Understanding EMV Chip Cards and Contactless Payments

EMV (Europay, Mastercard and Visa) Chip Cards are embedded with microchips while contactless cards use NFC technology to make payments.

A single card can integrate both EMV micro chips as well as contactless NFC (Near Field Communication) technology to store and process payment data. Nowadays both can be used on a single debit or credit card, such cards thus also use RFID technology for contactless payments.

EMV chip cards and contactless payments both ensure secure transactions but they still operate differently. EMV chip cards require physical insertion into a terminal and often need a PIN or signature for verification, whereas contactless payments allow users to tap their card or device near the terminal, enabling quicker transactions and often removing the need for extra verification for low-value purchases.

EMV Chips Cards

EMV cards contain a microprocessor chip that stores and encrypts cardholder details securely. The EMV chip is mostly used in debit and credit cards and is designed to add an additional layer of security against fraud.

This chip serves several crucial functions:

| Data Storage | Transaction Security |

|---|---|

| The EMV chips securely stores the data of the cardholder which includes account details and cryptographic keys that protect transactions. | Each transaction generates a unique one-time-use code that makes it impossible for fraudsters to replicate the card data even if they intercept it. |

EMV cards create a unique transaction code every time the card is used. These cards are also known as Chips cards, smart cards, or IC cards (integrated circuit cards).

EMV® Chip technology enables secure and seamless contact and contactless payments with cards and mobile devices worldwide. These small square chips are located on the back of the card and can only be authenticated by special readers.

EMV chip cards are used at any point of sale terminal or ATM that is equipped to read and process them. This includes most retail stores, restaurants, and other businesses that accept both credit and debit cards.

Leading Companies in EMV Chip Cards

| Company Name | EMV Chip Cards |

|---|---|

| Visa Inc. | Visa is a leading payment processing company that has significantly contributed to the global adoption of EMV chip technology. The company provides resources to help merchants upgrade to chip technology, reducing fraud risks associated with Chip and PIN transactions at point-of-sale systems. |

| MasterCard | Mastercard plays a vital role in implementing EMV standards by promoting secure payment technologies through partnerships with financial institutions. The company also informs merchants about the benefits of EMV technology, including reduced fraud and increased customer trust. |

| American Express | American Express supports EMV integration for chip cards, highlighting that this technology reduces fraud risks through dynamic authentication data. The company also assists merchants in upgrading their systems to enhance payment security. |

| Discover | Discover Financial Services supports EMV technology as a member of the organization overseeing its specifications. The company promotes the use of EMV chip cards to enhance transaction security for consumers and merchants, as these cards are difficult to counterfeit. |

| JCB (Japan Credit Bureau) | JCB has adopted EMV technology to enhance payment security. As a member of EMVCo, JCB works with other card networks to promote global interoperability, allowing its cardholders to enjoy improved security for international purchases. |

| UnionPay | UnionPay is a key player in the global payments market, using EMV chip technology to enhance transaction security. As a member of EMVCo, it collaborates with major credit card companies to ensure its cardholders benefit from EMV specifications, promoting secure transactions worldwide. |

How Do EMV Chip Cards Work?

Step 1: Card Insertion

The cardholder inserts their EMV card into a compatible reader using the “dipping” method. The chip should face up and is inserted first into the terminal.

Step 2: Authentication

The terminal verifies that the card is genuine by checking the chip’s data.

Step 3: Authorization Request

After the authentication process, the authorization request is sent to the cardholder in various methods such as Chip and PIN or Chip and Signature. This enhances the data security by making sure that only authorized users can complete the transactions.

Step 4: Chip and PIN

The cardholder is required to enter a personal identification number (PIN) to complete the authorization request.

Step 5: Chip and Signature

It involves signing a receipt instead of entering a PIN.

Step 6: Transaction Completion

The processor verifies with the card issuer for approval or denial based on available funds or other criteria. The result is communicated back to the terminal to either complete or reject the transaction.

Benefits of EMV Chips

- Improved Security

- EMV chips store encrypted data that is dynamic and changes with each transaction. This makes it significantly more difficult for fraudsters to copy and utilize the information.

- Increased Security for Online Payments

- While EMV chips primarily enhance security for in-person transactions, they also contribute to a more secure online payment environment by making it harder for fraudsters to obtain and misuse card information.

- Contactless Convenience

- Many EMV cards also feature contactless payment capabilities, allowing for quick and effortless transactions with a simple tap.

- Global Acceptance

- EMV chip cards are widely accepted around the world, providing travelers with a seamless payment experience.

- Customer Trust and Confidence

- By offering a more secure payment experience, EMV chips help build customer trust and confidence in both merchants and financial institutions.

- Reduced Fraud

- EMV technology helps prevent fraud by requiring a PIN for transactions, in contrast to traditional magnetic stripe cards that typically rely on signatures.

- Reduced Liability for Merchants

- In many cases, merchants using EMV-compliant terminals and cards are less likely to be held liable for fraudulent transactions.

- More Payment Options

- EMV technology supports a variety of payment methods, including contactless payments, and can be used with mobile wallets such as Apple Pay and Google Pay.

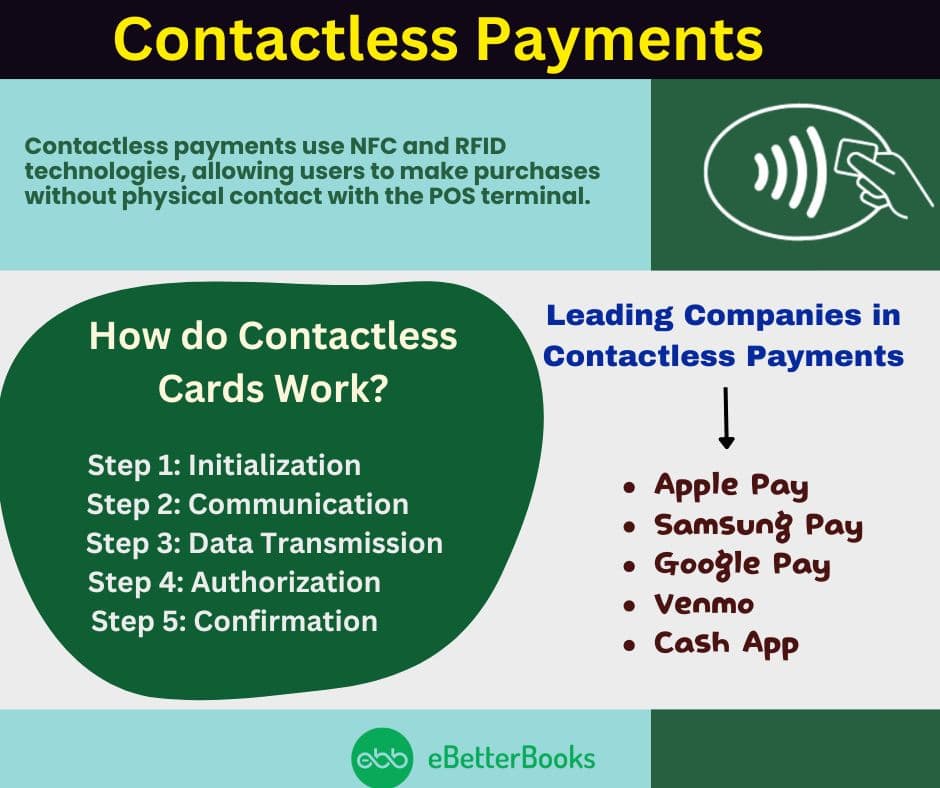

Contactless Payment

Contactless payments are a modern method that utilizes Near Field Communication (NFC) and Radio Frequency Identification (RFID) technologies which allow users to complete purchases without the need for physical contact between their payment device and the point-of-sale (POS) terminal.

The consumers can make payments by simply tapping their card near a compatible card reader that uses the NFC technology.

Contactless payments also generate a unique code for data security, similar to EMV chip cards.

EMV contactless payment cards are those cards which are integrated with the NFC technology. The integration of EMV technology and NFC allows users to make quick payments by tapping their mobile devices, smartwatches, or contactless cards at a point-of-sale (POS) terminal.

Leading Companies in Contactless Payments

| Companies Name | Contactless Payments |

|---|---|

| Apple Pay | Apple Pay enables payments in stores, apps, and online using iPhone, Apple Watch, iPad, and Mac. It uses NFC technology for contactless transactions and securely stores payment information in a Secure Element. Users can authenticate payments with Touch ID, Face ID, or a passcode. |

| Samsung Pay | Samsung Pay is unique for its use of NFC and MST technologies, enabling compatibility with almost any point-of-sale terminal. It enhances security through tokenization and requires user authentication via fingerprint or PIN. It also integrates with the Samsung Wallet app for card and transaction management. |

| Google Pay | Google Pay enables Android users to make secure payments by storing their payment information in the app. It uses NFC technology for contactless transactions and incorporates loyalty programs and promotions for added convenience. Security features include transaction alerts and payment data encryption. |

| Venmo | Venmo is mainly known for P2P payments, but it also offers in-store purchases through the Venmo Card. Users can load funds from their Venmo balance onto the card for tap-to-pay transactions at any Mastercard-accepting merchant. |

| Cash App | Cash App allows users to send money via mobile devices instantly and offers a Cash Card for purchases at participating merchants. The Cash Card functions like a debit card for tap-to-pay transactions. With a focus on simplicity and speed, Cash App also includes security features like transaction notifications. |

How do Contactless Cards Work?

The consumer brings their contactless card or mobile device close to the point-of-sale (POS) terminal to initiate a contactless transaction. This distance is typically within a few centimeters, often just an inch or two.

The point-of-sale POS terminal emits a radio frequency signal that is detected by the NFC chip implanted in the payment device. This communication occurs via Near Field Communication (NFC) or Radio Frequency Identification (RFID) technology which allows for data exchange without physical contact.

Once the card or device is in range, it securely transmits payment information to the terminal. This process is rapid and usually takes only a few seconds.

The terminal communicates with the customer’s bank account to ensure the details of the transaction and that there are enough funds. The completion of the transaction is processed almost instantly once the proposed deal is investigated and passed.

The terminal provides feedback through visual indicators such as a green light or a beep after successful processing, which confirms that the payment has been accepted.

Benefits of Contactless Payment

- Ease of Use:- One of the most significant benefits of contactless payment is quicker transactions and shorter queues at checkout. There’s no need to handle cash, and you avoid the hassle of entering a PIN.

- Fraud Protection:- Contactless payment technology is secure and encrypted, making it difficult for hackers to compromise.

- Safer Transactions:- Tap-to-pay technology is more reliable and secure than many other payment methods. Chip technology protects against fraudulent purchases through encryption and dynamic data technology.

- Flexibility of Payment Devices:- With cashless payments, you can say goodbye to bulky wallets. All you need to make payments is your NFC-enabled smartphone.

- Loyalty Benefits:- Many store loyalty programs are integrated with the tap-to-pay feature on your smartphone. This allows for automatic discounts and loyalty points during payment. Additionally, some banks offer cashback and incentives for using contactless payment.

- No Extra Cost:- Implementing a contactless payment facility does not incur additional processing fees. Businesses pay the same fee as they would for a transaction with a regular credit card.

Importance of EMV Chip Cards and Contactless Payment

| EMV Chip Cards | Contactless Payment | |

|---|---|---|

| Security Features | Provides enhanced security through dynamic authentication and encryption which significantly reduces the fraud risk. | Utilizes encryption and tokenization to protect transaction data that minimizes exposure to card details. |

| Fraud Prevention | Reduces counterfeit fraud by generating unique codes for each transaction which makes it difficult to clone the cards. | Prevents unauthorized access as card details are not transmitted during the transaction process. |

| Global Acceptance | EMV chip cards are recognized globally and are essential for secure transactions in regions where EMV standards are followed. | Increasingly accepted globally; compatible with EMV terminals, allowing for seamless transactions. |

| User Experience | Requires card insertion into a reader, which may take slightly longer than swiping a magnetic card. | Contactless payments offer faster transactions as users can just tap their card or mobile device on the terminal for the payment. |

| Liability Shift | Merchants are liable for fraud if they do not use EMV technology, encouraging adoption among businesses. | Liability often falls on the issuer in case of fraud that promotes consumers’ confidence in contactless methods. |

| Transaction Speed | Typically slower than contactless due to the need for chip reading and authentication processes. | Contactless payments are generally faster as it requires minimal interaction, you just need to tap or wave over the terminal. |

| Technological Evolution | EMV chip cards represent a significant advancement from magnetic stripe technology which enhances overall payment security. | Contactless payment represents a modern approach to payments that integrates with mobile wallets and smart devices into daily transactions. |

| Consumer Awareness | Growing awareness of security benefits pushes consumers to utilize EMV cards for safer transactions. | Increasing familiarity with contactless payments due to convenience and speed encourages usage among consumers. |

Security Measures To Protect Consumers

EMV chip cards and contactless payment systems encompass a range of security features designed to safeguard consumers during transactions.

Tokenization

This process replaces sensitive card information with randomly generated one-time-use codes that are unique to each transaction. This means that even if data is intercepted, no one can reuse it for fraudulent activities.

Dynamic Authentication

Each transaction generates a unique code that cannot be duplicated or used again, which enhances security compared to static codes found on traditional cards.

Biometric Security

Mobile devices often utilize biometric features like facial recognition or fingerprint scanning to authorize payments which adds an extra security before initiating a transaction.

Cardholder Verification Limits (CVM)

EMV supports four primary CVMs: offline PIN, online PIN, signature, and no CVM. The issuer determines the choice of CVM based on transaction risk and terminal capabilities.

For contactless transactions, the maximum limit, known as the CVM limit, is below, and no PIN or signature is required until the limit is exceeded. Once the limit is exceeded, additional verification methods such as PIN entry or biometric authentication become necessary to ensure secure transaction processing.

Limitations of EMV Chip Cards and Contactless Payments

Limitations of EMV Chip Cards

- Higher Costs

- It is quite expensive for merchants to implement EMV technology. The costs associated with upgrading point-of-sale terminals and training staff can restrict some businesses from adopting EMV systems.

- Slow Transaction Speeds

- EMV chip transactions were initially criticized for being slower than magnetic stripe transactions. Despite improvements, some consumers still experience delays due to card insertion and processing time.

- Complexity in Usage

- Consumers must properly use chip cards by inserting them instead of swiping, which can lead to confusion at checkout.

- Security Vulnerabilities

- While EMV technology helps reduce the risk of counterfeit card fraud, it does not protect against all types of fraud.

For example, if a card is lost or stolen, the data can still be compromised since EMV does not encrypt the transaction data stored on merchant devices. Furthermore, hackers may exploit vulnerabilities in the chip technology itself.

- Limited Acceptance

- Not all merchants have upgraded to EMV-compatible terminals, which can lead to inconvenience for consumers who rely on their chip cards.

- If a terminal cannot read EMV chips, customers may have to use the magnetic stripe feature instead, which diminishes some of the security advantages of using chip technology.

Limitations of Contactless Payments

- Limited Acceptance

- While contactless payments are becoming more common these days, many small retailers still do not support this payment method. This inconsistency can frustrate consumers who prefer contactless transactions.

- Transaction Limits

- Many regions impose limits on the amount that can be spent in a single contactless transaction without requiring additional verification (e.g., entering a PIN).

For example, in the U.S., there is a limit of $100 for contactless payments, which some consumers find restrictive.

- Technical Barriers

- Users must have NFC-enabled devices such as smartphones, smartwatches or cards to utilize contactless payments. This requirement can exclude individuals with older technology or those who are unfamiliar with mobile payment systems.

- Security Concerns

- Despite the fact that contactless payments are encrypted and tokenized, there are concerns that if the consumer’s card is lost or stolen it can be used for unauthorized purchases. Using the tap option eliminates the need to enter a PIN, which could have negative implications.

Conclusion

The future of financial transactions is evolving with secure payment technologies like EMV chip cards and contactless payments, benefiting both consumers and merchants.

As cyber threats rise, these innovations protect sensitive information and enhance user experience through speed and convenience. By prioritizing secure payment solutions, businesses can boost their reputation, reduce fraud risk, and build customer loyalty.

FAQs!

How does the chip work on a credit card?

An EMV chip in a credit card securely stores cardholder information and generates a unique one-time transaction code for each purchase. When inserted into a compatible terminal, the chip authenticates the transaction and helps prevent fraud, making it more secure than magnetic stripe cards.

What are the EMV chip companies?

The EMV standard was created by three major companies: Europay, Mastercard, and Visa. These companies, along with others such as American Express, Discover, JCB, and UnionPay, are part of EMVCo, the organization that oversees the development and management of EMV specifications.

How does contactless payment work?

EMV contactless payments let users complete transactions by tapping their card or mobile device near a terminal. Using Near-Field Communication (NFC) technology, this method allows secure data exchange without contact. Each transaction generates a unique one-time security code for added fraud protection.

How do I get contactless payment?

To use contactless payment, you need a credit or debit card that has the contactless symbol . You can also use mobile payment apps such as Apple Pay or Google Pay that support NFC technology. Simply tap your card or device on a contactless-enabled terminal to complete your transaction.

Is contactless payment safer than a chip?

Contactless payments are generally considered safe due to their use of encryption and unique transaction codes for each purchase, similar to EMV chip transactions. However, while both methods offer enhanced security over magnetic stripe cards, some experts argue that physical insertion (dipping) provides an additional layer of security as it requires direct interaction with the terminal.

What is the dipping method used in EMV chip cards?

The dipping method involves inserting an EMV chip card into a reader at a point of sale. The card remains in the reader while the transaction is processed, allowing for secure communication between the card and terminal. This method ensures that the unique transaction code generated by the chip cannot be reused or intercepted by fraudsters.