Outsourcing accounting services helps the businesses in optimizing the efficiency, enhancing the financial performance, driving profits, improving cash flow and growth of the business.

It is very important to have a trusted expert provider to manage all your business accounts at one place without any hassle.

Outsourcing accounting services is a great way to manage your finances.

Business owners do not need to worry about setting up a separate accounts department and burdening themselves with the additional cost of implementing different accounting software.

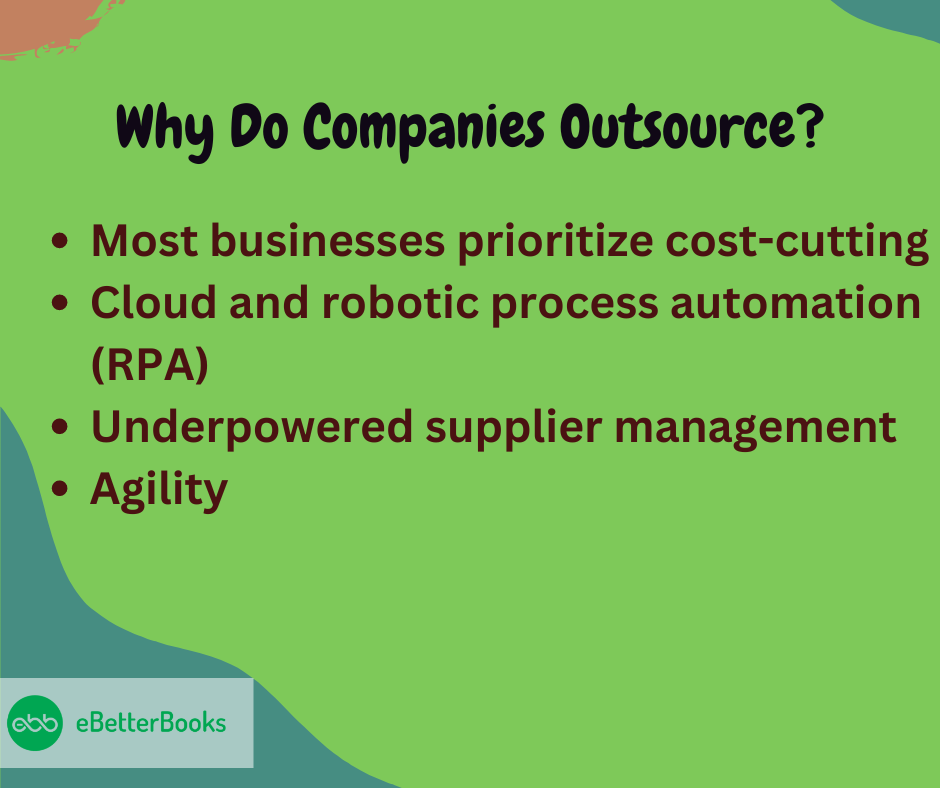

Why Do Companies Outsource?

Companies outsource accounting services because it helps the business save on costs and lets the businesses focus on their core business functions.

- Most businesses prioritize cost-cutting: Cost reduction is an auxiliary benefit to goals such as enhancing agility or improving the quality of service.

- Cloud and robotic process automation (RPA): Cloud and RPA technologies enable users to automate any process via a web-based interface and are becoming increasingly important in almost all types of transactions for businesses of all sizes.

- Underpowered supplier management: Successful businesses invest more in developing their supplier management capabilities through RPA and outsourcing to get the most out of their service provider ecosystem.

- Agility: Businesses are being compelled to become more adaptable due to changing business conditions, visa limitations, and increased client demands. As companies adjust to a world where speed, quality, flexibility, and affordability are more crucial than geography, outsourcing will continue to gain momentum.

Pros of outsourced accounting services

1. Cost-Effective Method

Outsourcing accounting services is one of the most cost-effective ways of managing your financial accounts. It eliminates the additional cost of hiring accountants and setting up separate account departments for maintaining your business accounts.

When you outsource accounting, you are merely responsible for the task you are getting done by the outsourced accountant’s team. One can opt for online accounting software. The platform offers all the accounting requirements which are needed to run the business finances smoothly. Online accounting software works on monthly subscription packages, which are highly cost-effective. Business owners get the complete flexibility to select the packages according to their needs and budget.

2. Time Effective

Worrying about your accounts book to be perfect is a waste of time when you have outsourced accounting services. The most significant benefit of outsourcing accounting services is that you can save much time and invest the same time in your business’s other essential jobs.

Outsourced accountants give you financial advice, and the work done in return for what you pay is result-oriented. All you are required to do is to provide the deadline to your outsourced accountants. This structure helps you to spend on the things for which you started the business in the first place.

3. Expert Assistance

The outsourced accountants are incredibly skilled. Therefore they assist you with accurate financial reports and advice, which helps you make the best possible business decisions.

They provide you with experienced guidance for generating more money, securing your business’s financial health. This results in practical work and commercial success.

4. Job on Contractual Basis

Hiring accounting service is much better than in-house accounting sources when running a small and medium business enterprise. Business owners can hire expert accountants on a contractual basis.

This alone has many advantages; you can shift if you are not satisfied with the services.

Your requirement is for a short period, then hiring accountants on contractual jobs can give you the kind of flexibility that works in favor of your company’s financial budget. Plus, you do not have to hire a full-time workforce and give them fixed big fat salaries.

5. Assured Secrecy

When a professional employee is looking into your business finances, you do not need to worry about the accounts being revealed to outside sources. They assure you of a high-security level and 100% transparency while working on your financial statements.

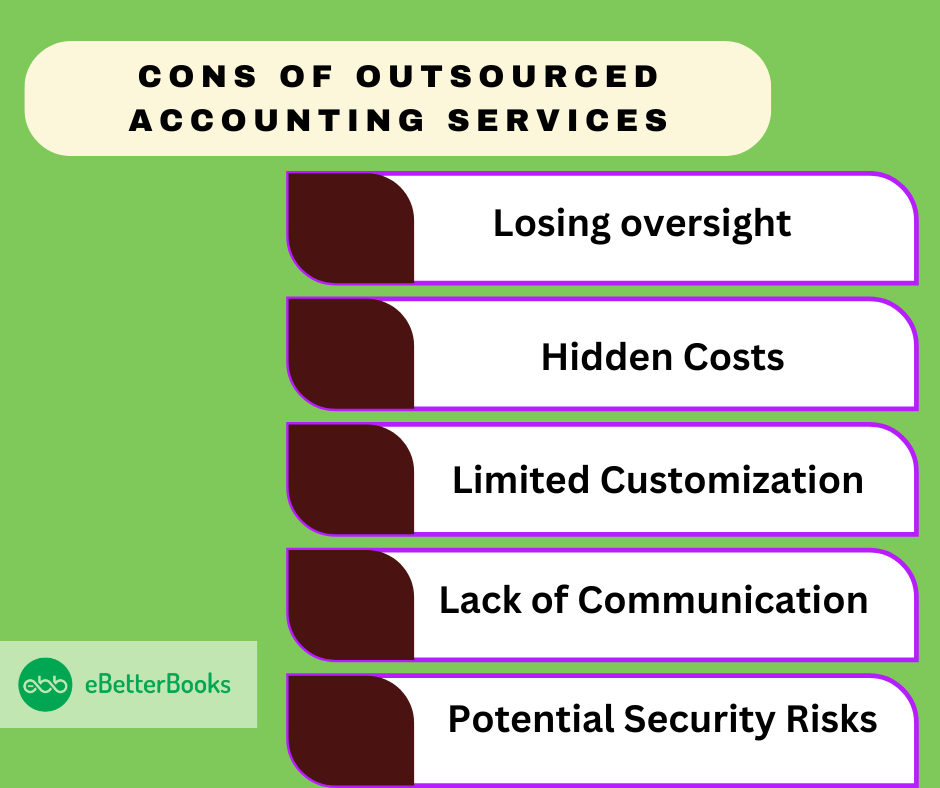

Cons of outsourced accounting services

1. Losing Oversight

When you stop handling your accounts on your own or in-house accounting is not part of your business, then you may end up worrying about your financial statements.

Business owners who tend to check reports closely might freak out by charging their business account to an outsourced accounting service. It is imperative to maintain transparency with CPA, hold regular meetings, and schedule check-in monthly or at least quarterly is the least you can do. The purpose of outsourcing accounting service is to free your team members from manual data entry and bookkeeping, which demands lots of your valuable time and money. It is not to keep you in the dark about the financial position of the business.

Outsourcing accounting services almost include some of the hidden charges for additional services or complex tasks. So, always look for a transparent and detailed service agreement before you begin with the outsourcing services.

3. Limited Customization

Most of the businesses require unique accounting solutions which gets restricted due to limited customization options because some of the providers are not able to provide flexibility or expertise to cater to specific industry needs.

4. Lack of Communication

It is extraordinary to have your workforce physically in the office although the work from home policy is quite popular nowadays. The key to a successful business operation is effective communication within the organization.

Outsourcing accountants may come as a barrier to effective communication between the two. However, there are several ways to build client-vendor communication for getting a robust solution for the company. Build a communication bridge between the team members and the hired services by making them part of your chat system, regular mail check-ins, inviting them over to the office every month, zoom meetings, and more. This will help to eliminate the communication barrier as it is concerned with your business’s finance.

5. Potential Security Risks

There are still chances of data breaches in any digital environment. So, always look for those providers who offer high security measures, established data protection protocols, and adequate insurance.

Outsourcing vs. Insourcing

- Outsourcing

Outsourcing your business accounting is cost-effective for businesses. Businesses get access to expertise, and this helps them focus on their core business operations. This helps the businesses in scalability.

On the other hand, some issues businesses face while opting for outsourcing accounting services include loss of control, hidden costs, potential security risks, communication challenges, and limited customization.

- Insourcing

Businesses gain full control over all their activities, customization, direct communication, and a better understanding of the business.

On the other hand, some issues businesses face when businesses insourcing accounting services include limited expertise, recruitment, and training challenges, higher costs, and less ability to focus on business.

When to Outsource Accounting Service?

Outsourcing accounting services for every business is very different.

- For companies with an existing in-house finance and accounting team, partnering with an outsourcing company can provide an opportunity for the current staff to work alongside specialists and gain expertise in technical areas.

- For companies with a well-established finance leadership and infrastructure, outsourcing may be optional.

When integrating an outsourcing company into your business, it’s crucial to take the learning curve into account. The complexity of the business frequently determines the time needed for an outsourcing partner to integrate completely; this might overshadow the benefits and become a major factor in terms of both time and costs.

Additionally, modern technology can streamline various accounting tasks, improving efficiency from Record to Report. These tools facilitate enhanced management of your accounting operations.

Selecting a Right Accounting Service Provider

- Proven track record: Always look for records of similar businesses to demonstrate their expertise and reliability.

- Strong communication skills: Always have clear and effective communication regarding all financial needs.

- Transparent pricing: To avoid surprises, always be aware of hidden fees. A reputable provider will deliver detailed pricing breakdowns and service agreements upfront.

- Robust security measures: Always look for a service provider who follows the industry-standard security protocols and data encryption practices.

- Genuine commitment to your business goals: Always select a service partner who takes the time to understand your individual needs and challenges, and who actively works towards attaining your financial objectives.

Conclusion

Choosing the right accounting service provider will lead you and your business to new heights. Outsourcing accounting services or enrolling in online accounting software can solve all your financial problems in one place.

From your bookkeeping to taxation, invoicing, payroll, and more, accounting service providers have a lot to offer to make accounting hassle-free. You can focus on things for which you started your business in the first place.

The sooner you hire an accountant, the faster the results will reflect. Running a successful business demands a lot; outsourcing accounting services can be a task but do not hire anyone without properly researching their professional competency and policies to verify what will work best for you.

FAQs

What types of businesses benefit most from outsourced accounting?

Outsourcing can benefit companies of all sizes such as startups, growing businesses, those lacking in-house accounting expertise, and those seeking cost efficiency.

Do businesses lose control over finances by outsourcing?

Ans: No, businesses don’t lose control over finances by outsourcing.

How much does outsourcing accounting cost?

Ans: Outsourcing accounting cost depends on the business’s size and the nature of service. But mostly the cost revolves around $500 to $5,000+ per month.

What are the cons of outsourcing accounting services?

- Communication problems

- Hidden costs

- Reduced oversight