Proven strategies like Snowball (targeting low balances first) and Avalanche (focusing on high-interest debts) can significantly accelerate your credit card debt payoff.

Americans are reeling under a credit card debt of approximately $ 1.16 trillion with around 3.25% of delinquency rate. Shockingly, 42% of college students in the USA have a significant credit card debt burden.

Additionally, consolidating debt, negotiating lower interest rates, and making payments above the minimum can optimize your repayment efforts. Balance transfer cards offering 0% APR can further reduce the amount of interest you pay, enabling you to reduce your overall debt more efficiently.

By implementing these strategies, you can experience a sense of relief and pay all of your credit card debt for a debt-free future.

Key Takeaways

- Many credit card debt strategies can help you get out of debt—from payoff plans like the avalanche and snowball methods to consolidation options such as balance transfer credit cards and personal loans.

- The best way to pay off credit card debt depends on your total debt, interest charges, APR, financial habits, and spending preferences.

- Paying off your credit card debt sometimes lowers your score if it changes factors like your credit mix, your credit length, and the credit utilization ratio.

Proven Strategies to Pay Your Credit Card Debt Faster

There are no quick strategies for paying off your credit card bill. However, depending on the situation, these combinations of strategies can reduce your debt, lower your credit card APR, and avoid higher interest rates for a debt-free future.

- Choose Snowball Method

The snowball method involves repayment strategies that focus on paying down the amount with the lowest balance first. To get started, list all your debt from lowest to highest.

Make sure you pay only the minimum balance for each loan except the one with a lower debt balance. Now, you have to pay more than the minimum amount for the lowest balance credit card each month so that you can close the loan account first.

Now, start with the lowest balance among the remaining credit card debts and start making the maximum payments you can to close the loan account.

Tip: Focus on paying off the smallest debt first while making minimum payments on others. Build momentum as you clear each balance.

Let’s understand this with an example below:

| Example of Snowball Method: Suppose James has three credit cards, i.e., American Express, Chase Sapphire, and Citi Double Cash cards, with the remaining balance of $900, $650, and $2000. So, using the snowball method, James would pay the $650 credit card debt balance first. Then, he would make a payment of the $900 credit card debt, and finally, he would close the credit card debt of $2000. |

- Avalanche Method

The Avalanche Method also starts by listing all credit cards with the remaining balance and interest rates. When you choose this method, you have to pay the highest-interest credit card debt first.

If you are choosing this method, make sure you have a budget that allows you to pay more than the minimum payment each month. When you start making extra payments for higher interest each month, you will soon close the highest-interest credit card debt balance.

Now consider the next credit card debt with the highest interest and start making payments extra payments each billing cycle while making minimum payments for the rest.

Tip: To reduce the total cost of borrowing, pay off the debt with the highest interest rate first, then move to the next highest rate.

Let’s understand this with an example:

| Example of Avalanche Method: Suppose you have three credit cards where you have to pay APR of 20%, 17%, and 12%. When you choose the Avalanche Method, you will first pay off the card balance with the 20% APR. Then, you have to move on to the next credit card with the 17% APR and finally pay off the credit card with the 12% APR. |

- Credit Card Debt Consolidation

If you think the Avalanche and Snowball methods are not working for you, consider a credit card debt consolidation option to pay off the bills on each credit card.

Credit card debt consolidation is an option where you can merge all your credit debt into one single debt and pay a single EMI without following any strategy.

For example, you can merge your personal loans and balance transfer credit cards. This allows you to combine your credit card balances into a single balance, and you have to pay one monthly EMI payment.

It helps you keep track of your bills, and it also reduces your interest payments. However, it’s important to note that debt consolidation can affect your credit score, as debt settlement involves closing multiple credit card accounts and opening a new one. This impact may be temporary, but it’s something to consider when choosing this strategy.

Choosing a balance transfer cards that offer an intro 0% APR for up to two years, but after ward, you could be hit with interest rates that are just as high or even higher than your current cards charge.

Tip: Combine all your debts into one with a lower interest rate or a 0% intro APR balance transfer card to simplify payments and save on interest.

Let’s understand this with an example below:

| Example of Credit Card Debt Consolidation: For instance, imagine you have three credit cards with a total debt of $10,000, and interest rates are 17%, 19%, or 24%. By consolidating this debt into a balance transfer card with a 0% introductory APR for 18 months, you can simplify payments into one monthly EMI and save on interest during the promo period. However, be prepared for higher rates once the promotional term ends. |

- Negotiate Interest Rates with Your Lenders

This is a general opinion that you have to pay the same interest rates, whatever was fixed with your lender in the beginning. But that’s not the case.

You can check with your lender to decide on lower interest rates and make payment plans that fit your budget.

Have an honest conversation with your lender about your financial situation and tell them about your payment plans. If you make sure, you will make every effort to pay the bills that you owe. You can get some help from them to lower interest rates for your credit card bills.

Tip: Call your credit card company to request a lower interest rate or discuss better repayment terms tailored to your financial situation.

- Pay More than the Minimum Payment

One of the fastest ways to pay off credit card debt is to make extra payments each month, even when you can make a small difference.

The role of minimum payments on revolving credit cards is that they cover a very tiny fraction of the principal amount, and it takes more billing cycles to pay off the whole credit card debt.

Tip: If you make larger payments, you will pay more money towards the principal, and less interest will be added to your loan balance each month.

This is easier to understand with an example:

| Suppose your credit card has a $5,000 balance, a 20% APR, and a minimum monthly payment of $100. If you only pay the minimum, most of it goes toward interest, and it could take over 20 years to clear the debt, costing thousands in interest. However, if you pay $200 each month instead of $100, you reduce the principal faster, shorten the repayment period, and save significantly on interest charges. Even small efforts or making a bit extra payments can make a big difference over time. |

- Credit Card Debt Settlement / Restructuring

Lenders and credit card companies might agree for small repayment amounts, assuming it’s better to receive a part of the repayment than none at all. However, debt settlement has its own risk factors.

While debt settlement can help reduce the overall debt, it often negatively impacts a borrower’s credit score, making it more difficult and expensive to obtain credit in the future. Many creditors also need to refrain from engaging with debt settlement companies, limiting the effectiveness of this strategy.

Typically, debt settlement takes 3-5 years to negotiate and resolve debts ranging from $10,000 to $15,000. Before pursuing this option, it’s important to weigh the potential savings against the long-term impact on creditworthiness.

Tip: If you are overwhelmed, negotiate with creditors to settle debts for less than you owe. Be aware that this can hurt your credit score.

Tips for Paying Off Credit Card Debt Faster

Struggling with high-interest credit card debt? Consolidation, smart budgeting, and income boosts can help you regain control. Explore practical strategies to simplify payments and reduce financial stress.

Consolidate or Transfer Your Credit Card Debt

Consider consolidating your high-interest bills into one with a lower interest rate through a debt consolidation program.You can use a low-interest personal loan from a bank, credit union, or reputable peer-to-peer lender to reduce your credit card bill and simplify multiple payments. Alternatively, look for a balance transfer card with a low or zero introductory rate and transfer your other card balances to it.

Here are two common ways to consolidate debt:

- Transfer Balances: Utilize a low balance transfer rate to shift debt from high-interest credit cards. While fees typically range from 3% to 5% of the balance you transfer, the savings from the reduced interest rate can often outweigh the transfer fee. Be sure to consider this when evaluating your options.

- Tap into your Home Equity: If you have equity in your home, you might be able to use it to pay down credit card debt. A home equity line of credit may offer a lower interest rate than what your credit cards charge. However, be aware that closing costs may apply. If you choose to consolidate your debt, it’s essential to manage your spending to avoid accumulating new debt in addition to what you’ve just consolidated.

Increase Your Income

To pay off your debts faster, start looking for a side jobs that will help you earn more money:

- Consider getting a second job.

- Take on additional hours at your current job.

- Sell personal belongings that you no longer use or need.

- Request a raise from your current employer.

- Start a side business based on your skills and expertise.

- Search for temporary or odd jobs, such as handyman services, babysitting, or yard work, on job boards.

Snowball Method for Debt Management

The snowball method involves paying off the credit card with the smallest balance first. Once you’ve fully repaid that balance, you take the amount you were paying towards that debt and apply it to the next smallest balance.

Although this method may take more time and money, it offers psychological benefits. Paying off your first card can give you a sense of accomplishment that motivates you to tackle the next one.

Learn to Keep your Credit Card Bills Low, Do Frugal Shopping

| Avoid Impulse Buying | Review Bills | Use Credit Wisely | Cut Luxuries | Find Grocery Deals | Create a Budget |

|---|---|---|---|---|---|

| Stick to your shopping list and pay with cash instead of credit. | Look for savings on cable, internet, and insurance. | Avoid charging items you can’t pay off within three months. | Make coffee at home instead of buying expensive drinks, and ignore triggers for unnecessary spending. | Use coupons and wait for sales, and consider buying store brands. | Track your monthly income and expenses, and consider using a budgeting app. |

Pay Your Credit Card Bills on Time

Paying on time helps you avoid late fees and other charges. If you pay your entire balance on time, you won’t be hit with high interest charges. The fine print in your credit card agreement provides the issuer with plenty of reasons to complicate your financial situation if you miss a payment. Eventually, this will be reflected in your credit reports from the three major credit bureaus: TransUnion, Equifax, and Experian.

Impact of Credit Card Debt on Your Credit Score

Credit scoring models such as Vantage Score® and FICO® analyze your credit score to determine how effectively you are managing your credit.

These credit scoring models consider many factors when deciding your credit score:

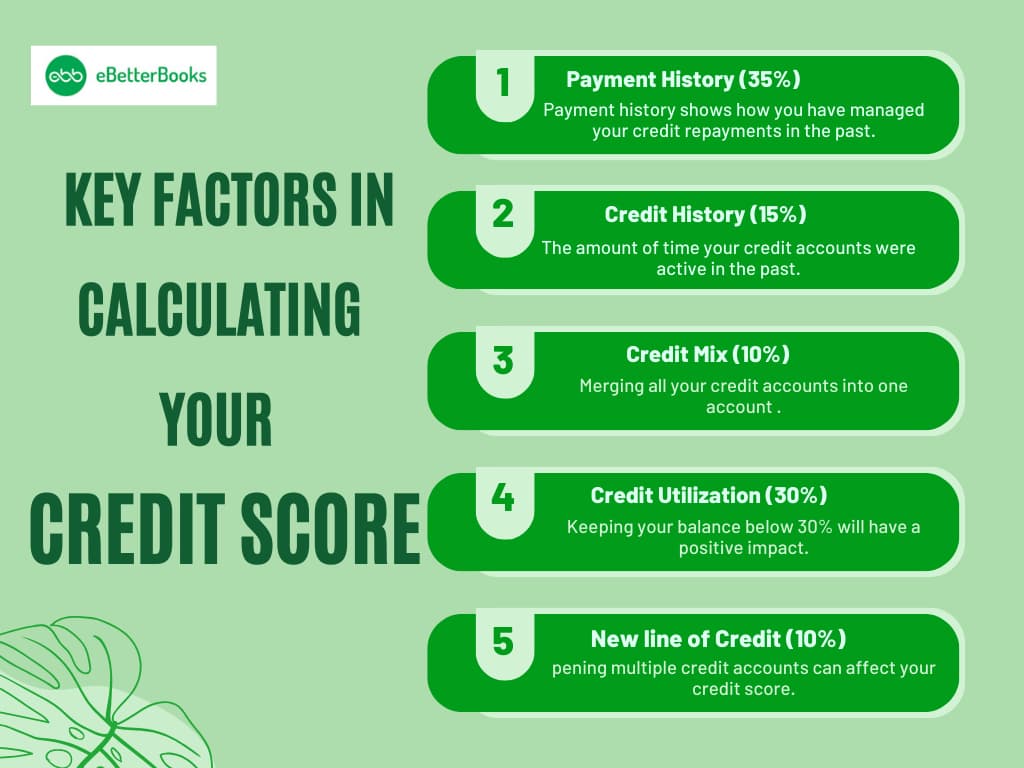

Key Factors in Calculating Your Credit Score

When your credit score is calculated, these factors can simply play major roles;

- Payment History (35%): payment history shows how you have managed your credit repayments in the past.

- Length of Credit History (15%): The amount of time your credit accounts were active in the past; a longer time can positively impact your credit.

- Credit Mix (10%): Merging all your credit accounts into one account will be considered when your credit score is calculated.

- Credit Utilization (30%): Keeping your balance below 30% will have a positive impact on your credit score.

- New line of Credit (10%): Opening multiple credit accounts can affect your credit score.

How Credit Card Debt is Impacting Your Credit Score

Your credit card debt is not just impacting your current financial situation; it is impacting your credit score, too:

- Credit Utilization Ration: If you have a high balance against your credit limit, your credit utilization ratio will be increased. A high credit utilization rate will suggest that you are too dependent on your credit and use it excessively. This can make you wary of lending more money.

- Credit History: If you make late payments or miss payments on your credit card for just a few days, it will badly impact your credit. Missing payments can lead to interest charges, fines, and a negative impact on your credit.

- Interest Rates and Debt Accumulation: High interest rates can make it harder to pay the principal amount by which the credit balance increases.

When your credit card balance grows, your debt-to-income ratio increases, which makes you a high-risk borrower and impacts your credit.

- Closing Your Credit Card Accounts: If you pay off your credit card bills, you may wish to close your account, too, especially when you don’t need it.

Closing your account can reduce your total available credit, increasing your credit utilization ratio and lowering your credit score.

- Debt Settlement and Charge-Offs: If you are financially unable to pay your debt, you may ask for a credit card debt settlement from your lender. This action will be reported to credit bureaus and will impact your credit score.

Benefits of Paying Your Credit Card Bill Faster

Paying your credit card debt not only helps to achieve a debt-free future but also helps you gain more credit card opportunities in the future:

- Unlock More Credit Card Opportunities

The faster you pay off your credit card debt, the sooner your debt-to-income ratio will improve by boosting your credit score. Not only will you qualify for lower interest rates in the future, but you may also be eligible for a wider range of loans, including larger loans, making it easier to achieve financial goals such as purchasing a home or a car.

- Free up Your Line of Credit

Try to maintain all of your card balances to 50% or less of your overall limit. This helps to boost your capability. A healthy capacity improves your credit score. The average spending limit of card balances is approximately 30%, which is good in the long run. This helps you to achieve more credit opportunities in the future and brings more flexibility to your finances.

- Reduce Debt Interest Charges

If you do not pay your credit card in full the next month, you will be charged interest per day based on your daily balance. If you pay a portion (or all) of your bill early, you will have a lower average daily balance and reduced interest payments. Check your credit card rates regularly, as credit unions often offer more competitive rates, helping you save money.

- Faster Debt Repayment

Limiting your interest payments increases the amount of money you have available to pay off your loan balance. Additionally, consider where your money is going. The identical dollar you spent to pay off your bills may have been used to increase them.

By curbing unnecessary interest spending, you can accelerate repayment, allowing you to clear your balance sooner and retain more financial control.

Take the Next Step Towards Your Credit Card Debt Payment Process

Now that you have analyzed all the proven strategies to pay off credit card debt, it is high time to create a good plan and make it happen! Paying off your credit card debt is an amazing way to plan for your finances in the long run, and it’s completely doable.

All it takes is your commitment and dedication, and a focus on why you’re doing it. If you begin to feel overwhelmed due to the financial crisis, you can take the help of a financial professional who can help you devise a proper plan to achieve your financial goals.

Best Strategies for Managing Credit Card Debt

The best strategies for managing credit card debt include:

- Create a Budget: A budget is essential for meeting financial obligations and achieving goals like debt reduction. To create one, list your income sources and all monthly expenses, including fixed costs like rent and utilities, as well as discretionary spending.

- Pay More than the Minimum: Credit card issuers usually set a monthly minimum payment, often around 2% of your balance. However, it’s important to remember that banks earn money from the interest charged on unpaid balances. By paying more than the minimum amount required, you will reduce your debt more quickly and save on interest costs.

- Maintain a Low Credit Utilization Ratio: Try to pay your credit card balance in full each month. However, if that’s not feasible, aim to maintain a low utilization ratio. Your credit utilization ratio is the percentage of your total credit limit that you’re using. To help keep this ratio low, consider spreading your spending across multiple credit cards.

- Automate your Payments: Automating your payments is a simple way to ensure your debts are paid on time, helping you avoid additional costs. As you manage this process, you’ll be more effective in maintaining financial control and sticking to a monthly budget.

- Balance Transfer: If you have a credit card with 15% interest, consider transferring that balance to a card with a 0% interest rate. This can help you pay off your debt faster.

- Request Rate Reductions: It might seem unusual to call your credit card company to request a lower interest rate, but sometimes this strategy can be effective. Many credit cards come with high interest rates. However, if you make your payments on time, they can be a helpful tool for improving your credit rating.

Step-by-Step Credit Card Debt Reduction Plans

Here is a step by step credit card reduction plant which you can use to reduce your debt:

Step 1. Contact your Credit Card Company

The moment you realize that you will not be able to make the payment on time, contact your credit card company immediately and explain your situation to them. Informing your credit card provider can help you avoid issues and manage your finances. They may offer a payment plan that fits your budget, adjust your payment due date, or allow you to negotiate a lower annual percentage rate (APR) on your balance.

Step 2. Try a Debt Management Program or Credit Counselling

You can also seek help from non-profit credit counselling agencies or debt management programs for budgeting support. These programs can help you manage your credit card debt by providing lower payments and interest rates until your accounts are paid off.

Step 3. Transfer your Balances to a 0% intro APR Credit Card

To get benefit from a 0% introductory APR credit card, you typically need a credit score of at least 670. Transferring your credit card debt to such a card can save you money, but it may not be a good option if you’re struggling to make your current payments, as you’ll still need to pay on the new card during the intro period.

If you can’t get approved for a 0% intro APR card and have multiple balances, consider a debt consolidation loan. This allows you to manage a single payment, potentially at a lower interest rate, even though your debt will still accrue interest.

Step 4. Stick to the Debt Repayment Method

Analyse your debt and decide which repayment strategy is right for you.

- Snowball Method: Always pay off the smallest debt in full while only making minimum payments on other larger credit debts. Once the minimum amount on the smallest debt is paid, they should move to the next smallest debt and so on, forming a snowball effect.

- Avalanche Method: Always pay the debts that have higher interest while making minimum payments on lower-interest debts. This method reduces the amount of interest that can be charged over a period of time.

What Are the Risks of Ignoring Credit Card Debt?

The risks associated with ignoring credit card debt are:

1. Account Sent to Collections

Around 180 days, the credit card issuer may charge off your account, assuming it won’t receive payment. A charge-off doesn’t cancel your debt; the issuer can send it to a collection agency, which will try to collect it. By then, late fees and interest may have raised your balance significantly.

2. Late Fees

Your credit card issuer may charge a late fee if your payment is just one day late. As of March 2024, the Consumer Financial Protection Bureau (CFPB) has set a cap on credit card late fees at $8; however, this ruling is currently entangled in legal issues.

At this time, the specific amount of the late fee can vary based on the terms of your credit card. Some cards may not impose a late fee at all or may waive the fee for the first late payment. Others may charge up to $30 for the initial late payment and up to $41 for any subsequent late payments made within six billing cycles.

3. Damaged Credit Score

A card issuer can report your late payment to the credit bureaus – Experian, TransUnion, and Equifax, once your account is 30 days past due. Late payments can remain on your credit report for up to seven years and can affect your credit scores throughout that entire period.

4. Legal Action Against You

If you ignore your payment of the past -due credit card balance, creditors may take legal action by filing a summons and complaint in civil court. Failing to respond could lead to a default judgment, allowing creditors to seize bank funds, or place liens on your property. These actions can persist for years.

Declaring bankruptcy is often the only way to permanently eliminate such judgments. Even if you avoid a judgment by appearing in court, the legal process can be stressful and costly due to accumulating court fees.

5. High Penalty APR

If you miss a payment, your standard APR may be replaced by a higher penalty APR. This higher rate initially applies only to new purchases, but if you are over 60 days late, it can also affect your current balance.

The penalty APR compounds daily, quickly increasing your debt. To revert to your standard APR, ensure your account is current and consistently make on-time payments for at least the minimum amount due.

Can Budgeting Apps Help Manage Credit Card Debt?

Yes, Budgeting Apps can help you in managing your credit card debts by tracking your expenditure, analysing your spending habits and financial goals.

These apps get easily linked with your accounts and identify areas where you can cut costs and redirect funds toward paying off credit cards. Features like payment reminders help prevent missed due dates, avoiding late fees and interest charges.

Some apps, such as Tally and YNAB, offer debt payoff strategies like the snowball and avalanche methods, which assist users in creating structured repayment plans.These budgeting apps provide insights into spending habits, automate savings, and even track credit scores, making them valuable tools for maintaining financial discipline and efficiently reducing credit card debt.

Credit Card Debt Management for Low-Income Households

Managing credit card debt on a low income can be challenging. However, you can still clear your debts by creating a budget using apps like Mint or YNAB to track income and expenses while cutting unnecessary costs and designating a fixed amount for repayment.

You can prioritize debts by using the Snowball Method for quick wins or the Avalanche Method for reducing interest payments.

Avoid new debt by not using credit cards during repayment and building a small emergency fund. With discipline and planning, low-income households can effectively manage and eliminate credit card debt.

Learn to Remain Debt-Free While Using your Credit Card

Remain debt-free on your credit card, follow the financial management plan given below:

1. If you Already Have Debt then Prioritize Debt Repayment

Individual who already have debt, financial management helps with:

- Avoiding late fees and high-interest charges by making timely payments.

- Choosing a repayment strategy (Snowball or Avalanche method).

- Consolidating debt to reduce interest rates.

2. Make a Budget and then Spend

In addition to financial control, budgeting will help the spenders to:

- Distribute funds for necessities, savings, and discretionary spending.

- Monitor their income and expenses.

- Identify areas where spending can be trimmed to avoid debt.

- You can also use budgeting apps to automate tracking.

3. Always Keep an Emergency Fund to Avoid Debt

You should save enough to cover 3 to 6 months’ worth of living expenses or start small by regularly setting aside a percentage of your income. These funds should be enough to cover unforeseen events like medical expenses, forced relocation, etc.

4. Use Credit Card to your Advantage and Follow these Steps

- Paying credit card balances in full each month.

- Monitoring credit reports to guard against identity theft and fraud.

- Keeping credit utilization under 30%.

Conclusion

Managing credit card debt effectively requires proactive communication and planning. So, to reduce your credit debt faster, maintain a budget, prioritize high-interest debts, increase your income, transfer your balance, and go for debt management programs. By staying informed and taking action, you can work towards a debt -free future.

Frequently Asked Questions

What is credit card debt management?

Credit card debt management is the process of evaluating your debt and clearing some of it with financial budgeting and planning. It involves some programs and strategies that help in clearing credit card debt, such as paying on time, creating a budget, maintaining a low credit utilization ratio, and more.

How can I create a plan to pay off my credit card debt?

In order to create a plan to pay off your credit card debt, you should begin with:

- Write down how much you owe to every creditor.

- Start by cleating the debt of creditors with a high interest rate and making the minimum payment with the rest.

- If you get any cash gift, work bonus, or other unexpected money, then use it to pay off your debts.

How can balance transfers help with debt management?

Balance transfers help manage debt by consolidating it, reducing interest rates, and enabling focus on paying down the principal balance. This is how one can save money and also accelerate debt repayment.