.1 (10%)

- Conditions: For businesses with bad credit, tailored.

- Minimum Credit Score: 500+

- Repayment Terms: Typically 3 to 18 months

- Program: Rapid Finance Small Business Loans

- Additional Info: The sponsor offers up to $1m in funding through a fast application process.

9. Torro

- Main Offering: Bad Credit Business Loans

- Interest Rates: Starting at 15% to 40%

- Conditions: Lends short-term loans to businesses with fewer credit lines.

- Minimum Credit Score: 550+

- Repayment Terms: 3 months to 18 months

- Program: Torro Business Loans

- Additional Info: Get quick funding (in 48 hours or less) of up to $575,000.

10 LoanBuilder (PayPal)

- Main Offering: LoanBuilder Business Loan

- Interest Rates: Starts at 6.49%

- Conditions: Businesses with credit challenges will be a part of customizable loan programs.

- Minimum Credit Score: 600+

- Repayment Terms: 13 to 52 weeks

- Program: PayPal LoanBuilder

- Additional Info: It provides up to $500,000 in funding with a customized loan term and repayment structure based on the business’s financial health.

What is the Minimum Credit Score for a Small Business Loan?

The minimum credit score needed to secure a small business loan varies greatly and is based on the type of lender and loan product. The minimum credit score doesn’t generally range from 500 to 680, as there tend to be other factors behind the lights that lenders might be considering other than just credit score, like cash flow, revenue, and collateral.

Below is a more detailed explanation of how having a minimum credit score affects small business loans, loan amounts, interest rates, and eligibility criteria.

Minimum Credit Score: 500 – 580

- Loan Type: Bad Credit Loans, Merchant Cash Advances, Alternative Lenders

- Interest Rates: Ranging from starting as high as 10% to as high as 99% based on the lender and ‘perceived risk.’

- Loan Amounts: These are usually capped at $500,000 but may be capped at lower amounts ($50,000 to $100,000), contingent on risk with higher-risk loans.

Eligibility:

- Revenue: Lenders may look much more at cash flow and monthly revenue than they do credit scores. While there are many lenders in this range, many of them will require businesses to show consistent revenue (from $10,000 to $20,000 per month or better).

- Time in Business: Time of operation at least 6 months to 1 year.

- Collateral: The loan may be unsecured or may require a personal guarantee or collateral from the lender.

Example: While Fundbox, which gives up to $100,000 credit lines for small firms scoring 500 or less, will extend credit at rates running from 10-20%, they are more interested in a company’s business performance. Also, National Funding provides loans for those above 500+ but with rates that are most likely higher because of the larger associated risk.

Minimum Credit Score: 580 – 600

- Loan Type: Business Lines of Credit, Short Term Loans, Working Capital Loans.

- Interest Rates: Typically between 15% and 45%

- Loan Amounts: The size can range from $5,000 to $250,000.

Eligibility:

- Revenue: There are a lot of lenders who require a minimum monthly revenue of at least $8,000 and up to $15,000.

- Time in Business: At least 1 year, though some lenders accept 6 months.

- Collateral: Unsecured but most likely secured by a personal guarantee with the person or resource who is providing the security.

Example: OnDeck offers loans to businesses with credit scores as low as 600, with a heavy focus on cash flow. With APRs of 29.9%, OnDeck provides short-term loans up to $250,000.

Minimum Credit Score: 600 – 640

- Loan Type: Line of Credit for Business, Medium Term Loans

- Interest Rates: Typically between 8% and 35%

- Loan Amounts: $5,000 to $500,000

Eligibility:

- Revenue: Lenders might want to see a bunch of $8,000 to $10,000 per month in revenue.

- Time in Business: It’s usually at least one year, but sometimes, if you have really good cash flow, it is as short as six months.

- Collateral: Personal guarantees, though unsecured in most cases.

Example: However, to be eligible for the business line of credit at BlueVine, you need a 600 or higher credit score. Depending on business performance, interest rates for their lines of credit begin at 4.8%.

Minimum Credit Score: 640 – 680

- Loan Type: Traditional Term Loans, SBA Loans, Business Lines of Credit

- Interest Rates: Starting at 4% to 15%

- Loan Amounts: Depends on the lender and loan product, from $10,000 to several million dollars.

Eligibility:

- Revenue: Most traditional lenders require that your business have a history of generating at least $15,000 in monthly revenue.

- Time in Business: Often, it is required 2 years or more in business.

- Collateral: Almost all traditional loans will need collateral, such as company assets, real estate, and equipment.

Example: Normally, SBA loans, which are partially government-guaranteed, require at least a credit score of 680. They carry interest rates between 6% and 10%, plus they offer longer repayment terms with lesser interest rates.

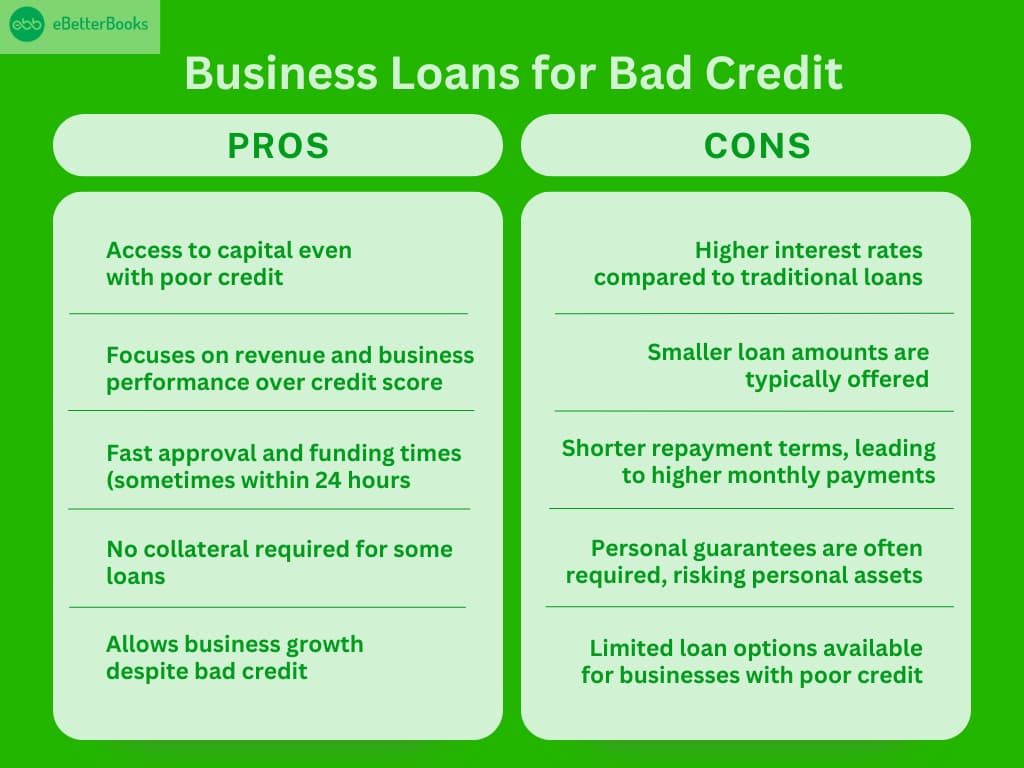

Pros and Cons of Bad Credit Business Loans

Pros of Small Business Loans for Bad Credit:

- Access to Capital: It even funds businesses with poor credit, allowing them to circumvent bad cash flow.

- Flexible Eligibility: Instead of just your credit score, lenders tend to pay more attention to your business’s revenue and financial performance.

- Fast Approval: Many bad credit loans get approved quickly, and the funding progresses relatively quickly, in some cases less than 24 hours.

- No Collateral Required: Some lenders offer unsecured loans, thereby reducing the threat to the assets.

- Business Growth Opportunity: Your bad credit doesn’t necessarily have to limit the opportunities businesses have to seize or protect themselves from some unexpected financial expenses.

Cons of Small Business Loans for Bad Credit:

- High Interest Rates: Aside from traditional loans, many also have significantly higher interest rate loan options.

- Smaller Loan Amounts: The capital available is therefore limited with a smaller loan size.

- Shorter Repayment Terms: If you have bad credit, you will find that bad credit loans tend to have shorter repayment periods, which increases monthly payments.

- Personal Guarantees Required: Many lenders require personal guarantees, which means the individual’s assets are at risk.

- Limited Options: Businesses with poor credit are less likely to find financing from fewer lenders who offer less flexibility to borrow.

How to Use a Loan Responsibly to Build a Positive Credit History?

A responsible use of a loan can be a vital first step in regaining or establishing a good credit history.

Here are some key strategies to ensure that your borrowing helps improve your credit profile:

- Choose the Right Loan: Choose a loan that corresponds to your financial condition. Loans with acceptable repayment terms and lower interest rates are to be searched for. Don’t borrow with predatory terms that will just make things worse.

- Make Timely Payments: One of the best ways to create a good credit history is to make on-time payments every time. Remind yourself or automate the payments to avoid missing a date.

- Keep Your Balance Low: If you have a line of credit, aim for a utilization ratio (the percent of what’s available that you’re using) of 30% or below. This shows you taking responsibility for your credit and making a positive impact on your credit score.

- Monitor Your Credit: You should regularly check your credit report, check that you have credit available, and find out if any errors have been made. You have one free look at your report each year from most credit bureaus. There are no inaccuracies — dispute them promptly.

- Limit New Credit Applications: You should resist the urge to apply for a lot of different loans, thinking you have a better chance of being approved: each play affects your credit score. Spell applications out for necessary loans and sprinkle the applications over time.

- Maintain Good Financial Habits: Exercise responsible credit management in addition to repaying the lent funds. This comprises budgeting, saving, and using other credit instruments properly. Good financial behaviors are financially beneficial and improve your financial credibility.

- Consider a Secured Loan: If you are struggling to qualify for an unsecured loan, a secured loan using collateral may well be the ticket for you. This is easier to acquire, but you risk an asset. As with any asset, the longer you carry it, the more attached you become to it. As long as you repay responsibly, it will also help to build credit.

Alternatives to Business Loans for Bad Credit

If getting a conventional business loan is out of the question because of a bad credit score, there are other ways businesses can access capital, as stated below.

- Personal online loans for businesses as well

- What It Is: Personal loans are a good way of financing your business, especially when business loans are not available due to poor credit. They are different from traditional business loans as they depend on your credit rating, not your business’s financial standing.

- Benefits: If personal credit is better than business credit, it will be easier to get approved. Business funds can be used for any purpose related to the business.

- Drawbacks: There are huge risks, such as the intermingling of the owner’s and the business’s resources. The interest rates may be higher, and the loan will appear on the personal credit report, affecting the personal position.

- What It Is: It is also common for businesspeople to use business credit cards to secure revolving credit, typically suitable for small and frequent business expenses. Most business credit card companies provide cards to businesses with poor credit ratings.

- Benefits: Immediate and immediate services credit cards with bonus points or cash back. Some cards have a zero-percent introductory interest rate, which makes them useful for short-term financing only.

- Drawbacks: Very high if the balance remains unpaid each month, or in other words, if the full minimum amount is not paid off each month. The credit utilization ratio, which is the second factor, shows that if you frequently spend most of your credit or when the amount of credit that you are using is high, this will affect your credit score.

- Crowdfunding

- What It Is: Crowdfunding means that you can finance your business by receiving small contributions from a large number of people online, usually via the internet, for instance, through Kickstarter, GoFundMe, or Indiegogo. It is a flexible method of financing business activities or a certain product, excluding using credit.

- Benefits: There is no repayment if you use rewards-based crowdfunding. This approach can also build market interest and awareness in your business or product before it is launched.

- Drawbacks: Running a crowdfunding campaign often takes time, and the campaign’s outcome is not assured. In some cases, expenses may be funded by backers; however, to encourage backers, some incentives must be given, which adds to the cost.

The Bottom Line

Though not qualifying for a good credit score makes it harder for a person with bad credit to access a business loan, it does not completely rule them out. You might need to use some solutions to mainstream financing, including the process of searching for approval or going for a non-conventional loan.

There are also several ways you can increase your likelihood of approval for a bad credit business loan: The first is to update your business plan, and the second is to check your credit score.