Anaplan excels in advanced planning and forecasting, making it perfect for organizations that need to align financial strategies with operational goals. Its collaborative features foster real-time decision-making among teams.

Anaplan is a cloud-based software for performance management and business planning that assists enterprises with a variety of planning and decision-making requirements.

Anaplan offers tools for forecasting, budgeting, supply chain management, and sales performance management.

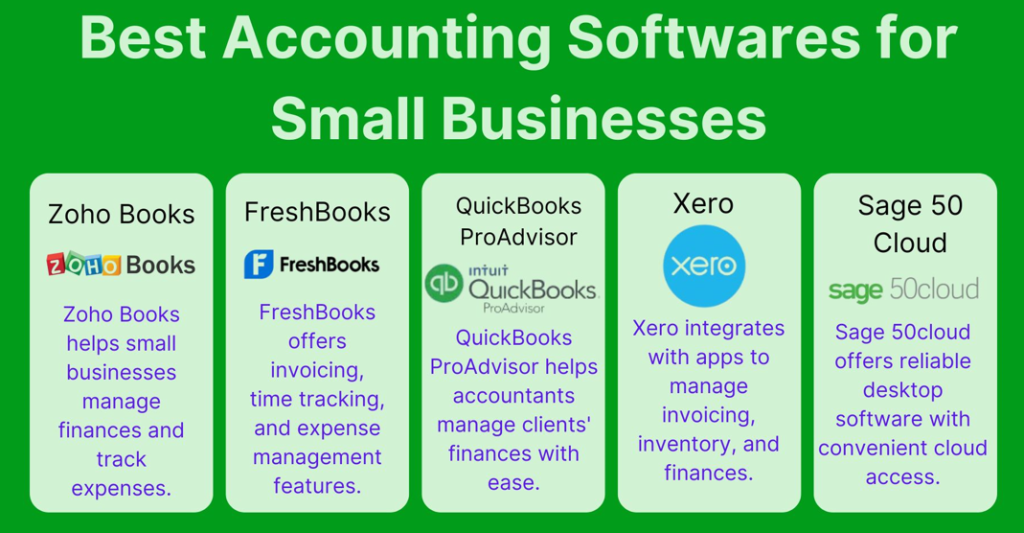

Zoho Books features an intuitive interface and automation, allowing small businesses to manage their finances, track expenses, and generate insightful reports, ensuring compliance and efficiency in operations.

Zoho Books is a cloud-based accounting solution that helps small to medium businesses manage accounting and track expenses, automate processes, and connect various departments.

It assists users in various accounting functions like creating invoicing, tracking expenses, managing taxes, inventory control, and report generation at a cloud level.

Xero offers a customizable platform that integrates with various third-party applications, supporting small to medium-sized businesses in managing invoicing, inventory, and financial tracking with flexibility and scalability.

Xero is a powerful cloud-based accounting software popular for small businesses, sole traders, start-ups and freelancers.

It is designed to handle all the basic accounting functions such as creating invoices and purchase orders, managing business expenses and cash flows at a reasonable price.

Unlike many traditional accounting tools, it does not ask you to manually enter your financial data, as it is connected directly to your bank accounts and credit cards.

Workday Financials is designed for larger organizations, providing a unified system for financial and human capital management. Its robust analytics capabilities enhance decision-making and streamline financial operations.

Workday Financial Management is a cloud-based financial system that helps companies enhance their financial and operational data with its cloud technology.

It is designed to offer the organization real-time financial insights, streamline processes, and make data-driven decisions.

Workday Financial Management users get financial features like a general ledger function, accounts receivable, accounts payable, budgeting forecasting, and asset management.

Spreadsheet Server enables users to leverage Excel for reporting while integrating with ERP systems, making it an excellent choice for organizations that prefer Excel's flexibility alongside accurate financial data management.

Insight Software developed Spreadsheet Server, an electronic financial reporting system that uses soft Excel. Users can extract data from various ERP systems and load the information into Excel.

This enables real-time financial reporting and analysis with data from GL and other sources and improves data accuracy.

Spendesk automates expense reporting and approval workflows, making it an ideal solution for businesses seeking effective management of spending and real-time visibility into expenses.

Spendesk is an expense management platform companies use to spend and enhance financial control.

It provides businesses with various features, including unlimited virtual cards, invoice management, and automated approval workflows.

This software allows employees to access funds easily while enabling finance teams to monitor budgets and spending in real-time.

SAP HANA Cloud Platform processes large data volumes in real-time, providing advanced analytics that empower businesses to gain actionable insights for improved financial decision-making.

SAP HANA Cloud Platform allows businesses worldwide to build, extend, and integrate enterprise applications in real-time. This platform uses SAP’s in-memory computing technology.

Organizations are also able to develop specific approaches that help to improve the initial outcomes, modify the existing systems, and optimize the work under the influence of data science.

SAP General Ledger Accounting offers extensive features for managing financial transactions, making it suitable for large corporations that require reliable compliance and accurate record-keeping.

SAP General Ledger Accounting is a fundamental module in SAP’s Financial Accounting (FI) system. It is designed to comprehensively and integratively manage and record all of a company’s financial transactions.

This module is essential for creating financial statements, ensuring compliance with accounting standards and managing accounts.

SAP Financials OnDemand provides flexibility for managing financial operations, allowing businesses to easily access real-time insights and ensure compliance in a cloud environment.

SAP Financials OnDemand is a financial management solution designed to track end-to-end financial transactions, planning, and reporting to compliance and risk management. SAP Financials OnDemand is a cloud-based solution developed by SAP.

SAP Financials OnDemand helps businesses improve collaboration across teams, reduces operational complexity, and ensures that financial processes are seamlessly integrated with broader enterprise operations, contributing to more holistic business management.

SAP Cash Management helps organizations optimize cash flow with tools for managing liquidity and forecasting needs, ensuring financial health and stability.

SAP Cash Management is cloud-based software that provides a comprehensive overview of an organization’s cash flow by processing and analyzing all cash and bank transactions. This includes sales receipts, payments for supplier invoices, stand-alone payments, and unallocated payments/receipts.

SAP Cash Management also works to analyze financial transactions over a given period, providing vital insights into liquidity.

Sage Intacct is tailored for nonprofits, offering robust fund accounting and reporting features that enhance efficiency and transparency, which are essential for organizations focusing on accountability.

Sage Intacct is one of the cloud-based accounting software created to help businesses manage their finances, accounting, and ERP.

It helps businesses handle general ledgers, order entries, accounts payable, bank reconciliation, suppliers, purchasing, supply chain, cash management, and access reporting and dashboards.

Sage Intacct is ideal for all types of businesses, whether they are small-scale businesses, medium-sized businesses, or larger companies.

Sage Business Cloud Accounting supports small business growth with essential features and a user-friendly interface that allows entrepreneurs to manage their finances effectively and efficiently.

Sage Business Cloud Accounting is a cloud-based accounting solution personalized mainly for small businesses, startups, and self-employed individuals.

Sage Business Cloud Accounting offers a user-friendly interface along with powerful features that help users to automate different accounting tasks such as invoicing, expense tracking, and tax calculations.

Sage 50cloud combines the reliability of desktop software with cloud access, making it a great choice for businesses that prefer traditional accounting tools but require remote functionality.

Sage 50cloud is one of the most famous desktop accounting software with a cloud connection for small and medium-sized businesses. This popular software has long been a trusted solution for businesses looking to streamline their financial operations.

It is capable of performing all accounting operations, from managing payroll to generating comprehensive reports.

QuickBooks Self Employed is tailored for freelancers, providing invoicing, expense tracking, and tax calculation features that simplify financial management without the complexity of larger systems.

QuickBooks Self-Employed is accounting software created exclusively for freelancers, independent contractors, and sole proprietors. It enables customers to manage their company’s finances, track costs, and plan for tax season.

QuickBooks ProAdvisor equips accounting professionals with tools to effectively manage clients' finances, enhancing service delivery through robust reporting capabilities.

A QuickBooks ProAdvisor is an accounting or bookkeeping specialist who has undergone professional training, testing, and certification from Intuit on a variety of QuickBooks-specific subjects and skill sets.

The certification process is rigorous, involving a two-hour exam with a minimum score requirement of 80%, comprehensive training, and an annual certification exam. This ensures that QuickBooks ProAdvisors are highly qualified and knowledgeable in their field.

QuickBooks Online Advanced is ideal for growing businesses, offering scalable features and advanced reporting tools that help customize accounting processes as needs evolve.

QuickBooks Online Advanced is the highest tier of QuickBooks Online. It has all the benefits of the previous tiers, just at a larger scale, for larger and more complex businesses.

QuickBooks Online Accountant is designed for accounting firms, providing tools for seamless client management and collaboration to improve workflow efficiency.

QuickBooks Online Accountant is a cloud-based accounting practice management software designed for accounting and bookkeeping professionals who serve multiple clients.

The platform provides direct access to clients’ books, which is essential for managing client transactions, reviewing books, and making adjustments.

It emphasizes collaboration, convenience, and a user-friendly interface, helping you to access and track financial data, create reports, manage transactions and collaborate with your clients on the same platform.

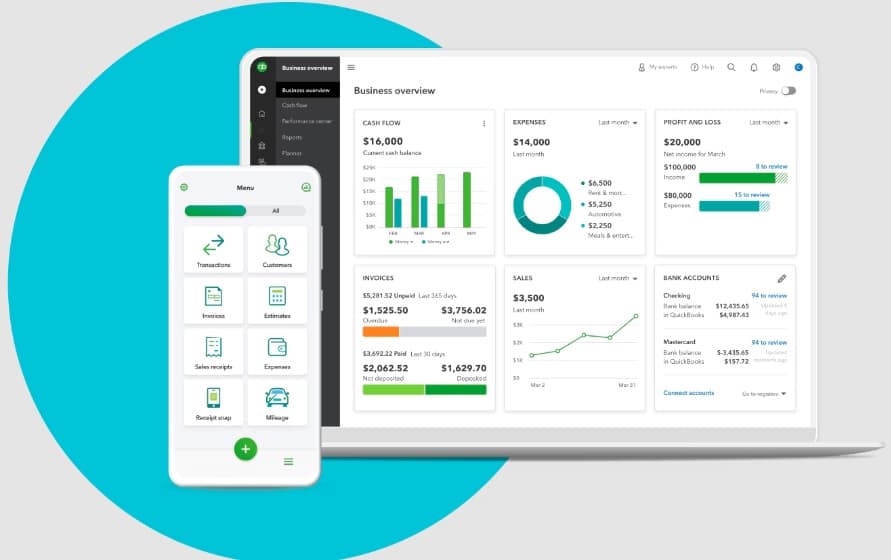

QuickBooks Online provides a comprehensive solution for small businesses, featuring invoicing, expense tracking, and real-time financial insights, making it a popular choice among startups.

QuickBooks Online is a cloud-based accounting software that helps the company manage its finances and allows businesses to access data from any place.

With QuickBooks Online, you can manage your finances from any internet-connected computer, giving you the flexibility to stay on top of your financial tasks, even when you’re on the move. QuickBooks Online offers plans for businesses of all sizes, including new businesses, professional services, and product sellers.

QuickBooks Desktop remains a reliable option for businesses preferring traditional software, offering robust features for invoicing, payroll, and reporting tailored to various industries.

QuickBooks Desktop is a robust and popular accounting software that functions similarly to other ERP tools. It is specially designed to meet the financial needs of small and medium-sized businesses.

This accounting software comes up with a package of comprehensive tools and helps generate invoices and payroll processes, manage inventory, and provide detailed financial reports.

QuickBooks Desktop, unlike QuickBooks Online, allows you to choose between online and local backups, schedule data and company file backups automatically or manually, and restore backups from a previous time period.

Oracle Fusion Financial Management offers a comprehensive suite for financial reporting, compliance, and analytics, ensuring large enterprises can manage their financial operations accurately and efficiently.

Oracle Fusion Financials is a powerful enterprise resource planning (ERP) technology designed to help small and midsize businesses improve workflow management and streamline their financial processes.

It is a complete set of solutions that assists businesses in achieving their financial performance while boosting their efficiency, streamlining operations, and increasing productivity.

NetSuite is a cloud-based ERP solution that provides extensive financial management features and integration with other business functions, ensuring cohesive operations across the organization.

NetSuite is an effective cloud-based business management solution that offers tools for different business processes such as accounting, CRM, and ERP. All these processes are sealed in a single system to help companies redesign their operations, receive real-time updates, and enhance their bottom line.

Some of the companies that are using the NetSuite software are small to medium-sized businesses since it can easily expand as the business expands without necessarily needing a large IT support.

MYOB is designed for small businesses, offering features that cater to local regulations and tax requirements, helping users manage finances effectively while ensuring compliance.

MYOB is an Australian software company that provides tax, accounting, booking, and other business services. It offers a wide range of cloud-based and desktop accounting products, such as Payroll Essentials and MYOB AccountRight, which are ideal for businesses of all sizes.

This software includes features such as invoicing, payroll management, inventory tracking, and tax compliance that make MYOB an extensive tool used for financial management.

Multiview is tailored for organizations with complex accounting needs, offering a flexible architecture that accommodates multiple entities and currencies, making it ideal for multinational corporations.

Multiview ERP is an enterprise resource planning (ERP) software solution developed by Multiview Corporation.

Multiview ERP software mainly targets medium to large-sized businesses in various sectors such as healthcare, financial services, and nonprofits.

Multiview ERP is developed to incorporate multiple business processes such as financial reporting, budgeting, inventory management, project accounting, and purchase order processing functionalities into a single platform that improves operational efficiency and financial visibility.

Microsoft Dynamics SL is ideal for project-driven organizations, providing specialized tools for project accounting, resource management, and budgeting to ensure accurate financial tracking and successful project outcomes.

Microsoft Dynamics SL is an enterprise resource planning (ERP) solution for small to midsize businesses (SMBs). Microsoft Dynamics SL was first known as Solomon software, and many businesses with prior Solomon exposure recognize the platform as both Solomon and Dynamics SL.

Dynamics SL sets itself apart from many enterprise resource planning (ERP) solutions by connecting project management and accounting software capabilities and giving businesses greater control over their profitability information, operational efficiency, and overall workflow.

Microsoft Dynamics NAV combines accounting with ERP features, making it suitable for small to mid-sized businesses seeking robust financial management alongside inventory and customer relationship management.

Microsoft Dynamics NAV ( Navision), formerly known as Dynamics 365 Business Central, is an easily adaptable Enterprise Resource Planning (ERP) solution for SMEs which helps small and medium-sized businesses to automate and connect their sales, purchasing, operations, accounting, and stock management.

It is one of the most popular high-class integrated management systems in the world, running the operations within 120,000+ companies from various industries across more than 165 countries.

Microsoft Dynamics GP offers comprehensive financial management tools, with extensive features that support payroll and reporting for various industries, ensuring businesses can effectively manage their finances.

Microsoft Dynamics GP (Great Plains) is an accounting or ERP software package specially designed for small and medium-sized businesses. It is used for inventory management, supply chain management, project management, sales, operations, human resources, business intelligence, and payroll.

Microsoft Dynamics GP is complete ERP business management and accounting software that monitors numerous business operations, tracks work processes, and streamlines workflows.

KashFlow simplifies financial management for small businesses with features tailored to local accounting regulations, ensuring easy compliance and effective reporting.

Kashflow is efficient cloud-based accounting software that helps small businesses, freelancers, and start-ups manage their finances. It also has functionalities such as invoicing, expenses, VAT, and even reports.

KashFlow supplies users with an easy-to-use tool interface and assists in maintaining a business’s compliance with tax laws and tracking finances in real-time. It also connects with payment solutions and other enterprise applications, so it is an all-in-one solution for daily accounting work.

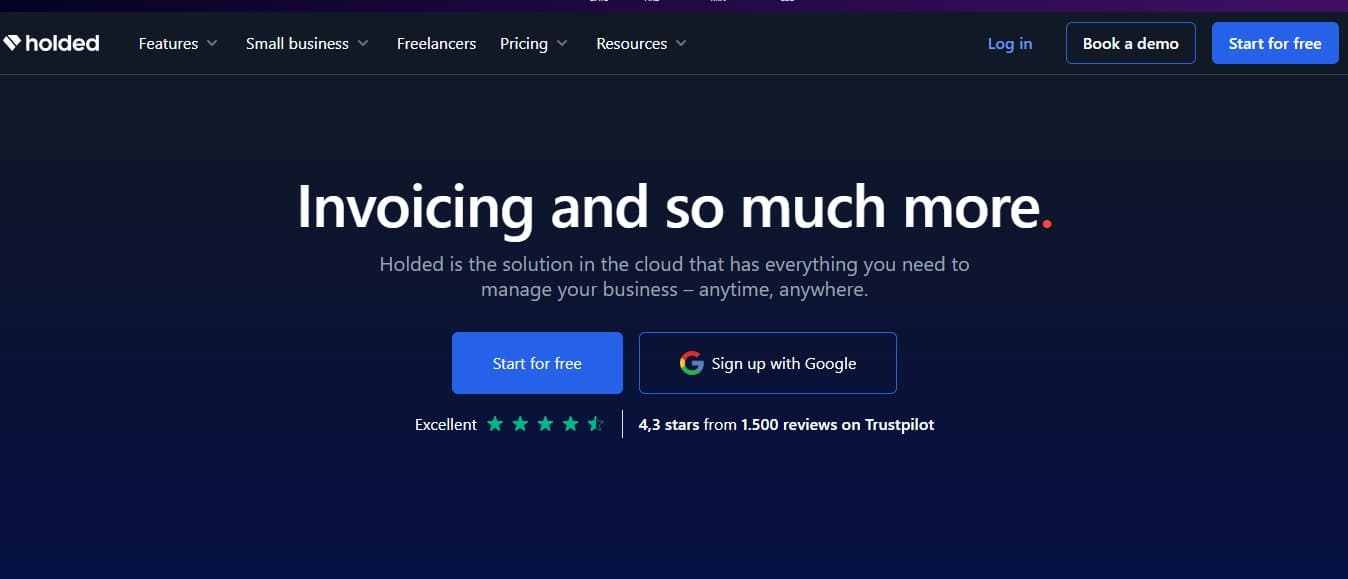

Holded is an all-in-one platform for startups, integrating accounting, invoicing, and inventory management in a user-friendly interface that empowers new businesses to manage their finances efficiently.

Holded is ERP software designed for small and medium-sized businesses to manage finance and business operations. It is a cloud-based SaaS accounting software accessible from desktop and mobile devices.

The invoicing module allows administrators to request payments from clients, give estimates to potential customers, and create financial reports. Task management, budgeting, data import, bank reconciliation, product catalogs, inventory tracking, and customer relationship management (CRM) are additional functions.

FreshBooks is designed for service-based businesses, providing invoicing, time tracking, and expense management features. Its user-friendly design helps professionals manage their finances while focusing on client service.

In its simplest definition, FreshBooks is an easy accounting app that runs from the cloud and includes the following: FreshBooks’ main features include expenses, invoices, time, and reports, which can be accessed through the FreshBooks mobile app.

FreshBooks’ main target audience is clients in the SME sector or Small and Medium-Sized Enterprises. It effectively integrates invoicing and accounting business by maintaining a simple user interface.

Fiserv specializes in payment processing, offering tools for managing transactions and streamlining operations with robust security features and integration capabilities to enhance financial management.

Fiserv is a provider of payment and financial services technology. The company provides payment and mobile banking systems, account processing systems, and electronic payment products and services.

It also offers financial solutions, business solutions, card issuer processing, network services, account processing and digital banking solutions, merchant acquiring and processing and business management platforms, item processing solutions, source capture systems, card solutions, and lending and risk management solutions.

FinancialForce Accounting is built on the Salesforce platform, making it an excellent choice for businesses already using Salesforce. Its seamless integration provides real-time financial insights within the existing CRM ecosystem.

FinancialForce Accounting is a cloud-based financial management solution that is created to incorporate seamlessly with Salesforce leads to a customer relationship management (CRM) platform. It is also known as certinia.

FinancialForce accounting provides businesses with a complete set of accounting functions such as general ledger management, accounts receivable and payable, revenue recognition, and expense management.

Expensify simplifies expense reporting with automated receipt tracking and approval workflows, ensuring compliance and providing real-time insights into financial policies.

Expensify is a robust expense management tool, designed to simplify the complex task of managing expenses for businesses of all sizes and industries.

It automates the entire expense reporting process, from receipt capture to final approval, reducing time spent on receipt handling, minimizing data entry errors, and streamlining cost reimbursements.

The software comes up with plenty of features like receipt scanning, intelligent expense categorization, GPS mileage tracking, real-time expense analysis, and billable expense tracking.

Epicor ERP provides comprehensive solutions for manufacturing businesses, integrating accounting with production management to optimize financial planning and operational efficiency.

ERP, Epicor’s flagship product, is a comprehensive solution that integrates a business’s core processes—supply chain management, inventory, operations, financial, human capital, and customer relationship management (CRM)—in a single platform.

This comprehensive integration allows for full data exchange throughout all of a company’s business fields, offering a holistic operation perspective.

Dext specializes in receipt management and expense tracking, streamlining bookkeeping for businesses that need efficient oversight and management of their financial activities.

Dext is a digital productivity tool that started as ‘Receipt Bank’ and assists businesses, accountants, and bookkeepers in processing receipts, invoices, and other forms of financial proof.

It helps capture, extract, and sort data from receipts and invoices, thus easing record-keeping regarding expenses and other financial chores.

Dext connects well to tools such as Xero, QuickBooks, and Sage, which helps automate the bookkeeping section and minimize data entry mistakes.

CosmoLex is tailored for legal firms, offering specialized features for trust accounting and case management, ensuring compliance while streamlining financial operations.

CosmoLex is a legal practice management software designed for law firms. It helps firms integrate their day-to-day operations, such as time tracking, billing, and accounting, into one unified platform.

CosmoLex aims to reduce the risk of errors that can arise from using multiple, disconnected systems. It is a perfect choice for law firms of all sizes, handling both front and back-office tasks.

Cognos provides robust analytics and reporting capabilities, helping organizations transform data into actionable insights for better decision-making in financial management.

Cognos Analytics, IBM’s adaptable business intelligence and performance management software, is designed to empower non-IT employees in large organizations.

It offers a remarkable degree of flexibility, putting you in the driver’s seat to extract, interpret, and present data for decision-making in a way that perfectly aligns with your unique needs.

Classe365 is designed for educational institutions, integrating accounting with student management features, ensuring efficient financial tracking and compliance within the education sector.

Classe365 is a tailored accounting software for educational institutions such as schools, universities, and other educational institutions.

It provides features like fee management, invoicing, payment tracking, online payment integration, automated receipts, expense management, budgeting donation and fundraising, financial reporting, and integration with other third-party applications.

Caseware Working Papers offers specialized tools for auditors and assurance professionals, providing features for document management, collaboration, and compliance to enhance audit efficiency.

Caseware Working Papers is an accounting and auditing software platform. It is widely used by accountants, auditors, and finance professionals.

The users can easily manage, organize, and prepare financial statements, audit files, and other working documents.

The software streamlines the audit process by allowing users to import client data, generate reports, and ensure compliance with accounting and auditing standards.

Blackbaud Financial Edge NXT is tailored for nonprofits, offering advanced financial management features to help organizations maintain transparency and accountability in their financial reporting.

Blackbaud Financial Edge NXT is a cloud-based financial solution designed for government non-profit organizations. It organizes essential financial matters like budgeting, expenditure, and fund accounting, enabling organizations to work with optimum financial precision.

Features available on the platform include real-time reporting, customizable dashboards, and automation according to regulatory standards.

Bill.com automates accounts payable and receivable processes, allowing businesses to manage invoices and payments seamlessly, improving cash flow management and operational efficiency.

Bill.com (also known as BILL) is a financial operations platform for small and midsize businesses (SMBs). It is a comprehensive, cloud-based software tool that streamlines your cash inflow and outflow processes.

BILL provides an integrated platform for bill payments, invoicing, accounts payable, and receivables—essentially, a place to do all your financial process management in one place. Two years ago Divvy became part of the BILL portfolio, offering spend and expense management functionality to deliver more capabilities to help SMBs automate their financial operations.

Basware focuses on automating the invoice process, helping businesses improve their cash flow and streamline accounts payable and receivable management.

Basware is a cloud-based purchase-to-pay and e-invoicing solution; enabling businesses around the world to reduce costs, manage spend and forecast growth.

It offers networked source-to-pay tools, e-invoicing, analytics and value added services, facilitating automated operations and management, spend and supply chain visibility, supplier management, early payment discounts and much more.

AvidXchange specializes in automating accounts payable processes, providing tools for invoice management and payment processing to enhance financial efficiency.

AvidXchange stands out as a cloud-based accounts payable and payment automation software, offering unique features such as paperless invoicing, payment automation, utility bill management, and fraud detection.

Its key advantage for small and mid-size businesses is automated invoice processing and payment management.

This seamless software helps with its four major primary modules—billing payment, purchase order processing, and utility bill management—built within this platform.

Avalara offers comprehensive tax compliance solutions, helping businesses manage sales tax calculations and reporting accurately across various jurisdictions, ensuring compliance with regulations.

Avalara AvaTax is an integrated third-party application where companies can determine the amount of tax to charge on their invoice depending on the location. AvaTax is a tool used in tax compliance that can calculate taxes for more than 12,000 jurisdictions in the U.S.

It helps businesses save time and avoid the complicated computation of taxes across different jurisdictions. At the same time, they can focus on what they are offering to the market.

Aplos Accounting is designed specifically for small nonprofits, providing features for fund accounting and reporting that enhance financial transparency and compliance within the nonprofit sector.

Aplos Accounting is a cloud-based management system that is designed for churches and nonprofits. Aplos facilitates the management of financial transactions, donation tracking, comprehensive report creation, and nonprofit regulatory compliance.

Users can easily create custom financial reports, track donations, and keep a check on budgeting from anywhere. The software helps nonprofits, churches, and small businesses manage complex accounting processes.

Greenspoon is a specialized accounting software tailored for tax filing and reporting, designed specifically for professionals. Its robust tools simplify tax compliance, ensuring accurate calculations and seamless reporting, making it a trusted choice for tax professionals in the accounting domain.

The software’s core strength lies in its streamlined tax filing and reporting capabilities. By automating complex tax processes, Greenspoon stands out as an efficient solution for professionals aiming for accuracy and compliance in their tax obligations.

Greenspoon empowers small businesses with features that simplify tax filing, helping them stay compliant with evolving regulations. As the best tax filing and reporting software for small businesses, it bridges efficiency with cost-effectiveness to achieve specific financial goals.

Unlike typical accounting software, Greenspoon offers specialized tax compliance tools, advanced reporting features, and a focus on professional-grade accuracy, setting it apart as a high-value solution for tax professionals and businesses alike.

Greenspoon is ideal for tax professionals, accountants, and small business owners who prioritize accurate tax compliance and need a reliable, streamlined solution for filing and reporting obligations.

Top 5 Pros of Greenspoon

Top 5 Cons of Greenspoon

Top 5 Features of Greenspoon

Top 5 Benefits of Greenspoon

Corcentric is a leading tax firm automation software designed specifically for small businesses. It streamlines workflow automation, data integration, and tax management, making tax-related processes faster and more accurate.

Corcentric’s tax firm automation capabilities make it unique. This software reduces administrative burden while ensuring data accuracy. Its automated processes save time and costs, making it ideal for small businesses.

Corcentric helps small businesses achieve their goals through automated workflows and customizable tools. It efficiently manages tax compliance, financial reporting, and payment processes.

Corcentric stands apart from traditional software by offering specialized features tailored to the unique needs of tax firms. It is highly customizable and adapts to specific business requirements.

Corcentric is primarily designed for tax firms and small businesses. It caters to professionals prioritizing workflow efficiency and data management.

Top 5 Pros of Corcentric

Top 5 Cons of Corcentric

Top 5 Features of Corcentric

Top 5 Benefits of Corcentric

Holded is an ERP software designed specifically for small and mid-sized businesses, excelling in tax filing and financial reporting. It integrates various modules like accounting, invoicing, and customer management, ensuring smooth tax management processes for professionals.

Holded’s specialized tax tools simplify compliance by automating calculations, generating error-free reports, and integrating seamlessly with external software. These capabilities make it the best tax-filing accounting software for small businesses.

Holded empowers small businesses by providing cost-effective solutions for tax filing, invoicing, and reporting. Its automation features save time, reduce manual errors, and improve overall financial accuracy, helping businesses achieve their goals.

Unlike typical accounting software, Holded offers a centralized platform with advanced visual reporting, comprehensive integrations, and customizable workflows. This ensures better productivity and tailored solutions for unique business needs.

Holded is ideal for small to mid-sized businesses, especially those in retail, e-commerce, and professional services, seeking an efficient tool for tax filing and integrated accounting management.

Top 5 Pros of Holded

Top 5 Cons of Holded

Top 5 Features of Holded

Top 5 Benefits of Holded

Dwolla specializes in ACH (Automated Clearing House) payments, focusing on seamless and secure bank-to-bank transfers. Its robust API ensures easy integration, making it ideal for businesses aiming to simplify financial processes, particularly those requiring strict tax compliance management.

Dwolla’s tax compliance strength lies in its ability to automate payments and provide detailed transaction records. These features help businesses maintain accuracy and adhere to tax regulations, setting it apart as a trusted solution for efficient financial oversight.

Dwolla empowers small businesses by reducing payment processing costs through low transaction fees and automation. It enhances operational efficiency, allowing businesses to focus on growth while ensuring compliance with financial standards.

Unlike traditional accounting software, Dwolla emphasizes custom payment flows and scalability. Its developer-friendly API, white-label options, and fraud detection capabilities make it a versatile choice for businesses seeking tailored solutions.

Dwolla is designed for U.S.-based small to midsized businesses that require streamlined ACH payments. It’s especially valuable for those prioritizing compliance, cost-efficiency, and custom integration in their financial systems.

Top 5 Pros of Dwolla

Top 5 Cons of Dwolla

Top 5 Features of Dwolla

Top 5 Benefits of Dwolla

Gappify is a cloud-based accounting software that specializes in automating tax processes for finance teams. It focuses on automating accruals, managing accounts payable, and ensuring tax compliance, reducing manual tasks and enhancing operational efficiency.

The software’s unique selling proposition (USP) lies in its advanced tax automation capabilities. By handling tax processes and compliance efficiently, Gappify helps businesses avoid errors and streamline their financial operations.

For small businesses, Gappify helps achieve specific goals by automating repetitive accounting tasks. This allows businesses to focus more on growth and strategic planning, while Gappify ensures smooth, accurate tax management and reporting.

What sets Gappify apart from traditional accounting software is its deep integration of tax automation. Unlike general accounting tools, it prioritizes automating tax workflows, improving accuracy and reducing the time spent on manual entries and reporting.

Gappify is designed for small and medium-sized businesses looking to optimize their accounting processes. It is particularly useful for teams seeking tax automation and efficient management of financial workflows.

Top 5 Pros of Gappify

Top 5 Cons of Gappify

Top 5 Features of Gappify

Top 5 Benefits of Gappify

UAS (Universal Accounting Software) is a comprehensive solution designed for businesses requiring tax and accounting services. It offers a robust platform, focusing on automating accounting processes and tax management, making it an ideal choice for businesses seeking an efficient, all-in-one accounting solution.

The tax and accounting solutions specialty is UAS’s unique selling point because of its strong integration of accounting features with tax automation tools. This combination simplifies complex tasks such as tax filings, deductions, and accounting processes, providing seamless workflows for businesses.

UAS supports small businesses by streamlining accounting and tax management, enabling faster financial reporting and accurate tax compliance. With its automation features, it reduces manual tasks, helping businesses stay focused on growth and other critical areas.

UAS distinguishes itself by offering an integrated approach to tax and accounting. Unlike typical accounting software, it combines tax compliance and reporting, providing small businesses with advanced features that are tailored to their specific needs in both sectors.

UAS is ideal for small to mid-sized businesses that require efficient tax automation and comprehensive accounting services. Its user-friendly platform is tailored to businesses that want to simplify financial management and ensure timely tax compliance.

Top 5 Pros of UAS

Top 5 Cons of UAS

Top 5 Features of UAS

Top 5 Benefits of UAS

Clearwater is a specialized accounting software designed for tax firm management. It offers robust tools tailored to treasury and accounting professionals, enabling them to collect, validate, reconcile, and analyze investment data. The software’s customizable general ledgers and compliance tracking make it ideal for managing complex tax operations, ensuring that tax firms meet regulatory standards effectively.

The best tax firm management accounting software for small businesses, Clearwater stands out due to its strong focus on investment management. This expertise allows tax firms to handle accounting tasks and investment portfolios seamlessly, catering to a niche market that requires specialized features for handling financial data with precision.

Clearwater helps small businesses achieve specific goals by offering streamlined processes for tax reporting, compliance tracking, and performance monitoring. It simplifies data reconciliation across multiple platforms, enabling businesses to stay ahead of tax deadlines and regulatory changes, enhancing efficiency and reducing errors.

What sets Clearwater apart from typical accounting software is its specialization in tax firm management. Unlike general accounting tools, Clearwater provides tools designed specifically for the complexities of tax and investment management, making it the go-to choice for firms that need precise, customizable solutions.

Clearwater is primarily aimed at tax professionals and small to medium-sized firms seeking specialized tools for managing investments and taxes. Its tailored approach makes it suitable for businesses that require advanced accounting solutions for managing complex portfolios and compliance.

Top 5 Pros of Clearwater

Top 5 Cons of Clearwater

Top 5 Features of Clearwater

Top 5 Benefits of Clearwater

RealPage Accounting Software is tailored to meet the specialized financial needs of real estate professionals. Its robust tools focus on tax reporting, ensuring compliance with industry regulations. With advanced reporting features, RealPage provides real-time visibility into financial data, streamlining operations across multiple properties

RealPage is an efficient accounting software specializing in tax reporting. It offers the best tax reporting solutions for small businesses, making it an indispensable tool in the accounting domain.

Tax reporting expertise is RealPage’s most significant USP. It ensures the accuracy of financial data for small businesses, streamlining the tax process to make it faster and error-free.

RealPage helps small businesses achieve their financial goals by automating tax calculations, generating detailed reports, and ensuring regulatory compliance, saving both time and resources.

RealPage stands apart from typical accounting software due to its tax reporting specialization. It provides precise data, user-friendly interfaces, and unique analytics tools to enhance business performance.

The intended audience for RealPage is small businesses that need support in tax reporting and financial management, simplifying and efficiently handling complex tax processes.

Top 5 Pros of RealPage

Top 5 Cons of RealPage

Top 5 Features of RealPage

Top 5 Benefits of RealPage

Fortnox is a Sweden-based cloud accounting software tailored for small and medium businesses across various industries, including consulting, education, and e-commerce. It offers comprehensive solutions for invoicing, payroll, expense management, and seamless integration with other systems, enhancing financial management with automation and efficiency.

Fortnox delivers cloud-based accounting solutions with expertise in tax and financial management. It simplifies complex tasks for small and midsize businesses by automating critical financial processes. Fortnox stands out due to its focus on tax and accounting automation for professionals. Its intuitive design and tailored features cater specifically to business-centric needs.

Fortnox enables small businesses to achieve operational goals like saving time, enhancing accuracy, and streamlining financial workflows. Its integrations support real-time decision-making and better financial coordination.

Fortnox differentiates itself with user-friendly interfaces and extensive integration capabilities. Its API support and automatic banking connections provide superior efficiency compared to traditional solutions.

Fortnox is tailored for small and medium-sized enterprises, freelancers, and professionals from diverse industries requiring efficient financial management.

Top 5 Pros of Fortnox

Top 5 Cons of Fortnox

Top 5 Features of Fortnox

Top 5 Benefits of Fortnox

QuickBooks Desktop is widely recognized for its robust capabilities in tax and accounting automation, making it an ideal choice for businesses seeking comprehensive financial management solutions. Its advanced inventory tracking, batch invoicing, and detailed reporting stand out among accounting software, particularly for small and medium-sized enterprises needing precise tax compliance and automation tools.

QuickBooks Desktop specializes in automating repetitive accounting and tax tasks, offering unmatched efficiency for financial operations. Its comprehensive features, including job costing and inventory management, make it the best accounting software for tax and accounting automation for small businesses.

QuickBooks Desktop is uniquely designed to automate complex financial workflows, including payroll, tax compliance, and custom reports. These automation capabilities minimize errors and save time, which are critical for small businesses to operate effectively.

By streamlining financial processes like expense tracking, tax calculations, and batch invoicing, QuickBooks Desktop empowers small businesses to focus on growth. Its customizable reports provide actionable insights, helping businesses make informed decisions and achieve specific financial goals.

Unlike typical accounting tools, QuickBooks Desktop combines offline functionality with advanced tools like job costing and detailed reporting. This versatility ensures reliability even in limited connectivity environments while addressing intricate accounting needs.

QuickBooks Desktop is tailored for small to medium-sized businesses requiring detailed financial oversight, especially those in manufacturing, retail, or service industries. Its powerful tools cater to companies with complex accounting needs, ensuring compliance and operational efficiency.

Top 5 Pros of QuickBooks Desktop

Top 5 Cons of QuickBooks Desktop

Top 5 Features of QuickBooks Desktop

Top 5 Benefits of QuickBooks Desktop

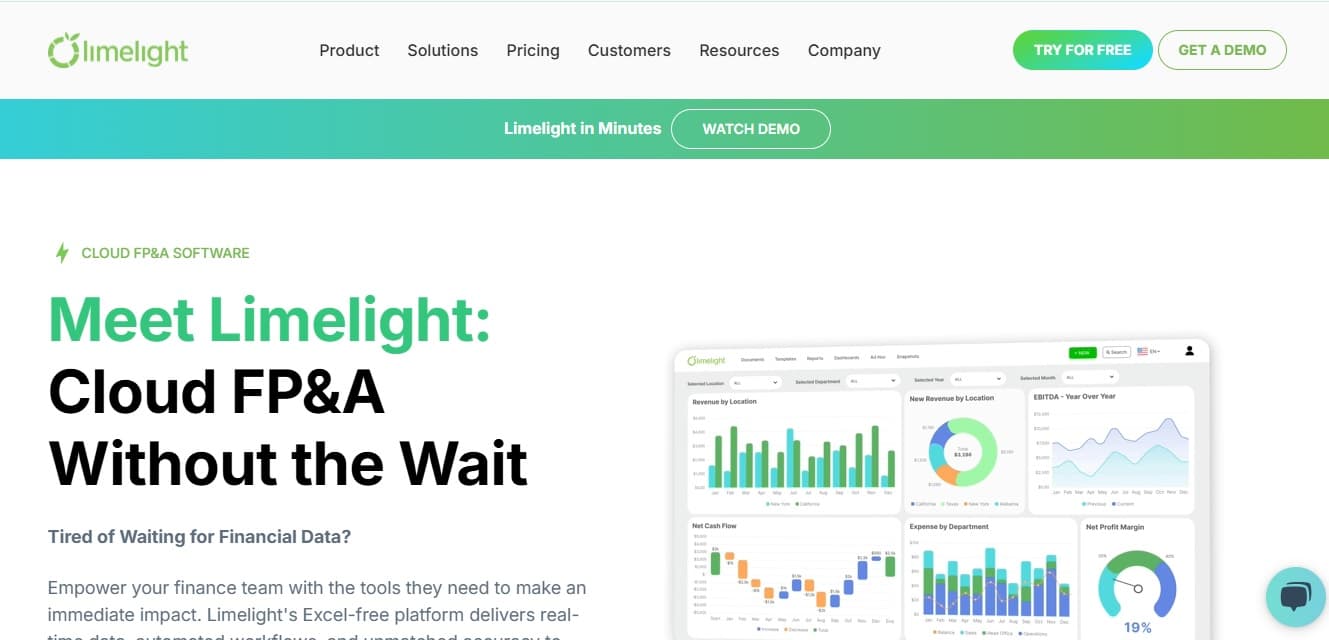

Limelight is a software designed for simple and efficient cash flow management. It streamlines financial operations for small businesses, making it a reliable option due to its category expertise.

Cash flow management is Limelight’s biggest strength. Its simplicity and user-friendliness make it stand out, offering tailored solutions for small businesses’ financial needs. It helps small businesses achieve financial stability and goals by tracking cash flow, controlling expenses, and simplifying decision-making processes.

Limelight stands apart from traditional accounting software with its simplicity and intuitive interface, focusing on core needs without complex reporting. The primary audience for Limelight is small businesses and startups seeking an easy and efficient financial management solution.

Top 5 Pros of Limelight

Top 5 Cons of Limelight

Top 5 Features of Limelight

Top 5 Benefits of Limelight

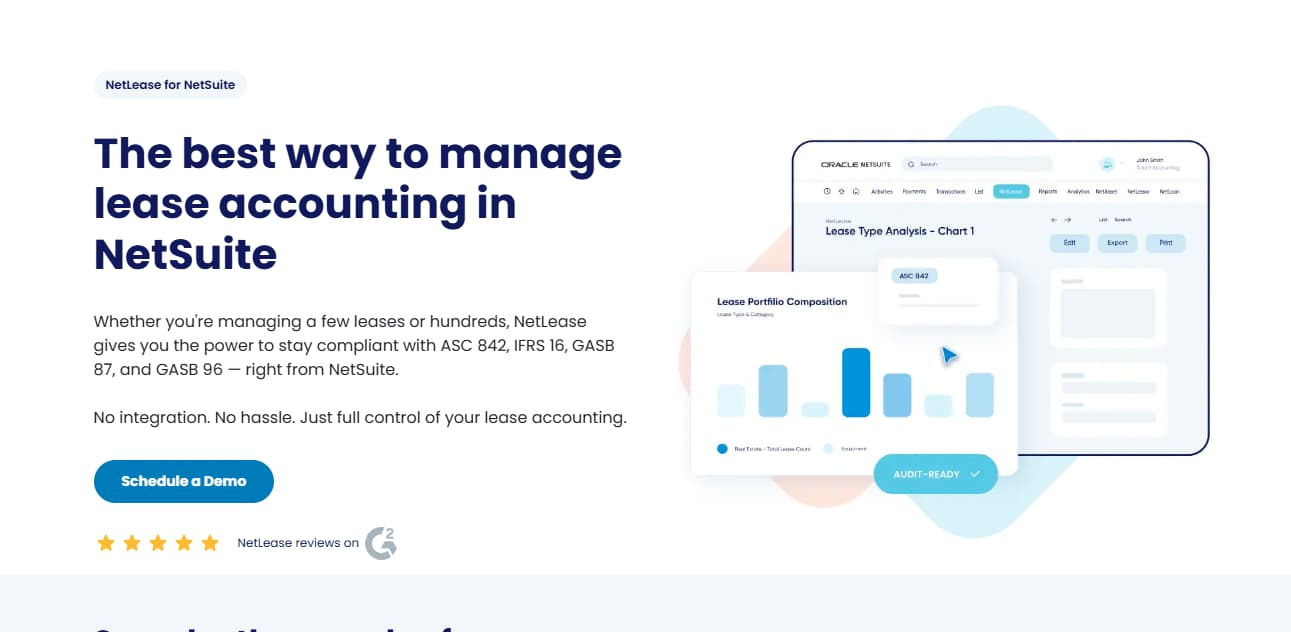

NetLease is a cutting-edge software designed to excel in financial management. It ensures cash flow efficiency and stability for small businesses, making it a unique and reliable choice in its category.

The primary USP of NetLease lies in its cash flow management capabilities. It provides tailored tools to strengthen financial frameworks, offering a seamless experience for small business users. It assists small businesses in monitoring cash flow, prioritizing expenses, analyzing financial data, and achieving strategic goals through effective and targeted solutions.

Unlike traditional accounting software, NetLease focuses on meeting the specific needs of small businesses. Its user-friendly design ensures accessibility and eliminates unnecessary complexity. It is ideal for small businesses and startups looking for efficient cash flow management. It caters to users seeking straightforward yet powerful financial solutions.

Top 5 Pros of NetLease

Top 5 Cons of NetLease

Top 5 Features of NetLease

Top 5 Benefits of NetLease