QuickBooks Online is a comprehensive solution that has accounting features that provide a robust platform for companies that require detailed financial management.

FreshBooks offers a more concise and intuitive web-based interface designed exclusively for sole practitioners and business people in the services field.

QuickBooks Online and FreshBooks are two of the most recommended accounting tools for small businesses, though they satisfy different requirements.

QuickBooks Online is beneficial for managing business reports and monitoring small companies’ revenues and expenses. It is best known for its easy basic accounting features and available integrations with other software.

FreshBooks is versatile accounting software suitable for a wide range of users, including small and medium businesses, freelancers, self-employed individuals, businesses with contractors, and those with employees.

QuickBooks is packed with features to provide extended reporting, a payroll interface, and multiple-user support—it is the best choice for medium and large businesses that definitely require special accounting.

FreshBooks is designed with the user in mind, making it incredibly easy to use. Its features include time-tracking tools, Double-entry accounting reports, simplified billing, and efficient project management for freelancers and service authorities.

Also, Data conversion between QuickBooks Online and Freshbooks is very straightforward with the right services like Dataswitcher and MMC Convert. Currently, both platforms allow the user to accurately transfer sensitive information, including clients’ personal information, invoices, and transaction history.

| QuickBooks Online | FreshBooks |

|---|---|

| Quickbooks Online by Intuit is an online-based accountant suitable for most small-scale businesses, as well as their daily accounts and financial requirements. QuickBooks is suitable for small business needs because it is cheaper and affordable, and it provides many different plans that may suit the business needs. Some features of QuickBooks Online include advanced user roles and permissions, scalable pricing tiers, basic account chores like receipt capture and organization, inventory tracking, invoicing, and taxes. QuickBooks Online has multiple third-party integrations, which enable businesses to enhance data reliability, improve the flow of operations of employees, and save time and money. | FreshBooks is a simple accounting software solution for freelancers, solo entrepreneurs, and small service businesses that still need to be ready to invest in an experienced accountant. Known for its simple and user-friendly interface, FreshBooks is a tool that is designed to manage the company’s basic financial operations, such as invoicing, expenses, and projects. FreshBooks is convenient to use with its clear line and turn, and it can be used via the Internet so that you can manage your finances with the help of any device, including your smartphone. This makes it possible for you to do all the important business transactions while on the move; you do not need an accounting degree to handle the accounting operations. |

| Features of QuickBooks Online | Features of FreshBooks |

|---|---|

| Business Funding: This means that businesses applying for loans can make applications from QuickBooks. The funds are available within 1 to 2 business days, so they do not charge a higher interest rate for early payoff. | Business Invoicing: With FreshBooks, users can build, brand, and send professional invoices that include automatically generated reminders for late payments to clients as well as real-time statuses of the invoices. |

| Tracking Income: QuickBooks helps businesses as all bank and credit card transactions are automatically downloaded, allowing organizations to monitor income from anywhere. | Expense Tracking: The features help easily feed bank accounts and credit cards with FreshBooks, categorize the expenses, control the expenses more conveniently, and aid in the management of the cash flow. |

| Invoicing: Companies can automate their recurring invoices, payments, customized invoices, and invoice status tracking. | Time Tracking: Time and expenses for issues and clients, where self-employed individuals and groups of people can include timesheets into invoices for proper billing. |

| Tracking Payment: Customers can also make payments to the business through eChecks, cards, and the Automated Clearing House (ACH). The business can forward payment links to its customers and operate smoothly. | Project Management: FreshBooks has integrated project management features that let users invite team members to share tasks and files and track work, which is perfect for service-based businesses. |

| Manage and Pay Bills: QuickBooks helps businesses collect all the bills in one place and can pay them directly in the software to ensure they are remembered and paid on time. | Estimates & Proposals: This feature helps users develop estimates and proposals for possible projects. It can be of immense benefit to the clients to afford them a detailed insight into projects before work is commenced. |

| Inventory: Companies can manage stocks, products, and sales costs and receive alerts when stocks are low. They can also import products and services from MS Excel and Google spreadsheets. | Payment Processing: FreshBooks allows clients to pay through cards or bank transfer, online check or direct check, check and bank transfer, or ACH fee, and it comes equipped with a client portal. |

| – | Accounting Reports: With a visually friendly and digestible setup, FreshBooks offers daily, weekly, monthly, or custom financial reports comprised of profits, losses, sales tax, and expenses to assist business owners in making rational decisions. |

| Key Functionality of QuickBooks Online | Key Functionality of FreshBooks |

|---|---|

| Payroll Management: Employers can easily calculate and manage the employee’s wages with a clear understanding of the taxes to be paid to the authorities. | Recurring Invoices: Set up a few types and schedules of the invoices, and clients will be automatically reminded to make payments if they have some services on a regular basis. |

| Syncing Instantaneously: Businesses gain a special benefit from receiving the most recent financial data, and real-time updates are made regarding transactions and data to make better decisions. | Mobile Accessibility: FreshBooks’ mobile app enables clients to operate financially from any place possible through features such as receipt capture, invoicing, and reports. |

| 1099 E-File & Pay: Businesses can prepare and file 1099-MISC and 1099-NEC forms for free and can e-file countless forms. They can also send copies to the contractors using autopilot. | Client Portal: Clients then have access to a specific section where all invoices can be viewed and paid, hence improving the reliability of payments made. |

| Workflow Customization: Companies can set up and run applications tailored to specific tasks for team members to make sure they adhere to proper procedures. | Late Fees & Automatic Payment Reminders: Integration of late fee addition and automatic reminders are available in FreshBooks, thus enabling early payments to be made for the invoices and less chances of delay. |

| Team Management: Companies can manage their staff productivity, assign employees to particular customers, and also track the hours booked. | Tax Calculations: FreshBooks comes in handy when it comes to taxes because it caters to tax, generation of tax summaries, and tax-deductible expenses, therefore making it easy in terms of the tax period. |

| Reporting: They can create reports for profit and loss, sales and use taxes, accounts payable and receivables, and almost any financial output. | Third-Party Integrations: Many third-party applications such as Stripe, G Suite, Shopify, and many more work with fresh books, enhancing its other features for companies that require them. |

| Add-On Applications: QuickBooks has integrated third-party applications that can enhance the program’s functionality based on business operations. | – |

| Variants | Variants |

|---|---|

| Simple Start: For solo entrepreneurs | Lite: For Freelancers |

| Essentials: Includes all the features of Simple Start, plus the ability to add up to three users | Plus: For Self-employed |

| Plus: A growth-focused solution | Premium: Business with Contractors |

| Advanced: A comprehensive solution | – |

| Who is it for? | Who is it for? |

|---|---|

| Small to medium-sized businesses | Freelancers and solopreneurs |

| Companies needing advanced accounting features | Service-based professionals |

| Businesses that require detailed reporting | Small businesses with basic accounting needs |

| Teams needing multi-user access | Users seeking simplicity and affordability |

Pros:

Cons:

Pros:

Cons:

| Pricing of QuickBooks Online | Pricing of FreshBooks |

|---|---|

| Simple Start: $35/month | Lite: $19/month |

| Essentials: $65/month | Plus: $33/month |

| Plus: $99/month | Premium: $60/month |

| Advanced: $235/month (price at the last update). | Select: Custom pricing |

| Note: Visit the QuickBooks Online website to view the latest prices and additional discounts offered. | Note: Visit the Freshbooks website to view the latest prices and additional discounts offered. |

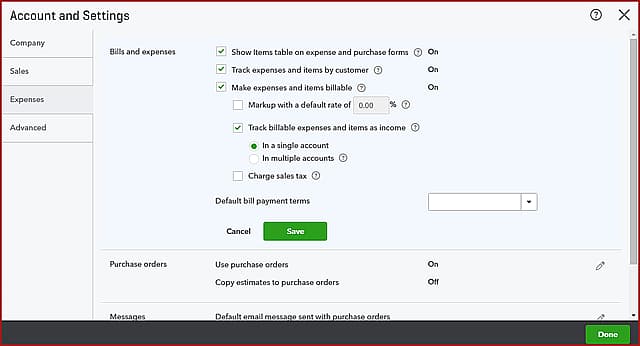

QuickBooks Online has a setting page that will allow you to select which options you want to be displayed on the dashboard, for example, tracking of billable expenses and items, display of the item table on the form for expenses and purchase Bills and Expenses, use of Purchase Order, Copy Estimates to Purchase Order under the Purchase Order section and several other features.

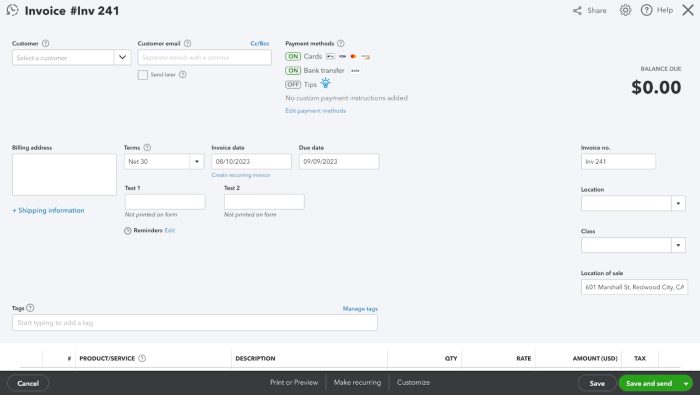

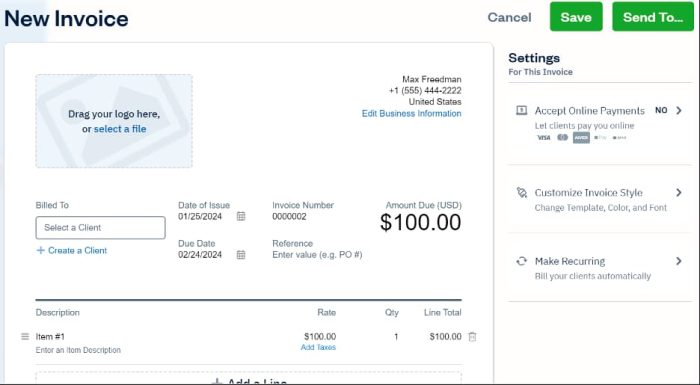

An invoice screen in QuickBooks Online allows you to complete your customer information, such as customer name, customer email, payment option, invoice number, customer’s billing address, invoicing date, due date of payment, and so on.

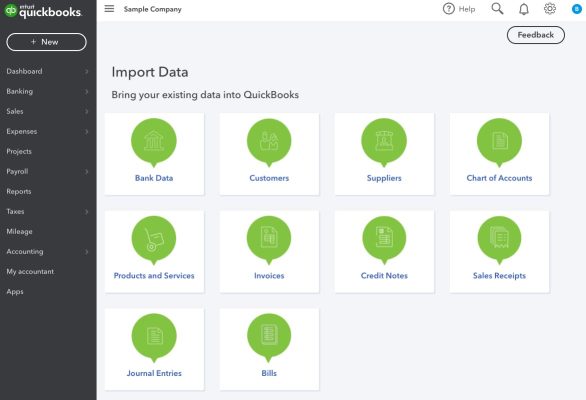

An Import Data Screen in QuickBooks Online lets the user import their existing data, including bank data, invoices, suppliers, products & services, credit notes & pending bills, customers, journal entries, bills & much more.

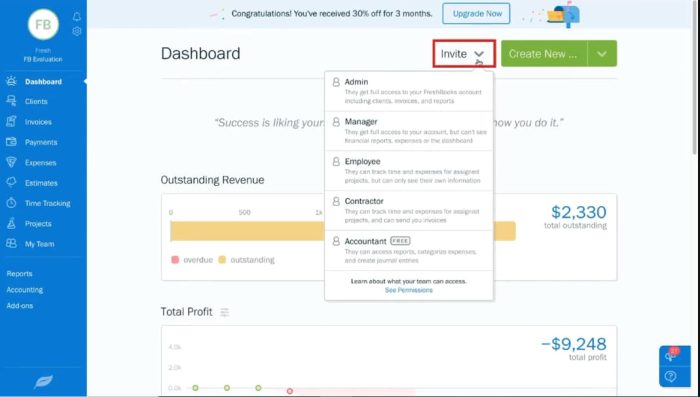

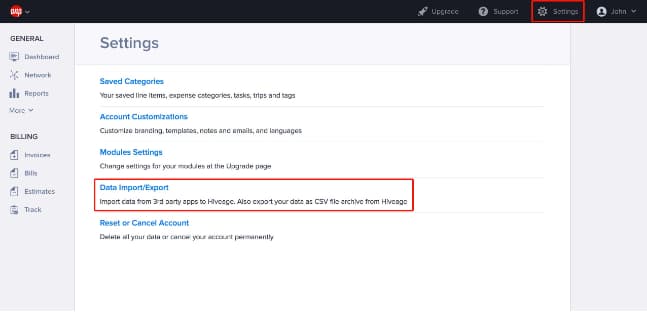

FreshBooks has an option setting page wherein you can modify what is displayed on the homepage. This includes tracking of recoverable costs as well as detailed billing ability to present tables of expenses and purchase orders. You can also set the option for multiple users to access different values and taxes and configure the values for automatic alerts on invoices.

The invoice section in FreshBooks provides the way for customer details such as the name, e-mail, preferred payment methods, the number of the invoice, the customer’s address, the date of the invoice, and the due date to be entered. The columns that are added accommodate special notes, terms, and any given discounts as well. It also allows users to enter more hours and expenses to be billed and make some appearance adjustments in the invoice.

Under FreshBooks’ import data feature, users can transfer all information, such as client list, expense list, product/service list, time log list, and past invoice list. The program provides predefined categories for a fast setup or the ability to configure the fields individually to correspond to record categories.

| Aspect | Quickbooks Online | Freshbooks | Decision Criteria |

| Ease of Use | QuickBooks Online has a user-friendly interface, though it may be complex for new users. | FreshBooks is intuitive and easy for non-accountants to use. | Select FreshBooks if you are a novice or have not-so-profound accounting knowledge; it is quite simple to use. QuickBooks Online is the best option if you know more about accounting or require more features. |

| Scalability | It is ideal for businesses of all sizes, with a range of plans to suit different needs. | It is best for freelancers and small businesses. | QuickBooks is more suitable for larger organizations that are midway into growth, while FreshBooks serves perfectly for small-scale businesses or start-ups. |

| Integrations | QuickBooks Online has an extensive list of third-party apps that help organizations work with different tools and manage their processes efficiently. | FreshBooks is compatible with other business solutions, such as Stripe and PayPal, making it easier to manage payments and other issues. | Select QuickBooks if your company needs many applications and services to be connected to third parties to enhance your business process. Compared to QuickBooks, FreshBooks has fewer integrations, and it’s a better choice for basic environments. |

| Data Security | QuickBooks has extra security layers that encrypt the data and automatically back up to ensure that your financial details are safe and retrievable. | FreshBooks provides an open and secure cloud environment that is encoded so that no one can violate your financial information; you have access to it from anywhere. | QuickBooks wins in case you require enterprise characteristics, including security and backup, compared to Sage. FreshBooks provides good security but sometimes does not suit large and overly complicated companies. |

| Collaboration/Number of Users | QuickBooks provides multiple user access, options in terms of user roles, and restrictions that are convenient for various groups of users. | FreshBooks restricts the number of users that can be allowed under any plan and does not allow for the creation of distinct user roles. | Choose QuickBooks if your business has a big team or if you need precise rights and privileges of the users. Honestly speaking, FreshBooks is more suitable for smaller groups, and the application has only several opportunities for user roles and access modification |

| Learning Curve | QuickBooks is not too easy, but it is not very difficult either, so it’s medium to high computer software that requires prior accounting knowledge. | FreshBooks can be recommended to people who have no experience with accounting because it is very easy to use | FreshBooks is good if you don’t have an accounting background or if you are just starting your own business due to its simple usability. If you have previous experience in accounting or will require more of an accountancy program, you should go with QuickBooks. |

| Real-time Accounting | QuickBooks updates the books as the transactions take place; hence, the details obtained are always current. | While using FreshBooks, the financial data is updated instantly, and thus, you keep track of the finances of your business. | Both of them provide real-time reports; however, QuickBooks offers very powerful tools for real-time reporting. |

| Report Generation | QuickBooks allows for detailed reports on daily business transactions, and thus, it is best for businesses that provide detailed reports. | FreshBooks has simple reports and is not customizable; therefore, it can work best for small businesses. | QuickBooks is best known for its detailed financial reports, while FreshBooks is best for simple reports. |

| Custom User Authorisations | QuickBooks offers highly flexible user permission management to enable you to arrange many levels of access for each of your team members. | FreshBooks allows for only a few user hierarchies and roles, and it is quite simple to manage the teams. | QuickBooks is useful for an organization that requires precise user roles and permissions. |

| Pricing | Starts at $35/month, with scalable pricing | Starts at $19/month, with fewer tiers | For small businesses, FreshBooks is priced less than QuickBooks, but the latter is more scalable. |

| Cloud-Based Software | Yes | Yes | They are both online-based, and they give one easy access anytime. |

| Updations and Backups | Automatic updates and cloud backups | Automatic updates and cloud backups | Both update and back up your company file and sub-file and also offer more enhanced options in QuickBooks. |

| Customer Support | 24/7 support via chat, email, and phone | Phone support 8 a.m. to 7 p.m. Eastern, weekdays | QuickBooks has more elaborate customer service provisions. |

| Training | Offers self-guided tutorials and webinars | Offers easy-to-follow guides and live support | While using FreshBooks is easier, QuickBooks has more training resources for extra complex trades. |

Based on what was highlighted above, when it comes to selecting suitable accounting software that would properly suit particular business needs then, it is important to consider the following:

Deciding on what software to use depends on the size of the business, the growth stage, and the need. For example, a start-up or business might wish to select a tool that only has the necessary functions for an organization’s needs.

In contrast, a growing organization with branches or departments across the country may require one more feature for the various sections of operation.

Bigger organizations or businesses require things like higher levels of data protection and elaborate reporting coupled with integration with other tools that are used in different departments.

Real-time is useful to businesses that wish to have the most up-to-date data on their finances, and on the other hand, cloud-based access will enable users to access their finances at any time and any place.

Data security is also another big issue that arises since businesses have to safeguard their financial records.

Another thing that goes hand in hand with the decision as to which tool to use includes its compatibility with the currently used software and its ability to integrate with other tools necessary for business, such as payment facilitators and CRM systems.

These integrations can make it much easier to control all the monetary data taken together from one place without having to pass data from one program to another repeatedly.

What is also worth considering is who will be using the software and in what environment.

If the system is only going to be used by an in-house accountant, then they alone can use the simplified version of the system that may require a few user roles to be created; however, if more team members or, in this case, clients have access, more attention should be paid to user roles and permissions to regulate what data the user can see.

How easily the software can be implemented to become instrumental to daily business operations depends on its ease of learning and available customer support.

Often, when the application’s user interfaces are complex or hard to understand, this slows down operations or creates confusion.

This gives a special appeal to such programs that are more inclined to offer specialized features depending on industries, like project management software that is more common with companies that are engaged in service businesses or inventory tracking that is more relevant to those companies that deal in merchandising.

And the Winner Is: QuickBooks Online

When comparing, assessing, and ranking all these factors, QuickBooks online is the best suited for most new growing enterprises.

Here’s why: Since QuickBooks is web-based, it is highly flexible and will accommodate any changes in the business or simply evolve with a changing business.

It provides a vast array of tools to help you manage real-time financial data updates, allowing multiple users to set up permissions and the ability to interface with almost any third-party applications that could help manage a business.

Although QuickBooks Online needs the intuitive, friendly interface of FreshBooks and is better suited for small businesses as it has more features.

It can handle more company employees or fulfill the requirements of specific companies, and it offers the option to add extras as per evolving business needs. QuickBooks Online is better for businesses that have aspirations of expansion or require the close management of their money.

For most growing businesses, QuickBooks Online boasts complicated features, flexibility, and compatibility with multiple users and integrations.

Freelancers and small businesses would benefit much from FreshBooks, but QuickBooks consists of features businesses are likely to need as they grow. Therefore, if you pick out a solution that would adapt as your company evolves, QuickBooks Online is your best choice.

QuickBooks online is an advanced solution for those businesses that need more features, while Freshbooks is more for those who need simple graphic-based invoicing and are less into accounting.

QuickBooks online has a higher level of options that would be suitable for businesses that stock material goods. Unlike other software options, FreshBooks has relatively short inventory features and is most helpful for service-based companies.

This tool doesn’t offer payroll options, but FreshBooks can be linked to payroll software such as Gusto. QuickBooks Online also offers an integrated payroll option, which can be purchased and used alongside QuickBooks Online.

FreshBooks costs less overall and is designed for small businesses and freelancers who don’t need many features. It is more costly than the other two versions, but it has more flexibility for businesses that are expanding.

Yes, but quite often, third-party software or professional assistance may be needed to make sure all data is transferred correctly, particularly when undertaking complicated transactions or carrying over old data. Both website builders allow using the export/import features to transfer your data between the platforms.