Introduction:

If you have bad credit, you can apply for a secured credit card, sponsored card, cards that help build credit score, supplementary card, etc. Ensure you meet key criteria like income stability and low existing debt to increase your chances of approval.

While traditional credit cards may be out of reach, there are specialized options, like secured cards and credit-building cards, designed for individuals with bad credit.

By understanding what lenders look for, such as income stability, debt-to-income ratio, and credit history, you can take proactive steps to improve your chances of approval.

With the right strategy, you can begin rebuilding your credit and regain financial flexibility.

Some Credit Card Companies Offering Credit Cards for Bad Credit

Many credit card companies/ issuers do provide credit cards for people with bad credit or no credit history:

| Capital One | Citi | Chase | Wells Fargo | American Express |

|---|---|---|---|---|

| Capital One Platinum Credit Card | Citi® Secured MasterCard® | Chase Freedom® Student Credit Card | Wells Fargo Business Secured Credit Card | Amex EveryDay® Credit Card |

| Capital One Secured MasterCard® | Citi Rewards+® Student Card | – | – | American Express Serve® (Prepaid Card) |

Learn to Choose the Right Card With The Low Credit Score

Choosing the right credit card with a low credit score can be a critical step toward rebuilding your financial health.

Here are some essential tips to guide you through selecting the right card:

Research Available Options

Look for Specific Card Types

When you have a bad credit score it becomes important for you to look for the card options which are designed for individuals with poor credit histories. These typically include secured credit cards and student credit cards. Secured cards usually require a cash deposit that serves as your credit limit while student cards are designed for those who are new to credit.

Compare Terms, Fees, and Benefits

Before applying for any card you should compare the terms, fees, and benefits that are associated with each option.

Look for features such as:

- No Annual Fees: Many cards designed for low credit scores do not charge annual fees which can help you to save money.

- Low-Interest Rates: Since interest rates can be higher for those with lower scores, it becomes crucial for you to find a card with competitive rates.

- Rewards Programs: Some cards may offer rewards or cashback on purchases which can be helpful if used responsibly.

Ensure Reporting to Credit Bureaus

Choose Cards That Report to Major Bureaus

It’s important to select credit cards that report your payment history to all three major credit bureaus: Experian, Equifax, and TransUnion. This reporting is crucial as it helps you to build your credit profile over time. Regularizing your on-time payments can positively impact your credit score and make it easier for you to qualify for better cards in the future.

Some Additional Considerations

- Check Eligibility Requirements: Each card will have specific eligibility criteria based on your credit score and history. Make sure that you meet these requirements before applying to avoid unnecessary hard inquiries on your credit report.

- Understand Fees and Penalties: You should be aware of any potential fees associated with the card for which you are applying, such as foreign transaction fees or late payment fees. Understanding these can help you avoid surprises later on.

- Utilize Credit Building Resources: Some cards offer various features to the individuals such as credit monitoring and financial education resources which can help you manage your finances better and improve your score over time.

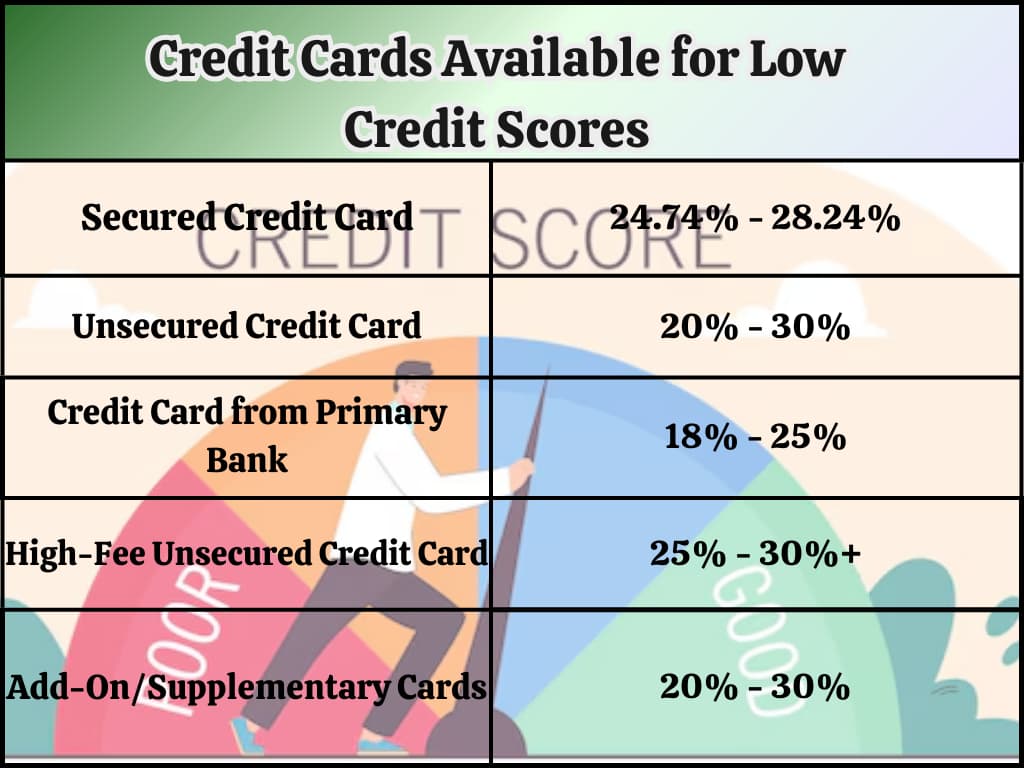

Credit Cards Available for Low Credit Scores

For individuals with low credit scores, secured credit cards and credit-builder cards are the most accessible options. Secured cards require a deposit that acts as your credit limit, while credit-builder cards are designed to help you rebuild credit over time. Some cards may offer rewards or low fees, making them a good choice for responsible use. It’s important to compare the terms and ensure the card reports to all three major credit bureaus to help improve your score.

| Type of Credit Card | Description | Eligibility | Benefits |

|---|---|---|---|

| Secured Credit Card | Requires collateral, typically a fixed deposit which serves as security for the credit limit. | Individuals with low credit scores | Helps build credit history; the credit limit is usually 80-90% of the deposit value. |

| Unsecured Credit Card | It does not require any collateral but comes with higher interest rates and fees. | Individuals with poor credit scores | Opportunity to demonstrate responsible use and improve creditworthiness. |

| Credit Card from Primary Bank | Offered by your own bank often with lenient approval criteria based on existing relationships. | Long-term customers or those with no score | Easier approval; potentially lower fees and interest rates. |

| High-Fee Unsecured Credit Card | No collateral is required but comes with high maintenance fees and interest rates. | Individuals in urgent need of credit | Provides a chance to build credit if managed responsibly. |

| Add-On/Supplementary Cards | Issued under a primary cardholder’s account, may be easier to obtain if the primary holder has good credit. | Family members or spouses of good credit holders | Allows access to credit while building one’s own score through responsible use. |

Interest Rates of the Available Credit Card Options

When selecting a credit card with a low credit score, it’s important to compare interest rates, as they can vary significantly. Cards for individuals with poor credit often come with higher interest rates, so look for options with lower rates to minimize the cost of borrowing. Finding a card with a competitive interest rate can help you manage your debt more effectively. Following are a few of the cards that are available for low credit scores individuals:

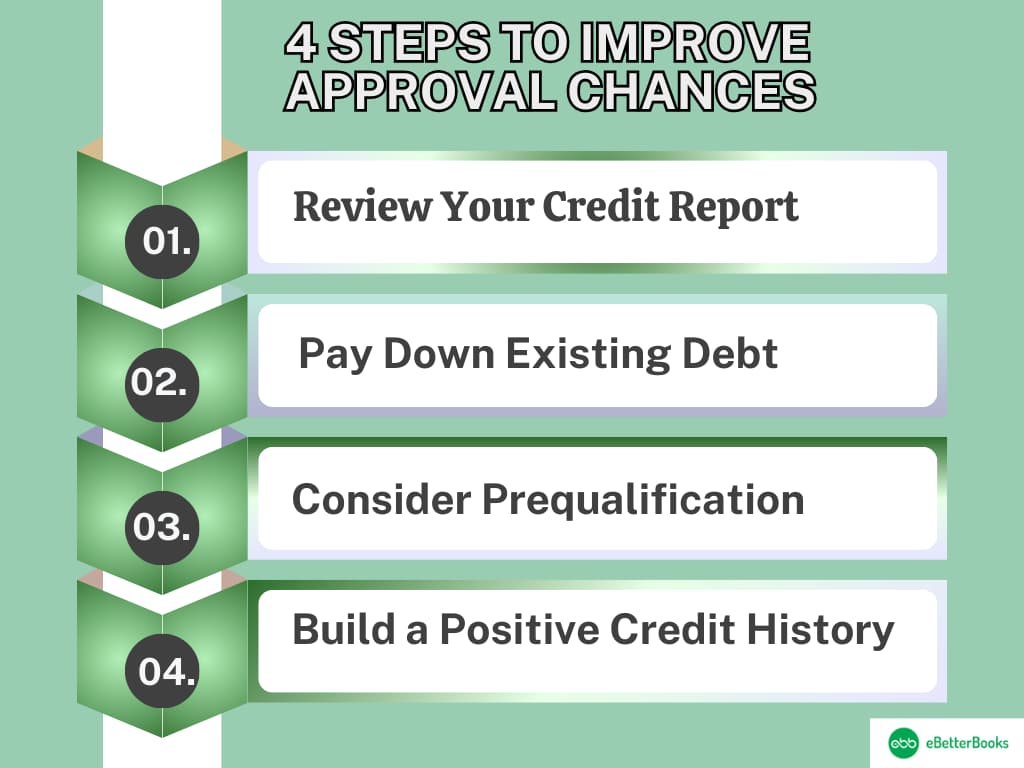

4 Steps to Improve Approval Chances

Improving your chances of getting approved for a credit card with a bad credit score can be challenging, but by taking the right steps, such as reviewing your credit report, paying down existing debt, and considering prequalification you can increase your approval likelihood. By following these steps, you can make progress toward improving your credit score and improving your likelihood of credit card approval.

Below are four essential steps to help improve your chances:

01. Review Your Credit Report

Importance of Reviewing Your Credit Report:

- Your credit report is a complete record of your credit history and is crucial in determining your creditworthiness. It includes details about your payment history, outstanding debts, and any negative marks such as bankruptcies or late payments.

- Reviewing your credit report on a regular basis will allow you to determine errors or inaccuracies that could negatively impact your score. You are allowed to one free credit report annually from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

Steps to Review:

Discuss if you find any inaccuracies, and by correcting these inaccuracies, you can improve your score and increase your chances of credit approval.

Carefully check for any unfamiliar accounts or incorrect information, such as payment histories or account statuses.

02. Pay Down Existing Debt

Why Paying Down Debt Matters:

- High levels of existing loans can significantly reduce your credit score. Around 30% of your credit score is reported by the amount you owe compared to your available credit.

- Reducing your debt load improves your score and demonstrates to potential lenders that you are managing your finances responsibly.

Strategies for Debt Reduction:

- Make consistent payments on time to avoid further penalties and negative impacts on your score.

- Create a budget to prioritize paying off high-interest debts first.

- Consider reducing debts into a lower-interest loan if possible.

03. Consider Prequalification

Benefits of Prequalification:

- Many lenders offer prequalification processes that allow you to see what cards you might qualify for without affecting your credit score. This is typically done through a soft inquiry rather than a hard inquiry which can negatively impact your score.

- Prequalification can help you identify suitable credit cards that serve specifically to individuals with bad credit.

How to Prequalify:

- Review the offers presented and choose the one that best fits your needs.

- Visit the websites of potential lenders and look for their prequalification options.

- Provide basic personal and financial information as requested.

04. Build a Positive Credit History

Importance of Building Positive Credit History:

- Establishing a positive payment history is one of the major factors in improving your credit score, accounting for about 35% of it.

- Consistently making on-time payments can gradually enhance your score making it easier to secure new lines of credit in the future.

Ways to Build Positive Credit:

- Regularly use existing accounts responsibly by keeping your balances low and paying them off in full each month.

- Consider obtaining a secured credit card, where you deposit money as collateral. This allows you to build credit while minimizing risk for the lender.

- Become an authorized user on a family member’s or friend’s account with a good payment history; this can help improve your score without requiring you to manage the account directly.

What is a Bad Credit Score?

FICO score below 580 and VantageScore below 601 are categorized as bad credit score which reflects poor creditworthiness and categorises the user into subprime credit range.

A poor credit score signifies a high risk individual for lenders which may lead to higher interest rates or secure loans with less favorable terms for the borrowers.

A poor credit score leads to challenges in applying for mortgages, auto loans, or even rental agreements, as credit score is a decision-making criterion for lenders.

FICO and Vantage scoring systems operate on a scale from 300 – 850, where lower scores reflect a higher probability of default on debts.

What Causes Bad Credit Scores?

The main contributors are Payment History, Length of Credit History, Late Payments, High Credit Utilization, Bankruptcies, or Frequent Hard Inquiries.

Understanding these factors can help you identify areas to improve to enhance your credit score over time.

Here’s a breakdown of the primary causes that negatively impact your credit score:

Payment History

Payment history is the major factor that affects the credit scores approximately about 35% of the total score. It reflects how consistently a borrower has repaid the funds on their credit accounts, such as loans and credit cards.

Timely payments indicate responsible financial behavior, while delayed payments, defaults, or accounts sent to collections are part of the major factors that severely damage your credit score.

Even if you miss a single payment it can lead to a significant drop in the score, especially if it is more than 30 days late, as these failures can remain on the credit report for up to seven years.

Length of Credit History

The length of credit history contributes about 15% to a credit score. This factor considers how long the borrower has been using credit and includes the period of their oldest account and the average period of all accounts.

A longer credit history generally suggests better financial management as it provides lenders with more data on the borrower’s repayment behavior.

Late Payments

Consistently missing payment deadlines on your loans or credit cards is one of the most significant factors that can affects your credit score negatively. Each late payment is recorded on your credit report and remains there for up to seven years which makes it a long-term liability.

High Credit Utilization

High credit utilization occurs when a borrower uses a large percentage of their available credit which gives a sign to a lender that the borrower may be overextended financially. Individuals are recommended to keep their credit utilization below 30% and if they exceed this limit it can lead to a lower credit score. This ratio of credit utilization is calculated by dividing total outstanding balances by total available credit limits.

A consistently high utilization rate indicates potential financial distress that makes lenders suspicious of extending further credit. Reducing balances and maintaining low utilization can help improve credit scores over time.

Bankruptcies or Settlements

Severe financial incidents such as bankruptcies or settlements can have an ongoing negative impact on your credit scores. These incidents can remain on your credit report for up to ten years which severely limits your ability to secure new credit during that time.

Lenders view these situations as indicators of high risk which leads to higher interest rates or absolute denial of your future loan applications.

The stigma attached to bankruptcy makes it crucial for individuals to manage their finances carefully to avoid such drastic measures.

Frequent Hard Inquiries

When you apply for multiple lines of credit in a short period of time it results in several hard inquiries on your credit report which can negatively affect your score.

Each hard inquiry typically causes a small drop in your score, and multiple inquiries within a brief timeframe can compound this effect.

Lenders analyze numerous inquiries as a sign that you may be experiencing financial difficulties which may raise worries about your ability to repay your new debts.

It’s advisable to limit applications for new credit and space them out over time to mitigate the impact on your score.

Impact of a Bad Credit Score

A bad credit score can have a far-reaching impact on various aspects of an individual’s life, leading to significant challenges and financial burdens. The main consequences of having poor credit scores are Difficulty in Obtaining Credit, Higher Interest Rates, Housing Challenges, Increased Insurance Premiums, or Employment Obstacles.

Understanding these, in brief, can help individuals realize the importance of managing and improving their credit scores to avoid financial setbacks.

Here’s a breakdown of causes that negatively impact your credit score:

Individuals who have a bad credit score often face significant difficulties while applying for credit. Lenders view those with poor credit as high-risk borrowers which makes them less likely to approve applications for loans, credit cards, or mortgages. This can lead to outright rejections or the need to seek out subprime lenders who may offer credit but at much higher costs. Consequently, this limitation can hinder financial flexibility and emergency funding options.

If individuals with bad credit do manage to secure loans or credit even after bad credit scores then they might encounter much higher interest rates as compared to those with good credit. Lenders compensate for the perceived risk associated with bad credit by charging them higher rates which increases the overall cost of borrowing significantly. For instance, average interest rates for personal loans can soar above 165% which can be a financial burden for those who need to carry a balance on their loans or credit cards.

A poor credit score can severely restrict housing options. Many landlords follow credit checks as part of their tenant screening process. A negative credit history of an individual leads to the rejection of rental applications or it may require higher security deposits. This situation limits housing choices and it also forces individuals to settle for less desirable living conditions or neighborhoods.

Insurance companies usually use credit scores as a factor while determining the premiums for auto and home insurance. A bad credit score of an individual can result in significantly higher insurance rates, as insurers consider individuals with poor credit as a higher risk. For instance, drivers with bad credit may pay up to 77% more for car insurance compared to those with good credit scores. This additional financial burden can strain the budgets of individuals who are already facing challenges due to their bad credit status.

In several places, employers have the legal right to check an applicant’s credit history during the hiring process. While employers can not see the actual credit score of the applicant they can determine the negative indicators such as missed payments or bankruptcies that can influence hiring decisions, particularly for positions that involve financial responsibilities.

Conclusion

Applying for credit with a bad credit score can be difficult but you can still make it possible. Individuals can take some useful steps to improve their financial standing by understanding the major factors that contribute to poor credit, such as payment history and credit utilization. Strategies such as reviewing credit reports for inaccuracies, paying down existing debts, and considering secured credit cards can significantly enhance one’s chances of obtaining credit.

Moreover, being informed about the different types of credit cards that are available for those with bad credit and ensuring that these cards report to major credit bureaus is crucial for rebuilding a positive credit history. Ultimately, with diligence and responsible financial behavior, individuals can work towards regaining their creditworthiness and accessing better financial opportunities in the future.

FAQs!

Is there any way to get a credit card with bad credit?

Yes, individuals who have bad credit can still obtain a credit card through secured credit cards which require a cash deposit as collateral. This deposit typically serves as the credit limit for the card.

What is the easiest credit card to get with a low score?

The most straightforward credit cards to obtain with a bad score are typically secured credit cards which requires a deposit that acts as a collateral. It’s advisable to check with your primary bank as they may have customized options for long-term customers.

What is the lowest credit score for a credit card?

While there is no universal minimum score for obtaining a credit card, many lenders consider a score of around 650 to be the threshold for approval. However, some issuers may accept scores below this level, especially for secured cards or through specific programs aimed at rebuilding credit.

What are the 2 disadvantages of a poor credit score?

Two significant disadvantages of a poor credit score include higher interest rates on loans and credit products, which can lead to increased financial costs over time.Individuals with low scores may face challenges in obtaining new credit that limits their financial options and opportunities for growth.

How to increase your credit score immediately?

To increase your credit score quickly you need to pay down the existing debts to lower your credit utilization ratio which should ideally be below 30%. You should also make sue that all bills are always paid on time and check your credit report for errors that can be disputed. These actions can show lenders that you are responsible and improve your score in a short period.