QuickBooks Online, developed by Intuit, is an accounting software customized for small- to medium-sized businesses. It automates key tasks such as income and expense tracking, invoicing, and financial reporting, with pricing ranging from $17.50 to $200 per month based on selected features.

In contrast, Xero is another cloud-based accounting solution that offers similar functionalities, including invoicing, bank reconciliation, and payroll management, starting at $15 to $78 per month. Both platforms are designed for users with limited accounting knowledge.

When it comes to target audiences, QuickBooks Online is particularly suited for small business owners who require strong inventory management and advanced tax features, whereas Xero is ideal for businesses that prioritize collaboration among team members and accountants that makes it a scalable solution for growing companies.

QuickBooks Online excels with its extensive customer support options such as phone support on higher-tier plans, automatic backups, and extensive integrations with over 750 third-party applications.

Meanwhile, Xero stands out due to its modern user interface, unlimited user access across all plans, customizable invoice templates, and expense tracking options.

Xero provides a free conversion feature that allows users to migrate data from QuickBooks seamlessly when signing up. This service includes access to prior fiscal year transactions that enables users to generate reports and conduct comparisons easily.

However, QuickBooks Online also facilitates migration from Xero, covering the cost of transferring up to two years of historical data through its partners.

This process typically takes a few hours, with more complex migrations completed within 72 hours.

While Xero is a popular cloud-based accounting solution, it does have some drawbacks:

| QuickBooks Online Accounting Software | Xero Accounting Software |

|---|---|

| QuickBooks Online (QBO) is a cloud-based accounting software designed for small to medium-sized businesses. QuickBooks Online is known for its user-friendly interface and strong customer support options that make it suitable for users with varying levels of accounting knowledge. QuickBooks Online provides advanced features to cater to businesses that require comprehensive financial oversight. | Xero is a cloud-based accounting solution for small businesses. Its intuitive interface simplifies accounting tasks. Xero is particularly noted for its unlimited user access across all pricing plans by making it ideal for teams. Xero integrates seamlessly with various third-party applications and supports multi-currency transactions which is beneficial for businesses operating internationally. |

| Features of QuickBooks Online Accounting Software: | Features of Xero Accounting Software: |

|---|---|

| Invoicing: Businesses can automate their recurring invoices, send payments, create customized invoices, and monitor their invoice status. | Unlimited User Access: Businesses can enhance teamwork and efficiency in financial management by adding an unlimited number of users which provides collaborative access for team members and accountants. |

| Billing: Businesses can easily organize all their bills in one place and make payments right in QuickBooks in order to avoid missed or late payments. | Project Tracking Capabilities: Businesses can manage resources effectively and analyze project profitability with the help of project tracking feature that enable users to plan, budget, and monitor project costs in real-time. |

| Expense Tracking: Businesses can easily accept payment from their customers via eChecks, cards, and ACH transfers. They can send payment links to their customers and can run the business freely. | Multicurrency Support: Xero supports transactions in over 160 currencies that allow businesses to manage international sales and purchases easily. |

| Financial Reporting: Businesses can track income from anywhere as all of their bank and credit card transactions automatically get synced with QuickBooks. | Customizable Dashboard: Businesses can focus on key performance indicators by customizing their Xero dashboard to display the most relevant financial metrics and reports at a glance. |

| Inventory Management: It helps businesses to track products and cost of goods and get notifications when inventory is low. They can also import the products and services from Excel and Google Sheets. | Comprehensive Integration Options: Xero integrates seamlessly with over 1,000 third-party applications, including payment gateways, CRM systems, and eCommerce platforms. |

| Mobile App Access: It provides mobile access to businesses, allowing them to track their work effortlessly. | Automated Bank Reconciliation: Businesses can quickly match transactions with their records by reducing manual entry errors and saving time with the help of automated bank reconciliation processes. |

| QuickBooks Online Functionality: | Xero Functionality: |

|---|---|

| Payroll Management: QuickBooks Online enables businesses to efficiently estimate, run payroll, and automatically calculate and file payroll taxes that simplifies the entire payroll process. | Integration Capabilities: Xero supports integration with various third-party applications (e.g., Stripe, Vend) to enhance functionality and simplify workflows across different business operations. |

| Workflow Customization: Customizable workflows ensure that team members adhere to established processes that enhance operational efficiency. | Collaboration Features: Xeros allows multiple users such as accountants and advisors, to access financial data simultaneously for enhanced collaboration. |

| Syncing Instantaneously: Access to real-time financial data allows businesses to make informed decisions based on the latest transaction updates. | Payroll Management: Businesses can automate payroll calculations, tax filings, and employee payments that simplifies payroll management to save time and reduce errors. |

| 1099 E-File & Pay: Businesses can create and e-file unlimited 1099-MISC and 1099-NEC forms with automatic distribution of copies to contractors. | Document Management: Businesses can store documents securely within Xero that allows easy access to contracts, bills, receipts, and other important files from anywhere. |

| Reporting: Businesses can generate extensive reports that cover profit and loss, sales tax, accounts payable, accounts receivable, and more for insightful analysis. | Data Security: Xero employs multiple layers of security to protect sensitive financial information that ensures compliance with regulations such as GDPR in Europe. |

| Team Management: Businesses can track employee performance, assign team members to clients, and manage timesheets effectively. | Stock Tracking: Businesses can monitor inventory levels and integrate them into invoicing processes for efficient stock management. |

| Add-on Applications: It enhances the QuickBooks interface with various add-on applications customized according to specific business needs. | Automated Bank Feeds: Businesses can connect to over 21,000 banks globally for automatic transaction imports, simplifying the reconciliation process. |

| QuickBooks Online accounting software has different variants: | Xero accounting software has different variants: |

|---|---|

| Simple Start: $35/month Essentials: $65/month Plus: $99/month Advanced: $235/month (pricing as of latest update). | Early Plan: ($15/month) Growing Plan: ($47/month) Established Plan: ($80/month). |

| Who is it for: | Who is it for: |

|---|---|

| Small to medium-sized businesses requiring strong accounting software. Freelancers and self-employed individuals. Businesses require strong inventory management features. | Small businesses with multiple users needing collaborative access. Growing startups requiring project-tracking capabilities. Companies operating internationally needing multicurrency support. |

Pros and Cons of QuickBooks Online Accounting Software:

| Pros | Cons |

|---|---|

| User-friendly interface suitable for all skill levels. | Higher cost compared to Xero accounting software. |

| Strong customer support options such as live chat and phone support. | Limited number of users per plan (up to 25 on Advanced). |

| Comprehensive reporting features and integrations with third-party apps. | Limited functionality for larger enterprises; may lack advanced features which is required for complex operations. |

| QuickBooks Online provides a 90-day cash flow forecast, which is more extensive than Xero’s offerings. | QuickBooks Online requires a stable internet connection for access which can be a significant drawback during outages or slow connections. |

| It is suitable for small to medium-sized businesses and can scale as the business grows. | QuickBooks Online offers fewer customization options that makes it difficult to customize the software to specific business needs.. |

Pros and Cons of Xero Accounting Software:

| Pros | Cons |

|---|---|

| Intuitive design focused on user experience. | Xero’s payroll capabilities are not as strong as some competitors which is required for payroll management. |

| Affordable pricing structure compared to competitors. | Lacks comprehensive tax management features such as advanced tax deduction strategies, 1099 management, or customizable tax categories. |

| Xero integrates with over 1,000 third-party applications, enhancing its functionality. | Xero does not have automatic backups as part of its service which poses a risk for businesses that rely heavily on data security and recovery options. |

| It enables businesses to manage their finances on the go that provides flexibility and convenience. | Businesses can access time tracking feature only after buying the highest-tier plan. |

| Xero supports multi-currency transactions, making it suitable for businesses with international dealings. | Xero’s cash flow forecasting capabilities are limited as compared to QuickBooks online. |

| QuickBooks Online Price Range | Xero Price Range |

|---|---|

| Starts at $35/month for Simple Start, going up to $200/month for Advanced plans. Pricing varies by plan features and user limits. | Starts at $15/month for the Early plan, with Growing at $47/month and Established at $80/month. All plans offer unlimited users. |

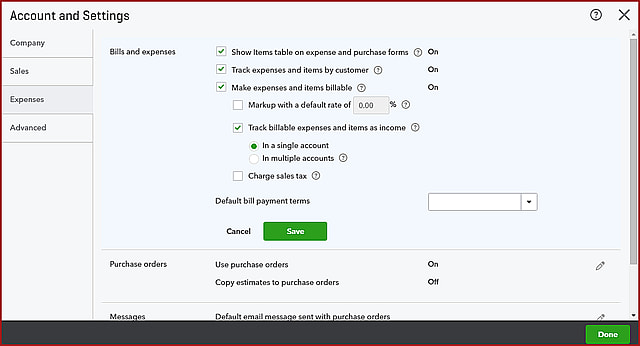

In QuickBooks Online, the “Settings” Screen allows users to customize their dashboards by selecting which features they want to display. This includes options for tracking billable expenses and items, showing an item table in the “Bills and Expenses” section, utilizing purchase orders, and copying estimates to purchase orders.

Users can tailor their experience further by enabling or disabling various functionalities according to their needs.

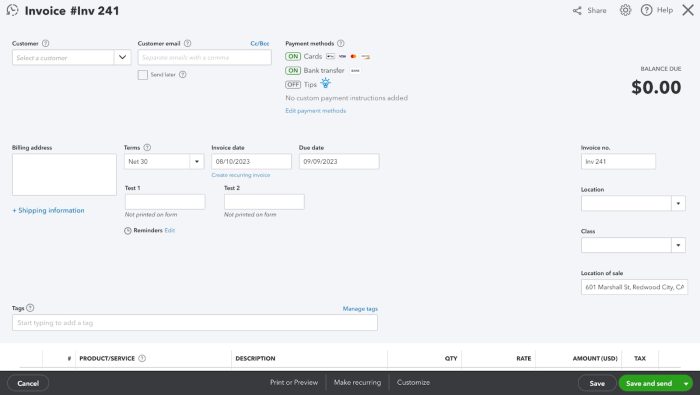

An “Invoice” Screen in QuickBooks Online allows you to input customer details such as the customer’s name and email address, select payment methods, assign an invoice number, and enter the billing address, invoice date, and payment due date, among other options.

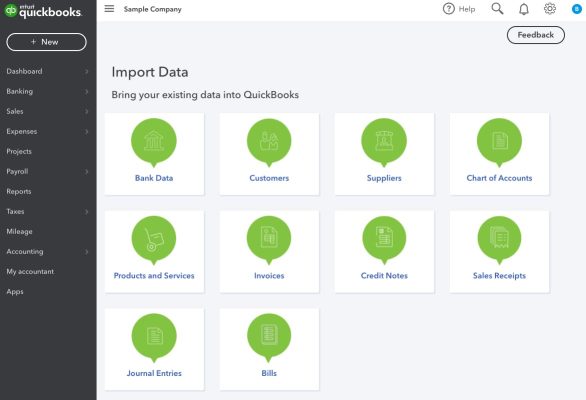

An “Import Data” Screen in QuickBooks Online allows you to upload your existing data, including bank transactions, invoices, suppliers, products and services, credit notes, customers, journal entries, bills, and more.

This image shows the “Add New Account” feature in Xero accounting software. Users can select an account type such as Expense, or Direct Costs, and customize the account’s name, code, and tax settings which impacts financial reports such as the income statement and balance sheet.

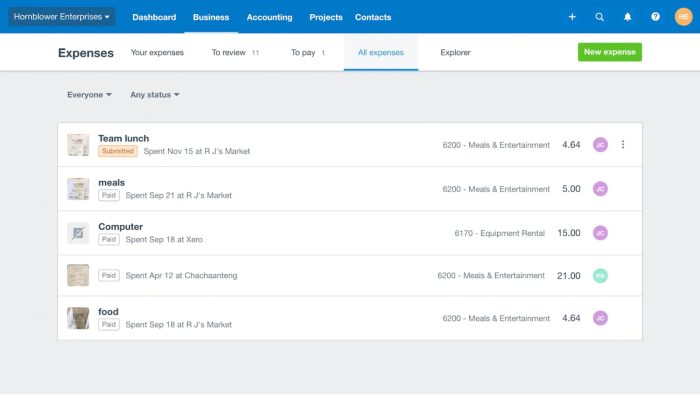

The “Expenses” dashboard in Xero accounting software displays a list of recorded expenses with details such as expense type, date, vendor, amount, and status (e.g., Submitted, Paid). It allows users to filter expenses by status and quickly review, manage, or add new expense entries.

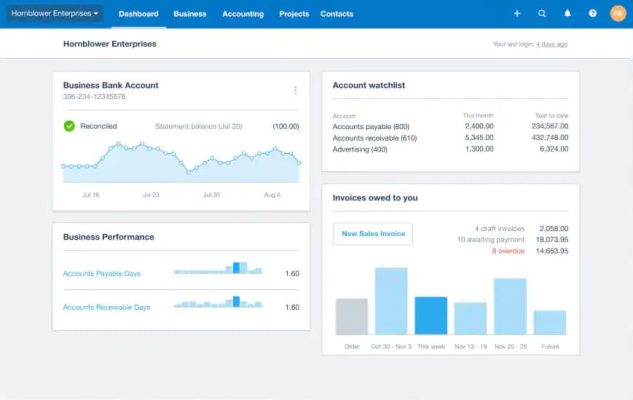

The “Dashboard” screen of Xero accounting software provides a complete overview of your business finances at a glance. It features key panels that display your bank balances, cash flow, outstanding invoices, and bills due that allows for easy monitoring of your financial health.

Users can customize the layout and content to prioritize the information most relevant to their operations, making it a powerful tool for financial management.

| Feature | QuickBooks Online | Xero | Decision Criteria |

| Ease of Use | Slightly steeper learning curve; offers a customizable dashboard and global search. | Intuitive and modern interface which is easier for beginners. | Choose Xero for a simpler, more user-friendly experience, especially if you’re new to accounting. Opt for QuickBooks if you need advanced features and can invest time in learning the system. |

| Scalability | Supports up to 25 users on the highest plan and good for growing businesses. | Allows access to unlimited users across all plans and suitable for larger teams. | Select Xero if you anticipate needing many users without additional costs. Choose QuickBooks if your team is smaller and you prefer its reporting capabilities. |

| Integrations | Integrates with numerous third-party apps and has strong ecosystem. | Xero supports many integrations and slightly fewer options than QuickBooks. | If you require extensive integrations, go with QuickBooks due to its broader ecosystem. Choose Xero if its integrations meet your needs at a lower cost. |

| Data Security | Offers automatic backups and updates and has a strong security measures in place. | Lacks automatic backups, relies on user-initiated backups. | Prefer QuickBooks online for better data security features, especially if data integrity is critical for your business operations. Choose Xero if you are comfortable managing backups manually. |

| Collaboration / Number of Users | Limited to 25 users on the highest plan; collaboration features available. | Unlimited users on all plans; facilitates easy collaboration among team members. | Opt for Xero if collaboration among a large team is essential, as it allows unlimited access without additional costs. Choose QuickBooks if your user count is lower and you value its reporting features more. |

| Learning Curve | More complex due to advanced features; may require training for full utilization. | Easier to learn with a straightforward interface; less training is needed. | Choose Xero for a quicker onboarding experience, particularly beneficial for small business owners or those unfamiliar with accounting software. Select QuickBooks if you’re willing to invest time in learning its advanced functionalities for better reporting and tracking capabilities. |

| Realtime Accounting | Provides real-time updates and bank feeds; strong performance in this area. | It offers real-time accounting features but slightly lacks in performance compared to QBO. | Both platforms offer real-time accounting, but choose QuickBooks Online for potentially faster updates and better performance in high-volume scenarios. If your needs are basic, either option will suffice. |

| Report Generation | Advanced reporting capabilities with customizable options; supports detailed analysis. | Good reporting tools but less customizable than QuickBooks; basic inventory tracking included. | If detailed reporting is crucial, select QuickBooks Online, which offers more robust and customizable reporting features. Choose Xero if you need basic reports without extensive customization requirements. |

| Custom User Authorisations | Allows creating multiple user roles with specific permissions across plans. | Offers user roles but less flexibility compared to QuickBooks in terms of authorizations. | Opt for QuickBooks Online if custom user permissions are vital for your business operations, especially in larger teams or complex organizational structures. Choose Xero if standard roles are sufficient for your needs without requiring extensive customization. |

| Pricing | Basic plan starts from $35/month and higher tiers available based on features needed. | Basic plan starts from $15/month and generally lower pricing across plans compared to QuickBooks Online. | If budget is a primary concern, choose Xero, which typically offers lower pricing options across all tiers compared to QuickBooks Online’s higher starting costs. Select QuickBooks Online if its additional features justify the higher price point for your business needs. |

| Cloud-Based Software | Fully cloud-based with mobile app support; accessible from anywhere with internet. | Also fully cloud-based with strong mobile app capabilities; very accessible as well. | Both platforms are cloud-based, making either suitable based on other feature preferences rather than this criterion alone. |

| Updations and Backups | Automatic updates and backups included in all plans; hassle-free maintenance. | Manual backups required; no automatic updates provided by default. | Choose QuickBooks Online for automatic updates and backups that reduce maintenance efforts, ensuring data safety without additional work on your part. Opt for Xero if you’re comfortable handling backups manually and prefer its other features over automated maintenance tasks. |

| Customer Support | More extensive support options including phone support on higher plans; limited hours. | 24/7 online support available across all plans but lacks phone support options available in QuickBooks Online. | If customer support is crucial, select QuickBooks Online, which offers more comprehensive support options including phone assistance on higher-tier plans. Choose Xero if online support suffices for your business needs at a lower cost without needing immediate phone support availability during off-hours or weekends. |

| Training | Offers various training resources but may require more due to complexity of software. | Generally easier to learn with ample resources available online for self-training purposes. | Choose Xero for easier self-training opportunities and quicker onboarding processes, especially beneficial for smaller teams or those new to accounting software. Select QuickBooks Online if you prefer structured training resources despite the steeper learning curve involved. |

On what basis are we going to evaluate a winner?

To select an accounting software best suited for business needs, accounting software is analyzed in accordance with the stage of the business, i.e., a startup, small or medium size business, geographical spread (many branches), enterprise-level requirements, etc.

In addition to these factors, the a need for real-time updates, cloud features, data security, file compatibility with current software, and the need for any integrations.

Also, we consider if there is only an in-house need where it will be handled only by an accountant or if you need to add other stakeholders to your accounting information.

Another major factor is the learning curve, after-sales support, and any industry—or business-specific features that make it a more value-for-money proposition.

Xero accounting software is recommended among the two accounting software options as it excels due to its unlimited user access across all plans that makes it an ideal for collaborative environments, particularly for small to medium-sized businesses that require multiple stakeholders to access financial data simultaneously.

It also has affordable pricing and strong integration capabilities with over 1,000 third-party applications that provide significant value for money compared to QuickBooks Online.

Xero enhances teamwork and efficiency in financial management by enabling real-time collaboration among multiple users without additional costs.

Its cloud-based features and customizable dashboard allow businesses to adapt quickly to changing needs, that improves decision-making and operational agility compared to QuickBooks Online which has user limits and higher costs.

Based on the comparison between QuickBooks Online and Xero seems to be the preferred choice for businesses that prioritize collaboration and ease of use, particularly for teams requiring unlimited user access.

Its intuitive interface and lower pricing structure make it accessible for small to medium-sized enterprises especially those with international dealings due to its multi currency support.

Whereas, QuickBooks Online stands out for its advanced features and robust customer support which makes it suitable for businesses needing comprehensive financial oversight and reporting capabilities.

Both platforms aim to simplify the transition for users, but Xero’s feature is particularly highlighted for its straightforward integration during initial setup.

Xero is considered better than QuickBooks Online primarily due to its intuitive interface which simplifies tasks for users with limited accounting knowledge, and it offers multi currency support, which is beneficial for businesses operating internationally.

Yes, QuickBooks can be compatible with Xero; however, transitioning from QuickBooks Online to Xero requires careful planning for data conversion to ensure accurate transfer of financial information. Professional assistance may be necessary to address the differences in accounting functions between the two platforms.

Accountants may prefer Xero for its collaborative features which allows multiple users to access financial data simultaneously. However, some accountants might favor QuickBooks Online due to its advanced reporting capabilities and comprehensive customer support options, making the choice dependent on specific business needs.

No, QuickBooks Online is generally more expensive than Xero, with pricing starting at $35 per month compared to Xero’s starting price of $15 per month. This cost difference makes Xero a more attractive option for businesses with budget constraints.

No, Xero and QuickBooks Online do not have direct integration. However, you can transfer data between them using:

Yes! Xero is designed with a user-friendly interface, making it accessible for beginners with little to no accounting experience. It’s a great choice for small businesses and individuals new to accounting software. However, while the platform is intuitive, the wide range of features may feel overwhelming at first. With time and practice, most users find it easy to navigate.

QuickBooks Online and Xero are best suited for small to mid-sized businesses. While they offer essential accounting features, they may lack scalability and advanced reporting needed by large enterprises. Bigger businesses may require solutions like QuickBooks Enterprise or NetSuite for better customization and automation. However, with add-ons, some large companies with simpler needs can still use QuickBooks Online or Xero effectively.

Both QuickBooks Online and Xero prioritize security to protect financial data, using encryption, backups, and strict access controls. Here’s how their security features compare:

QuickBooks Online Security

Xero Security