Properly recording personal money invested into a business is essential for maintaining accurate financial statements and ensuring tax compliance within QuickBooks. This process requires business owners to correctly differentiate the transaction as either an Owner’s Contribution (Equity), which increases ownership stake and is not repaid, or an Owner’s Loan (Liability), which is a debt the business must repay.

The guide details the necessary steps for creating and utilizing specialized equity accounts in both QuickBooks Desktop and QuickBooks Online. Crucially, the content extends to advanced financial management, covering the precise method for recording non-cash asset contributions at their Fair Market Value using a journal entry, addressing the specific tracking needs for multiple owners in a partnership structure, and outlining the significant risk of tax penalties if owner contributions are mistakenly classified as taxable sales income. Following these authoritative bookkeeping practices is paramount for audit readiness and clear financial analysis.

Highlights (Key Facts & Solutions)

- Distinguish Funds: Funds must be classified as Owner’s Contribution (Equity) (not repaid, affects capital) or Owner’s Loan (Liability) (formal debt requiring repayment and interest tracking).

- Non-Cash Assets: Contributions of items like equipment must be recorded at their Fair Market Value (FMV) using a Journal Entry to debit the Asset account and credit the Owner’s Equity account.

- Record in QBO: The simplest way to record a cash investment in QuickBooks Online is via the Bank Deposit function, specifically categorizing the transaction against the Owner’s Equity account.

- Avoid Income Error: Never record owner contributions as sales income, as this artificially inflates revenue, misrepresents business performance, and leads to an incorrect, higher tax liability.

- Multiple Owners: Multi-owner businesses (partnerships) must establish separate, dedicated Equity accounts for each partner (e.g., Partner A Capital, Partner B Draw) to satisfy partnership agreements and K-1 tax reporting requirements.

- Reimbursements: Repaying an owner for a business expense they personally paid should be recorded as a legitimate Business Expense or repayment against a Liability account; it is not an Owner’s Draw.

- Track Net Investment: The total net investment (contributions minus draws) is most accurately viewed on the Balance Sheet Report under the Total Equity line item.

Understanding Personal Money or Personal Funds Provided by the Owner

Personal money refers to the funds that business owners put into their company’s finances. It is one way to add additional capital to the business.

There are two ways to put personal money into the business:

- You can list it as an “Equity”.

- You can list it as a “Loan” (i.s. loan yourself money)

Importance of recording personal money

- It helps maintain clear records of the owner’s contribution.

- It helps ensure that the financial statement shows accurate business performance.

- It ensures that the business is compliant with the latest accounting standards and tax laws.

- It helps in organizing the funds into the balance sheet.

- It helps businesses track the company’s financial records without any hassle.

How to Record Personal Money put into Business QuickBooks Desktop?

To record personal money put into a business in QuickBooks Desktop, create an equity account in the Chart of Accounts, enter the owner’s contribution, and save the transaction.

Steps to Record Owner Contributions in QuickBooks Desktop:

Part 1: Create a New Bank Account

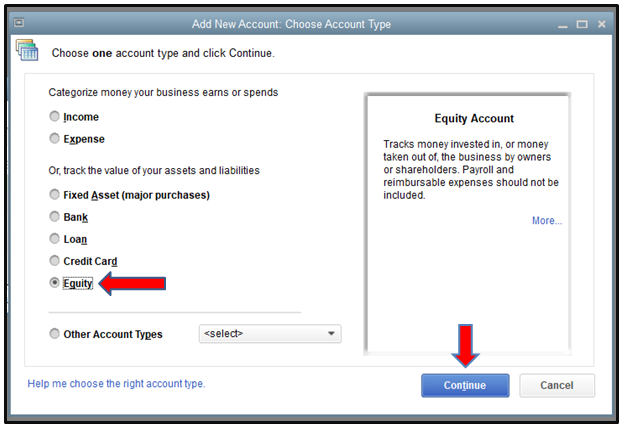

Create a new bank account in QuickBooks Desktop, go to the Chart of Accounts under Accounting, click “New,” and select Equity as the account type.

Step 1: Navigate to the Chart of Accounts

- Click on the Accounting.

- Choose the Chart of Account.

Step 2: Select the account details

- Click on the New button on the screen.

- Choose Equity under the Account Type.

Part 2: Record the Owner’s Contribution

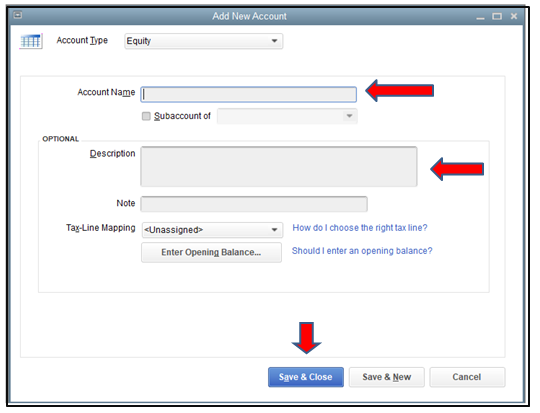

How to record the owner’s contribution, enter the transaction in QuickBooks Desktop by selecting Owner’s Equity, inputting the contribution name and amount, then save and close the transaction.

Step 1: Enter the transaction

- Choose the Owner’s Equity from the Detail Type field on the screen.

- Put the Owner’s Contribution in the Name field.

- Enter the contribution amount in the Balance field.

Step 2: Save the transaction

- Once you have entered all the required details, Click on Save and close.

How to Record Personal Money put into Business QuickBooks Online?

Record personal money in QuickBooks Online, set up an equity account under Chart of Accounts. Record the investment via a bank deposit, then pay from the investment using Check or Expense options.

Steps to Record Owner Investment in QuickBooks Online:

Part 1: Set Up an equity account

How to set up an equity account in QuickBooks Online, go to the Chart of Accounts under Settings, select Equity from the Account Type, choose Owner’s or Partner’s Equity from the Detail Type, and save.

Step 1: Navigate to the Chart of Accounts

- Click on the Setting option on the screen.

- Choose a Chart of Accounts.

Step 2: Mention the account details

- Click on Equity from the Account Type drop-down.

- Choose the Owner’s Equity or Partner’s Equity from the Detail Type drop-down.

Step 3: Save the transaction

- Once you have entered all the required details, Click on Save and close.

Part 2: Record the Investment

Record an investment, go to + New and select Bank Deposit. Choose the bank account, enter the date, investor details, equity account, payment method, and amount, then save the transaction.

Step 1: Navigate to the Bank deposit

- Click on the + New option on the screen.

- Choose a Bank deposit.

Step 2: Enter the transaction details

- Choose the bank account you’re depositing the money from the Account drop-down.

- Mention the date on which you have deposited the money.

- In the Add funds to this deposit section, mention the name of the investor in the Received from the field.

- Choose the appropriate equity account from the drop-down list in the Account field.

- Set a Payment method.

- Mention the investment amount in the Amount field.

Step 3: Save the transaction

- Once you have entered all the required details, Click on Save and close.

Part 3: Pay the Fund from the Investment

How to pay from an investment, create a Check for actual payments, entering check details and categories. For card payments, record as an Expense, include vendor, payment method, and details, then save.

Case 1: Making a payment with an actual check

Make a payment with a check in QuickBooks, click + New, select Check, specify the payee, enter the check number, allocate amounts to equity and expense accounts, then save and close.

Following the step-by-step information below:

Step 1: Find the person or business

- Click on the + New button on the screen.

- Click on Check.

- Mention the person or business you’re paying back.

Step 2: Enter the check details

- For the Check no., put a check number.

- Mention the following information in the Category Details section.

- In the First line, enter the equity account you use to track the investment and the amount you’re paying back today.

- In the Second Line, enter the expense account you use to track the interest you pay and the amount of interest included in your payment today.

- In the Other lines, enter any additional fees and their appropriate accounts.

Step 3: Save the transaction

- Once you have entered all the required details, Click on Save and close.

Case 2: Making a payment with a debit or credit card

To record a payment with a debit or credit card, click + New, select Expense, enter vendor details, payment method, amount, and tax. Add a description and save the transaction. Record the repayment as an expense in your QuickBooks Online account.

Following the step-by-step information below:

Step 1: Navigate to Expense

- Click on the + New button on the screen.

- Now, choose Expense.

Step 2: Enter the transaction details

- Choose the vendor in the Payee field,

- Choose the account you used to pay the expenses in the Payment Account field.

- Mention the date for the Expense in the Payment date field.

- Choose how you paid for the Expense in the Payment method field

- If you want detailed tracking, mention a Ref no or Permit no.

- In the Tags field, mention the preferred label to categorize your money.

- In the Category Details section, mention the expense information. In the Category drop-down, select the expense account you use to track expense transactions. Then, enter a description.

- Mention the Amount and Tax.

- If you plan to bill a customer for the Expense, choose the Billable checkbox and mention their name in the Customer field.

Step 3: Save the transaction

- Once you have entered all the required details, Click on Save and close.

Advanced Scenarios in Recording Personal Funds in QuickBooks

While recording personal funds in QuickBooks may seem simple, real-world situations often involve more complex decisions. Whether it’s choosing between equity and loan treatment, managing multiple owners, or avoiding tax pitfalls—understanding these advanced scenarios is critical. This section breaks down 5 important sub-topics that help business owners make smarter entries, avoid errors, and keep their books clean, compliant, and audit-ready.

Difference Between Owner’s Equity and Owner’s Draw in QuickBooks

In QuickBooks, Owner’s Equity records the money or assets the owner contributes to the business, while Owner’s Draw tracks the money taken out for personal use. Use Owner’s Equity when you add funds (cash, property, or equipment) to the business. Use Owner’s Draw when you withdraw cash, pay personal bills, or transfer profits. These two entries impact financial reports differently: equity increases business value, draw reduces it. Keeping both accounts separate helps maintain clean records, ensures accurate tax reporting, and supports clear cash flow tracking. QuickBooks requires you to choose the correct type during each transaction to avoid errors.

When Should You Record Personal Funds as a Loan vs. Equity?

Record personal funds as a loan in QuickBooks if you plan to repay yourself with interest, track liability, and show it as a debt on the balance sheet. Use equity if the money is invested without expecting repayment, affects ownership value, and supports long-term growth. Loans require a payment schedule, impact liabilities, and need formal documentation. Equity boosts net worth, simplifies reporting, and avoids repayment obligations. Decide based on intent: repayment = loan; ownership stake = equity. Proper categorization prevents audit issues, supports clean financials, and helps align your books with legal and tax requirements.

How to Track Multiple Owners’ Contributions Separately in QuickBooks

To track multiple owners’ contributions, create individual equity accounts for each owner, label them clearly, and assign each deposit to the correct account. This method separates ownership stakes, supports accurate reporting, and helps during profit distribution. In QuickBooks, use the Chart of Accounts to create accounts like “Owner A Equity” and “Owner B Equity.” Record each contribution through Bank Deposit or Journal Entry, linking the correct owner’s account. This keeps ownership transparent, simplifies end-of-year tax filing, and ensures legal clarity during audits or exit planning. Always reconcile entries to avoid discrepancies in capital balances.

Tax Implications of Recording Personal Investments in QuickBooks

Recording personal investments correctly in QuickBooks impacts tax liability, audit accuracy, and financial transparency. Owner contributions marked as equity are not taxable income but increase your capital account. Misclassifying them as revenue may inflate profits, trigger higher tax, and cause compliance issues. If treated as a loan, the business may deduct interest paid, but it must follow loan documentation and payment rules. Accurate classification avoids IRS scrutiny, simplifies Schedule C or K-1 reporting, and ensures year-end statements reflect real owner activity. Always consult a tax advisor when recording large transactions to align with federal and state laws.

Common Mistakes to Avoid While Recording Personal Money in QuickBooks

Many users make critical mistakes like using income accounts, mixing personal and business funds, or skipping documentation. Never record owner contributions as sales income—this inflates revenue, increases tax, and misleads reports. Avoid combining personal expenses in business accounts; it breaks audit trails, damages credibility, and complicates tax filing. Failing to categorize deposits properly (loan vs. equity) leads to balance sheet errors, ownership disputes, and reporting issues. Always attach notes, use correct equity or liability accounts, and reconcile regularly. These practices protect financial accuracy, maintain compliance, and improve business decision-making.

Essential Add-ons for Smarter Personal Fund Management in QuickBooks

Recording personal funds in QuickBooks goes beyond just entries—it requires strategy, clarity, and smart financial handling. This section covers 5 practical topics that support the main process, such as reimbursements, capital tracking, and reporting. These insights help you stay audit-ready, legally compliant, and financially accurate. Whether you’re managing multiple owners, separating finances, or choosing between journal entries and deposits, these supplementary practices tighten your books and improve financial control.

How to Reimburse Personal Expenses Paid for the Business in QuickBooks

To reimburse personal expenses, record them as a business expense, not personal spending. Use the Expense or Journal Entry feature in QuickBooks, select the correct vendor, and assign the proper business category. Link the payment to the owner’s equity or loan account to track repayment accurately. Always attach receipts to support the transaction, ensure tax deductibility, and maintain clear audit trails. Avoid paying back directly without recording—this causes balance sheet mismatches, missing expenses, and incorrect profit figures. Timely reimbursement improves transparency, supports tax claims, and keeps owner finances organized.

Understanding Capital Accounts for Sole Proprietors and Partnerships

Capital accounts track each owner’s investment, withdrawals, and share of profits. In QuickBooks, sole proprietors usually use a single Owner’s Equity account, while partnerships need separate capital accounts for each partner. These accounts reflect ownership changes, help with profit distribution, and support accurate tax reporting. Set them up under the Equity category in the Chart of Accounts, and name them clearly—like “Partner A Capital.” Avoid mixing capital with draws or expenses. Well-maintained capital accounts ensure clean books, simplify year-end adjustments, and provide transparency during audits or ownership changes.

How to Generate Reports to Review Owner Contributions in QuickBooks

To review owner contributions, use custom reports in QuickBooks that filter transactions by equity accounts, date range, and source. Start with the General Ledger or Transaction Detail by Account report, customize it to show only owner-related entries, and group by account for clarity. You can export reports to Excel for deeper analysis, partner reviews, or tax filing. Accurate reports help track how much each owner has invested, validate financial records, and support fair profit distribution. Always verify entries with attached notes or receipts for full transparency and error-free accounting.

Best Practices for Keeping Personal and Business Finances Separate

Always maintain separate bank accounts, credit cards, and expense records for your business to avoid confusion, ensure compliance, and simplify bookkeeping. In QuickBooks, never record personal expenses in business categories—it skews financial reports, increases tax risk, and complicates audits. Use owner’s draw or reimbursement entries when crossing funds is unavoidable. Reconcile accounts monthly, label transactions clearly, and avoid paying personal bills from business accounts. Separation builds credibility with lenders, supports cleaner tax returns, and protects you in case of legal or IRS scrutiny.

Using Journal Entries vs. Bank Deposits to Record Owner Investments

Use Bank Deposits when you’re physically depositing cash or checks into a business account—this links directly to your bank feed, tracks payment method, and simplifies reconciliation. Use Journal Entries when adjusting balances, recording non-cash contributions, or entering prior-period investments—this gives you more control over accounts, dates, and narratives. Bank Deposits are quick, beginner-friendly, and visible in the register. Journal Entries are precise, useful for accountants, and better for equity-to-loan adjustments. Always choose the method based on transaction type, documentation available, and reporting needs. Incorrect usage can lead to double entries, missing funds, or tax issues.

Conclusion!

Categorizing personal and business funds is important for accurate financial reporting. Updating the information in your accounting software, QuickBooks helps you in generating accurate reports and update your capital accounts, equity and other related ledgers.

FAQ

What is the fundamental difference between an Owner’s Contribution (Equity) and an Owner’s Loan (Liability) in QuickBooks?

The core difference is the expectation of repayment and the resulting classification on the Balance Sheet.

- Owner’s Contribution (Equity): This is money or assets invested by the owner to increase their capital stake. For sole proprietorships and partnerships, this flows through the Equity section and is not expected to be repaid by the business as a formal debt.

- Owner’s Loan (Liability): This is funds provided by the owner with the expectation of formal repayment, typically with interest. It is recorded in a liability account, often labeled “Due to Shareholder” or “Shareholder Loan.”

A key distinction based on entity type: For a sole proprietorship or partnership, most cash put in or taken out flows through Equity accounts (Contributions and Withdrawals). For a corporation, funds paid to the shareholder are almost always recorded as a Liability (Shareholder Loan) until converted to equity.

How should I track non-cash assets (like a personal computer or vehicle) that I contribute to the business in QuickBooks?

Non-cash asset contributions must be recorded at their Fair Market Value (FMV) on the date of the transfer, not the original purchase price. This transaction is typically recorded using a Journal Entry in QuickBooks.

The Journal Entry structure is as follows:

- Debit the appropriate Asset account (e.g., Equipment, Vehicles) for the FMV.

- Credit the Owner’s Equity account (or the specific Partner’s Capital Account).

This process ensures the asset’s value is properly recognized on the business’s books and increases the owner’s capital. Supporting documentation (like an appraisal or market data) for the FMV should be kept on file.

What specific tax risks do I face if I mistakenly classify an Owner’s Contribution as Sales Income in QuickBooks?

Mistakenly classifying an owner’s contribution as sales or service income artificially inflates the business’s gross revenue, leading to several adverse tax and reporting consequences.

Key risks include:

- Higher Taxable Income: The funds are treated as earned revenue, which directly increases the business’s net profit. This can result in an overstatement of income and a subsequent increase in self-employment taxes or corporate income taxes.

- Inaccurate Financial Analysis: The business’s financial health, specifically its operating performance, is misrepresented, misleading owners, lenders, and investors.

- Audit Risk: Repeated misclassification can complicate tax compliance and increase scrutiny during an audit, as capital contributions are non-taxable events for the business.

For multi-owner businesses (Partnerships or S-Corps), how do I ensure I track each owner’s capital balance separately?

In QuickBooks, multi-owner entities must create separate, detailed Equity accounts for each owner to accurately track their specific ownership stake, required for tax reporting documents like the K-1.

The Chart of Accounts should be structured to include:

- A main Equity account (e.g., Partner A Capital).

- Sub-accounts underneath the main Equity account to differentiate activity:

- Partner A Contribution: Records money or assets invested.

- Partner A Draw/Withdrawal: Records money taken out for personal use.

- Retained Earnings/Net Income: This is typically handled by QuickBooks at year-end, but some firms maintain separate year-end profit distribution accounts.

This structure allows for a clear, auditable balance of each owner’s net investment.

Why is a Journal Entry often preferred over a Bank Deposit when transferring funds between an owner’s personal account and the business?

While the Bank Deposit function is quick and user-friendly for a simple cash deposit (especially with connected bank feeds), a Journal Entry (JE) is often preferred by accounting professionals for:

- Complex Transactions: JEs are necessary for recording non-cash transactions (assets, debt cancellation) or when converting a shareholder loan to equity.

- Accuracy for Dual-Account Entries: JEs provide precise control over the debit and credit sides, ensuring the corresponding asset (bank) and equity/liability account are correctly affected.

- Detailed Documentation: JEs allow for a complete, detailed narrative in the memo field, which is crucial for the audit trail of internal transfers like owner loans.

For a simple cash investment, categorizing the bank feed transaction directly to Owner’s Equity is the simplest and most common method in QuickBooks Online.

When reimbursing myself for a personal expense paid for the business, why must I record it as an Expense and not an Owner’s Draw?

Reimbursing a personal payment for a business cost must be recorded as a legitimate Business Expense because the original transaction provided a tax-deductible benefit to the company (e.g., utilities, supplies).

- Expense Classification: The payment from the business bank account to the owner should be categorized against an Equity account (e.g., Owner’s Equity or Partner’s Equity) or a Liability account (Due to Owner), depending on how the initial owner payment was recorded.

- Why not Draw: An Owner’s Draw is a non-deductible reduction of capital or profits taken out for personal, non-business use. The reimbursement payment is settling a business liability to the owner, not distributing profit.

How can I quickly generate a report in QuickBooks to see the total net investment by the owner at any given time?

The most accurate report for determining the total net investment (capital contributed minus capital withdrawn) is the Balance Sheet Report.

Steps to Review Net Investment:

- Navigate to the Reports menu.

- Select the Balance Sheet Standard report.

- Set the reporting date to the desired snapshot date.

- Scroll down to the Equity section.

- The Total Equity line item represents the owner’s cumulative net stake, including Net Income, and the balances of all Contribution, Investment, and Draw accounts.

For a more granular view of only the activity (contributions and draws), run the General Ledger Report filtered specifically for the Owner’s Equity or Capital accounts.

Disclaimer: The information outlined above for “How to Record Personal Money put into Business QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.