Discover Global Network offers credit card payment platform and is the largest credit card issuers in the USA and is a part of Diners Club International.

Discover credit card is most widely known for its importance on your credit score terms, card cash back, low fees, and high-quality customer service. Discover is the FDIC-insured direct banking division of Discover Financial Services.

Discover is currently among the largest credit card issuers, and it provides millions of credit cards. It runs the Discover Global Network, the chain of millions of merchant and CA sites; PULSE, the ATM/debit network of the United States and Diners Club International, the global merchant payment network with acceptance across the globe.

Discover has its payment platform through which it processes card transactions, which is identified as Discover Network. Discover financial services has turned into a strong online banking service in just a few years of its operation.

Discover is an American Financial services company located in Riverwoods, Illinois and is primarily responsible for issuing the Discover credit card. Discover Bank operates virtually and has customer centers in Hammersmith, Farnborough, Houston, etc.

Discover Products

Here are some of the products that Discover Financial Services deals with:

- Cash Back Credit Card

- Travel Credit Card

- NHL Credit Card

- Student Credit Card

- Business Credit Card

- Home Equity Loans

- Mortgage Refinance

- Personal Loans

- Student Loans

How Discover Cards Work?

Discover cards work very differently from other bank cards. However, customers find Discover cards similar to other cards such as Visa or MasterCard.

Discover directly offers credit cards using its brand name, whereas Visa only grants permission to use the Visa brand name with issuing banks, which in turn provide Visa-branded credit cards to their customers.

Discover Financial generates interest income from credit card users, apart from the transaction fee that is charged to merchants who accept payment through Discover card.

Discover tends to operate more like American Express, which is a direct issuer. Discover cards have provided great offers to attract customers, such as offering cash back by being the first major credit card brand.

The company’s profitability lies in the number of acceptances among merchants (which boosts the transaction and minimum payment-processing fees) and the average loan portfolio of the card holders.

Discover Financial’s model offers incentives that will lead to customers utilizing their Discover cards more to borrow through the credit card such as increasing the credit card limit or removing the annual card fee.

Benefits of Being of Discover Bank Cardholder

- Rewards: Discover cards provide cash back on everyday purchases, and they never expire. You can use your rewards for cash at any time, at Amazon.com checkout, or when you make a payment with PayPal.

- Free FICO® score: You can get a free Credit Scorecard with FICO® Credit Score and much more.

- Customer service: Cardholders can get in touch with a Discover bank customer service provider at any time.

- Fraud liability guarantee: Credit cardholders are never responsible for fraudulent use of the card.

- Free Social Security number alerts: Credit cards offer cardholders free monitoring for the Social Security number and notification when the Social Security number is detected on the dark web, or unauthorised credit accounts are created.

- Online privacy protection: Discover allows cardholders to freely remove their personal information from search sites through Discover’s mobile app.

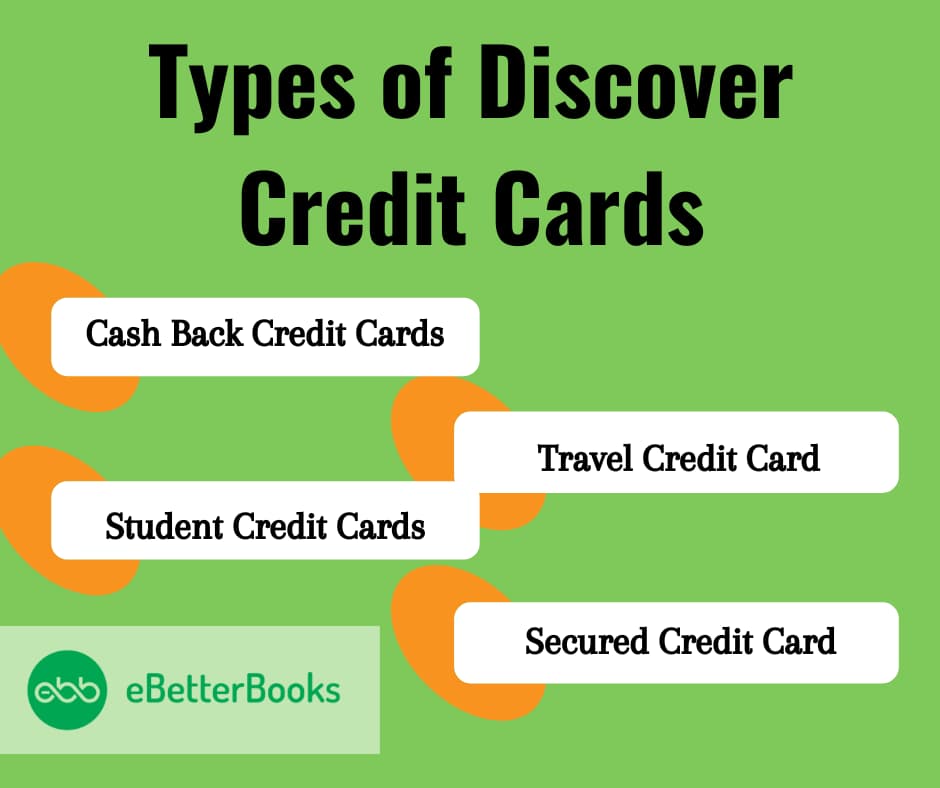

4 Types of Discover Credit Cards

- Cash Back Credit Cards: Discover it® Cash Back, Gas & Restaurant Card, NHL® Discover it®

- Travel Credit Card: Discover it® Miles

- Student Credit Cards: Discover it Student® Cash Back, Student Chrome Card

- Secured Credit Card: Discover it® Secured credit card

Acquisitions by Discover Financial Services

| PULSE | Discover Financial Services acquired an interbank electronic funds transfer payments network known as PULSE in 2005, which led Pulse and its 4,000 member banks, credit unions, and savings institutions to combine with the Discover Network’s four million merchants and cash access locations. |

| Greenwood Trust Company | Greenwood Trust Company was established on August 30, 1911, in Greenwood, Delaware. It was acquired in 1985, and on August 1, 2000, it was named Discover Bank. |

| Diners Club International | Citigroup sold Discover the Diners Club International network to Discover Financial in April 2008 for $165 million.The Federal Trade Commission approved the transaction in May 2008, and it was officially completed on July 1, 2008. |

| Student Loan Corporation | On September 17, 2010, Discover Financial Services made an offer to buy out Citigroup’s Student Loan Corporation at $30 per share. The transaction was closed on December 31 and rebranded as Discover Student Loans. |

| Home Loan Center | On June 6, 2012, Tree.com, Inc. completed the sale of substantially all of the operating assets of its Home Loan Center, Inc. business to a wholly owned subsidiary of Discover Financial. Discover acquired the sold assets for $45.9 million. |

Discover – Mobile App

Discover Credit card and bank accounts can be easily and securely accessed on the go with Discover’s Mobile App. You can see your Discover account balance and account information, make and change payments, learn how to manage your account info and rewards, and much more simply from your mobile device.

Access your account fast by:

- Sign in easily with a 4-digit Passcode.

- Activate Quick View to check Discover account details without having to sign in.

Handle Your Discover Bank Deposit Account and Personal Loan Account

- View account information ( account balances, transaction history, and summary )

- Find ATMs – ( nationwide ATMs are available to use your Discover debit card )

- Track schedule transactions and account activity

- View statements

- View and send secure messages

- Make Personal Loan payments

- Transfer money

- Pay bills

- Deposit checks

Handle Your Discover Credit CARD Account

- View and search transaction activity

- Check your balance and available credit, and view or download monthly statements.

- Link your Discover card to your Amazon and PayPal accounts

- Redeem rewards

- Make payments and edit or cancel pending payments.

- Activate a new card or report a current card as lost, stolen, or misplaced.

- Redeem rewards for gift cards.

- View your FICO® Credit Score*

- Use the Travel Notification feature

- Send and receive messages with Discover Customer Service

- View and edit the account profile

- Freeze or unfreeze the account to prevent new purchases, cash advances, and balance transfers

- Sign up to receive alerts about your account.

Note: Zelle and the Zelle-related marks are trademarks and are used herein under the license of Early Warning Services, LLC.

How to Apply for a Discover Credit Card?

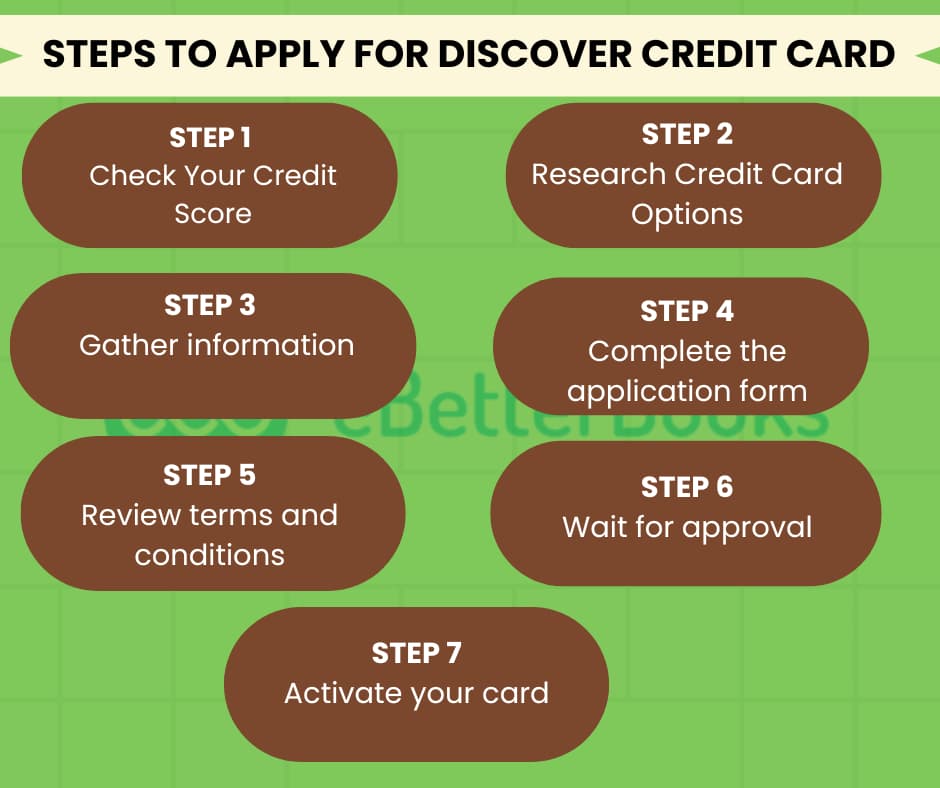

If you are someone who already has a bank account with Discover and is planning to get a Discover credit card in order to enjoy the fast account access and the great benefits, follow the below-mentioned steps:

Step 1: Check Your Credit Score

It is very important to understand that your credit score plays a major role in determining which credit cards you’ll qualify for and the rates you’ll get.

Step 2: Research Credit Card Options

There are different credit cards offering different perks, so look for those cards that fulfill your financial needs. You can compare the card details from the Discover website and get an idea of which one is suitable for you.

Step 3: Gather Information

To apply for a credit card you’ll need to provide personal and financial information to verify your eligibility, such as your Social Security number, employment information, income details, and, in some cases, bank account information.

Step 4: Complete the Application Form

Go to the website, click on “Apply,” and fill in the required information or call customer care.

Step 5: Review Terms and Conditions

Make sure to read the credit card’s terms, such as rewards, APR, and fees. Once you have carefully read the documents, submit the application.

Step 6: Wait for Approval

Online applications may be approved instantly or take a few days, while additional verification could take one to two weeks.

Step 7: Activate Your Card

After receiving your credit card, follow the provided instructions to activate.

History of Discover Financial Services

| Years | Detail |

| 1981 | Sears bought Dean Witter Reynolds, a brokerage firm, and Coldwell Banker & Company, a real estate giant with plans to move into the sale of financial products. |

| 1985 | Sears acquired Greenwood Trust Company. These companies were operated as a Sears subsidiary called Dean Witter Financial Services Group, Inc, a subsidiary offering one-stop financial services. |

| 1986-1987 | Sears’ credit card operations incurred losses, and it increased from $22 million in the fourth quarter of 1986 to $25.8 million in the first quarter of 1987. |

| 1993 | Sears decided to spin off its financial services division and created Dean Witter, Discover & Co., which is under the Stock Ticker Symbol of DWD. |

| 1995 | Discover Card Services changed the name of the Company to NOVUS Services, Inc., in order to separate network operations from the Discover Card. |

| 1997 | Dean Witter, Discover & Co. merged with Morgan Stanley, and the two companies were known as Morgan Stanley Dean Witter, Discover & Co. |

| 1999 | The company rebranded itself as Discover Financial Services, Inc. The NOVUS logo was retired and replaced by the Discover Network logo. |

| 2005 | Morgan Stanley declared that it would divest Discover Financial Services as an independent company within six months.Later that year, industry sources informed us that Morgan Stanley was reevaluating its plan to spin off Discover. In August, it was confirmed that Discover would not be sold. |

| 2006-2007 | In December 2006, Morgan Stanley confirmed that Discover would be a standalone trading company, which would be better for growth and success. Later, Discover Financial Services went public on June 30, 2007, and traded on the NYSE for the first time on July 2 as DFS. |

| 2024 | Capital One has set its sights on buying Discover in 2024, a deal that would cost $35.3 billion.In the spring, the Attorney General of New York initiated an investigation to determine whether the proposed takeover of Discover would violate state anti-trust laws.In July 2024, a proposed consumer class action lawsuit was filed in Virginia, alleging that the acquisition would breach federal antitrust laws. If approved, the acquisition would create the largest U.S. credit card issuer by balance and the sixth-largest U.S. bank by assets. |

Conclusion

Discover has always remained committed to its mission and values of providing consumers with affordable and low-fee financial products, cash-back rewards, exceptional customer care, and convenient financial tools. With credit cards, loans, and mobile banking, customers can access their bank accounts conveniently.