Equipment Financing Loans for Small Businesses

The SBA 504 Loan for Equipment Financing supports businesses in purchasing large pieces of equipment. The loan is long-term, fixed-rate, and intended for equipment that is considered necessary by the business, such as production machinery.

This loan has a very flexible arrangement; for instance, 50% of the amount is being sourced from a private bank, while 40% of it is from a Certified Development Company (CDC) that is affiliated with the SBA. The remaining 10% of it is a down payment from the business owner.

As this loan requires little down payment and provides several fixed interest rates and terms of upto 25 years, the SBA 504 loan is suitable for any firm that wants to purchase relatively expensive equipment, and doing that would have a negative impact on the business cash flow. This loan provides a sable and cheaper means by which business ventures can start or grow by procuring the equipment required for expansion processes.

Purpose

This kind of loan mainly focuses on providing working capital to businesses to enable them to arrange for capital investment for the growth of their operations, especially when a large capital outlay is needed. In equipment financing, the SBA 504 loan enables any small business to obtain loans for purchasing large machinery, machinery equipment, and many other assets that are vital in business operations but may force the proprietor to deplete cash resources. The SBA 504 loan program allows small businesses to incur less upfront costs and develop loans that have more reasonable interest rates than conventional loans; thus, it is easy for small businesses to finance sustainable growth.

Different from other SBA Loans

While the SBA 504 loan looks like other SBA loans, the primary difference is that this loan is specifically geared at funding fixed assets and has a specific structure. While the SBA 7(a) loan can be used for nearly any permissible use, including working capital, refinancing, or even inventory, the SBA 504 Loan is strictly for the acquisition of fixed assets that will be owned for the long-term like real estate and equipment. Further, the loan structure is different from that of conventional loans provided by the SBA. The SBA 504 loan involves a partnership between three parties, which includes the private bank, a CDC, and the borrower. This is helpful for the borrower for more than one reason: it reduces the initial outlay since the borrower has to put in less of his money while receiving the stability of fixed interest rate financing.

Partnership with CDCs

Certified Development Companies are a key component of the SBA 504 Loan, which are charitable organizations approved by the SBA to provide business and economic development in their specific regions. These individuals are involved with small companies, which evaluate their requirements and guide them on the SBA 504 loan. The CDC’s job is to offer 40% part of the loan, while the SBA guarantees the loan and takes the role of leading the business throughout the loan application process. This not only increases the financing option for a given business but also guarantees that they get funds from organizations that have a keen interest in stimulating the local economy. Therefore, the collaboration of the SBA 504 loan helps to provide a sound coupled solution for those entrepreneurs who require acquiring equipment or have real estate and do not want to take high risks.

Types of Equipment that are Qualified for SBA 504

SBA 504 loan is versatile as it may cover flexible types of equipment that a small business needs for its successful functioning and development, such as heavy machinery, manufacturing equipment, technology systems, and vehicles for business use.

Here are the common types of equipment qualified for the SBA 504 financing:

- Manufacturing Equipment: Thai includes machines used in the production or manufacturing of goods, such as line machines, packaging machines, and many other industrial machines.

- Construction Equipment: Mobile equipment normally utilized in construction works, such as bulldozers, cranes, loaders, and so on, is a form of other sub-classification.

- Heavy Machinery: Goods vehicles, which include forklifts, tractors, and all other heavy-sized vehicles used in various industries, including agricultural, logistics, and warehouse industries.

- Medical Equipment: Hospitals, clinics, and all healthcare enterprises can lease special and costly equipment, such as MRI machines, X-ray machines, and surgical instruments.

- Commercial Vehicles: SBA 504 also allows businesses to finance delivery trucks, vans, or any specialized vehicles needed for business operations.

- Specialized Technology and IT Equipment: Technology industry enterprises can use such assets to fund crucial organizational assets such as servers, massive computation facilities, or telecom equipment in the long term.

- Energy-Efficient Equipment: The SBA itself supports buying efficient equipment, such as solar panels to run factories or energy-saving machines, and such purchasing may also be eligible for other incentives.

Including these major types of equipment, the SBA 504 loan allows the business to acquire necessary investments in fixed assets to enhance its growth capacity.

Top Industries for SBA 504 Loans for Equipment Financing

Many industries stand to gain from SBA 504 equipment financing because it means that such important, costly fixed assets may be obtained without heavily impacting their cash flow.

Some key industries that utilize SBA 504 Loans for equipment purchases include:

- Manufacturing: Most manufacturing industries use large and costly equipment to produce their products for their customers. Assets that SBA 504 loans can finance include assembly line machines, packing systems, order picking equipment, and robotic equipment, which are important in enhancing production capabilities.

- Construction: Construction companies use SBA 504 loans to finance major equipment and fleet, including, but not limited to, bulldozers, excavation vehicles, cranes, and loaders. This equipment is necessary to finish big work and expand a company’s list of services.

- Healthcare: SBA 504 loans are employed by hospitals, clinics, and medical practices to purchase high-tech medical equipment such as MRI and X-ray machines and operating instruments. This enables healthcare providers to extend niche services and improve technology-based treatments that would otherwise be expensive to finance.

- Agriculture: Buying fertilizers, seeds, herbicides, and pesticides requires large machinery, which is common in farming activities. These businesses are able to obtain such equipment through the SBA 504 loan, an intervention that enhances crop production and farming.

- Logistics and Transportation: Financing in logistics and transport organizations is advantageous for financing commercial vehicles, trucks, and distribution equipment. These are important for supply chain prerequisites, product movement, and operational growth.

- Technology: Businesses in the technology industry require certain specialized assets, such as servers, communication equipment, or information technology-related items. The SBA 504 loan helps them grow and obtain new and technologically improved equipment and machinery as a response to existing market challenges.

- Energy: Renewable energy sector firms can utilize SBA 504 financing to acquire energy-efficient and renewable equipment, including solar panels and wind turbines, for business development and to support sustainable development.

Advantages of SBA 504 Loans for Equipment Financing

The SBA 504 loan has several significant benefits for small businesses that need to finance the acquisition of equipment.

These benefits make it an attractive option for businesses aiming to grow while maintaining financial stability:

- Lower Down Payments: The SBA 504 loan is beneficial in that its down payment requirement will be far less than most other conventional lending programs. The general idea of the loans is that the borrower is only required to contribute 10% of the total amount of the loan, contrary to the huge cost that people incur while trying to acquire conventional loans. This helps businesses to retain more of their working capital for other operational costs or expenditures, or other uses for that matter.

- Competitive Fixed Interest Rates: The SBA 504 loan interest rates are fixed, which means businesses have an opportunity to get a fixed rate throughout the credit repayment period and will not be influenced by floating rates in the market. Due to long-term stability, it offers financial certainty for those who are repaying, which could help various businesses better plan out and forecast their payments.

- Long-Term Repayment Terms: The SBA 504 loan is an inclusive loan repayment structure that can take businesses up to 10 to 25 years to repay. This minimizes the monthly cash outlay, helps businesses keep control over cash flowing in and out, and allows businesses to enjoy the use of the financed equipment.

- Preserving Cash Flow: With the SBA 4504 loans, businesses are able to finance high-cost equipment needs without hurting their cash reserves through large initial outlays. The reduced down payments and longer repayment periods allow businesses to preserve their capital and use the funds for working capital or other areas of development.

- Tax Benefits: The assets acquired through SBA 504 financing could help qualify for tax benefits related to depreciation. They can sometimes recover the depreciation of this equipment over time and ensure that their taxable income is reduced, improving cash flow. This tax incentive can lower the cost of the loan even further.

Eligibility Criteria for Equipment Financing with SBA 504 Loans

Eligible Equipment

SBA 504 Loan for equipment financing must meet the following conditions in the equipment to be financed by a bank.

Here are the key qualifications for equipment to be considered eligible:

- Long-Term Use: The equipment must be a capital asset, that is, a fixed asset of a purely long-term nature. This implies that it should have an estimated useful life of less than 10 years. This means that there is always a guarantee that the asset being financed is very important to the business’s long-term operation.

- Tangible and Depreciable: According to the IRS, it must be an asset, tangible: physical goods that can be involved in business processes and that meet requirements for depreciation. This category consists of items such as machines, automobiles, and any big industrial apparatus.

- Essential to Business Operations: The equipment has to be material to the organization’s strategic business functions. For example, it could be equipment used for the production of goods, equipment or tools used in the healthcare sector, or equipment used by construction organizations. It should also help advance businesses and their performance.

- Located in the U.S.: All the equipment applied for must be used in the USA only. SBA 504 loans can only be taken by organizations based in the United States, and the credit facility is aimed at fuelling economic progress in the country.

- Business Use: To be eligible, the financed equipment should not be used for personal purposes. It should be related to the business function, growth, or company optimization.

- Energy Efficiency: Another set of equipment that can fit into the category includes those involved in energy-efficient or green practices. They should invest in energy-efficient equipment such as solar energy systems, and the SBA may also support such investments.

However, to be considered valid for an SBA 504 loan, the equipment must be long-term, tangible, and depreciable, used in business operations, add value to the company, and be located in the United States. These qualifications ensure that the funds will be employed only to finance value-based projects that relate to business growth and internal effectiveness.

Examples of Eligible Equipment

Here are detailed examples of eligible equipment for SBA 504 loans presented in point format:

- Manufacturing Machinery: This includes production lines and their parts, injection molding machines, Computer Numerical Control (CNC) machines, and other manufacturing machinery critical for expanding and improving production processes.

- Construction Equipment: Forklifts, loaders, graders, scrapers, concrete pous, drills, and the ubiquitous crane are essential tools for developing large construction projects and improving the efficiency of the construction site.

- Medical Equipment: Diagnostic and therapeutic facilities equipment and life-enriching and sustaining equipment such as MRIs, X-rays, ultrasound equipment, and surgical tools.

- Commercial Vehicles: Business Vehicles include delivery trucks, semi-trailers, vans, and other specialized business transport needed for carrying goods and offering services.

- Agricultural Equipment: Basic farm implements such as tractors, harvesters, plows, irrigation, and seeders are highly relevant to farming activities throughout the crop-growing process.

- IT Infrastructure: Reference to technology fixed assets that include additional large servers, networking equipment, telecommunication systems, and data storage equipment that assist companies in the tech industry.

- Retail Technology: Physical tools or devices that facilitate store operations in areas such as retail transactions through POS terminals, inventory management by use of technology, and self-checkout tills.

- Energy-Efficient Equipment: Long-lived tangible and intangible assets like solar power panels, windmills, and energy-efficient heating, ventilation, and air conditioning systems, together with other assets, create environmentally friendly business operations and lower energy expenses.

These examples show the diversity of equipment that can be funded through the SBA 504 loan program, proving once again that the SBA aims to finance major, fixed assets that can be permanent properties that facilitate business expansion.

Ineligible Equipment

List of factors for an SBA 504 loan that can make a piece of equipment ineligible:

- Short Lifespan: Assets with a useful life of less than 10 years, such as office supplies or software, are not allowed as they are not long-term assets in the business.

- Personal Use: Equipment that is not primarily used for business purposes and is used mainly for personal purposes of owners of the business or employees.

- Leased or Rented Equipment: This can include machinery that is leased or rented, which the business does not own outright. The borrower cannot claim depreciation benefits or long-term use, making it miss the SBA 504 criterion.

- Disposable or Consumable Equipment: Equipment that includes consumables used while running the business, such as raw materials inventory, does not qualify because it is not fixed in nature and is usually used up within a short period.

- Speculative Purposes: For instance, equipment acquired for the primary market with the intention of reselling or for participation in another business activity is not acceptable under the SBA 504 loan program.

- Location: Equipment that is mainly sited or employed in foreign countries cannot be financed. SBA 504 loan is authorized for the promotion of domestic business development and related investments.

- Irrelevance to Core Operations: Equipment that does not qualify as essential business functions or equipment that cannot increase productivity or cause business expansion is therefore ineligible for SBA 504 financing.

These criteria ensure that the SBA 504 loan program supports long-term physical and business fixed assets that wouldn’t ordinarily be supported under conventional loan instruments.

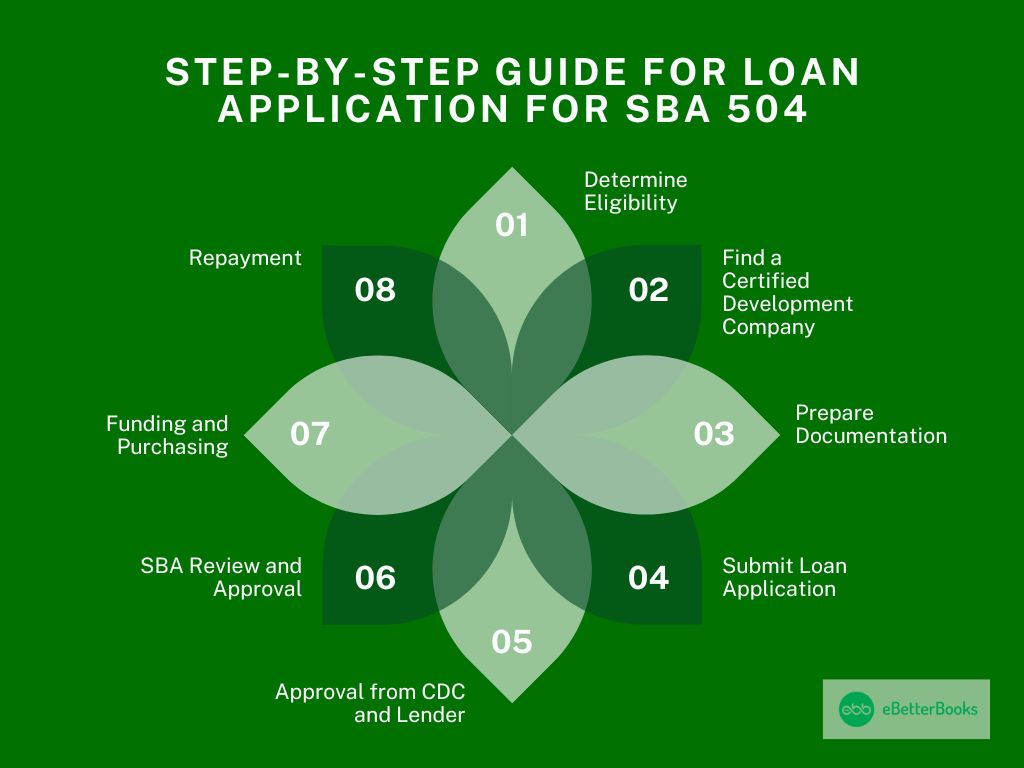

Step-by-Step Guide for Loan Application for SBA 504 Loans for Equipment Financing

Here’s a step-by-step guide to applying for an SBA 504 loan:

- Determine Eligibility: Ensure your business is SBA-approved and that your equipment also meets SBA standards. Your business should generate profits, and the equipment should be permanently installed, having a useful life of over ten years.

- Find a Certified Development Company (CDC): Engage the services of a CDC through the SBA as it forwards the 504 loan applications. CDCs are local, and they will assist you in the loaning process.

- Prepare Documentation: You will need your business financial records, tax returns, business proposal or plan, and details of the equipment or project you intend to fund.

- Submit Loan Application: Proceed and forward your loan application to the CDC. You should be able to repay the loan, and the CDC will analyze your balance sheet and propose a business plan to validate this.

- Approval from the CDC and Lender: Once the CDC completes its part of the approval process, your application will be forwarded to the SBA. Subordinate debt, as the name implies, is financing that the borrowers get from a lender, usually a bank that will also have to fund its part.

- SBA Review and Approval: The SBA will check the application as soon as the CDC sends the loan package for approval. If the loan application is approved, then the SBA will guarantee up to 40 percent of the loan through the CDC.

- Funding and Purchase: After approval, the lender disburses their share (usually 50%), and the rest is done through the CDC with the SBA. With this, you can now invest in the equipment.

- Repayment: Despite offering competitive fixed interest rates, borrowers repay in equal monthly installments over the agreed-upon term of the transaction, which ranges from 10 to 20 years.

Finding and Working with CDCs

A major task while looking for an SBA 504 loan is identifying a CDC since it is an SBA-designated Certified Development Company that is a non-profit entity whose mission is to facilitate economic development.

Here is a guide for working with CDCs:

- Finding a CDC: Small business people can access a CDC by using the SBA website list containing CDCs from different states. This makes it easy for businesses to find a local CDC that fully understands the local market and can help them through the loan procedures. It is also advisable to seek referrals from business development centers, chambers of commerce, or the SBA district offices. Generally, these organizations already have working partnerships with CDCs and can refer good ones to you.

- Initial Consultation: After a CDC has been determined, the first step is to arrange for an appointment. At this meeting, the CDC will consider the particular requirements, qualifications, and preparedness of the business for the SBA 504 loan. Those applying for the loans should be ready to disclose simple financial and business information, a proposed business plan, and information regarding the equipment or real estate being offered as security.

- Application Process: Business Owners need the CDC’s assistance in filling out the loan application. This requires filling out balance sheets, forecasts, and project descriptions—the CDC partners with a particular bank. The bank contributes 50%, the CDC does 40% through an SBA 504 loan, and the borrower contributes 10%.

- Loan Approval and Closing: CDC will forward the loan package to the BA for endorsement. Once Clients approve, the CDC starts liaising with the bank and the borrower to close the loan and disburse the loan to facilitate the purchase of the equipment or the identified property.

With a CDC, there is definitely a streamlined process, especially when it comes to SBA 504 loans. The CDC will help the business through each phase, which in turn makes it easy for a business to secure affordable capital for expansion. The full list of Certified Development Companies is available on the SBA’s official website.

Document Required for SBA 504 Loan for Equipment Financing

Here are the documents required for an SBA 504 loan application:

- Business Financial Statements: Income and expense, profit and losses, for the last two to three years, such as income statements and statements of financial position.

- Business Tax Returns: You need to carry the last three Federal Tax Returns.

- Personal Financial Statements: Bank Statement pay stubs of all managers and owners that own at least 20% of the business.

- Personal Tax Returns: Taxes returns of all significant business people for the last two to three years.

- Business Plan: An understandable business plan that captures your company’s activities and how you plan to use the borrowed cash.

- Equipment Purchase Details: Original instructions are quotations or invoices for equipment that is to be financed.

- Debt Schedule: An arrangement of all present obligations and debts of the business.

- Legal Documents: Lease agreements, licenses, articles of incorporation, other business legal documents, and the like.

- Resumes of Owners and Key Managers: Details of the experience of the management team and who they are.

- Collateral Information: Information about the forms of security that have been provided in order to secure the advancement.

- Loan Application Form: SBA loan completed forms, as a general rule, are SBA Form 1244.

- Environmental Reports (if applicable): Depending on where the loan is being invested, environmental matters, including property with environmental issues, may be called for.

They comprise the essential tools by which the lender and the SBA can evaluate your financial capacity to repay the loan.

Structure of SBA 504 Loan

The structure of an SBA 504 loan involves three primary components, each contributing to the total financing needed for the business project:

- Bank or Private Lender Portion (50%): In most cases, a team comprising a bank or a private lender offers protein funding, which is half the cost of the total project. This portion is obtained from a conventional loan facility with a standard nominal interest rate and a credit repayment requirement. The major risk lies with the lender, so the lender comes up with more favorable rates.

- Certified Development Company (CDC) Portion (40%): The CDC provides 40% of the project cost through a debenture supported by the SBA. The interest rate of the CDC’s loan is, therefore, fixed at 8 percent, and it is repaid over 10, 20, or 25 years, depending on the type of asset. This part is guaranteed by the SBA and, therefore, less risky for the lenders while the borrower is extended a good deal.

- Borrower’s Contribution (10%): The business owner makes an initial payment of 10% of the costs to be incurred during the project. At times, the business entity may be a brand-new business, or the property to be acquired is a special-purpose property, such as a hotel or car washing business. The borrower has to contribute up to 15% to 20%.

This type of loan facilitates the propositions of large projects through low initial costs, especially on interest, long-term interest rates, and reasonable monthly installments. The CDC is at a middle ground, taking risks between the business owner or borrower and the private lender or bank, making this financing model stable for small business funding.

Cost Associated with the Loan

The costs associated with an SBA 504 loan include several components, such as interest rates, fees, and other expenses that borrowers should be aware of:

- Interest Rates: Specifically, the SBA 504 loan portion, which is equivalent to 40% of the total amount of the project, has a fixed interest rate, which is established at the time the loan from the sale of debentures is funded. These rates are normally fair and below the going market rates since the SBA’s goal is to help small businesses with low-cost term financing. They offer competitive fixed interest rates for the duration of the mortgage term, which is usually 10, 20, or 25 years.

- Bank Loan Rates: The bank or private lender portion (50% of the project cost) normally can bear variable or fixed interest rates as decided by the lender. This rate is versatile and differs depending on the lender, the borrower’s credit score, and the overall market state. It is usually higher than the CDC’s portion because each has negotiated on its own.

- Fees: SBA 504 loans come with different charges, as explained below:

- CDC Processing Fee: It has been a tradition that 1.5% of the CDC loan amount is charged to defray the administrative expenses of the CDC.

- SBA Guarantee Fee: A payment made to the SBA to guarantee the loan, commonly 5% of the portion guaranteed by the SBA.

- Legal Fees: Legal expenses for preparation of documents, etc., and fees associated with taking the loan execution and closing papers, which depend on the nature of the transaction.

- Other Fees: Additional costs may include underwriting, title, appraisal, environmental, and administering fees.

- Prepayment Penalties: Prepayment is allowed for SBA 504 loans at an adjustable rate depending on the loan period, particularly the first half, which is 5-10 years long.

These are some of the costs associated with an SBA 504 loan, but the low fixed interest rates, long-term loan repayment terms, and minimal down payments may more than offset these charges.

Repayment Options and Flexibility

Repayment terms options for the SBA 504 loan are made in a manner that the small business is in a position to make standard and fixed repayments with some degree of flexibility.

Here’s how the repayment structure works:

- Fixed Monthly Payments: The SBA 504 loan has a CDC portion that keeps fixed monthly payments throughout the expected lifespan of the loan, which ranges from 10 years to 20 years, or 25 years. The fixed rate, as taken on here, is perfect because it doesn’t change from time to time, and businesses will be in a position to budget for the number of irregular payments without having to worry more about the interest rates. The long interval for which it is repaid also makes the monthly payments manageable.

- Bank Loan Repayment Terms: The balance amount, which is 50% of the project cost from the bank or private lender, would have a different repayment plan. The type of loan can either be a fixed rate or variable rate, and the term usually spans between 5 and 20 years. Each is determined in accordance with the lender’s terms, which could be rather flexible when it comes to refinancing or changing the payment schedule.

- No Balloon Payments on the CDC Portion: Unlike some of the reduced standard loans, the CDC/SBA portion does not include balloon payments. The absence of end-of-term payments also means businesses can more easily plan for the long term when repaying the loans.

- Prepayment Options: However, the SBA 504 loan attracts early payoff costs, which are cheaper toward the later part of the payoff period. The penalty is normally for the first 5 years of the loan period or the first 10 years of the loan period if it is a 10-year loan, and it declines every year.

- Flexible Use of Funds: Loans must be used for fixed assets such as real estate and equipment; however, businesses are allowed to amalgamate several projects, for example, buying land and equipment under one loan with an easier way of making payments.

Conclusion

Overall, the SBA 504 loan is a great instrument for financing the purchase of equipment and other fixed assets for small businesses. The fixed interest rates for the loan, long repayment terms, and low down payments make the loan an affordable source of financing key equipment without adversely affecting the firm’s cash flow.

By the CDCs, one can be sure that borrowers will receive qualified assistance starting from the application and ending with receiving credit. Further, the ability to fund almost every type of equipment across sectors makes it fit for all industries, which include manufacturing, healthcare, farming, and technologies, among others.

When applied to equipment financing, the SBA 504 loan has a direct positive impact on the business’s development that does not tie up the working capital for other expenses – the way to long-term success. For more information, you can visit the official SBA site.