The SBA Microloan program offers microloans of up to $50,000 to qualified small business owners, nonprofit child care centres, and entrepreneurs through qualified nonprofit intermediaries called as Microloan lenders.

SBA microloans are often directed toward undeserved communities, such as women and veteran business owners. SBA microloans are funded by the U.S. Small Business Administration (SBA).

The Microloan Program’s administrative costs are funded through SBA salaries and expenses and business loan administration accounts. Each year, the SBA gets an appropriation for credit subsidies for its direct lending (Microloan) program and for Microloan technical assistance grants.

What is an SBA microloan?

The Small Business Administration provides funds to specially designated intermediary lenders, nonprofit community-based organizations with experience in lending, management, and technical assistance. These intermediaries administer the Microloan program for eligible borrowers.

An SBA microloan offers financing of up to $50,000 for small businesses to manage and grow their operations. The average microloan amount is about $13,000, and the interest rates range from 8 percent to 13 percent.

SBA microloan program features

The SBA Microloan program offers small, short-term loans to small businesses and a few non profit childcare centers.

These loans are offered through intermediary lenders, which are nonprofit organizations with experience in business assistance and lending.

Here are the key features of the SBA Microloan program:

| Loan Structure | There is no such thing as a line of credit in microloans, so there is a term loan pattern. |

| Funding Limits | The fund amount is up to $50,000 but the average fund amount is $15,799 (as per 2023 fiscal year). |

| Payback Schedule | Businesses can pay back up to 7 years. |

| Interest rate | The interest rate ranges from 8% to 13%. |

| Associated fees | There is up to 3% of the loan amount (up to 2% for loans with terms of less than one year), in addition to closing costs determined by the lender. |

| Loan processing time | This totally depends on the lender. It might take a week to 30 or more days to receive funding. |

| Usage | Microloans can be used for inventory or supplies, working capital, furniture or fixtures, machinery or equipment. |

What can an SBA microloan be used for?

SBA microloans can be used for various purposes to pay for most business expenses totaling less than $50,000. So,SBA microloans are used in:

- Working Capital – The funds cover daily operations, such as payroll, rent, utilities, and inventory.

- Purchasing Inventory or Supplies – The funds to buy raw materials, products, or equipment needed in order to run the business.

- Furniture, Fixtures, or Equipment – The funds to buy or lease equipment, tools, or machinery necessary for business operations.

- Marketing and Advertising – The funds to cover promotional activities or advertising campaigns to attract customers.

- Startup Costs – The funds required for the initial expenses required to start a new business.

- Renovation or Improvement – The funds to renovate or improve business facilities, such as a store or office.

- Technology Upgrades – The funds for investing in technology, such as computers, software, or other systems to enhance productivity.

While an SBA microloan can be a valuable tool for boosting your working capital, it’s important to remember that these funds cannot be used for real estate purchases or to pay off existing debt.

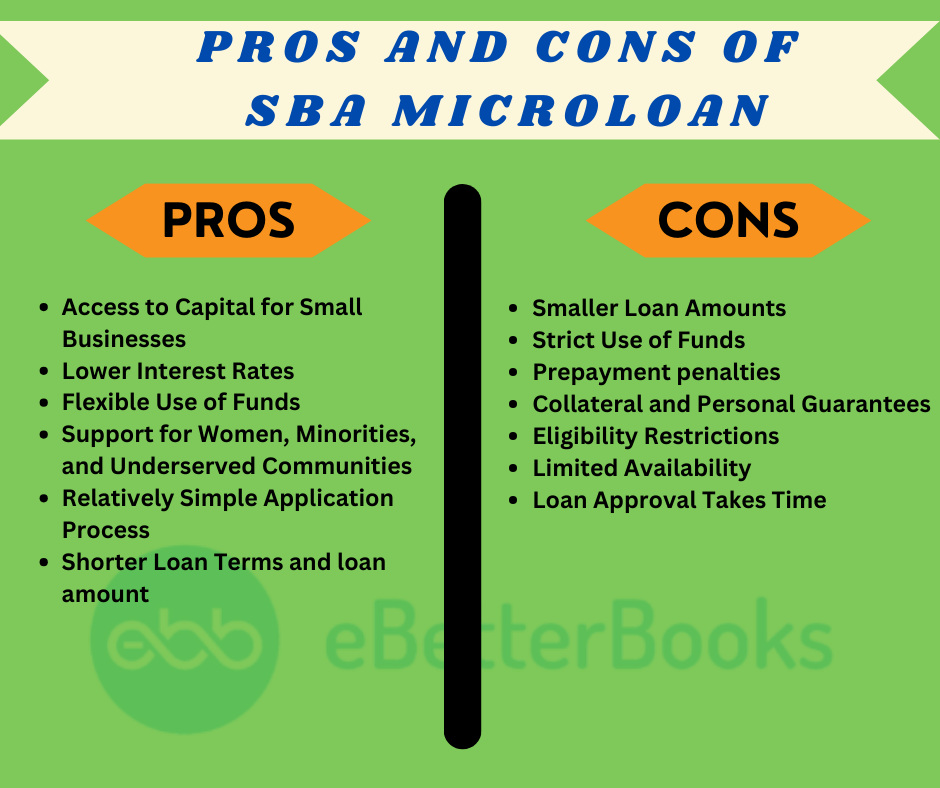

Pros and Cons of SBA Microloan

Pros of SBA Microloan

- Access to Capital for Small Businesses

SBA Microloans offer smaller amounts of capital, which can be incredibly beneficial for startups or businesses that may not need a large loan or that struggle to secure traditional financing.For businesses or owners with limited credit history, securing a microloan and making timely payments can improve creditworthiness, making it easier to access larger loans in the future.

- Lower Interest Rates

SBA Microloans generally have lower interest rates compared to traditional loans, making them more affordable for small businesses or startups. Interest rates for SBA loans are made up of the lender’s additional percentage on top of the base rate. The base rate may fluctuate over time and is usually determined by the prime rate, LIBOR, or the optional peg rate. SBA maximums on interest rates contribute to borrowers’ affordability of SBA loans.

- Flexible Use of Funds

SBA Microloans can be used for various business purposes, such as inventory, working capital, supplies, furniture, fixtures, machinery, or equipment. However, they cannot be used to pay off existing debt or purchase real estate.

- Support for Women, Minorities, and Underserved Communities

SBA Microloans are often targeted toward underserved groups, including women, minorities, and low-income entrepreneurs. This helps promote diversity in business ownership.In addition to the loan, many SBA microloan intermediaries provide free or low-cost consulting, technical assistance, and training services to help businesses succeed.

- Relatively Simple Application Process

Microloans are frequently simpler to get than larger loans, even if there is still an application process. The application process is very simple and can be completed in just a few minutes ( if you have all the documents handy).

- Shorter Loan Terms and loan amount

The typical repayment term for an SBA Microloan is up to six years, which allows businesses to pay off the loan quickly without long-term debt commitments.Microloans are between $500 and $50,000, making them ideal for businesses that don’t need a large loan but require small capital amount to grow or sustain operations.

Cons of SBA Microloan

- Smaller Loan Amounts

The loan amounts are limited to $50,000. This amount is not sufficient for some businesses that require larger capital to grow or scale operations.

- Strict Use of Funds

While the SBA microloan funds can be used for various business needs, they cannot be used for debt refinancing or real estate purchases, as these activities limit flexibility for certain businesses.

- Prepayment penalties

Prepayment penalties apply to SBA 7(a) loans if you pay down more than 25% of the outstanding sum during the first three years of the loan. In the first year, the penalty is equivalent to 5% of the prepayment amount; in subsequent years, it decreases. Prepayment penalties for 504 loans vary throughout the first few years of the loan. Prepayment penalties are usually not applicable to microloans.

- Collateral and Personal Guarantees

Many SBA lenders require borrowers to pledge assets as security. Even though the SBA guarantee lowers risk, the lender may still need collateral and a personal guarantee from the borrower.

- Eligibility Restrictions

As, not all businesses qualify for SBA Microloans. In 2023, just one-third of businesses were authorized for SBA 7(a) loans. Although there are no precise time-in-business criteria for the SBA 7(a) and 504 loan programs, your business must be profitable at the time of application, and lenders may have additional restrictions. With limited regulations from the SBA, SBA-approved lenders are free to determine the conditions and specifications of the microloan program. As a result, certain intermediaries may provide initial money under the program.

- Limited Availability

Microloans are offered through intermediaries, and the availability of these loans can vary by location. Some areas may have fewer lending institutions that offer them.

- Loan Approval Takes Time

Sometimes, the loan application process takes longer than two months. To choose the best loan program and SBA-approved lender, borrowers should study SBA loans by contacting their local SBA district office. Once the lender approves the application, it must be submitted to the SBA for a second review, prolonging the waiting period.The approval process can take time, as it requires the lender’s review and may involve business development training before funds are released.

SBA microloan vs. SBA 7(a) loan

| SBA microloan | SBA 7(a) loan | SBA 7(a) loan through SBLCs | |

| Lender Type | The SBA Microloan program is administered by nonprofit, community-based lenders. | The SBA 7(a) loan program is administered by banks and online lenders. | The SBA 7(a) loan through SBLCs is administered by non-profit community based lenders. |

| Repayment period | For repayment terms, SBA Microloans have a maximum term of up to six years. | SBA 7(a) loans can have terms of up to 10 years for working capital and equipment loans, and up to 25 years for real estate loans. | SBA 7(a) loan through SBLCs can have terms of up to 10 years for working capital and equipment loans, and up to 25 years for real estate loans. |

| Interest rate range | The interest rates for SBA Microloans vary depending on the lender but typically range between 8% and 13%. | The interest rates for SBA 7(a) loan vary depending on the lender. | The interest rates for SBA 7(a) loan through SBLCs vary depending on the lender. |

| Loan amount limit | The loan amount for SBA microloan is up to $50,000. | The loan amount for SBA 7(a) loan is up to $5 million. | The loan amount for SBA 7(a) loan through SBLCs is up to $350,000. |

What credit score do you need for an SBA microloan?

The minimum credit score required for an SBA microloan is between 620 to 640 score. However, some SBA microlenders may accept lower credit scores, particularly if other aspects of the application, such as business financials or collateral, are strong.

Eligibility for an SBA Microloan

SBA Microloan requirements can differ depending on the intermediary lender.

However, common eligibility criteria include:

- Minimum Credit Score: A credit score of 620 or higher is generally recommended, although some SBA lenders may accept lower scores.

- Time in Business: Some lenders are willing to work with newly established businesses, while others may require that the business has been operating for at least two years.

- Location: Many microlenders operate within specific communities or regions, so you may need to demonstrate that your business is situated in an eligible area.

- Personal Finances: You might be required to show that you have not experienced any recent bankruptcies, are currently on tax payments, and do not have any outstanding liens against you.

- Business Finances: Lenders often look for evidence of positive cash flow or positive cash flow projections.

- Collateral: Many SBA micro lenders typically require the loan to be secured with collateral.

Requirements for Startups

The SBA defines startups as businesses that have been operating for two years or less. The intermediary lenders may have specific credit scores and collateral requirements for startups.

Requirements for Existing Businesses (Over 2 Years Old)

For businesses operating for more than two years, intermediaries may have distinct criteria related to the applicant’s credit score and cash flow. Even some established businesses will likely be required to provide collateral.

Who can take the SBA Microloan?

- Startups and New Small Businesses: Microloan is designed for entrepreneurs starting new ventures or businesses in their early stages.

- Women, Minority, and Veteran-Owned Businesses: Special consideration is given to businesses owned by women, minorities, and veterans to boost access to capital.

- Businesses with Smaller Capital Needs: Microloans up to $50,000 are available to businesses requiring smaller amounts of funding.

- Nonprofit Childcare Centers: These non profit childcare centers are also eligible for SBA microloans, enabling them to finance their operations or expand their services.

How to apply for an SBA microloan?

The SBA Microloan application process may vary depending on the lender, but you can expect to need some or all of the following documents:

- Personal identification

- Personal tax returns (typically at least two years)

- Business tax returns

- Business license and any operating agreements

- Business plan

- Business lease and contracts

- Cash flow projections

- Recent pay stubs

- Balance sheet and income statement

- List of collateral and current business assets

- Existing debt schedule, if applicable

After submitting your SBA microloan application, the lender will review it and guide you through the underwriting process. If approved, your funds will be distributed once you sign the loan agreement.

Since SBA Microloans are administered solely by intermediary lenders, the SBA itself does not need to approve your application.

What time does it take to get approval for an SBA microloan?

It usually takes 30 to 90 days to get approval for an SBA microloan, as funding can take anywhere from seven to 90 days. Typically, once the SBA approves the loan, businesses receive the funds within seven to 14 days.

Although approval times can vary depending on factors, including the lender’s workload and how quickly you submit all essential papers, certain microlenders may deliver a decision more rapidly.

How to get an SBA microloan?

To get an SBA microloan, you must identify and apply through an SBA-approved intermediary lender. The intermediary lender could be a nonprofit and community-focused organization. The SBA provides a list of active intermediaries on its website, allowing you to filter by state.

Steps to submit the application

Step 1: Find an SBA-Approved Microlender

Start by locating an SBA-approved microlender in your area. You can do this by reviewing the list of approved lenders provided by the SBA.

Step 2: Gather Your Documents

Although the required documents may differ depending on the lender, you’ll typically need to provide some or all of the mentioned documents.

Step 3: Submit a Loan Application

After choosing the lender that best fits your business needs, submit your loan application.

Step 4: Wait for Approval

Once your application is submitted, you’ll need to wait for the lender’s decision. Approval timelines can vary, but it generally takes one to three months for a response.

Step 5: Receive Funds

If approved, you may have to wait for the funds to be deposited into your account. Make sure to repay the loan as agreed to avoid late fees and protect your personal or business credit.

SBA Microloan Lenders

SBA Microloan lenders are nonprofit organizations that collaborate with the Small Business Administration (SBA) to offer small, short-term loans to qualifying businesses.

These lenders prioritize supporting small businesses, startups, and entrepreneurs who may face difficulty in obtaining traditional financing.

Community Development Financial Institutions (CDFIs)

CDFIs specialize in promoting economic development in underserved and low-income areas. Many CDFIs are SBA Microloan intermediaries, offering small business loans and additional resources, such as financial education and business coaching.

Nonprofit Lenders

There are numerous nonprofit organizations which are SBA-approved microloan lenders, offering funding, technical assistance, training and mentoring to help small businesses succeed.

Local and Regional Lenders

Some SBA Microloan lenders operate at the community or regional level, tailoring their loan programs to meet the needs of local businesses. These lenders have strong ties to the local economy and aim to boost growth within their specific communities.

Specialized Microloan Providers

There are certain microlenders, such as Minority Deposit Institutions (MDIs) and Women’s Business Centers (WBCs), who focus on providing loans to underrepresented groups, such as women, low-income entrepreneurs, and minority-owned businesses.

How to Increase Your Chances of Approval for SBA Microloans?

In order to increase their chances of approval for SBA microloans, borrowers must focus on their credit scores. While credit scores are critical, they are not the only aspect lenders consider.

Other key factors include:

- Credit History: Lenders look beyond the score to review the details of your credit history, including late payments or bankruptcy.

- Income and Repayment Capacity: Lenders evaluate your ability to repay the loan by examining your income and existing debt obligations.

- Collateral: The presence and value of assets you can offer as collateral are important, especially for securing larger loan amounts.

- Business Financials: The lenders carefully review your business’s financial statements, cash flow, and overall profitability.

Different ways to improve your SBA microloan approval

- Ensure You Meet the Requirements: Your credit score and business credit history are key factors in any loan decision, as they help lenders evaluate your creditworthiness.

- Prepare All Necessary Documents: To expedite the process, gather all required documentation and information in advance. Submitting a complete and accurate application the first time increases your chances of approval.

- Choose the Right Loan Program: Different SBA loan programs are designed for different types of small businesses and purposes, so find the one that best fits your needs.

- Select the Right Lender: Each lender has its requirements, and some are better suited for specific SBA loans than others

- Have a Professional Review Your Application: Before submitting, consider having an accountant or another professional review your application to ensure everything is in order.

Frequently Asked Questions

What is the interest rate for SBA Microloans?

The interest rate for SBA microloans ranges from 8% to 13%, but that totally depends on the lenders.

What is the SBA microloan limit?

The SBA microloan limit is $50,000.

What is the minimum down payment for a SBA microloan?

Most SBA microloans do not require a down payment. These loans are generally for smaller amounts $50,000 or less and are administered by nonprofit organizations.

Is it hard to get an SBA microloan?

No, it is not hard to get an SBA microloan if your business meets the eligibility requirements along with all the required documents.

What is the smallest SBA loan amount?

The smallest SBA loan amount available through the SBA Microloan program is $500.