Accounting automation has many benefits, such as reducing data entry errors, saving time by streamlining manual processes, enhancing data accuracy, addressing productivity issues, and helping with quick data retrieval.

Key Takeaways

➡️ Accounting automation reduces data entry errors, saves time, and enhances accuracy.

➡️ Automated accounting systems improve compliance and help manage financial risks effectively.

➡️ Automation addresses the inefficiencies and security risks of manual accounting, streamlining workflows and improving productivity.

Accounting has become one of the major struggles for businesses as it requires a lot of time and effort (40% of businesses spend 80% of the year managing the bookkeeping process). This not only consumes resources but also detracts from strategic initiatives.

What Exactly Is Accounting Automation?

Accounting automation is the process of automating manual accounting tasks using modern software and advanced technology. Automated accounting software can handle repetitive operations in real-time, reduce human errors, and eliminate the need for manual data entry.

Modern technology and new software solutions have enabled the automation of the accounting process, which eliminates the need for business owners to conduct it themselves.

Advanced accounting software does it all, with less dependency on people to make manual transaction entries. So that you don’t waste time forming complex logs and entering indefinite rows of data. This fantastic built-in format gets your work done in a few clicks. (How cool is it, right?) The main grounds of this software are to simplify things as much as possible and eliminate the previous complexities.

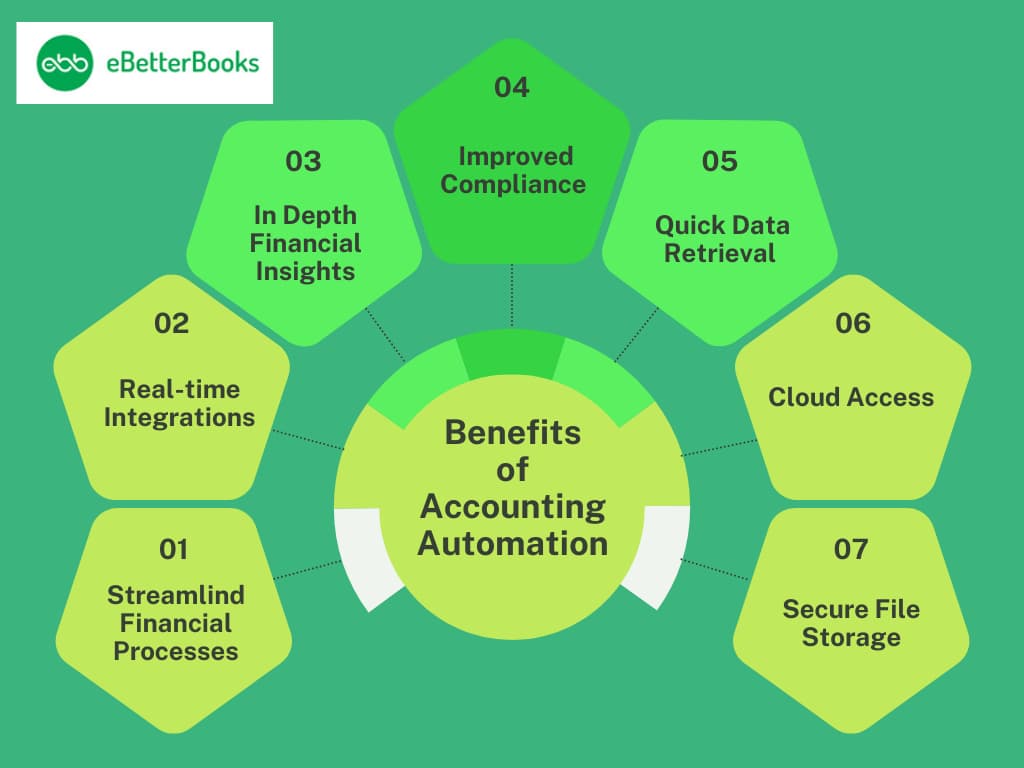

Key Benefits of Accounting Automation for Your Business

Here are the key benefits of accounting automation benefits for your business:

Streamlined Financial Processes

Automated Automated accounting reduces the need for manual data entry. For example, accounts receivable automation can help you save time 50% of the time spent on the invoicing process. Traditional accounting may necessitate a multi-departmental approach to handling invoices. Automation allows your firm to be more efficient through collaboration.

When different people or financial teams participate in the accounting process at different stages, it simplifies the process and saves your company time and money.

Real-Time Integrations

The more you can digitize business operations, the more effectively you can employ these solutions together. For instance, your payroll tool can be integrated with your accounting platform, which also receives data from your spending management program.

This means that all your financial data is updated in real-time across all platforms, reducing the need for manual data entry and ensuring data accuracy.

For example, integrating payroll with accounting can save HR departments up to 40 hours a month on administrative tasks.

The advantage of this is that you nearly never have to duplicate data from one area to another. You have up-to-date and accurate data on all platforms. This is aided by the fact that your accounting systems can exist in the cloud.

However, the benefit is that all of your financial operations can communicate with one another whenever necessary.

In-Depth Financial Insights

Accounting automation systems provide current pictures of your company’s financial condition. This means you can access up-to-date financial information at any time, allowing you to make informed decisions and respond quickly to changes in your business.

Businesses that adopt automation can make strategic decisions 30% faster than those who use manual methods.

With automated accounting operations, you no longer need to wait for the end-of-quarter report to receive an overview of your accounts. You can have direct access to your financial statements at any time.

Quick access to key performance indicators allows you to get important data and make critical changes without having to wait for quarterly reports, which may be more reactive than proactive.

Improved Compliance

In this context, compliance means that your organization follows all local, state, and federal regulations, industry standards, and best practices. Automated accounting services ensure that important financial data is accurate and up to date, reducing compliance risks.

This means that you can be confident that your financial records comply with the latest regulations and standards, reducing the risk of penalties or legal issues.

This means that you can be confident that your financial records comply with the latest regulations and standards, reducing the risk of penalties or legal issues.

Similarly, automated accounting methods enable corporate leaders to manage risk better. Risks can take numerous forms, such as shifting markets, increasing debt, fraud, or inadequate liquidity. Automated accounting can detect patterns or inconsistencies by collecting and presenting accurate data in real time.

This allows you to identify misreporting or fraud issues before they become out of control. Automated accounting provides leaders with the financial tools they need to manage risk in a variety of areas.

Quick Data Retrieval

Earlier, accountants had to store the information in the files manually. If someone needed particular information about the transactions, they had to find the file first and then scan the entire file to find the needed information. Sometimes, the files were not in the same building or even lost. It was a headache!

But now, the story is not the same, as one can easily find the necessary file or document with one click almost instantly. Companies utilizing automated systems report reducing the time spent on document retrieval by 70%.

Even if you work in Excel, you don’t have a central location for your entire customer base and vendor, sales, and expense information. Spotting a sensitive detail is nearly impossible.

Cloud Access

Those who use cloud programs regularly can compare and judge how much more comfortable life is now than in the past when floppy disks or even USB sticks were used. Now, you can keep every essential software, process, and file with you wherever you go.

Do not worry about the time whenever you quickly need to check a document or process a cheque, unlike the earlier period when you physically had to be on the desk or have paper files with you.

Secure File Storage

One significant burden on companies and accountancy companies is storing the documentation on paper for about 7-10 years, depending upon the firm’s policy.

Fortunately, government tax offices worldwide are slowly adopting e-receipt storage (electronic receipts of documents instead of paper files). Modern software lets us receive the documents digitally.

Enhanced Collaboration and Accessibility

Automated accounting can help firms improve internal communication and provide easier access to financial records, greatly improving your company’s accounting workflow. Accounting automation enables various accounting team members to contribute to the accounting process, hence improving cross-departmental communication.

Similarly, automating your accounting processes allows for faster real-time access to your company’s financial statements and records and a 50% increase in inter-departmental collaboration.

Many automatic accounting programs are cloud-based so that you can access your data from anywhere, including your smartphone. With improved access to accurate and reliable data, you can track financial realities and make the right decisions.

After reviewing these advantages, you must have understood how these automation features and benefits streamline business workflow and facilitate compliance management.

Now let’s understand the difference between manual accounting process and automated accounting process:

What is the Real Difference Between Manual Accounting and Automated Accounting?

Check out the real difference between manual accounting and automated accounting processes through this chart:

Process | Manual Accounting | Automated Accounting |

Data Entry | Requires manually entering data into spreadsheets or software, leading to errors and consuming time. | Automated systems pull transaction data from bank accounts and other sources, reducing errors and speeding up the process. |

| Closing & Reconciliation | Accountants must manually match transactions and check for discrepancies, which can take days. | Automation tools match transactions automatically, flagging any issues, so closing the books is much faster. |

| Document Retrieval | Finding documents can be time-consuming, especially if they’re stored in different locations or formats. | Documents are stored digitally in one place so that they can be found instantly with a quick search. |

| Error Detection | Errors are found through manual reviews, which can miss small mistakes | The software detects errors automatically and alerts you to issues, reducing the chances of missed mistakes |

| Access & Security | Data is often stored locally or on physical paper, which can be hard to secure. | Cloud-based systems use secure logins and encryption to keep data safe, with easy access from anywhere |

| Compliance & Reporting | Accountants must manually track changing tax laws and regulations, and reporting can be time-consuming. | Automated systems update based on new regulations and generate reports automatically, saving time and reducing errors. |

What are the Challenges of Manual Accounting?

Manual accounting involves a number of issues that can dramatically reduce the efficiency and accuracy of financial management inside an organization.

The following are some of the primary issues related to manual accounting:

- Time-Consuming Procedures: Recording and validating transactions manually takes a long time, especially during high financial periods like month-end close.

- Human Errors: Human errors, such as improper inputs or missed transactions, can result in false financial statements, raising regulatory and legal concerns. They also impact stakeholders’ and investors’ confidence in the organization.

- Lack of Real-time Data: Delays in updating financial data limit access to real-time financial information, which is critical for decision-making.

- Limited Scalability: As firms expand, the amount of transactions grows, making manual processes more inefficient and error-prone. Manual methods are unable to handle this transaction volume, resulting in a high mistake rate.

- Security Risks: Manual accounting leaves physical records subject to theft, loss, or damage, and sensitive data is not encrypted. Furthermore, compliance with industry standards such as GDPR, ISO, PCI DSS, HIPAA, and SOC ensures that your data is secure and compliant.

- Difficulty Maintaining Compliance: Manual systems make it more difficult to keep up with changing requirements, raising the risk of non-compliance.

- Inefficient Audit Trails: Manual systems frequently lack clear audit trails, complicating the auditing process and tracing financial history.

- High Cost: Manual accounting becomes increasingly expensive over time due to hidden expenses associated with errors and inefficiency.

Accounting Tasks a Business Should Automate

Businesses should automate key accounting tasks to improve efficiency and reduce errors.

These tasks include:

- Invoice Generation: Able to automatically generate and deliver invoices to clients.

- Expense Tracking: Record and organic expenses with integrated Finance.

- Bank Reconciliation: Records of the bank statements should be matched with the accounting records.

- Payroll Processing: Another ideal solution is to attempt to automate employee payments and tax deductions.

- Financial Reporting: Make timely financial reports to enhance organizational decision-making.

- Accounts Payable/Receivable: Follow up on unpaid debts and send follow-up emails for unpaid bills.

Steps to Automate Your Accounting Processes

Here are the key steps to automate your accounting process:

- Assess Your Needs: Determine which of the tasks can be conveniently floated to an accounting automation service, including invoicing, payroll, and reporting, among others.

- Choose Accounting Software: Choose the one that will suffice your business requirements, such as QuickBooks, Xero, or Netsuite, as they have the automation option.

- Integrate Systems: Integrate your accounting software with other applications that your business is using, such as customer relationship management, bank, and shopping carts.

- Set Up Automation Rules: There are things you need to know when it comes to invoicing, expenses, and payment reminders, and they are rather precise.

- Train Your Team: Inform the users on how to utilize the software and how to work under the new change.

- Monitor and Review: It should also be noted that the envisaged automatic processes should be checked systematically, and relevant changes should be made in due course.

Future Trends in Accounting Automation

As technology advances, the future of accounting automation appears bright. Artificial intelligence (AI) will play an important role in simplifying processes. AI can improve predictive analytics, allowing firms to make better decisions based on real-time data patterns. Furthermore, the use of blockchain technology may increase transaction security and transparency, lowering the chance of fraud.

Why You Should Combine Automated Accounting With Smart Software?

Accounting automation has several benefits, including the potential to save time, avoid costly errors, and keep all relevant documentation at your fingertips.

Spend management software includes the same accounting automation benefits as discussed previously. You may conduct transactions freely and easily, providing your finance staff more control over debits and credits.

What Should You Look for in Accounting Software?

When choosing accounting software, consider the following key factors:

- Ease of Use: The interface of the software should be easy to understand to reduce the time that users will take to master the software in question.

- Automation Features: Check for the functions of automated invoice generation, simple tracking of expenses, payroll system, and automated taxation.

- Customization: Check that the software meets your chosen industry requirements and also verify that you can adapt the software to have more unique features, such as new reports or a unique workflow.

- Integration Capabilities: It should be compatible with other applications such as CRM, banking, e-commerce, and payroll, among others.

- Scalability: Select your software with the provisions for further settings and more users when you expand your company.

- Security: Make sure to have security protocols on data of a financial nature through the use of encrypted accounts plus backup arrangements where necessary.

Wrapping Up

Accounting automation is more than a trend; it is a necessity for firms seeking efficiency, accuracy, and strategic advantage. By adopting automation, businesses can drastically improve their financial management operations and position themselves for future growth.

Frequently Asked Questions

What is Accounting Automation?

Automation in accounting refers to the use of software and technology to complete typical accounting operations such as data entry, transaction recording, and financial reporting. This simplifies operations, lowers errors, and frees accountants to focus on strategic initiatives rather than manual ones.

How is artificial intelligence (AI) used in accounting?

AI automates the processing of payslips, invoices, and bank statements, which speeds up the retrieval of financial data such as trial balances and income statements. Organizations use AI for document automation, data extraction, and predictive analytics to improve efficiency and decision-making.

What are the advantages of automated accounting?

Automated accounting provides advantages such as faster turnaround time, data accuracy, cost savings, extensive analysis, improved security, and faster data retrieval.

Can You give some examples of accounting process workflows?

Examples include invoice processing, expense approvals, payroll administration, journal entry approvals, account reconciliation, and month-end financial close. These workflows simplify and automate typical processes to increase productivity.