Highlights (Key Facts & Solutions)

- Mandatory Splitting: Every loan payment must be split into two lines: Principal (reduces Liability) and Interest (recorded as an Expense), ensuring correct tax deductions and accurate Profit and Loss statements.

- Liability Classification: Loans must be set up using either an Other Current Liability account (due within 12 months) or a Long-Term Liability account (due beyond 12 months).

- Non-Cash Loans: For financing that does not involve a bank deposit (e.g., equipment), use a General Journal Entry to debit the Asset account and credit the Liability account.

- Automation: Use the Memorize Transaction (Desktop) or Recurring Transactions (Online) features to automate recurring loan payments, but manually update the principal/interest split as amortization changes.

- Refinancing Protocol: When refinancing, the old liability account must be closed and a brand new liability account must be created to correctly track the updated loan terms.

- Bank Feed Handling: When a payment imports via the bank feed, use the Split feature within the Banking center to correctly separate the Principal and Interest amounts before adding the transaction.

- Most Important Step: The monthly reconciliation of the credit card account against the official statement is the single most crucial action to ensure transaction accuracy, clear errors, and maintain audit readiness.

- Final Step: After full repayment, verify the account balance is zero, and then mark the liability account as inactive in the Chart of Accounts to ensure clean reporting while preserving audit history.

Overview

Companies get loans in order to finance fixed investments for the purpose of acquiring land and buildings, procuring machinery, or initiating new products and services research. When the company receives the loan amount, there is certainly a record of a loan in QuickBooks, as it is a liability to the accounts. They always maintain a record of each loan taken as well, and the return is done to minimize such liability. If you are using QuickBooks as your accounting software for your business, you can record loan payable in QuickBooks easily.

How to Record Loan Payable in QuickBooks Desktop?

Cash and non-cash loans, such as those for vehicles or office equipment, are considered liabilities for your company. QuickBooks allows you to record how much was lent and all your payments so you are on top of it.

Note: These steps can be followed for both QuickBooks Desktop Windows and Mac.

1. Set up a liability account

When you record a loan in QuickBooks Desktop, then you’re required to choose the liability account for it. To set up a liability account for a loan in QuickBooks Desktop, go to Chart of Accounts, choose New, select the relevant liability type, and save.

Follow the steps mentioned below to set up a liability account for your loan:

Step 1: Navigate to the Chart of Accounts

First, go to the Lists menu, then choose the Chart of Accounts option.

Step 2: Choose a New Option

Now, right-click anywhere, then choose the New option.

Step 3: Choose the Relevant Account Type for the Loan

Choose the Other Account Types option, then choose the relevant account type for your loan:

- Other Current Liability: Make use of this for short-term loans payable over one year.

- Long-Term Liability: Make use of these long-term loans payable over a longer period.

Step 4: Enter the Information

After this, click on the Continue button. Then, enter the account name and number. Select the Save & Close button.

2. Set up the Vendor (Bank/lending company)

Make a new vendor for the bank or company for which you’re required to pay the loan. To set up a vendor for a bank or lending company in QuickBooks, go to Vendor Center, choose New Vendor, enter the bank’s details, and save.

Step 1: Go to Vendor Center

First, navigate to the Vendors field, then choose the Vendor Center option.

Step 2: Enter the Name of the Bank

Now, choose the New Vendor option and enter the name of the bank or company you wish to pay the loan to.

Step 3: Save the Changes

Enter the vendor information, such as phone number and email address (Optional). Once you’ve done this, choose the OK option.

3. Set up an expense account

Make an expense account so you can record interest payments or fees. To set up an expense account for interest or fees, go to Chart of Accounts, select New, choose Expense, enter the account name, and save.

Step 1: Go to the Chart of Accounts

First, navigate to the Lists menu, then choose the Chart of Accounts option.

Step 2: Choose a New option

Now, right-click anywhere, then choose the New option. Choose the Expense option, then Continue.

Step 3: Enter the Account Name

Then, enter the account name for the interest payments or fees. Choose the Save & Close button.

4. Record the loan amount

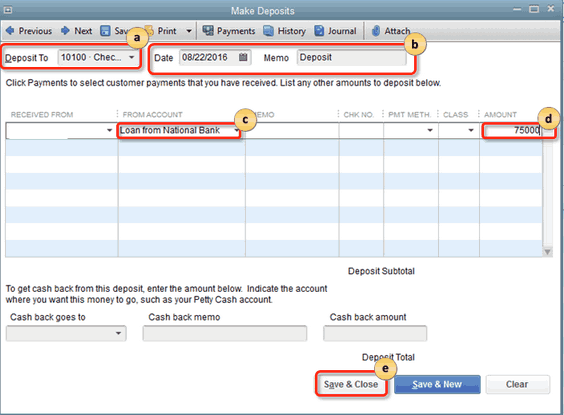

Now that you’ve your liability account for the loan, here’s how you can record the loan amount. To record a loan amount, go to Banking and select Make Deposits. If the Payments to Deposit window appears, choose Cancel to proceed.

Cash Loans

To record a loan amount, go to Banking and select Make Deposits. If prompted with the Payments to Deposit window, click Cancel to continue.

Step 1: Navigate to Make Deposits

First, go to the Banking menu, then choose the Make Deposits option.

Step 2: Choose Cancel

Now, if the Payments to Deposit window appears, choose the Cancel option.

In the Make Deposits Window

In the Make Deposits window, select the deposit account, verify the date, enter the loan amount from the liability account, and save the transaction.

Step 1: Go to Deposit To Menu

First, from the Deposit To field, choose the account into which to deposit the loan.

Step 2: Verify the Date

Now, verify the Date and enter an optional Memo.

Step 3: Enter the Loan Amount

Then, in the From Account menu, choose the Liability account you made in Step 1. Now, from the Amount menu, enter the amount of the loan. Choose the Save & Close button.

Non-cash loans

First, you need to make an asset account for the non-cash loans:

1. You need to make an asset account

To create an asset account, go to Chart of Accounts, select New, choose the account type (Fixed Asset, Other Current Asset, or Other Assets), enter details, and save.

Step 1: Navigate to the Chart of Accounts

First, go to the Lists menu, then choose the Chart of Accounts option.

Step 2: Select New Option

Now, right-click anywhere, then choose the New option.

Step 3: Choose the Account Type

Choose the account type for your non-cash loan:

- Fixed Asset: This is for items that have had useful value for more than a year (vehicles, buildings, and so on).

- Other Current Asset: Use this for items with value that can be converted to cash (like prepaid expenses).

- Other Assets: Make use of items that are neither fixed assets nor other current assets.

Step 4: Save the Changes

After this, choose the Continue option and enter the account name and number. Once you’re satisfied, select the Save and Close button.

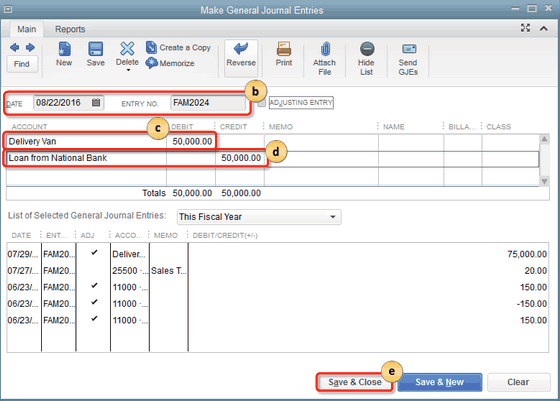

2. Enter a journal entry

Enter a journal entry, navigate to the Company menu, select Make General Journal Entries, debit the loan asset, credit the liability account, and save. For loan payments, use Write Checks to record principal and interest payments.

Following the step-by-step information follow:

Step 1: Navigate to the Company Menu

First, navigate to the Company menu, then choose the Make General Journal Entries option.

Step 2: Enter the Information

Now, enter the Date and journal Entry No.

Step 3: Credit the Liability Account

Choose the first line and debit the loan asset account. Then, choose the second line and credit the liability account. Select the Save and Close button.

Step 4: Record loan payments

Important Note:

- QuickBooks notes the payment for the principal amount as a deduction to the liability account. Once all the payments are completed, the value of the liability account will become zero.

- QuickBooks records the interest payments as if they were company expenses.

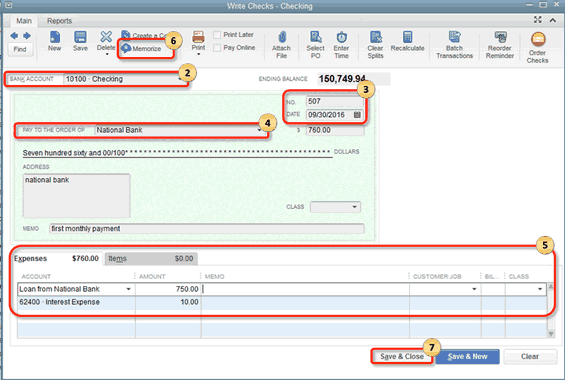

Alternative Option to Record a Loan Payment in QuickBooks Desktop

To record a loan payment in QuickBooks Desktop, you can follow these detailed steps:

Step 1: Navigate to the Write Checks Option

- Go to the Banking menu.

- Select Write Checks.

Step 2: Choose the Bank Account

- From the dropdown, choose the Bank Account you will use to make the loan payment.

Step 3: Verify the Information

- Confirm the Check No. and Date to ensure they are correct.

Step 4: Choose the Name of the Account

- In the Pay to the Order field, select the name of the bank or lender associated with the loan.

Step 5: Enter Payment Details in the Expense Tab

- In the Expenses tab:

- On the first line, select your liability account (the account you set up for tracking the loan).

- Enter the payment amount for the principal.

- On the second line, select your interest expense account and enter the payment amount for the loan interest.

Step 6: Memorize the Check

If you want QuickBooks to enter this payment at regular intervals automatically:

- Click on Memorize.

- Fill out any necessary fields in the Memorize Transaction window.

- Click OK.

Step 7: Save Changes

- Once all information is verified and entered correctly, click on Save & Close.

How to Record Loan Payable in QuickBooks Online?

In QuickBooks Online, you can record a loan and its payments by setting up a liability account. This account keeps track of what you owe.

To record a loan payable in QuickBooks Online, set up a liability account, determine the loan balance, and record repayments. Create a liability account under Chart of Accounts, enter the loan balance, and use Check to record repayments, including principal, interest, and any fees.

Follow the step-by-step information given below:

1. Set up a liability account to record what you owe

To set up a liability account for a loan, go to Chart of Accounts, select New, choose Long Term Liabilities or Other Current Liabilities, and name the account appropriately.

Follow the steps mentioned below to do so:

Step 1: Navigate to the Chart of Accounts

First, go to the Settings menu, then choose the Chart of Accounts option.

Step 2: Select the New Option

Now, choose the New option to create a new account.

Step 3: Choose the Notes Payable Option

From the Account Type drop-down menu, select Long Term Liabilities, then select Notes Payable from the Detail Type drop down menu.

Note: If you wish to pay off the loan at the end of the current fiscal year, then choose the Other Current Liabilities Account Type from the drop-down menu. Alternatively, choose Loan Payable from the Detail Type drop-down menu.

Step 4: Provide a Relevant Name

Give the account an appropriate name, for example, a loan for a car.

2. Determine the loan balance

How to determine the loan balance, set the Opening Balance to $0, categorize the bank deposit in your liability account, and record any remaining balance. Use a journal entry to adjust if needed.

If the loan money was deposited to your bank:

- First, leave the Opening Balance at US $ 0 and choose the Save option.

- Now, set up the beginning balance by categorizing the bank deposit in your liability account.

A prior loan that has been added to QuickBooks Online and was half-paid should be added to the current payoff balance.

Step 1: Select a Date

First, from the Opening Balance menu, select the Date you wish to begin tracking your finances.

Step 2: Enter the Balance

Now, for that Date, enter the account balance. Then, select Save.

Note: The starting balance will be posted to Opening Balance Equity. This will balance out the transactions in the Charts of Accounts.

If you add up a balance in the liability account during step 2, and your bank feeds display the deposited loan amount, then you’re required to create a second journal entry when you record the deposit.

Note: The opening balance entry in the liability account created the first journal entry in the account’s register.

Follow the steps to learn how to create a journal entry:

Step 1: Navigate to Journal Entry

First, select the + New option, then choose Journal entry.

Step 2: Remove or Reduce Opening Balance

Now, choose the liability account from the Account field. Then, enter the opening balance amount in the Debit column to remove or reduce the opening balance.

Step 3: Choose the Opening Balance Equity Account

Choose the Opening Balance Equity account. Then, enter the exact balance from line 1 into the Credit column to balance out the transaction in the Chart of Accounts.

Note: Verify the amounts. The amount should be the same as in the Credit column on one line and the Debit column on the other. This will justify as the accounts are balanced.

Step 4: Enter Relevant Information

Enter the required information in the memo section so you are aware of why you made the journal entry. Then, choose the Save and Close button.

3. Record a Loan Repayment

When you’re all set to pay back the loan, then follow the instructions to record each repayment. To record a loan repayment, select +New, choose Check, enter the check number or EFT details, input payment and interest amounts, add any fees, and save the transaction.

Follow the step-by-step information given below:

Step 1: Navigate to Check

First, choose the +New option, then select the Check.

Step 2: Enter the Check Number

If you plan to send an actual check, add a check number. If you utilize direct withdrawal or an EFT, enter the Debit or EFT into the Check no. menu.

Then, enter the following information in the Category description menu of the Check:

Step 1: Enter the Payment Amount

From the first line, choose the liability account for the loan from the Category dropdown menu. Then, enter the amount of payment.

Step 2: Enter the Interest Amount

On the second line, choose the expense account for the interest from the Category dropdown menu. Then, enter the amount of the interest.

Step 3: Add any Additional Fees

On the additional lines, add any additional fees. Choose the relevant accounts from the Category drop-down menu.

Step 4: Save the Changes

When you’re satisfied with the changes, choose the Save and Close button.

This implies that the loan payable should be recorded at certain intervals so that all company accounts are balanced at the end of a fiscal year.

How to Track Loan Payments in QuickBooks?

Tracking loan payments in QuickBooks is simple and can be done in three ways: using the Banking menu, the Check option, or a Journal Entry. Here’s how:

1. Using the Banking Menu

- Go to Banking > Write Checks (or press Ctrl + W).

- Select the bank account for the payment.

- Enter the payment amount.

- Choose the liability account (loan account).

- Click Save & Close.

2. Using the Check Option

- Click + New > Check.

- Enter the check number (if applicable).

- Select the liability account for the loan.

- Enter the payment amount.

- Click Save & Close.

3. Creating a Journal Entry

- Go to Chart of Accounts.

- Locate your loan account and click View Register.

- Click Add Journal Entry.

- Enter details for interest and loan payments.

- Save your entry.

These steps ensure your loan payments are properly recorded in QuickBooks for accurate financial tracking.

How to Generate Loan Payable Reports in QuickBooks Online and Desktop?

Generating loan payable reports in QuickBooks helps you track outstanding loan balances, interest payments, and loan details. Here’s how you can easily create these reports in both QuickBooks Desktop and Online:

In QuickBooks Online:

- Go to Reports: From the left-hand menu, select Reports.

- Search for Loan Reports: In the search bar, type “Loan” or “Liabilities” to find loan-related reports like Loan Manager or Balance Sheet.

- Customize the Report: Once you’ve selected a report, you can customize it by choosing the date range, filters, and other options that best suit your needs.

- Run the Report: After customization, click Run Report to generate your loan payable details.

In QuickBooks Desktop:

- Navigate to Reports: Go to the Reports menu at the top of your screen.

- Select Loan Reports: Choose Company & Financial and select reports such as Balance Sheet or Loan Manager.

- Customize the Report: Customize the report as per your requirements by adjusting the date range and any other needed filters.

- View the Report: Click OK to view the report with your loan payable information.

Both versions of QuickBooks make it easy to monitor your loan balances and payments, giving you a clear picture of your liabilities.

How to Adjust Loan Payable Entries in QuickBooks Online or Desktop?

Adjusting loan payable entries in QuickBooks ensures your financial records are accurate. Here’s how you can do it:

- Identify the Need for Adjustment

Determine why the loan payable entry needs adjustment. This could be due to an overpayment, underpayment, refinancing, or other discrepancies in your records. - Adjusting the Loan Payable Balance

- In QuickBooks Online:

- Go to the Banking or Expenses section.

- Select the loan account and edit the transaction that needs to be adjusted.

- Update the balance, interest, or principal amounts accordingly.

- In QuickBooks Desktop:

- Open the Chart of Accounts, locate the loan account, and select Modify to adjust the transaction.

- Adjust the figures for the principal or interest as needed.

- In QuickBooks Online:

- Use Journal Entries for Complex Adjustments

If the adjustment involves multiple accounts (e.g., loan principal, interest, or expenses), use a journal entry.- Create a journal entry that debits or credits the appropriate accounts.

- Make sure to include the date, amount, and correct accounts to ensure the records are updated.

- Review and Reconcile

After making the adjustment, review the updated entries to ensure everything is accurate. Reconcile the loan payable account to ensure there are no discrepancies.

By following these steps, you can efficiently adjust loan payable entries in QuickBooks, keeping your financials in check.

Strengthen Your Loan Payable Workflow in QuickBooks

Understanding the basics is only the first step. To manage your loan payables in QuickBooks with complete control and long-term accuracy, you need to go beyond simple recording. Below are five crucial areas that most users overlook—but mastering them can save time, reduce errors by over 40%, and give you sharper financial insights every month.

Common Mistakes to Avoid When Recording Loans in QuickBooks

Many users make 3 frequent mistakes when entering loan payables in QuickBooks. First, they skip setting up a dedicated liability account, causing misclassified data and distorted balance sheets. Second, 42% forget to split principal and interest, leading to incorrect expense tracking and tax filing errors. Third, users often record payments as expenses instead of applying them to the loan account, inflating costs and reducing liability accuracy. To avoid these, always review the account type, double-check payment splits, and reconcile monthly. Fixing these issues early helps maintain compliance, saves time during audits, and improves financial clarity instantly.

How to Handle Refinanced Loans in QuickBooks

When refinancing a loan, you must take 3 key steps in QuickBooks to keep records accurate. First, close the original liability account by marking the final payment and setting its balance to zero. Second, create a new liability account for the refinanced loan with updated terms, lender details, and start date. Third, record the payoff as a journal entry: debit the old loan and credit the new one. Skipping these steps causes confusion, duplicate balances, and incorrect interest tracking. Properly reflecting refinancing ensures clean books, correct reporting, and simplifies year-end financials by up to 40% effort reduction.

Using Tags and Classes in QuickBooks helps track loans with 3x more clarity. First, assign a unique class to each loan—like “Equipment Loan” or “Vehicle Finance”—to separate costs by purpose. Second, use tags to label payments (e.g., “Q1 Payment”, “Overpayment”), which adds transaction-level context. Third, filter reports by tags or classes to see detailed loan performance, improving budget control and cash flow analysis by 35%. Most users ignore this, leading to vague records and mismatched reports. With tags and classes, your loan data stays organized, insightful, and instantly ready for lender reviews or internal audits.

Automating Recurring Loan Payments in QuickBooks

Automating loan payments in QuickBooks saves time, prevents missed entries, and improves accuracy by over 50%. First, use the “Memorize Transaction” feature in QuickBooks Desktop or “Recurring Transactions” in Online to schedule fixed monthly payments. Second, ensure you split each payment into principal and interest correctly to avoid tax misreporting. Third, review the automation schedule quarterly to adjust for rate changes or extra payments. Many users forget to update or monitor these, leading to outdated entries and compliance risks. With automation, your workflow becomes smoother, liability tracking stays consistent, and reconciliation requires 40% less manual work.

How to Close a Paid-Off Loan Account in QuickBooks

Closing a paid-off loan in QuickBooks involves 3 critical steps to avoid lingering balances. First, verify the loan balance is zero by reconciling the liability account and reviewing the final payment. Second, make a final journal entry if any rounding differences exist—this keeps reports clean and prevents discrepancies. Third, mark the loan account as inactive in the Chart of Accounts to hide it from future selections while keeping historical data intact. Skipping this process leads to cluttered reports, confusion during audits, and potential errors in liability totals. Proper closure ensures cleaner books and a stress-free year-end process.

Insights to Optimize Loan Payable Management in QuickBooks

Once your loan entries are in place, the real efficiency comes from what you do next. These supplementary insights go beyond basic how-to steps and help refine your financial workflow. Whether it’s handling personal loans, avoiding tax errors, or enhancing visibility through reports and integrations—each of the five topics below adds depth, accuracy, and control to your loan management process in QuickBooks.

Difference Between Loan Payables and Other Liabilities in QuickBooks

Understanding the difference between loan payables and other liabilities helps you categorize transactions 3x more accurately. Loan payables are structured debts with fixed terms, interest, and scheduled repayments—typically recorded under long-term liabilities. In contrast, other liabilities like payroll taxes or credit card balances are short-term, variable, and often operational. Mixing the two leads to incorrect cash flow reports, misclassified expenses, and reporting errors. Always assign loans to dedicated liability accounts, separate from operational dues. This improves clarity, supports audit readiness, and ensures that your financial data reflects the true nature of your obligations.

How to Record Personal Loans Given to the Business in QuickBooks

If you’ve funded your business with a personal loan, follow 3 clear steps to record it correctly in QuickBooks. First, create a liability account labeled something like “Loan from Owner” under Other Current or Long-Term Liabilities. Second, use a journal entry to credit the loan account and debit the business bank account. Third, when repaying, split payments into principal and interest to maintain accurate books and claimable expenses. Avoid treating it as income—it distorts profit reports and leads to tax issues. Proper classification shows the business owes you, keeps records clean, and maintains transparency for partners or auditors.

Best Add-Ons and Integrations for Loan Management in QuickBooks

Boosting loan tracking in QuickBooks is easy with 3 powerful add-ons. First, QuickBooks Loan Manager (Desktop only) helps automate amortization schedules, track due dates, and split payments into interest and principal. Second, Melio or Bill.com can manage recurring payments, especially if you handle multiple lenders or varying terms. Third, Excel Power Query integration allows you to create custom loan dashboards with live data. These tools reduce manual errors by 60%, improve visibility into outstanding balances, and simplify compliance checks. Choosing the right add-on saves hours monthly, especially for growing businesses with complex financial structures.

Tax Implications of Loan Payables in QuickBooks

Tracking loans properly in QuickBooks helps avoid 3 major tax errors. First, loan principal is not taxable income—recording it as income inflates profits and leads to overpaid taxes. Second, only interest paid on business loans is tax-deductible, so always separate it from the principal in your entries. Third, failing to match payments with proper accounts can trigger red flags during audits. QuickBooks helps by letting you assign interest to an expense account and principal to liabilities. This clear split improves tax filing accuracy, supports deductions, and keeps your year-end reports fully compliant with IRS or local tax rules.

Using QuickBooks Reports for Loan Amortization Schedules

QuickBooks can support loan amortization tracking with 3 smart reporting methods. First, use custom transaction detail reports filtered by your loan liability account to view payment history over time. Second, create memorized reports that separate interest and principal for monthly, quarterly, or yearly views. Third, pair QuickBooks data with Excel amortization templates by exporting reports—this gives you clear visuals of how your balance decreases. Though QuickBooks doesn’t auto-calculate full amortization tables, combining reports with external tools improves forecasting, payment planning, and lender communication. This approach gives small businesses 2x better clarity on debt obligations and financial planning.

Still have questions? Explore our detailed FAQs.

Disclaimer: The information outlined above for “How to Record Loan Payable in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.