A credit card balance transfer involves moving out your multiple credit card debts with high interest rates to one credit card with 0% introductory APR.

This strategy can help you save money and pay off debt faster — if you’re careful about details like fees, interest rates, and restrictions on transfer amounts. By consolidating debt onto a single card and making timely payments, you can effectively reduce financial strain and focus on clearing your balance.

Key Takeaways

A balance transfer credit card lets you move debt from one card to another with a lower or 0% introductory APR, helping reduce interest costs.

Review your current balances and interest rates before choosing a balance transfer card to ensure it meets your financial needs.

Most balance transfer cards charge a fee, typically 3%-5% of the transferred amount, which is added to your new balance.

The 0% APR period is temporary, so paying off the balance within this time is essential to avoid high interest rates later.

What is a Balance Transfer?

A balance transfer is when you move out your outstanding debt from a high-interest credit card to a lower one, especially with 0% introductory APR. Transferring your credit card balance from a high APR (annual percentage rate) to a low APR (annual percentage rate) can save you money that you will pay on interest.

Balance transfers are commonly employed by individuals who want to transfer the amount they owe on a credit card to one with a much lower promotional interest rate. This is typically accomplished by creating a new credit card account to conduct the purchase.

For example, transferring your debt to a credit card with a zero percent introductory APR offer on balance transfers is one option that could help you reduce or pay off your debt interest-free for the introductory term.

A lender may charge a borrower for transferring existing debt from another institution. The balance transfer charge may be a percentage of the total amount transferred by the debtor. Many lenders may provide no fees or a low balance transfer cost as an introductory offer to new customers.

Example of Balance Transfer Credit Card

| Let’s understand this with an example below:Imagine you have $8,000 in debt spread across two credit cards, one with an 18% APR and another with 22%. You transfer the $8,000 balance to a new credit card offering 0% APR for 18 months with a 3% balance transfer fee. The transfer fee adds $240 to your balance, bringing the total to $8,240. Over 18 months, you pay $458 per month to clear the balance before the 0% APR period ends. If you don’t pay it off in time, interest will start accruing at a much higher rate. This helps reduce interest and makes it easier to manage your debt. |

Key Features of a Balance Transfer Credit Card

A balance transfer credit card is not a debt relief tool. Balance transfers are often subject to fees, and you will most likely be required to pay interest on the balance transferred.

Here are the key features of a balance transfer credit card:

- Introductory APR: The intro APR (annual percentage rate) on balance transfer credit cards is usually low; many have a 0% intro APR. However, this low or 0% intro APR is only applicable for a temporary period, and then the user has to pay an APR decided by the credit card company. The length of the APR period can range from 6 months to 21%, and the credit card issuer or lender company can decide this.

- Ongoing APR Interest: If you transfer debt and are still carrying a balance when the 0% intro APR period expires, you must begin paying interest on the remaining balance. To avoid this, plan to pay off your credit card amount during the no-interest promotional time.

- Transfer Restrictions: The limit of your transfer balance credit card can vary from one lender to another. When you choose a balance transfer credit card, always check the transfer limit of that credit card. Watch your debt, too. If you can transfer the whole amount from the same credit company, that would be good for you.

- Balance Transfer Fee: Many credit card companies charge balance transfer fees. If you are looking for a balance transfer credit card, then what transfer fee is being charged? Most of the time, these balance transfer credit card companies charge a 3%-5% transfer fee that would be added to your balance amount.

- Credit Limit: Every balance transfer credit card has a set limit; always check what limit your credit card issuer provides. It is important to check the credit limit to see whether the credit card lender is covering the full amount of your debt. Always ensure that the balance transfer credit card covers the full amount of your balance.

- Debt Consolidation: The balance transfer credit card is the best way to consolidate your credit card debt. You can move your one loan or other loan debt balance into one account with low interest and a zero percent interest fee.

- Credit Score Impact: If you apply for a balance transfer credit card, your credit score may be affected if it starts impacting your credit utilization ratio and debt-income ratio.

How Does a Balance Transfer Credit Card Work?

Let’s understand how a balance transfer credit card works:

A balance transfer allows you to transfer an unpaid debt from one or more credit cards to a new credit card by paying the outstanding sums with paper checks, online banking, or a mobile app.

You can transfer a balance to a credit card with an introductory annual percentage rate (APR) and make on-time payments. You can pay off your debt with little to no interest if you pay it off before the introductory period ends.

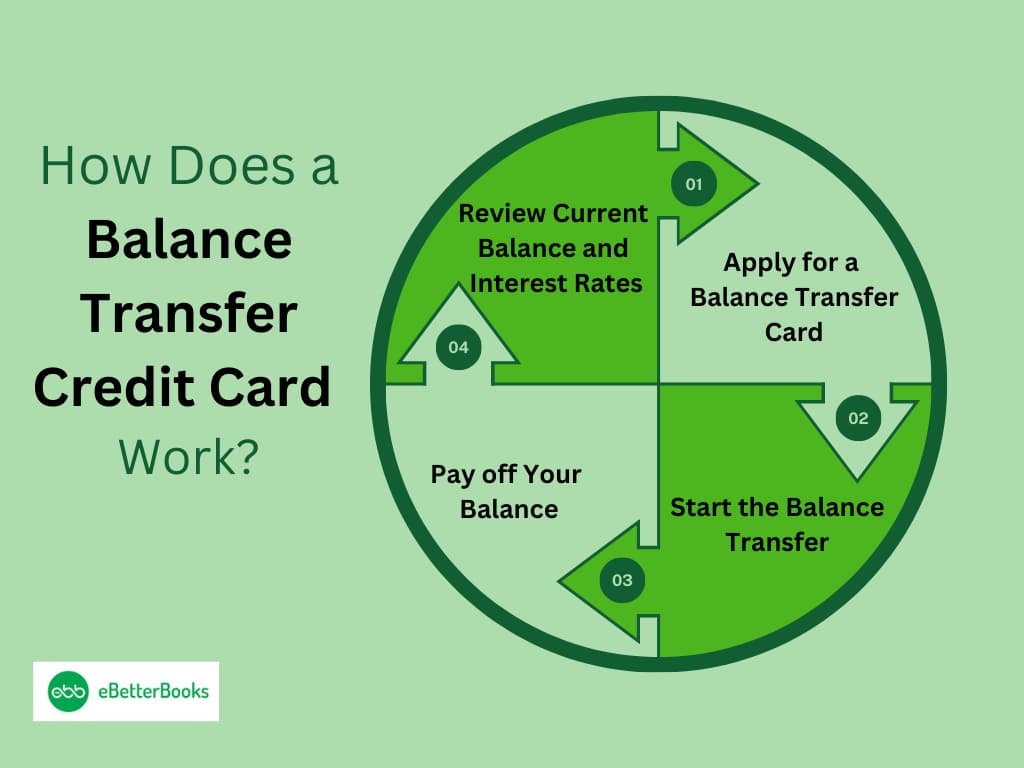

Here is how the balance transfer credit card works for you:

- Review Current Balance and Interest Rates

Before you begin a balance transfer, you should assess your current financial status. Analyze your credit card balances and interest rates to choose your next step. You’ll want to select a card that accepts the amount you want to transfer and has a lower interest rate than your existing one.

- Apply for a Balance Transfer Card

It’s important to select a balance transfer card that meets your financial requirements. You may be interested in a card that offers a 0% introductory APR on balance transfers. Ensure that the credit card has enough limits to cover your debt, and then check the balance transfer fee. It can vary from one credit card issuer to another (usually, the rates are 3% to 5% interest rate).

- Start the Balance Transfer

Whether you’re doing it online or by phone, you’ll need to submit information to complete the transfer. This comprises the issuer’s name, the amount of debt remaining to be paid off, and account information. Some balance transfers can also be initiated with convenience checks, which allow you to make payments to a specific person or organization and are charged to your credit account.

- Pay off Your Balance

Wait for the transfer to go through. A credit card provider may take many days, or even weeks, to approve your balance transfer. Until the transfer is complete, you should continue to make payments using your old card.

Once the balance transfer has been approved, the issuer will typically pay off your old account directly, and that old balance, plus the balance transfer fee, will show up in your new account. After the balance transfer is approved, the issuer will usually pay off your old account directly, and the old balance, plus the balance transfer fee, will appear in your new account.

Pros and Cons of Using a Balance Transfer Credit Card

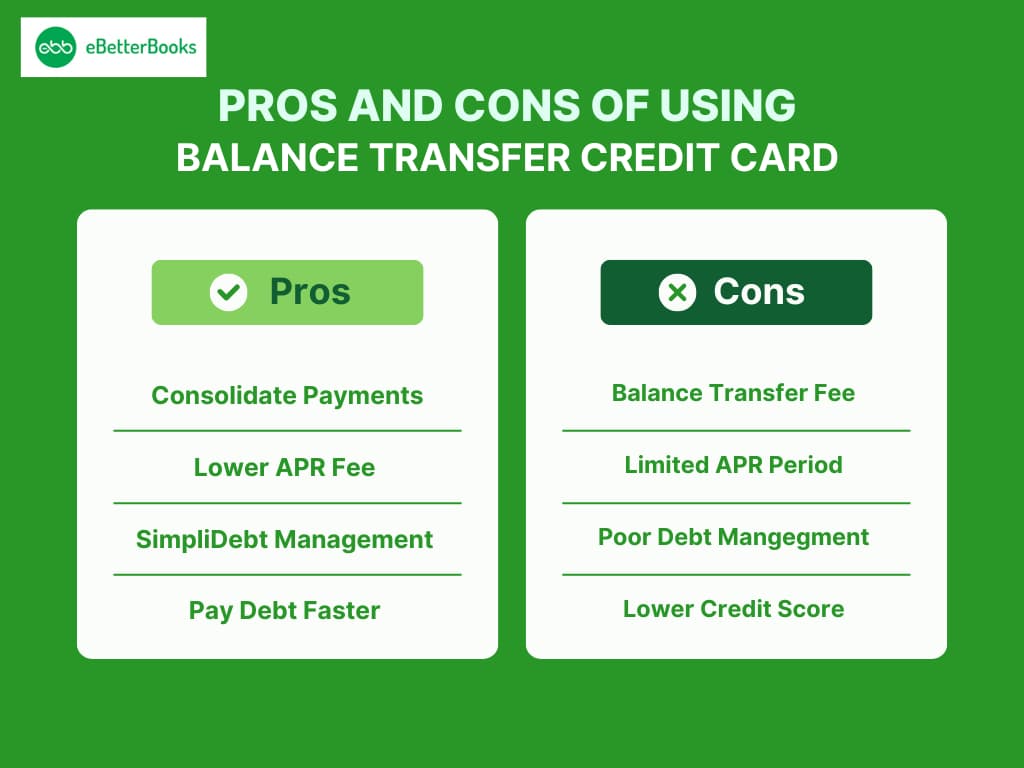

Pros of Balance Transfer Credit Card

Here are the benefits of using a balance transfer credit card:

- Consolidate Payments

You can combine various credit card accounts by moving them to a balance transfer card. When you consolidate your credit card debt onto one card, you can concentrate on one payment with a single due date rather than making several payments each month and keeping track of multiple deadlines. This can make it easy to track your payments.

- Lower APR Fee

A significant advantage of performing a balance transfer is the ability to save money on interest. Credit cards with APRs of 28% or higher are typical.

Some balance transfer cards provide an introductory 0% APR for a predetermined period of time. That way, the money you put towards your debt isn’t just eaten up by interest but is also used to pay down the principal balance.

- Simplify Debt Management

You may feel trapped with your current credit cards, which have high interest rates and terms that provide you with little value as a cardholder. Depending on the credit card you are approved for, you can transfer your debt to one with a lower interest rate and better terms.

You could find a balance transfer card that provides rewards. However, you should wait until your transferred balance is paid off before taking on additional credit card debt.

- Potentials of Paying Debt Faster

A balance transfer credit card helps you pay your debt faster. Yes, this is true. If you apply for a balance transfer credit card, you may choose a 0% intro APR and lower interest rate compared to your previous credit card.

Paying a single EMI with a low interest rate and 0% APR motivates you to pay your loan faster as you focus on paying the principal amount more.

Cons of Balance Transfer Credit Card

Here are the cons of balance transfer credit card:

- Balance Transfer Fee

Most good things are not free, including balance transfers. Many debt transfer credit cards carry a fee of 3% to 5% of the transferred amount, with a minimum fee of $5 to $10. Let’s say you transfer $5,000 with a 3% balance transfer fee. You’ll pay a $150 fee simply to complete the transaction. Consider the additional fee before transferring your amount to ensure you are still saving money.

- Limitation on 0% Introductory Period

Balance transfer cards may offer a 0% intro APR for a set period. The promotional term varies with each card, but you’ll find balance transfer cards with intro APR rates ranging from six to 21 months.

That implies that if you’re using this card to pay off debt, you should be informed of when the promotional period expires and what the APR will be after that. This temporary period of 0% will be over, and you will have to pay the APR amount later on.

- Poor Debt Management

If you’re considering a balance transfer, you’re probably hoping to reduce your debt and save money on interest. However, if you still need to address the cause of the problem, adding another credit card could easily lead to additional debt.

If you don’t have a plan, you could end up accumulating even more debt with your new credit card. Worse, you may not pay off your existing debt during the promotional period, resulting in simply shifting your debt around without saving any money.

- Lower Credit Score

Transferring your credit card debt into a credit card may lower the interest rates and give you a promotional time period of intro APR with 0% interest rates, but it may also hurt your credit score. However, if you make on-time payments and complete the full loan amount in the given time period, it will positively grow your credit.

Top Balance Transfer Credit Cards of 2024

Here are some of the popular balance transfer credit cards with APR, balance transfer fee, and other perks:

| Credit Card | 0% APR on Balance Transfer | Balance Transfer Fee | Introductory Period | Other Perks |

| Chase Slate® Card | 0% APR | No annual fee for the first 60 days | 15 months | 1. No annual fee 2. Access to Chase Credit journey tools |

| Citi® Double Cash Card | 0% APR | 3% (for the first 4 months) | 18 months | 1. 2% unlimited cash back on every purchase |

| Discover it® Balance Transfer | 0% APR | 3% | 18 months | 1. 5% cash back in rotating categories |

| BankAmericard® Credit Card | 0% APR | 3% (for the first 60 days) | 18 billing cycles | 1. No annual fee 2. Tools to track and manage balance |

| Wells Fargo Reflect® Card | 0% APR | 3% | 18 months (possibility of 3 more months) | 1. No annual fee2. Flexible date payment option |

| U.S. Bank Visa® Platinum Card | 0% | 3% | 18 billing cycles | 1. No annual fee 2. Access to purchase protection |

| Barclaycard Ring® Mastercard® | 0% | 3% | 15 months | 1. No annual fee2. Low ongoing APR |

How to Apply for a Balance Transfer Credit Card?

You can apply for a balance transfer credit card online in just a few minutes. Some cards allow you to begin the process of transferring balances as part of your application. In this situation, the balance transfer credit card application will ask for your credit card account number and the sums you intend to transfer to your new card.

When you apply for a new balance transfer card, you usually find out right away if you’ve been authorized. If you were not told of your acceptance when you submitted your application, you may need to wait for an email from the credit card provider. Learning that your card application is “pending” or “under review” can be nerve-racking, but be patient — in most circumstances, you’ll hear back from your credit provider within a few days.

Steps to Apply for a Balance Transfer Credit Card

Here are the steps to apply for a balance transfer credit card:

- Access Your Debt

| Identify the total debt amount and current interest rates to determine if a balance transfer will save you money. |

- Research and Compare Cards

| Look for balance transfer cards with 0% intro APR, low transfer fees (ideally 3% or less), and no annual fees. |

- Check Eligibility

| Review the card issuer’s credit score requirements and ensure your credit score meets the criteria. |

- Gather Required Documents

| Prepare personal and financial information, including income details and existing credit card statements. |

- Submit Your Application

| Apply online through the card issuer’s website, filling out all necessary fields accurately. |

- Request the Balance Transfer

| After approval, initiate the transfer by providing the old card details and the amount to be transferred. |

- Wait for Approval and Processing

| Balance transfers typically take 7–14 business days. During this time, you should continue making payments on your old card. |

- Start Using the New Card Responsibly

| Avoid new purchases and focus on repaying the transferred balance within the 0% APR period. |

The Bottom Line

Under the correct circumstances, a balance transfer can result in significant savings. Paying down a loan at 0% APR might be a significant step towards independence from debt. It is critical, however, to ensure that you qualify not only based on your credit history but also that your specific combination of debts, interest rates, and potential fees makes the process financially viable.