MARYLAND—The U.S. Small Business Administration (SBA) has announced Economic Injury Disaster Loans (EIDL) for Maryland businesses. These loans are available for businesses impacted by the recent drought and excessive heat.

Another recent news is related to Hurricane Helene in the USA. Hurricane Helene wreaked havoc in states like Florida, Georgia, Tennessee, and North and South Carolina, leaving small businesses grappling with the aftermath. In these challenging times, the U.S. Small Business Administration’s (SBA) Economic Injury Disaster Loans (EIDL) program emerges as a beacon of hope, offering crucial support to businesses in need.

What is the Economic Injury Disaster Loan (EIDL)?

The SBA has developed the Economic Injury Disaster Loan to assist businesses in coping with the financial losses occasioned by economic injury.

For instance, a small business in Florida used an EIDL to cover payroll and keep its staff employed during a period of reduced sales. Another business in Georgia used the loan to repair damage to their premises and purchase new equipment. These are just a few examples of how EIDL has been a lifeline for businesses in the aftermath of a disaster. Other businesses have used EIDL to pay for operating expenses, replace lost inventory, or even expand their operations to make up for lost revenue.

Key Features of EIDL

- Loan Amounts: Businesses could qualify for disaster-related economic injury and receive up to $2 million in assistance.

- Interest Rates: Small businesses pay 3.75% interest on the SBA loans, while nonprofitable organizations pay 2.75%.

- Repayment Terms: The repayment period, which can extend up to 30 years, offers a flexible and manageable payment plan. This allows businesses to pay in equal monthly installments, with the first payments due within the first year, providing the breathing room needed for recovery.

Why in the News?

The Economic Injury Disaster loans (EIDL) are available for small businesses, small agricultural cooperatives, small businesses engaged in aquaculture, and especially for most private nonprofit organizations with economic losses who have struggled with the drought and excessive heat between June 6th and October 22nd. The area for this loan includes primarily Talbot County and the adjacent counties of Dorchester, Caroline, and Queen Anne’s.

Yet, the U.S. Small Business Administration’s Economic Injury Disaster Loan (EIDL) program has provided a lifeline to many of those businesses.

The program has proven to be invaluable in covering payroll and addressing businesses’ needs for repairs. This helps businesses keep operations going and, in turn, keeps their employees happy. For all the media discussions about disaster recovery, the EIDL program is mentioned as an important resource for regaining economic stability. However, reports underscore the huge amounts of financial help that are available—up to $2 million, with favorable terms, including low interest rates and long grace periods for repayment.

The SBA’s EIDL program is a prop in the news coverage because local economies are trying to come back, and they can take advantage of this help to recover, adapt, and grow again after natural disasters.

What is Economic Injury?

Economic injury relates to any type of loss a company incurs when it is unable to finance its usual operations during a disaster, irrespective of whether or not the business’s actual property has been damaged. Such harm arises from interruption of business flow, logistics, or decreased consumer traffic when companies lack the funds to pay for mandatory expenses like wages, lease, power, stock, etc.

An independent family-owned restaurant in Georgia will likely experience severe cash flow problems and possibly cannot pay the workers, buy food to cook, or pay rent because that’s just not generating enough money with customers. Such economic injury emphasizes that it is not only buildings and infrastructure that can be a problem for businesses but also lost revenue when businesses cannot even meet basic operating expenses.

USA Today reported that Hurricane Helene’s damage could cost over $30 billion, pointing out the storm’s strong economic impact on the storm-hit regions.

Interest Rates and Payment Schedules for Disaster Loans for Economic Injury

If you are a small business, agricultural cooperative, aquaculture business, or nonprofit affected by Hurricane Helene and not just by physical loss or damage, the SBA’s EIDL can provide the working capital needed to recover.

Key information about EIDL for Hurricane Helene recovery:

Interest Rates:

- 4% for businesses.

- 3.15% for profit-making organizations and 25% for nonprofit-making organizations.

- 2.813% for homeowners and renters (for property repair).

Loan Terms: Up to 30 years.

Deferred Payments: They accrue no cost and are interesting during this period when no payments are needed the first year after the loan is disbursed.

Additionally:

- People may be paid as much as $500,000 for real estate repair.

- Those who lease a dwelling, as well as the homeowners, may receive up to $100,000 for the loss of personal assets.

- A home that now generates income may receive an additional 20 percent in loan for mitigation items such as a safe room, storm shelter, or retaining walls for the next disaster.

- Such favorable conditions enable the businesses and the homeowners to regain and reconstruct.

Who is Covered Under the Economic Injury Disaster Loan?

The Economic Injury Disaster Loan (EIDL) is not selective. It is open to any business that disasters have hit.

Here’s who qualifies for EIDL:

- Small Businesses: Private sector companies with total employment below 500 persons per enterprise.

- Agricultural Cooperatives: Farm-associated operations that are emerging rural agricultural cooperatives that meet all requirements stated by SBA for small businesses.

- Aquaculture Businesses: Organizations involved in aquaculture production.

- Private Nonprofit Organizations: Organisations that are not commercial and work for a cause, be it religious, social, or otherwise.

- Sole Proprietorships and Independent Contractors: Self-employed persons and others who meet the following conditions have the privilege of obtaining this program.

- Businesses in Declared Disaster Areas: Organizations operating in places that the SBA has defined as disaster areas as a result of severe economic loss resulting from activities such as hurricanes, wildfires, or other mishaps.

Specific Counties Approval of EIDL

In South Carolina, the disaster declaration covers the following counties eligible for both Physical and Economic Injury Disaster Loans:

- Eligible Counties: These include Aiken, Anderson, Bamberg, Barnwell, Cherokee, Greenville, Greenwood, Lexington, Newberry, Oconee, Pickens, Saluda, and Spartanburg.

Adjacent counties eligible only for Economic Injury Disaster Loans include:

- South Carolina: Abbeville, Allendale, Calhoun, Colleton, Edgefield, Fairfield, Hampton, Laurens, McCormick, Orangeburg, Richland and Union, York.

- Georgia: These include Burke, Elbert, Franklin, Habersham, Hart, Rabun, Richmond, and Stephens.

- North Carolina: These are Cleveland, Henderson, Jackson, Macon, Polk, Rutherford, and Transylvania.

Significantly, an EIDL application does not need a business to have experienced actual physical loss as with other forms of disaster relief funding; thus, EIDL is instrumental for businesses experiencing economic loss.

How to Apply for the Economic Injury Disaster Loan (EIDL)?

The Economic Injury Disaster Loan programs of the Small Business Administration offer loans to small businesses that are hit by natural disasters, including hurricanes. This can be useful for running your various operating costs, such as payroll, as well as other costs in order to steady your business during difficult times.

Here’s how you can apply for an EIDL:

Steps to Apply for EIDL

- Determine Eligibility: Check the requirements in order to qualify for EIDL for your business. In most cases, the affected small businesses and some charities situated in the disaster-affected zone are eligible to apply.

- Gather Required Information: The most common paperwork that should be prepared includes:

- Legal data about the business includes name, business address, and legal status.

- Resident taxpayers’ identification number

- Annual reports- balance sheet, profit and loss statements.

- Explanation of each economic injury.

- Create an SBA Account: If you do not have one, sign up on SBA’s website to open the application in order to apply.

- Complete the Application: You need to complete the EIDL application form. You can also do this online via the SBA website.

- Submit Your Application: After filling out the application, check the information and input it electronically.

- Await Response: Once you submit your application to the SBA, the agency will evaluate it and communicate your qualifications and loan details to you.

- Loan Approval and Funding: If, in the end, the loan is approved, you will be given papers to sign concerning the loan. After that, funds will be charged to your account.

For more detailed information and to access the application form, visit the SBA’s official website: SBA EIDL Application.

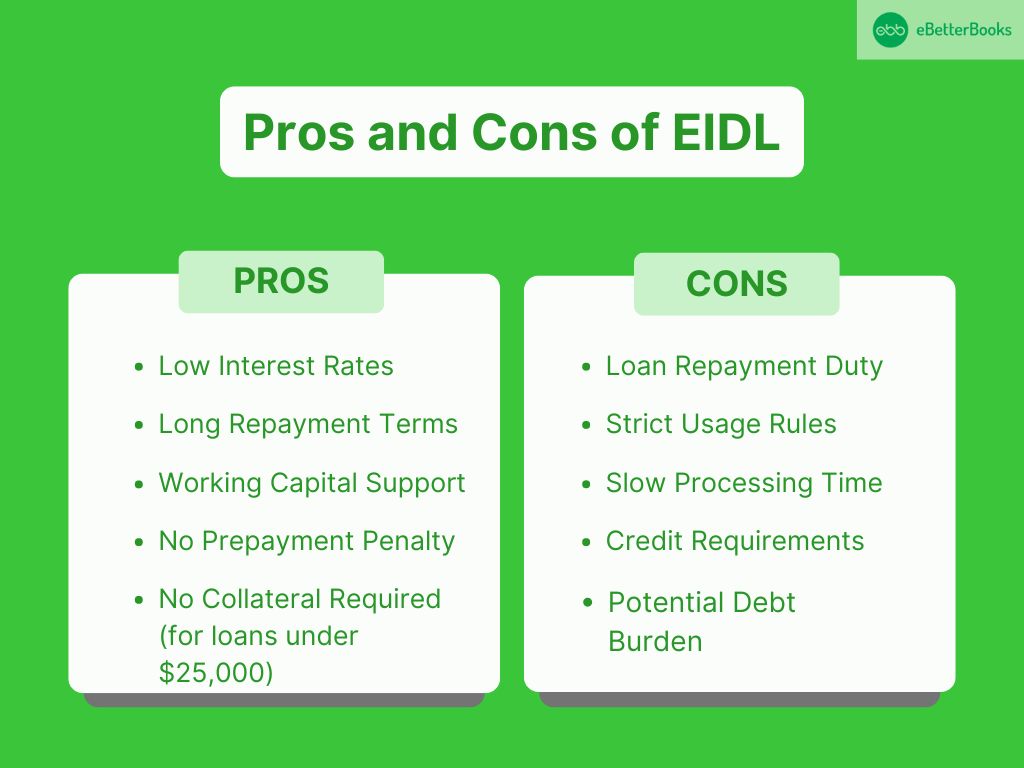

Pros and Cons of Economic Injury Disaster Loan (EIDL)

Here is the detailed version of the pros and cons of applying for an Economic Injury Disaster Loan (EIDL):

Pros:

- Low Interest Rates

- EIDLs come with relatively low interest for debts from where they can be self-servicing by the small business (3.75% for businesses and 2.75% for non-profits).

- Long Repayment Terms

- Loan terms may go up to 30 years, therefore making affordable monthly payments.

- Working Capital Support

- EIDLs give capital where your business has yet to be in a position to recover, giving you operating expenses such as pay, rent, and power.

- No Prepayment Penalty

- Interest rates are fairly low, and you are allowed to repay the loan balance before the period is up, thus cutting on the total interest charged.

- No Collateral Required (for loans under $25000)

- Business credit below 25000 dollars is unsecured and thus available to small-scale businesses than business credit above this limit.

Cons:

- Loan Repayment Duty

- However, EIDLs have to be repaid, and this is incredibly stressful for many businesses that are still reeling from the financial impact of a disaster.

- Strict Usage Rules

- EIDL money cannot be redirected for growth, purchases, or the fix of physical injury; it can only be used for normal operating costs.

- Slow Processing Time

- The application review and approval process can take quite some time. It can take weeks or even months to get approved and receive the funds when you need them.

- Credit Requirements

- However, even businesses hopeful of SBA loans’ flexibility will need to meet some creditworthiness standards to be approved, possibly reducing the number of businesses that apply for the loans.

- Potential Debt Burden

- Incentivizing failure means that existing struggling players in the field will potentially take on even more debt.

Collateral Requirements for Economic Injury Disaster Loan

Any collateral requirements for Economic Injury Disaster Loan debentures as stated in the 7(a) loan matrix.

The EIDL is generally offered without collateral security for loans up to $25000. However, for loans exceeding $25,000, it’s worth knowing that the SBA may demand.

Here are the key points regarding collateral requirements for EIDL:

- Loans of $25,000 or Less: No collateral is needed.

- Loans over $25,000: Collateral may be required. The SBA will, as a rule, maintain a security interest in the business’s assets. Equipment, inventory, and real estate are examples of the usual forms of collateral.

- Personal Guarantees: The SBA usually requires personal guarantees on loans, and for loans exceeding $200,000, they insist on owners’ guarantees. This means that the owner will be required to repay the loan in case the business defaults.

- Loan Terms: Collateral details/conditions may differ, so it is crucial to recognize the different conditions offered by the SBA for the needed loan.

What Uses are there for Disaster Loans?

Economic Injury Disaster Loan (EIDL) program can be used to cover different essential business expenses that come up in a disaster.

Here are the key uses of these loans:

- Working Capital: The loan’s purpose can be to help a business pay its rental fee, utilities, and payroll. This means you can continue to do business if revenue is disrupted.

- Fixed Debts: EIDL funds may be used to pay fixed debts, including rent or mortgage payments, as well as other ordinary and routine debts that do not vary as a result of the disaster where they were incurred.

- Accounts Payable: This loan can be used to help pay bills to your suppliers, contractors, or vendors that keep your business’s supply chain intact.

- Normal Operating Expenses: These are the regular costs of the business, such as inventory purchases, employee salaries, healthcare benefits, insurance, etc., which are initially required for its survival.

- Recovery and Rebuilding: The EIDL cannot be used to repair physical damage (which is covered by SBA Physical Disaster Loans), but it can be used to support your business during recovery by stabilizing your cash flow until your business can get back on its feet.

However, the funds cannot be used for:

- Refinancing long-term debt.

- Business expansion.

- Replacing lost profits.

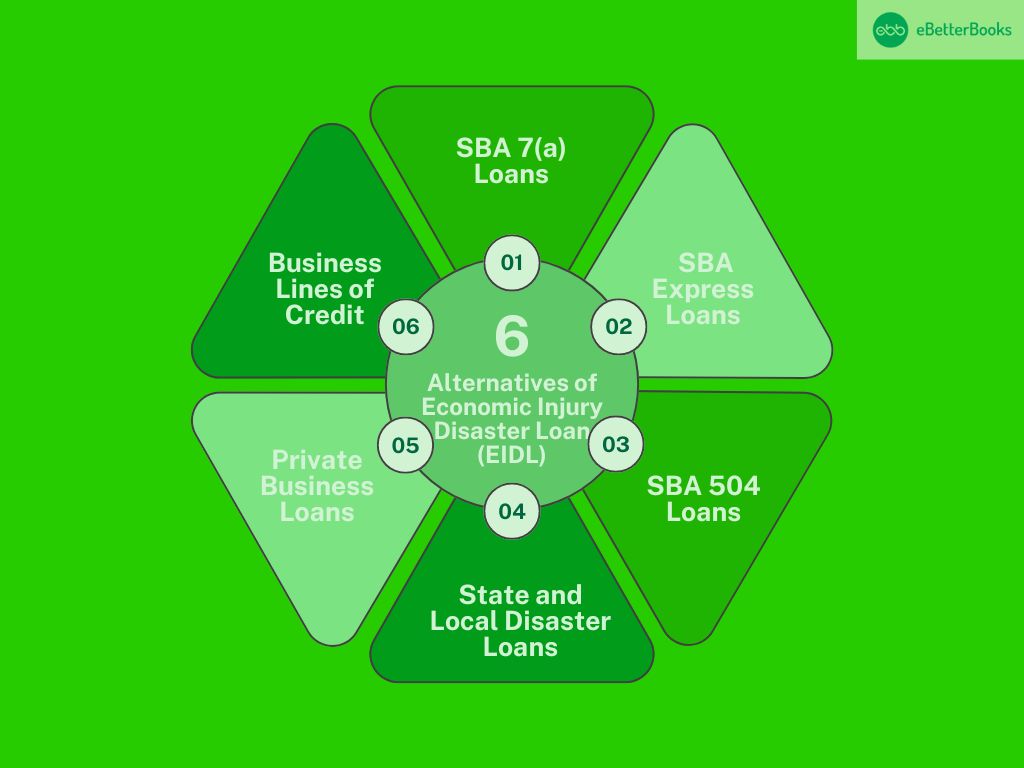

Alternatives of Economic Injury Disaster Loan (EIDL)

For businesses experiencing financial difficulties, there are a number of alternatives to the Economic Injury Disaster Loan (EIDL).

Here are a few options:

- SBA 7(a) Loans

SBA 7(a) loans are the SBA’s flagship offering for general business needs. These loans can be used for working capital, refinancing debt, purchasing equipment, and much more. Rates are competitive, and terms are flexible; the maximum loan amount is $5 million.

Several banks and financial institutions offer SBA 7(a) loans, including:

- Wells Fargo: A large SBA lender who lends 7(a) loans. You can begin the application process right from online.

- Chase Bank: SBA 7(a) loans are offered. You can apply online or visit a branch.

- Live Oak Bank: They specialize in SBA loans, and their entire application process is done online.

- SBA Express Loans

When compared to the 7(a) loan, the SBA Express is a faster version, with up to $500,000 in funding and approval in 36 hours or less. These loans are good for smaller businesses needing quick access to funds.

SBA Express loans are provided by many of the same banks that offer 7(a) loans, including:

- Bank of America: SBA Express loans are provided; you can start the application process online.

- U.S. Bank: It is quicker to get SBA Express loans on offer. There are online applications.

- Huntington National Bank: An online applicant option for Express loans with ratings as a top SBA lender.

- SBA 504 Loans

Part of the SBA 504 loan program is designed for qualified businesses to purchase or improve long-term assets like real estate or equipment. The loans amounting upto $5.5 million are usually partnered with loans from certified development companies (CDCs).

The bank will partner with Certified Development Companies (CDCs) to originate SBA 504 loans. Some include:

- PNC Bank: This website allows you to apply for SBA 504 loans or provides you with a chance to apply through their branch.

- Celtic Bank: Specializes in SBA 504 loans, with an online application option.

- Key Bank: As a SBA 504 lender, you can start the process online and work with partners who do SBA 504 loans.

- Disaster Loans: State and Local

Hundreds of state and local governments offer their disaster recovery loan programs. Federal loans are only sometimes available for some businesses, and these can be an alternative that often comes with different terms and requirements, a promising way to help the business out.

Local governments and local banks or development agencies often work together to provide disaster loans. These may include:

- State-Specific Banks: Often, Federally Insured regional banks, like Regions Bank in the Southeast or Fifth Third Bank in the Midwest, partner with a state and offer disaster loan programs.

- These loans usually come from state economic development sites or local banks so that you can apply for them.

- Private Business Loans

Businesses can also explore private loans from banks, credit unions, and online lenders. SBA loans can be bigger, and bigger loans can be easier to get, especially if you need the capital fast.

Many banks and online lenders offer private business loans, which can be applied for online:

- Lendio is an online marketplace where businesses can contact all the lenders present who offer Business loans. It is entirely online.

- OnDeck: Fast business loans and lines of credit online & provides.

- BlueVine: Business loans and lines of credit with a quick, online application process.

- Business Lines of Credit

A business line of credit gives you the flexibility to borrow some cash for your short-term needs. Unlike a traditional loan that you take once, you can borrow and repay funds when you need them, making the advantages of this option increasingly attractive for businesses suffering temporary cash flow problems.

Traditional banks and online lenders offer these:

- Kabbage: Through a simple, fully online application, provides lines of credit.

- Capital One: Provides business lines of credit where customers can apply online or at An in-store branch.

- American Express: It allows a line of credit for businesses and offers online applications.

Frequently Asked Questions (FAQs)

What is the maximum amount of loan disbursed or given under the Economic Injury Disaster Loan?

The Economic Injury Disaster Loan (EIDL) program disburses a maximum of $2 million. Yet a business’s eligibility for a loan is based on its financial needs and the economic injury caused by the disaster.

The $2 million cap is waived in certain instances if a business has suffered serious financial harm, but it is rare and exercised on a case-by-case basis. Small business loan terms are adjustable to cope with a business’s changing needs, including how long it takes to repay the debt and what interest charges the company will be required to pay.

Are SBA loans forgivable?

Economic Injury Disaster Loan (EIDL) and other SBA loans are not forgivable. The Small Business Administration (SBA) sets the terms under which borrowers must repay the loan.

Meanwhile, the Paycheck Protection Program (PPP) — which, like a normal SBA loan, was administered by the SBA but could grant loan forgiveness under certain conditions, such as for payroll or other eligible expenses — did exist. However, while the EIDL comes with low interest rates and long terms to ease the small business financial blow, it must be repaid in full.

In short, EIDL loans are not forgivable, but they have favorable repayment terms.

How much time do I have to pay back an EIDL?

If you can repay, your EIDL repayment term can be as long as 30 years. The SBA allows small businesses to concentrate on recovery without immediate financial pressure in terms that are as convenient as possible.

When does one receive the EIDL after approval?

After your EIDL is approved, it should only take 2-3 weeks to receive your funds. However, it takes time to process and may vary based on demand and the complexity of your application. In a few cases, you will (with a small advance), but the full loan will be processed.

Is the Economic Injury Disaster Loan (EIDL) for paying off other debts?

The EIDL can’t be used to refinance long-term debt or pay off existing loans. While it’s meant specifically to cover operating expenses, working capital, and fixed expenses such as rent, payroll, and utilities to help businesses endure the economic hardship brought on by a disaster, it also provides businesses with some cushion in the event of a major debacle.