FUTA is the Federal Unemployment Tax Act enacted in 1939 and forms an important part of the US payroll tax system that affects all businesses.

It is a federal law that requires employers to support unemployment compensation programs that provide financial assistance to workers who lose their jobs involuntarily.

What is FUTA?

FUTA stands for Federal Unemployment Tax Act. It was created to provide a safety net for unemployment and safeguard workers from any financial turmoil.

When you’re subject to FUTA tax, you must fill the Form 940.

FUTA was initially a product of the Great Depression when a majority of workers in the US were unemployed. As the tax law states, this is an employer-paid tax and not for employees to bear. It applies to the first $7,000 you pay each employee for their work during a year.

FUTA works alongside SUTA (State Unemployment Tax Act), which collects funds for unemployment at a state level. Both Federal and State unemployment tax is paid by most employers.

How Does FUTA Work?

The standard FUTA tax rate is 6% on the first $7,000 of an employee’s annual earnings. However, employers can receive a tax credit for state unemployment taxes paid, reducing the FUTA rate to as low as 0.6%.

If the company also pays state unemployment taxes on time, they might only have to pay 0.6% instead of 6%. So, the most a company would pay for one worker yearly could be as low as $42.

The FUTA taxes are paid quarterly, and employers must file an annual report using IRS Form 940. The due dates for quarterly payments are the last day of the month following the end of a quarter.

If a quarter’s total FUTA tax liability is less than $500, it can be carried over to the next quarter.

Self-employed and independent contractors do not need to pay FUTA. And if you employ an independent contractor, you don’t need to pay FUTA tax against their compensation.

State law defines individual state unemployment insurance tax rates. The state unemployment tax paid to workforce agencies is used exclusively to provide benefits to eligible unemployed workers.

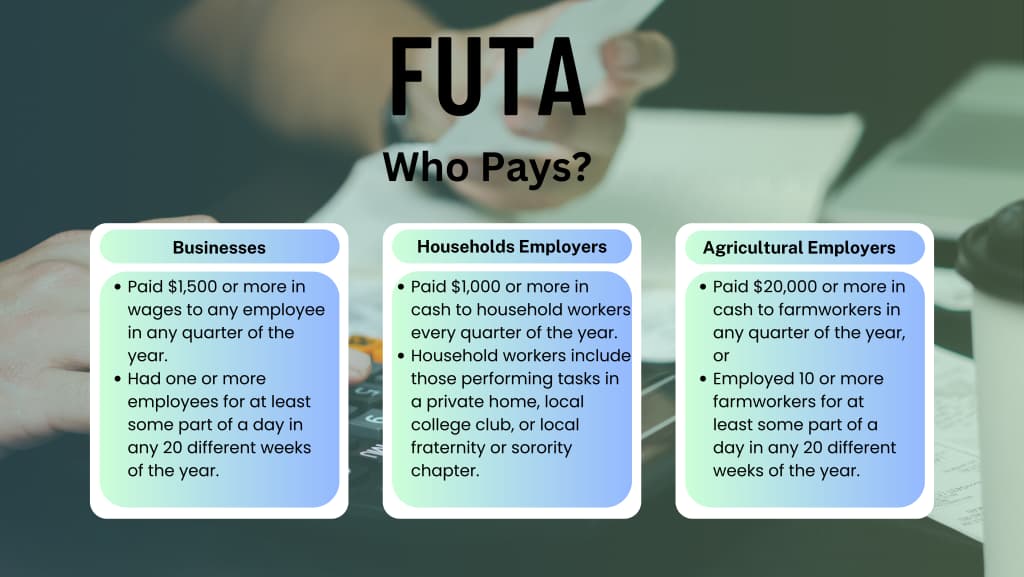

Who Pays the FUTA Tax?

Most employers who pay wages to their employees or workers must pay FUTA and SUTA. However, the reporting and payment requirements differ based on your business type.

Businesses

As per the IRS guidelines, businesses are required to pay FUTA tax if they satisfy at least one of the following conditions within a calendar year:

- Paid $1,500 or more in wages to any employee in any quarter of the year.

- Had one or more employees for at least some part of a day in any 20 different weeks of the year.

Households Employers

If you employ household maids, housekeepers, or other service providers, FUTA tax payment has specific reporting requirements.

In this context, tax is applicable if these two conditions are satisfied:

- Paid $1,000 or more in cash to household workers every quarter of the year.

- Household workers include those performing tasks in a private home, local college club, or local fraternity or sorority chapter.

Agricultural Employers

If you are an agricultural employer and satisfy any of the conditions below, you need to report FUTA tax:

- Paid $20,000 or more in cash to farmworkers in any quarter of the year, or

- Employed 10 or more farmworkers for at least some part of a day in any 20 different weeks of the year.

How to Calculate FUTA Tax Liability?

Calculating FUTA tax liability as an employer might initially appear complex, but you can break it down into a few steps, simplifying the process.

To recap, you only need to consider the first $7,000 of every employee’s annual wages for FUTA tax. The wages you pay beyond this are not subject to FUTA. Also, this amount does not include any exemptions like pension contributions.

- First, calculate the total wages paid to all employees during the previous quarter. If this sum exceeds $1,500, FUTA taxes must be paid, and the next step must be followed.

- To determine the total liability, multiply the current FUTA tax rate of 6.0% by the wages paid to each employee, capped at a maximum of $7,000 annually.

Formula for Calculating FUTA Tax Liability

FUTA Liability = Employee eligible wages x 6%

Here is a sample calculation of FUTA tax liability:

Let’s say you have 4 employees and pay each of them $40,000 in taxable income annually.

As the FUTA tax only applies to the first $7,000 of each employee’s pay, now applying the formula would look like this:

- Annual FUTA Liability = (4 x $7,000) x 6%

Your total annual FUTA liability will be $1,680.

Considering you pay the state unemployment taxes on time, you will be eligible for a tax credit of 5.4%. So, the tax liability will come down to $168 ($28000 x 0.06%).

How to Pay and Report FUTA Taxes?

Paying FUTA Tax

FUTA taxes are typically due one month after the conclusion of each quarter. The deposit can be made on the next business day if any deadline dates fall on a weekend or a legal holiday.

While FUTA has an annual reporting requirement, tax deposits must be made at least quarterly, specifically at the end of the month following the quarter’s end.

If your business collects $500 or less in FUTA taxes for a quarter, you can wait until the subsequent quarter to make the deposit. If your FUTA tax liability exceeds $500 for the calendar year, you should deposit at least one quarterly payment.

| DATES TO DEPOSIT FUTA TAX | |

| If the FUTA tax liability is more than $500 on: | Deposit your tax by: |

| 31st March | 30th April |

| 30th June | 31st July |

| 30th September | 31st October |

| 31st December | 31st January |

You can use the Electronic Federal Tax Payment System (EFTPS) to make deposits.

Reporting FUTA Tax

You can report FUTA using the IRS Form 940 and file unemployment taxes.

Although many companies make quarterly FUTA tax payments, filing Form 940 is an annual obligation, due by January 31 every year.

The IRS allows for electronic filing of forms or traditional mailing options. If you want to opt for paper form submission, use the correct mailing address based on your state.

Payments Exempt From FUTA Tax

There are many forms of payment that are exempted from FUTA.

These include:

Fringe Benefits

This includes meals and lodging provided for the convenience of the employer, contributions to accident or health plans for employees, payments for certain benefit plans like cafeteria plans, and employer reimbursements for qualified moving expenses.

Group Term Life Insurance

Coverage provided to employees, typically as part of a benefits package, is exempt from FUTA tax calculations.

Retirement Contributions

Employer contributions to qualified retirement or pension plans, including SIMPLE IRA and 401(k) plans, are exempt. However, employee contributions to these plans may still be subject to FUTA taxes.

Dependent Care Payments

Payments for dependent care, capped at $500 per employee (or $2,500 for married couples filing separately), are not subject to FUTA tax.

Other exemptions include:

- Payments made under a worker’s compensation law because of work-related injury or sickness are exempt.

- All non-cash and specific cash payments for agricultural labor, including payments to H-2A visa workers, are exempt.

- Payments to a spouse, parent, or child below the age of 21 for business-related services.

- Payments to non-employees are treated as your employees by the state unemployment agency.

FUTA Tax Credits

Unemployment taxes are applied at the federal level through the Federal Unemployment Tax Act (FUTA) and at the state level under the State Unemployment Tax Act (SUTA). Employers primarily pay most state unemployment taxes. However, some states, including Alaska, New Jersey, and Pennsylvania, require employees to contribute as well.

If an organization pays its state unemployment taxes in full and on time, it can earn a credit of up to 5.4% toward its FUTA unemployment taxes. In such cases, employers only need to apply a rate of 0.6% when calculating their FUTA tax payments.

FUTA Credit Reduction

FUTA credit reduction occurs when a state borrows funds from the federal government to cover its unemployment insurance liabilities and fails to repay those loans within the specified time.

If the state has any outstanding repayments to make on January 1 and does not repay the loans before November 10 of the taxable year, employers in that state face a reduction in the credit they can claim against their FUTA tax liability. This is done so the federal government can recover the money loaned to such states.

The credit reduction starts at 0.3% for the first year, which increases by an additional 0.3% for each subsequent year the loans remain unpaid.

Only after a state fully pays off its loans it can claim the maximum tax credit reduction of 5.4%. It means the state only has to pay a minimal 0.6% FUTA tax.

As of 2023, a few states have been identified as credit reduction states. For example, California and New York will face an additional FUTA credit reduction of 0.6%, making their total FUTA rate 1.2%.

The U.S. Virgin Islands will also see a more significant increase, with a general FUTA credit reduction of an additional amount of 3.9%, leading to a total FUTA rate of 4.5% on wages paid.

Conclusion

Understanding the Federal Unemployment Tax Act (FUTA) is important for businesses to understand the intricacies of payroll taxes. FUTA not only funds unemployment benefits but also carries implications for employers regarding tax rates, deadlines, and deductions.

FAQs:

How much is FUTA Tax?

The FUTA tax rate in 2024 is 6.0%, applying to the first $7,000 paid to each employee as annual wages.

What is the deadline for FUTA Tax?

FUTA taxes, due quarterly, have payment deadlines on January 31, April 30, July 31, and October 31. Employers with a cumulative liability of at least $500 contribute to this vital unemployment insurance system.

What does FUTA stand for?

FUTA stands for the Federal Unemployment Tax Act.

Do Self-Employed pay FUTA?

No, FUTA does not apply to self-employed individuals. It is particularly formulated for employers that employ workers whose pay is based on their payroll.

Is FUTA tax deductible?

Yes, FUTA tax is deductible for businesses. Employers can write off the amount paid in FUTA tax as a business expense to decrease aggregate tax liability.